Mother's Day Weekend Update by Red

(to watch on youtube: www.youtube.com/watch?v=hoYuzvibh3k)

_____________________________________________________

Ali's Post...

The Scary planetary alignment due on April 21st, 2014 which is synchronized with the upcoming huge financial asset bubble burst! Be ready!

Certain important planetary alignments can be used to project both the minor and major turning points in stock market. In other words, some important planetary aspects can be used as a great timing tool in the stock market activity.

There are two systems of measurement that define the periods of the planets; the “sidereal “and “synodic” systems. The sidereal period is the time it takes a planet to complete one orbit. For instance, the sidereal period of the earth is 365.25636 solar days or Mars whose sidereal period is 687 solar days. On the other hand, a synodic period measures the period between two successive conjunctions of two planets. For example, the time interval between two successive conjunctions of Jupiter-Uranus is 14 years.

The planetary aspects are created when the important angles of the planets are aligned. As a matter of fact, such angles have traditional names; Conjunction(360 degrees), Opposition(180 degrees), Trine(120 degrees), Square(90 degrees), Sextile(60 degrees), Semi-Square(45 degrees), Semi-Sextile (30 degrees).

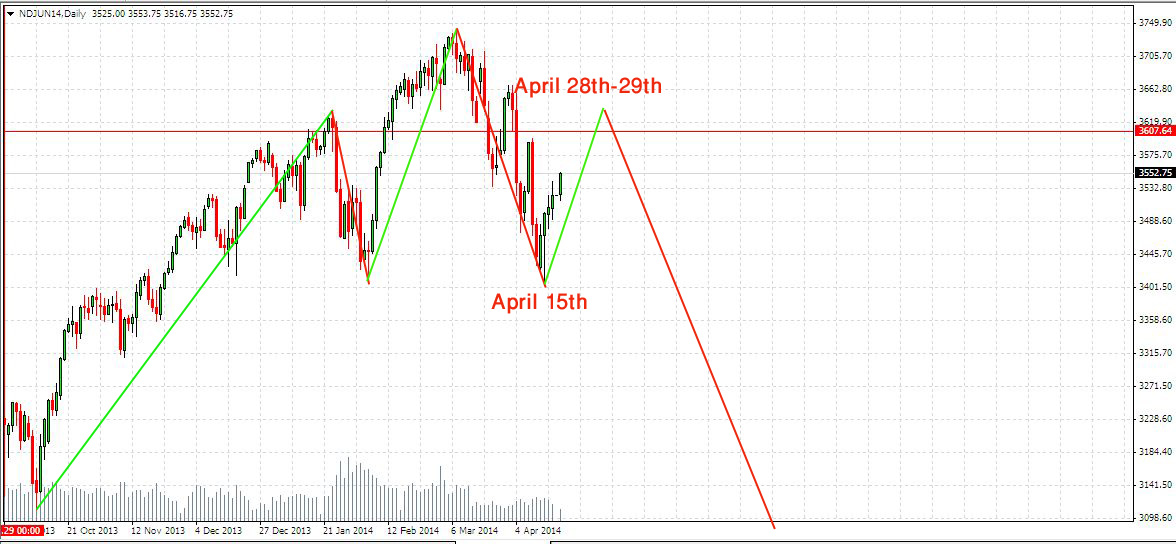

One of the most important planetary aspects is due on April 21st or 22nd, 2014 which could be synchronized with a nasty financial crisis.

Actually, It will not be the end of the world though. At that time, Uranus is exactly square (the 90-degree aspect) to Pluto. It is also square to Jupiter and both Jupiter and Pluto are square to Mars. You see, all four planets are either 90 degrees (Square) or 180 degrees (Opposition) to each other. It could be a real scary planetary aspect which might impact the financial markets, especially the stock market BIG TIME.

It is really important to understand that big world events are not necessarily synchronized with the major planetary aspects, the exact date on which they occur. Sometimes a couple of days before or after or even a couple weeks before or after. You have just begun to see the turmoil in the stock market though.

May you profit handsomely,

Ali

_____________________________________________________

Red's video...

