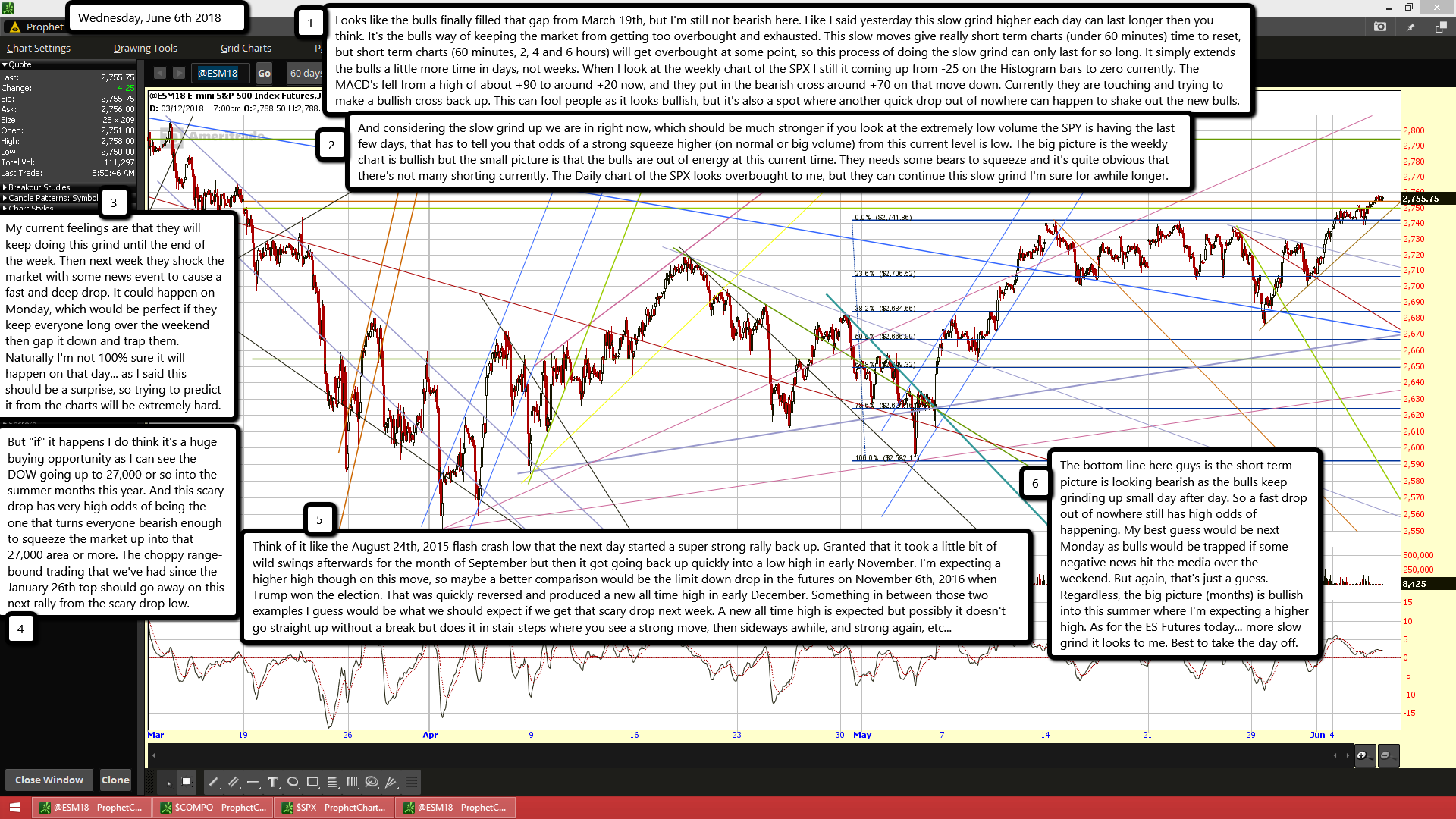

Looks like the bulls finally filled that gap from March 19th, but I'm still not bearish here. Like I said yesterday this slow grind higher each day can last longer then you think. It's the bulls way of keeping the market from getting too overbought and exhausted. This slow moves give really short term charts (under 60 minutes) time to reset, but short term charts (60 minutes, 2, 4 and 6 hours) will get overbought at some point, so this process of doing the slow grind can only last for so long. It simply extends the bulls a little more time in days, not weeks. When I look at the weekly chart of the SPX I still it coming up from -25 on the Histogram bars to zero currently. The MACD's fell from a high of about +90 to around +20 now, and they put in the bearish cross around +70 on that move down. Currently they are touching and trying to make a bullish cross back up. This can fool people as it looks bullish, but it's also a spot where another quick drop out of nowhere can happen to shake out the new bulls.

And considering the slow grind up we are in right now, which should be much stronger if you look at the extremely low volume the SPY is having the last few days, that has to tell you that odds of a strong squeeze higher (on normal or big volume) from this current level is low. The big picture is the weekly chart is bullish but the small picture is that the bulls are out of energy at this current time. They needs some bears to squeeze and it's quite obvious that there's not many shorting currently. The Daily chart of the SPX looks overbought to me, but they can continue this slow grind I'm sure for awhile longer.

My current feelings are that they will keep doing this grind until the end of the week. Then next week they shock the market with some news event to cause a fast and deep drop. It could happen on Monday, which would be perfect if they keep everyone long over the weekend then gap it down and trap them. Naturally I'm not 100% sure it will happen on that day... as I said this should be a surprise, so trying to predict it from the charts will be extremely hard.

But "if" it happens I do think it's a huge buying opportunity as I can see the DOW going up to 27,000 or so into the summer months this year. And this scary drop has very high odds of being the one that turns everyone bearish enough to squeeze the market up into that 27,000 area or more. The choppy range-bound trading that we've had since the January 26th top should go away on this next rally from the scary drop low.

Think of it like the August 24th, 2015 flash crash low that the next day started a super strong rally back up. Granted that it took a little bit of wild swings afterwards for the month of September but then it got going back up quickly into a low high in early November. I'm expecting a higher high though on this move, so maybe a better comparison would be the limit down drop in the futures on November 6th, 2016 when Trump won the election. That was quickly reversed and produced a new all time high in early December. Something in between those two examples I guess would be what we should expect if we get that scary drop next week. A new all time high is expected but possibly it doesn't go straight up without a break but does it in stair steps where you see a strong move, then sideways awhile, and strong again, etc...

The bottom line here guys is the short term picture is looking bearish as the bulls keep grinding up small day after day. So a fast drop out of nowhere still has high odds of happening. My best guess would be next Monday as bulls would be trapped if some negative news hit the media over the weekend. But again, that's just a guess. Regardless, the big picture (months) is bullish into this summer where I'm expecting a higher high. As for the ES Futures today... more slow grind it looks to me. Best to take the day off.