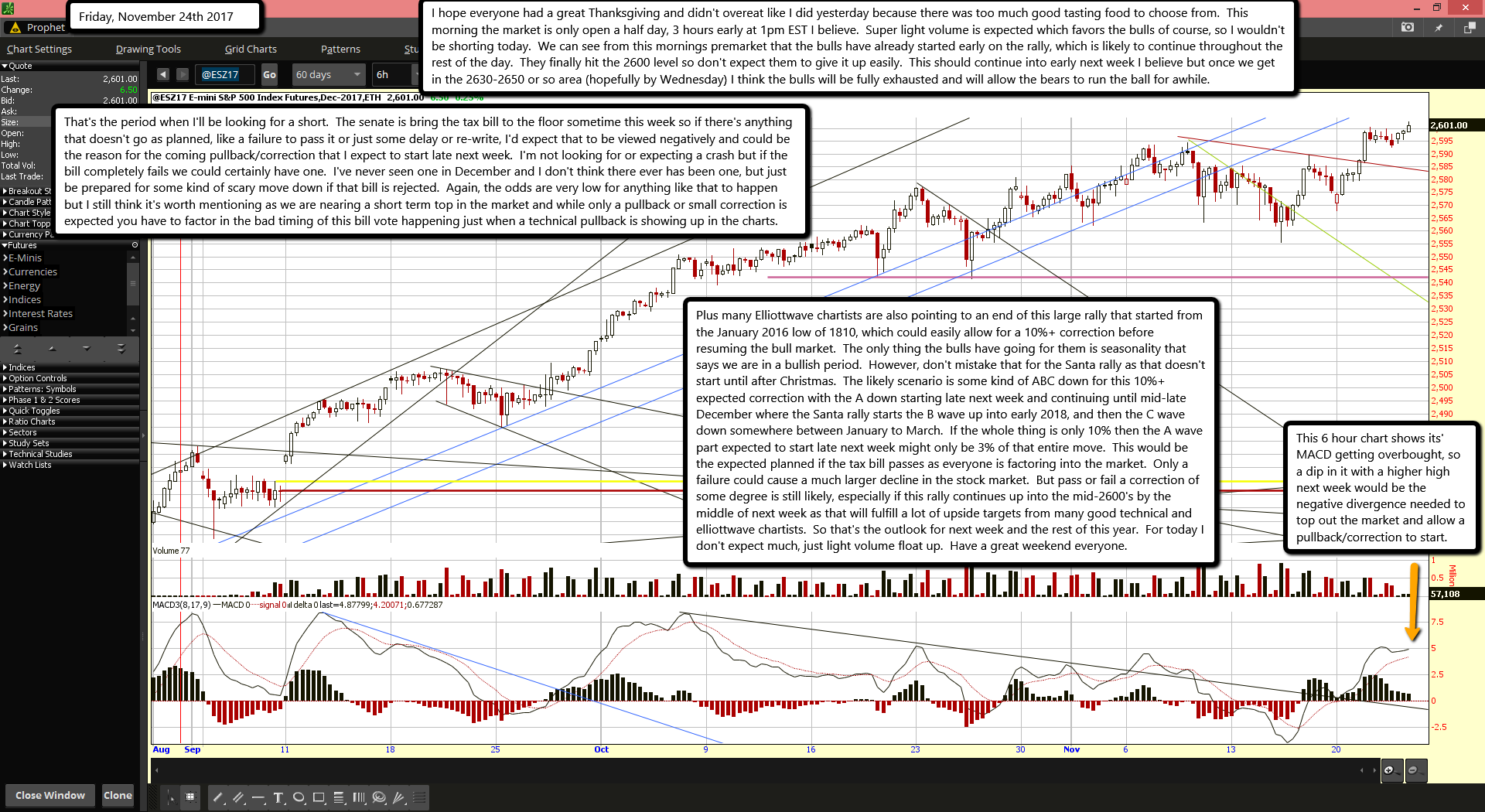

I hope everyone had a great Thanksgiving and didn't overeat like I did yesterday because there was too much good tasting food to choose from. This morning the market is only open a half day, 3 hours early at 1pm EST I believe. Super light volume is expected which favors the bulls of course, so I wouldn't be shorting today. We can see from this mornings premarket that the bulls have already started early on the rally, which is likely to continue throughout the rest of the day. They finally hit the 2600 level so don't expect them to give it up easily. This should continue into early next week I believe but once we get in the 2630-2650 or so area (hopefully by Wednesday) I think the bulls will be fully exhausted and will allow the bears to run the ball for awhile.

That's the period when I'll be looking for a short. The senate is bring the tax bill to the floor sometime this week so if there's anything that doesn't go as planned, like a failure to pass it or just some delay or re-write, I'd expect that to be viewed negatively and could be the reason for the coming pullback/correction that I expect to start late next week. I'm not looking for or expecting a crash but if the bill completely fails we could certainly have one. I've never seen one in December and I don't think there ever has been one, but just be prepared for some kind of scary move down if that bill is rejected. Again, the odds are very low for anything like that to happen but I still think it's worth mentioning as we are nearing a short term top in the market and while only a pullback or small correction is expected you have to factor in the bad timing of this bill vote happening just when a technical pullback is showing up in the charts.

Plus many Elliottwave chartists are also pointing to an end of this large rally that started from the January 2016 low of 1810, which could easily allow for a 10%+ correction before resuming the bull market. The only thing the bulls have going for them is seasonality that says we are in a bullish period. However, don't mistake that for the Santa rally as that doesn't start until after Christmas. The likely scenario is some kind of ABC down for this 10%+ expected correction with the A down starting late next week and continuing until mid-late December where the Santa rally starts the B wave up into early 2018, and then the C wave down somewhere between January to March. If the whole thing is only 10% then the A wave part expected to start late next week might only be 3% of that entire move. This would be the expected planned if the tax bill passes as everyone is factoring into the market. Only a failure could cause a much larger decline in the stock market. But pass or fail a correction of some degree is still likely, especially if this rally continues up into the mid-2600's by the middle of next week as that will fulfill a lot of upside targets from many good technical and elliottwave chartists. So that's the outlook for next week and the rest of this year. For today I don't expect much, just light volume float up. Have a great weekend everyone.