(to watch on youtube: www.youtube.com/watch?v=5G9_6ll4e5w)

Here's the link to Raymond Merriman's interesting post about these time period...

ES Chart analysis: http://niftychartsandpatterns.blogspot.in/2014/04/es-chart-analysis_22.html

One thing is certain, the market is not in some massive “squeeze the bears” move the last few days. It looks more to me like every point higher is a major struggle for the bulls. Definitely strong signs of weakness in this rally. Looks like it’s just waiting for some bad news (maybe some bad earnings?) so it can give up the fight and fall down.

The volume has been so low that you’d think the market has been closed. I don’t think there’s much more life left in these bulls now. If they are going to make a top soon today would be the ideal day. Then start some kind of down move, back up, down again… you know the deal.

But, by the end of the week I’d like to look back and see that Tuesday put in the high. However, I’m not thinking we’ll break that 1800 level this week though. Usually they chop around some in the early stages of a sell off. That’s what I’m expecting here. (Not that I wouldn’t be happy if it just fell off a cliff though… LOL).

Red, what about the weekly charts?

Are you not watching the MACD cycles? Those are offering upside across May, and into mid June.

You talk about the bulls struggling, well..kinda, but the trend IS the trend, and it is NOT down.

Right now, the notion of <1814 looks completely out of range for at least 2-3 months.

Correct Permabear… until that weekly rising trendline of support from

1074 SPX in October of 2011 is broken (around 1800 now) we are still in a

bull market. And while I see what you are talking about on the MACD’s

it just doesn’t match up with prior rallies with similar patterns.

I guess it’s possible (of course it’s possible… duh!) that they

manipulate the charts and continue rallying up despite what the charts

say, but right now that’s all I can go by. I just don’t see a new high

in the charts right now. The weekly chart looks different now then it

did in the past with similar patterns. (I cover that in the video).

Anyway, I guess we’ll know by the end of this week if they start moving down as

I expect or if they put in a new high and don’t look back.

re: I just don’t see a new high in the charts right now.

I refer you to the Transports index. Aka ‘old leader’, and they don’t call it that for no reason.

Ok… I thought you were expecting new all time highs? But you’re

not… so we agree. I seen the transports too and it’s clearly hit

resistance on the same rising trendline, so I don’t think it’s going

higher. The SPX should pullback too and not make a new high. But I’m

not looking for some crash move down… more like a steady trend change

that just keeps both sides guessing the direction.

No, I AM expecting new highs.

The transports is AT new highs..and the other indexes will largely follow.

—

Are you shorting this market right now? Just curious.

For the record, I’m content to just sit it out, probably for some weeks, maybe even mid June.

No Permabear, I’m neutral just like you. But tomorrow may be a different story? If no higher high is made (then today’s high) I will be looking to short it. It could go up a little more but I don’t see a new all time high as I think 1897 will stand for now.

Netflix chart analysis: http://niftychartsandpatterns.blogspot.in/2014/04/netflix-analysis-after-closing-bell.html

ES Charts: http://niftychartsandpatterns.blogspot.in/2014/04/es-chart-analysis_23.html

Gold analysis: http://niftychartsandpatterns.blogspot.in/2014/04/gold-trend-analysis.html

Here’s a possible scenario: http://screencast.com/t/agOb5fo6Cky

Apple and Facebook report after the close and we have a bear flag on the market now. Will it play out? I don’t know but the odds favor the bears in my opinion

New penny stock pick alert went out tonight… check your email in the morning.

ES update: http://niftychartsandpatterns.blogspot.in/2014/04/es-chart-analysis_24.html

The bulls sure are fighting hard here. But so far the high on the SPX is still intact… at least for now I guess. It’s very tricky here and I don’t know what the game plan is but as long as they don’t break Tuesday’s 1884.89 high I’m thinking we have topped in the short term.

Again, I’m not expecting any big selloff to start here as you know how they love to trick the bulls and bears alike before a big move. All I’m expecting is wild choppy swings until the end of this week with the high on Tuesday holding. Then next week we should see some more action to the downside I think.

