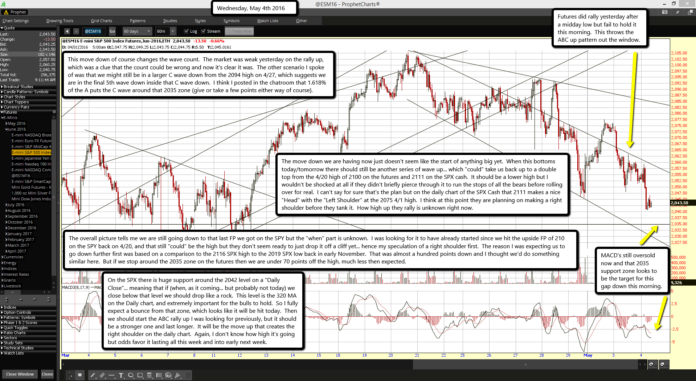

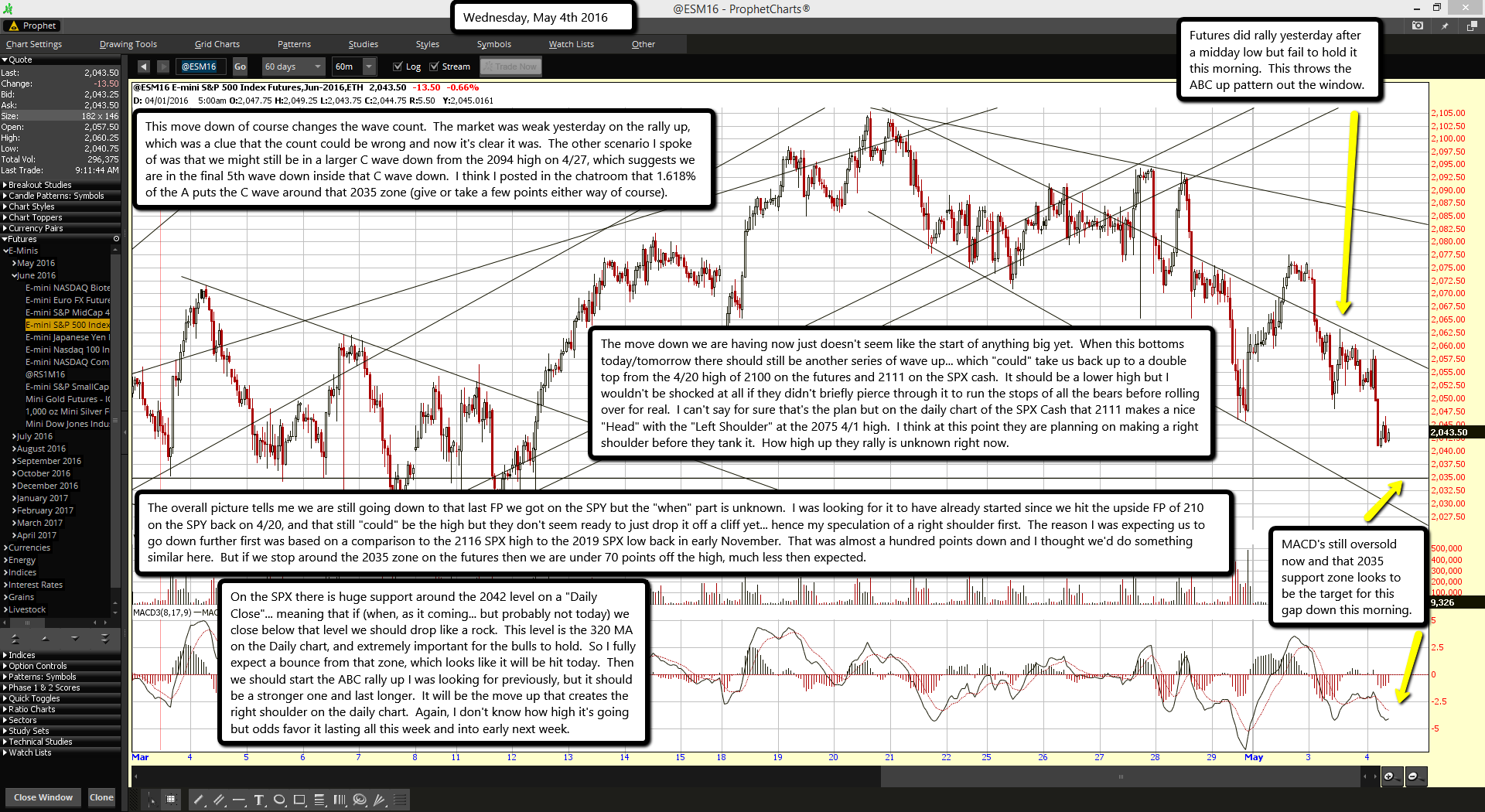

Futures did rally yesterday after a midday low but fail to hold it this morning. This throws the ABC up pattern out the window.

MACD's still oversold now and that 2035 support zone looks to be the target for this gap down this morning.

This move down of course changes the wave count. The market was weak yesterday on the rally up, which was a clue that the count could be wrong and now it's clear it was. The other scenario I spoke of was that we might still be in a larger C wave down from the 2094 high on 4/27, which suggests we are in the final 5th wave down inside that C wave down. I think I posted in the chatroom that 1.618% of the A puts the C wave around that 2035 zone (give or take a few points either way of course).

The move down we are having now just doesn't seem like the start of anything big yet. When this bottoms today/tomorrow there should still be another series of wave up... which "could" take us back up to a double top from the 4/20 high of 2100 on the futures and 2111 on the SPX cash. It should be a lower high but I wouldn't be shocked at all if they didn't briefly pierce through it to run the stops of all the bears before rolling over for real. I can't say for sure that's the plan but on the daily chart of the SPX Cash that 2111 makes a nice "Head" with the "Left Shoulder" at the 2075 4/1 high. I think at this point they are planning on making a right shoulder before they tank it. How high up they rally is unknown right now.

The overall picture tells me we are still going down to that last FP we got on the SPY but the "when" part is unknown. I was looking for it to have already started since we hit the upside FP of 210 on the SPY back on 4/20, and that still "could" be the high but they don't seem ready to just drop it off a cliff yet... hence my speculation of a right shoulder first. The reason I was expecting us to go down further first was based on a comparison to the 2116 SPX high to the 2019 SPX low back in early November. That was almost a hundred points down and I thought we'd do something similar here. But if we stop around the 2035 zone on the futures then we are under 70 points off the high, much less then expected.

On the SPX there is huge support around the 2042 level on a "Daily Close"... meaning that if (when, as it coming... but probably not today) we close below that level we should drop like a rock. This level is the 320 MA on the Daily chart, and extremely important for the bulls to hold. So I fully expect a bounce from that zone, which looks like it will be hit today. Then we should start the ABC rally up I was looking for previously, but it should be a stronger one and last longer. It will be the move up that creates the right shoulder on the daily chart. Again, I don't know how high it's going but odds favor it lasting all this week and into early next week.