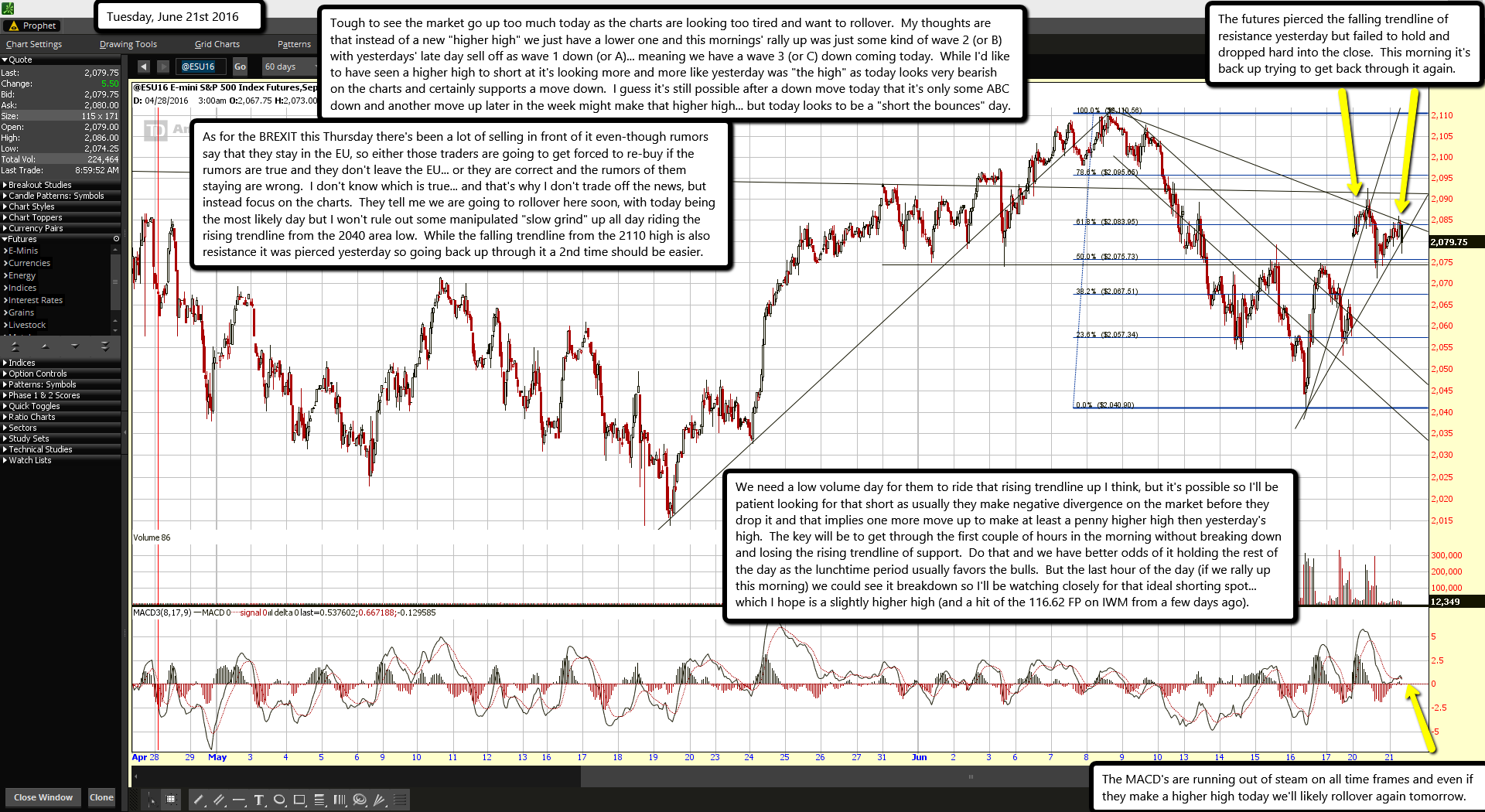

The futures pierced the falling trendline of resistance yesterday but failed to hold and dropped hard into the close. This morning it's back up trying to get back through it again.

The MACD's are running out of steam on all time frames and even if they make a higher high today we'll likely rollover again tomorrow.

Tough to see the market go up too much today as the charts are looking too tired and want to rollover. My thoughts are that instead of a new "higher high" we just have a lower one and this mornings' rally up was just some kind of wave 2 (or B) with yesterdays' late day sell off as wave 1 down (or A)... meaning we have a wave 3 (or C) down coming today. While I'd like to have seen a higher high to short at it's looking more and more like yesterday was "the high" as today looks very bearish on the charts and certainly supports a move down. I guess it's still possible after a down move today that it's only some ABC down and another move up later in the week might make that higher high... but today looks to be a "short the bounces" day.

As for the BREXIT this Thursday there's been a lot of selling in front of it even-though rumors say that they stay in the EU, so either those traders are going to get forced to re-buy if the rumors are true and they don't leave the EU... or they are correct and the rumors of them staying are wrong. I don't know which is true... and that's why I don't trade off the news, but instead focus on the charts. They tell me we are going to rollover here soon, with today being the most likely day but I won't rule out some manipulated "slow grind" up all day riding the rising trendline from the 2040 area low. While the falling trendline from the 2110 high is also resistance it was pierced yesterday so going back up through it a 2nd time should be easier.

We need a low volume day for them to ride that rising trendline up I think, but it's possible so I'll be patient looking for that short as usually they make negative divergence on the market before they drop it and that implies one more move up to make at least a penny higher high then yesterday's high. The key will be to get through the first couple of hours in the morning without breaking down and losing the rising trendline of support. Do that and we have better odds of it holding the rest of the day as the lunchtime period usually favors the bulls. But the last hour of the day (if we rally up this morning) we could see it breakdown so I'll be watching closely for that ideal shorting spot... which I hope is a slightly higher high (and a hit of the 116.62 FP on IWM from a few days ago).