Today is Soyuz 1/Gravity day. I noticed in the news that US astronauts are doing a space walk on the ISS a not so subtle reference to the Gravity flick when Clooney’s character breaks the alltime space walk record while US astronauts are performing repairs on the Hubble telescope. Later, the survivors venture over to the ISS hoping to take a ride back home on one of the Soyuz capsules. Tomorrow will be the 47 year 1 day anniversary ie 111. Oh and we had the grand cross today which I noticed most of the astro experts have conveniently ignored. I knew we were in trouble when this post popped up on Sunday in congruence with astro energy dude’s posts on the imminent demise of the stock market. And then Jeff Cooper with his “free” article last Friday on a possible waterfall decline for the markets. But I just saw another Dow 1700 ad over at DE’s so the bears can achieve some solace. Nothing special astro wise occurred April 21st, the meat of the event is occurring right now.

While I’m sure there will be some bounces along the way I don’t see an important bottoming area to go long at until around 1800 spx. The bounces from now until there should be shorted I believe. Then we’ll see what happens around 1800 before deciding on whether to go long or just exit shorts and wait to see if a rally starts or just a sideways chop (which would make a bear flag of course and then we’d see more selling).

SPY Weekend analysis: http://niftychartsandpatterns.blogspot.in/2014/04/spy-weekend-update_27.html

I’m not expecting too much action until the FOMC meeting this Tuesday/Wednesday. If we float up into the meeting then we should continue down after the meeting. The only wildcard is if they decide to “not cut another $10 Billion” out of the current QE program, which is possible I guess, but I don’t think it’s likely this time around.

With the market up still at high levels and no real bad news on the political or economic front there doesn’t seem to be any reason to “not cut” again. Now if something happened out of Russia then yeah… they might not make the $10 Billion cut and possibly reduce it to $5 Billion or even zero.

But the way it looks right now I still fully expect them to make another round of withdraws from the ongoing QE program. That should produce another wave down with the 1800 area being my target zone.

Of course if we drop into that area prior to the FOMC meeting then I’d expect a rally from the charts being oversold. What they would say to get the rally going is not known of course but it could be something as simple as just “hinting” that they “may” stop the withdraw in the future if things don’t turn around. You all know the game by now…

CRUDE Oil chart analysis: http://niftychartsandpatterns.blogspot.in/2014/04/crude-oil-chart-analysis_29.html

I’ve been having trouble with my hosting company gang, which is why the site has been down for awhile. Anyway, I’m expecting a big move in one direction or the other after the FOMC meeting Wednesday. Don’t know which way though as while the charts are bearish still there’s also some charts that look bullish.

So it’s mixed right now and will really just be determined by what Janet Yellen says about the future and not so much the expect $10 Billion they plan to remove from the current QE program. That’s already factored in the market right now I think and that news alone shouldn’t have too much of an effect. But what she says about the future after the entire QE program ends is what WallStreet is waiting to hear.

Since we are so close to a double top I highly suspect they will go up and hit it… and if SkyNet see’s a bunch of stops just overhead you know it’s going to go through the double top (even if it’s just for a quick intraday move) and hit those shorts.

The question then remains will the market roll back down and start another wave of selling or will something Yellen says spark a powerful rally to all time new highs? I just don’t know? Charts are mostly bearish and mildly bullish, but that doesn’t matter if the Fed wants to rally. So I’m neutral for now.

Bank of America chart analysis: http://niftychartsandpatterns.blogspot.in/2014/04/bank-of-america-analysis-before-opening.html

ES Chart analysis: http://niftychartsandpatterns.blogspot.in/2014/05/es-chart-analysis.html

This whole Donald Sterling/ Clippers ritual just fascinates me……..

http://www.x17online.com/gallery/view_gallery.php?gallery=Stiviano050114_x17

The guy gets a lifetime ban and possibly stripped of ownership of his team for private comments that were purportedly illegally recorded although it sounds like it was produced in a professional recording studio and sounds like he’s reading from a Quentin Tarantino produced screenplay. It’s actually quite comical. NBA owners going after one of their own with the corporate controlled media universally condemning him at a fever pitch. At first, I thought it was just hype for the Clipper-Warriors playoff series with the Clippers predictably falling on their face after Sterling’s spurious comments were released last Sunday but then they brought Obozo into the mix and had high profile NBA players and owners tweeting condemnations of Sterling. Then the NBA coming down hard on him Wednesday before Game 5 of the series in LA, just ahead of solar eclipse Wednesday night curiously 709 days from the great Mayan solar eclipse of May 20, 2012 (conjunct the Pleiades) which saw a nationally televised Dodgers-STL game played under the solar eclipse in LA.

