The last two days have be tough to forecast as wild intraday swings were fast and furious. In morning update yesterday when the market was up 10 points I thought it would grind higher the rest of the day but boy was that wrong! It rolled over and went negative by 10 points and then reversed back up again to go positive and then back down one more time into the close... wild day for sure!

Just before the end of the day I did another update for what I thought about today and I really wasn't sure (still aren't) but leaned bullish. However, I didn't have any really strong opinion and suggested everyone to just not trade anything overnight, long or short, as the direction was still unclear.

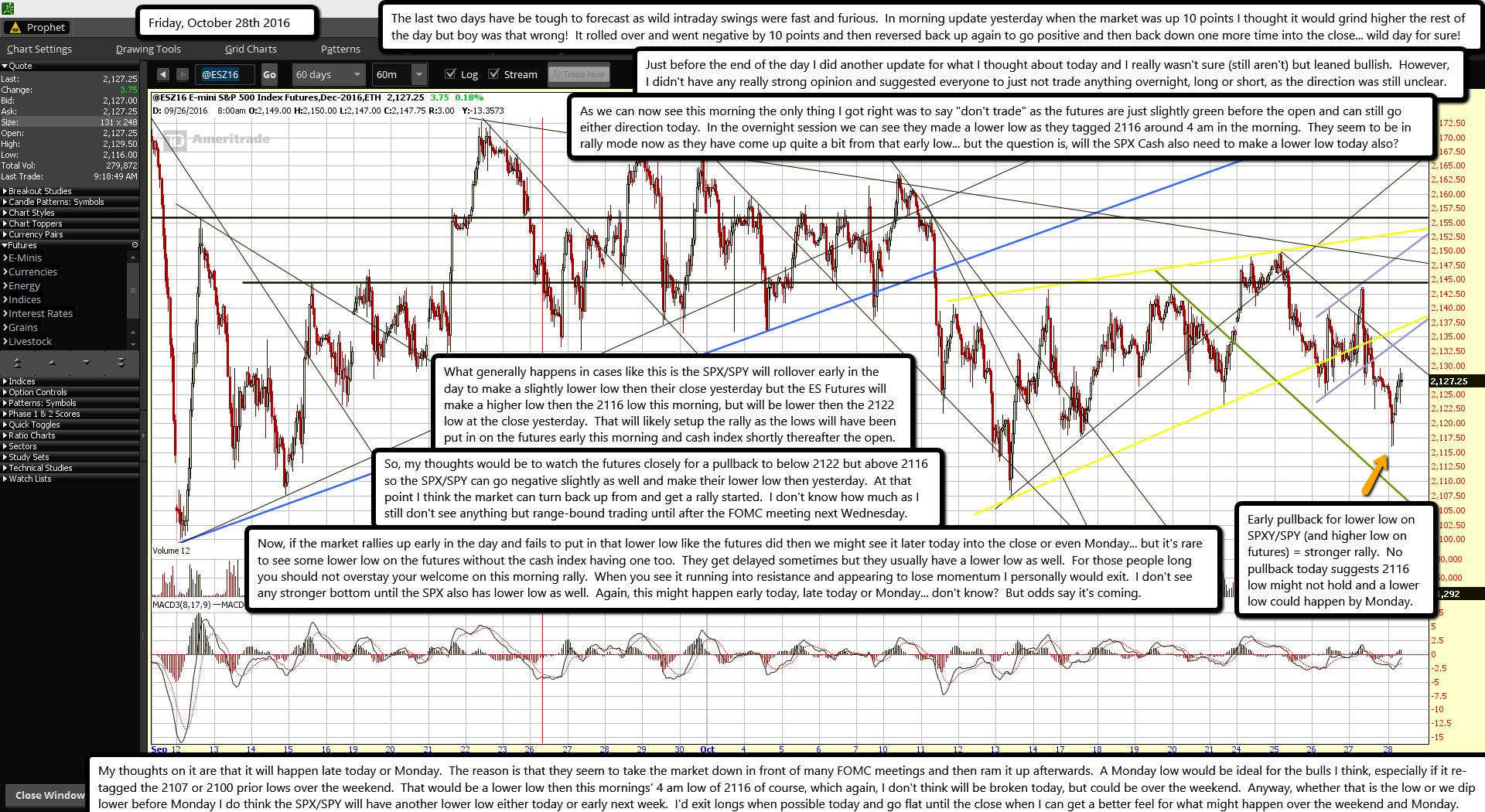

As we can now see this morning the only thing I got right was to say "don't trade" as the futures are just slightly green before the open and can still go either direction today. In the overnight session we can see they made a lower low as they tagged 2116 around 4 am in the morning. They seem to be in rally mode now as they have come up quite a bit from that early low... but the question is, will the SPX Cash also need to make a lower low today also?

What generally happens in cases like this is the SPX/SPY will rollover early in the day to make a slightly lower low then their close yesterday but the ES Futures will make a higher low then the 2116 low this morning, but will be lower then the 2122 low at the close yesterday. That will likely setup the rally as the lows will have been put in on the futures early this morning and cash index shortly thereafter the open.

So, my thoughts would be to watch the futures closely for a pullback to below 2122 but above 2116 so the SPX/SPY can go negative slightly as well and make their lower low then yesterday. At that point I think the market can turn back up from and get a rally started. I don't know how much as I still don't see anything but range-bound trading until after the FOMC meeting next Wednesday.

Now, if the market rallies up early in the day and fails to put in that lower low like the futures did then we might see it later today into the close or even Monday... but it's rare to see some lower low on the futures without the cash index having one too. They get delayed sometimes but they usually have a lower low as well. For those people long you should not overstay your welcome on this morning rally. When you see it running into resistance and appearing to lose momentum I personally would exit. I don't see any stronger bottom until the SPX also has lower low as well. Again, this might happen early today, late today or Monday... don't know? But odds say it's coming.

Early pullback for lower low on SPXY/SPY (and higher low on futures) = stronger rally. No pullback today suggests 2116 low might not hold and a lower low could happen by Monday.

My thoughts on it are that it will happen late today or Monday. The reason is that they seem to take the market down in front of many FOMC meetings and then ram it up afterwards. A Monday low would be ideal for the bulls I think, especially if it re-tagged the 2107 or 2100 prior lows over the weekend. That would be a lower low then this mornings' 4 am low of 2116 of course, which again, I don't think will be broken today, but could be over the weekend. Anyway, whether that is the low or we dip lower before Monday I do think the SPX/SPY will have another lower low either today or early next week. I'd exit longs when possible today and go flat until the close when I can get a better feel for what might happen over the weekend and Monday.