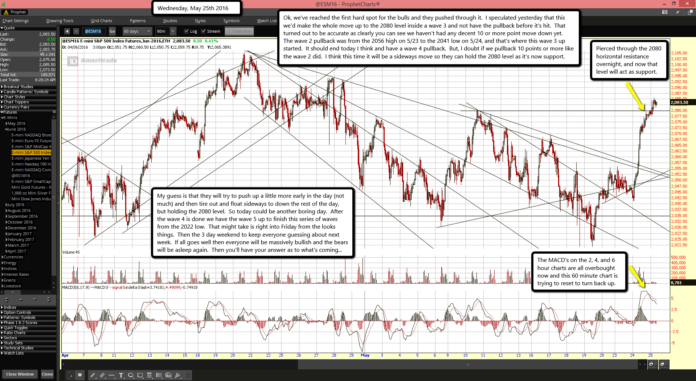

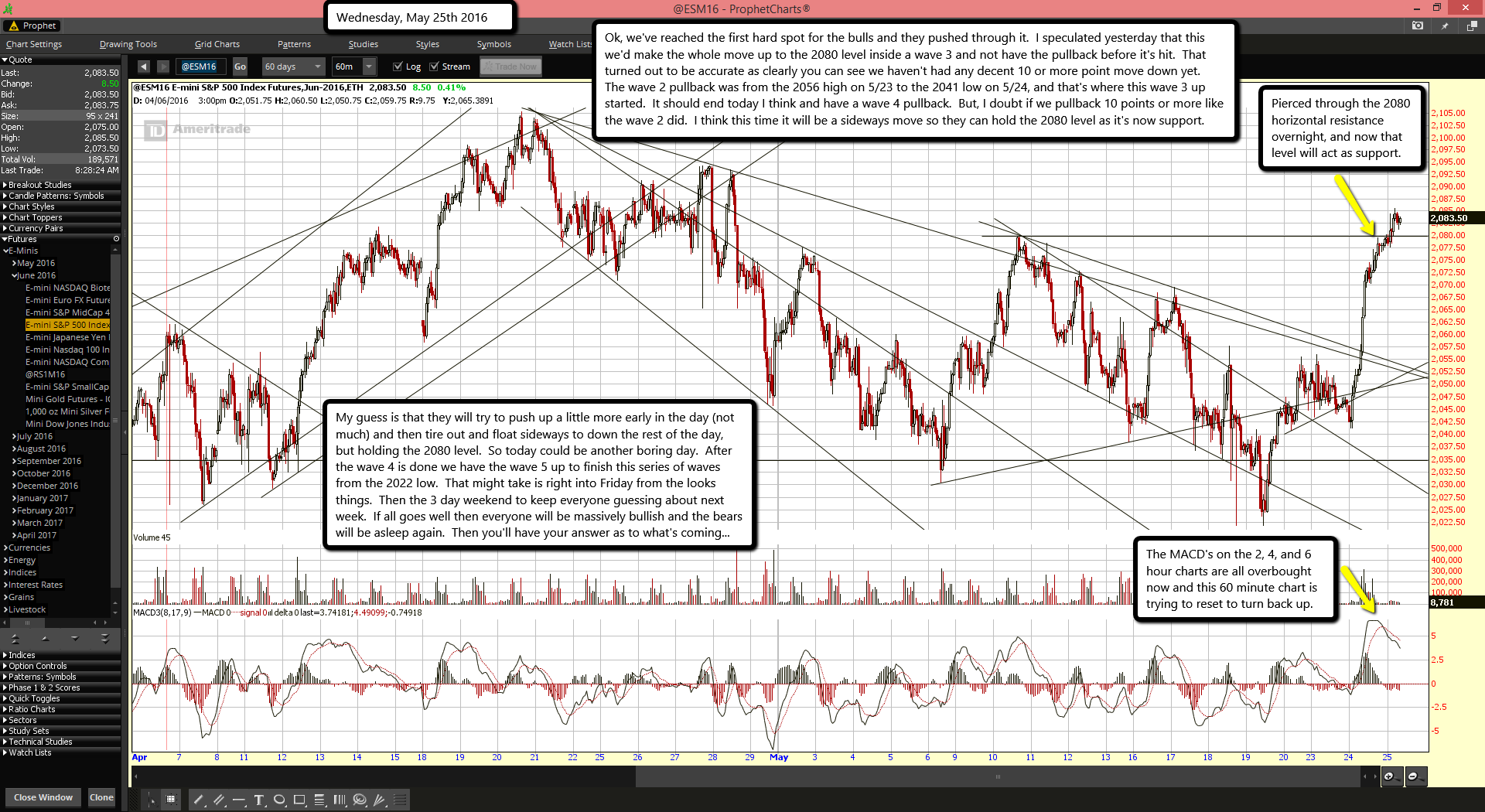

Pierced through the 2080 horizontal resistance overnight, and now that level will act as support.

The MACD's on the 2, 4, and 6 hour charts are all overbought now and this 60 minute chart is trying to reset to turn back up.

Ok, we've reached the first hard spot for the bulls and they pushed through it. I speculated yesterday that this we'd make the whole move up to the 2080 level inside a wave 3 and not have the pullback before it's hit. That turned out to be accurate as clearly you can see we haven't had any decent 10 or more point move down yet. The wave 2 pullback was from the 2056 high on 5/23 to the 2041 low on 5/24, and that's where this wave 3 up started. It should end today I think and have a wave 4 pullback. But, I doubt if we pullback 10 points or more like the wave 2 did. I think this time it will be a sideways move so they can hold the 2080 level as it's now support.

My guess is that they will try to push up a little more early in the day (not much) and then tire out and float sideways to down the rest of the day, but holding the 2080 level. So today could be another boring day. After the wave 4 is done we have the wave 5 up to finish this series of waves from the 2022 low. That might take is right into Friday from the looks things. Then the 3 day weekend to keep everyone guessing about next week. If all goes well then everyone will be massively bullish and the bears will be asleep again. Then you'll have your answer as to what's coming...