Alas the game did feature some memorable highlights like a 55-50 halftime score. And then benchwarmer Clipper #8, who had no reason for even getting into a playoff game, entered the game in the 3rd quarter and was promptly run over by Warriors player #10 flopping to the ground in dramatic fashion and eventually being removed from the floor by medical personel even though it appeared he fell cleanly to the ground. Now he has been declared out for tonight’s game. They flashed a nice 10-11 while #8 flopped to the gound, also a 10-11-22 combo.

Can’t quite find a 1987 connection to Sterling although he did buy the team in 1982 (bull market begining) for $12 million dollars so the number 31 does seem to have a recurring theme here. His girlfriend, (see above) is 31 years old. Somehow the wife is still involved in his life even though she’s suing the girlfriend and now has become the face of the franchise with Sterling’s banishment. So utterly ridiculous. And for more hilarity check out the photos above. Notice the numbers in the background including the nail salon’s address.

Also a social media infused scandal, a reflection of the current age….. the social media infused tech bubble….

The Miami Thrice purposely tanked and gave up the #1 seed for the playoffs which went to Indiana. Indiana furiously flailing in round 1 and on the verge of elimination. Is Indiana representing the 1987 NCAA champion Indiana team for the ritual? Miami now a #2 seed against the 7 seed.

Lakers fired their head coach/ or he officially resigned after the Lakers lost 55 games last year (27-55 record) yesterday one day after the Sterling NBA decision and on the opposite side of the solar eclipse in LA. LA=121. His two year record: 67-87

The failure of the market to make a new high today is a very bearish sign. The volume is very low today and that usually supports the bulls. During days of light volume the market should float up but it’s not doing that today. As long as we don’t make a new high then this entire move up is just a larger wave 2 with a wave 3 down expected to start soon afterwards.

We could see some heavy selling start next week if we don’t make a new high… and so far it’s not looking like it wants too! In fact it wouldn’t shock me to see some (planned) bad news released over the weekend to cause a gap down on Monday. I’m not saying that’s going to happen of course but I wouldn’t be surprised if it did.

Blackberry weekend update: http://niftychartsandpatterns.blogspot.in/2014/05/blackberry-weekend-update.html

EBAY Weekend update: http://niftychartsandpatterns.blogspot.in/2014/05/ebay-weekend-update.html

I believe we test new highs this week. We need to close at 1891 for 1910-1915.

That’s possible Amy… but I suspect we’ll have some downside this week first. Then possibly next week we run up and make a new high? We are in a choppy “topping” area right now and this could last for several move weeks.

Meaning we could have a few fairly large down days with rallies just afterwards to recapture the losses. This range of up and down moves just is the big institutions dumping on every rally up. But at some point soon (2-3 weeks?) the “buy the dippers” retail crowd will run out of money and then we’ll see some real selling.

There are many individual stocks that haven’t recovered from the selling 2 weeks ago even though the overall market rallied back up and erased the losses. This is an early sign that the whole market will soon rollover.

Could we make a new high up to 1910-1915 soon? Yeah, it’s possible. But the way the market is acting now it’s clearly having trouble getting through the prior high. However, if the big institutions just don’t dump their shares in this double top area then we could see it breakthrough some higher high, but I don’t think it will.

There’s needs to be some good buying volume from the retail traders in order for the big institutions to sell their shares into. That means we need some good earnings reports to come out this week and next, and it must be from popular companies. We seen Facebook and Apple last week and as soon as the market opened the following day the big boys dumped hard.

Any other time the great earnings from Apple would have rallied the market up 200 Dow points or more, but it just gapped up and crapped down as the institutions used the big buying volume to unload their shares. The stopped selling after the SPX dropped around 20 points from it’s high. At some point they are going to just keep on selling and we’ll see a BIG Move DOWN Happen!

My estimates are that we’ll drop some this week and recover some next week. Then by the second half of May we should see the big selling start. Don’t know when of course but we do have a Legatus meeting starting on the 28th this month, which could be a top of some kind before a big dump?

Maybe between now and then we do some type of wave one down and way two up, which tops out around then and starts our wave 3 down? If we don’t make a new high then we could have already made the wave one and two, but who’s to say that we don’t hit 1900 or so and then start the wave one down and two up into Legatus? I just think we’re going to be in a choppy (wild swing) range for a few more weeks.

ES Charts: http://niftychartsandpatterns.blogspot.in/2014/05/es-chart-analysis_5.html

Chop Chop Chop…

I’m expecting some downside this week but unfortunately I think we are going to continue to stay in a wide range for another couple of weeks or so… and then I think we’ll drop hard. Will we make a new high? I don’t know but it’s clearly showing signs of institutions dumping their

stock.

That’s why it could take a few more weeks for them to unload at the top. With that said you have to put two and tow together and speculate that the longer we chop sideways (and the closer the range is to the current high) the more people that will be putting stops up

in the low 1900’s… which we all know that SkyNet see’s!

Afterall, SkyNet is like the big ONE Eye on top of the mountain in the “Lord of the Rings” series. It see’s all and will go after those stops before it drops the market. On the other hand if the range is wide and we stay down below the current high by 20 SPX points or more then we might not do anything but a lower high by a point or two?

However, from the looks of the market today it looks like they are staying close to the prior top… which tells me we’ll pierce through it at some point over the next few weeks to clean-out the overhead stops that will be gathering in the low 1900’s in the coming days and weeks.

This projects us out to mid to late May before we start the big move down. Between now and then I’m just expecting some swings up and down but no big commitment in either direction.

Tomorrow could see some EXASperating moves in the markets. A little hanging man action today. Tomorrow, 5-6 is the 77th anniversary of the Hindenburg fiasco and 4 year anniversary of you know what. There have been a few minor change readings lately with one coming on Friday and they seem to work when they do, 2 days into the future.

Of course, another high made on 5-2 ala 2011, 2012 with the 2011 version being the Bin Laden high while Friday featured some geopolitical tensions. Friday also worked as a Lindsay low-low high cycle going back to the 3-6-9 low…..ie 3-6-9 low, 10-04-11 low, 5-02-14 high.

A certain little indicator, Nasdaq version has headed back downward after bouncing near the 0 line but never turning positive and is now making new lows in a very precarious technical position while the NYSE version is lagging/ diverging very badly. It seems obvious that it will be playing catchup to the Nasdaq in quite a dramatic fashion. Nasdaq and Russell 2000 are dithering until it’s time for them to attack their 200 day averages.

Crude oil on the brink of riding its lower BB lower after bouncing off of it today. Need to see the Australian dollar play out in a similar manner.

If the dollar yen chart is any indication of the future we should start dropping at the open this morning. Support is at 1875 and 1871 SPX should we fall that far.

ES Hourly range: http://niftychartsandpatterns.blogspot.in/2014/05/es-in-range.html

Crude oil descending triangle and 200 SMA: http://niftychartsandpatterns.blogspot.in/2014/05/crude-oil-descending-triangle-and-200.html

The market is hitting a necktie of support now. http://screencast.com/t/aDp2SLpZUHn

SPX near a short term bottom I think. http://screencast.com/t/znq7s16hW

Back now. Looks like we are hitting resistance now… http://screencast.com/t/L0tJOGL5DV

Tomorrow and Friday, the 8th and 9th will be 3 years 10 months from 7-8/9-2010, coincidentally a Thursday and Friday as well, of the major DECISION announcement and the unveiling of the Miami Thrice Number. 2 years 4 months from Tebow’s big 316 game/ 5 years 4months from the 2009 version. Basically the 4 year anniversary of you know what as well although another double ninen astro signature is featured later (basically the same thing I saw last November but let’s just say it’s rotated to the opposite side of the spectrum) Quetzi is also back in play again as a catalyst. Applying some Mayan mathematics to things, Monday, Cinco de Maya ie 5-5-5(14), was 13×55 days from the great Mayan solar eclipse of May 20,2010 although one can notice the 1356 number in the background of the Stavianos entourage photos I showed last Friday so maybe that number is more in play. Anyway there were many rituals featured on Cinco de Maya, most notably in the Yankees-Angels game on Derek Jeter night, most notably in the 8th inning.

Jeter playing in his swan song season seems to have some central role in the ongoing rituals. Popgun and Little Bro visited him in NYC on Sunday and then we had the special events on Jeter night in Anaheim the next day where he even had a key role but there were so many rituals in that inning that my head was spinning and left me a little disoriented. Pretty much too many to interpret properly.

But the key event of that inning occurred when the Yankees manager was thrown out of the game for arguing a strike call on hitter #11. The pitcher #36 had thrown 101 pitches at that point, the count was 1-1, and the score 1-1 in the eight inning. He proceeded to strike out #11 on an 87mph fastball. (on a 1-2 count for pitch #103?) A nice little 9 (36)–11 combo. The home plate umps # was 63…..Jeter was the next batter and grounded out into an inning ending double play. Jeter is 39 years old and they did mention he has won 5 world series and won an xamount of gold gloves. It’s also his 19th year in the majors. Anyway, more rituals were displayed during the eight inning, topped off by an Angels closer controversy ritual that saw pitcher #38 warming up in the 8th inning as the Angels built up a 4-1 lead on 3 bases loaded walks only to see pitcher #49 come into the game to close things out. Supposedly #38 got sick while warming up and couldn’t come into the game. It turns out 38+49=====87!!!! By the way, previously defrocked closer #49 lost the game the next night.

To better understand the situation, the Yankees manager freaks out on a strike call when the count is 1-1, the score 1-1.

The graphics on the TV displayed it as such:

#36s pitch count: 101

The score: 1-1 8(th inning)

the hitter’s count 1-1

The batter’s #:11

Later on 3 different Yankees pitchers walk in runs with the bases loaded to 3 consecutive batters. The first pitcher is taken out of the game and then thrown out by the ump.

Yellen spoke today so one reason for the pop today. She speaks tomorrow as well. Still the Nasdaq fared quite poorly. A certain little indicator, Nasdaq version still dropping at a brisk clip. NYSE version saw its component basically bounce to the 0 line.

IWM Analysis after close: http://niftychartsandpatterns.blogspot.in/2014/05/iwm-analysis-after-closing-bell.html

More new V. Stivianos photos in the link below including some fabulous Cinco de Maya photos. I like how she drivers her Ferrari to the nail salon in the hood. (old photos) In the old nail salon photos, one can see UNION in the background. The SOYUZ rockets/ space vehicles featured in Gravity mean UNION in English.

I guess they’re spoofing the whole Hollywood entourage scene as well for Stivianos 15 seconds of fame as well as the kept mistress persona running around in a furnished Ferrari that somehow she’s allowed to keep.

If the market fails to make a new high here I expect a nasty move down to follow that should break the recent 1859 SPX low. Here’s the scary thing for the bulls right now, the rising trendline of support on the weekly chart from the 2011 low is now around 1830 and once 1859 breaks there’s no support until 1814 area.

Since today is Thursday and the week is almost over with I’d expect any sell off to happen next week. Now if this plays out like I’m expecting we’ll break the rising trendline in the next 2 weeks. The first break should come in the middle of the week and then they should recapture it by the close on Friday to leave everyone guessing.

Will it happen next week or the week after? I don’t know? I am still expecting this choppy range for at least one more week but it could be stretched to 2 more weeks? You know how they love to tire us bears out and frustrate the bulls.

As far as important dates there’s only the 28th of this month as it’s the start of another Legatus meeting. Could it be the top before a nasty sell off and break of that all important trendline on the weekly chart? It’s possible. We’ve seen them stretch out topping patterns this long in the past so they could do it here too.

That would be 3 more weeks of this choppy crap but it’s not uncommon to see a long drawn out top before a big move down. However, if it doesn’t last that long then I’d look for the 22nd as a top since that’s an “eleven” and it’s a few days past option expiration week (next week) which is bullish around 80% of the time.

There nothing stating for sure that the high is in for sure yet either. They could put in a new high next week and then drop back for a wave 1 down the following week and a wave 2 up into the 28th… at which point I’d expect the nasty wave 3 down to start with the breaking of that rising trendline dating back to 2011.

Make no mistake about it… that trendline is the only thing keep the bulls in the game. Once it breaks the fence of protection is down and the hungry bears will be screaming into the cattle pen to rip the bulls to shreds.

My bad……Sinko De Maya.

Derek Jeter on his farewell tour broke a 161 at bat homerless streak dating to last July 28, last night when he knocked one out of the park. 161=23×7

Jeter hit it off the pitcher with the 12-16-1987 birthday. It was his 257 career home run.

A certain sports web site currently has a feature story showing Jeter and Pujols (2-5 or 5-2) congratulating each other and saying their performances are back but not to 2009 levels.

Crude oil chart update: http://niftychartsandpatterns.blogspot.in/2014/05/crude-oil-resistance-levels.html

Next level of support… http://screencast.com/t/NCTBIOvbXgfI

Where will the SPX bottom before the next bounce? It’s all up to the Dollar/Yen in my opinion http://screencast.com/t/wxBzJm68i

New Mothers Day Weekend Video: http://reddragonleo.com/2014/04/20/the-scary-planetary-alignment-due-on-april-21st-2014/

EURUSD Chart analysis: http://niftychartsandpatterns.blogspot.in/2014/05/eurusd-chart-analysis.html

SPY Analysis after close: http://niftychartsandpatterns.blogspot.in/2014/05/spy-analysis-after-closing-bell_10.html

APPLE Weekend analysis: http://niftychartsandpatterns.blogspot.in/2014/05/apple-weekend-update.html

Looks like bulls are back at it again. They never cease to amaze me. But again, this market isn’t about good earnings or good fundamentals, it’s about stealing the sheeps’ money. And I’m guessing there are a lot of bears’ stops sitting up here in this area and even more just above 1900 SPX.

You can pretty much say that it’s almost a guarantee that SkyNet is going to push this market over 1900 now and hit all those “buy stops” before it rolls back down any. Why? Because that’s what it’s programmed to do! The news doesn’t matter, it never does. I would now look for that 1925 area rising trendline to be hit before any decent pullback.

SPY Analysis after close: http://niftychartsandpatterns.blogspot.in/2014/05/spy-analysis-after-closing-bell_14.html

Today looks like some choppy sidesway wave 4 down, which implies we should have one more wave 5 up yet to come. If so, then that rising trendline coming in around the 1925 SPX is still a possible upside target.

It really should depend on how many bears’ stops are sitting right above the 1900 area as if it’s not very many then I doubt they get up past 1900-1915 SPX, but if it’s a lot then it should squeeze up to that rising trendline before stopping.

I would short any hit of that rising trendline the first time to see if it holds. There’s a 80-90% chance that the first hit will produce a pullback. Now will it go back up after the brief pullback and try a second time to break through? I don’t know? But we’ll cross that road when we get there. For right now we are still in a sideways wave 4 down and wave 5 up has yet to start.

The weekly chart is certainly trying to get positive on it’s histogram bars so possibly we’ll see that happen next weeK? Again, while the daily and shorter term charts look bearish the weekly is still holding that rising trendline from 2011 and until it breaks the bulls are still in control.

ES update: http://niftychartsandpatterns.blogspot.in/2014/05/es-falling-towards-support-levels.html

The volume is still light, so there’s still good odds of a higher high yet to come. http://screencast.com/t/0gMPkjChpp5o