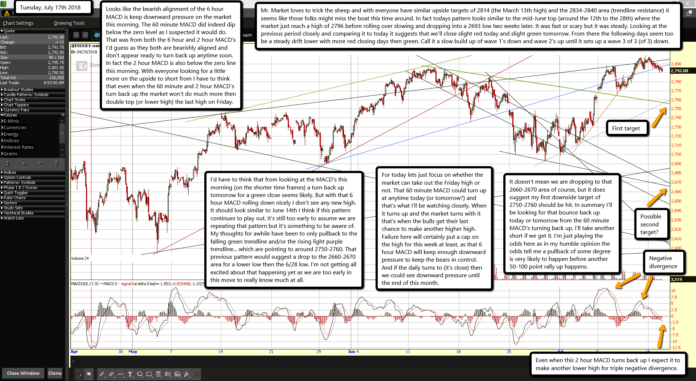

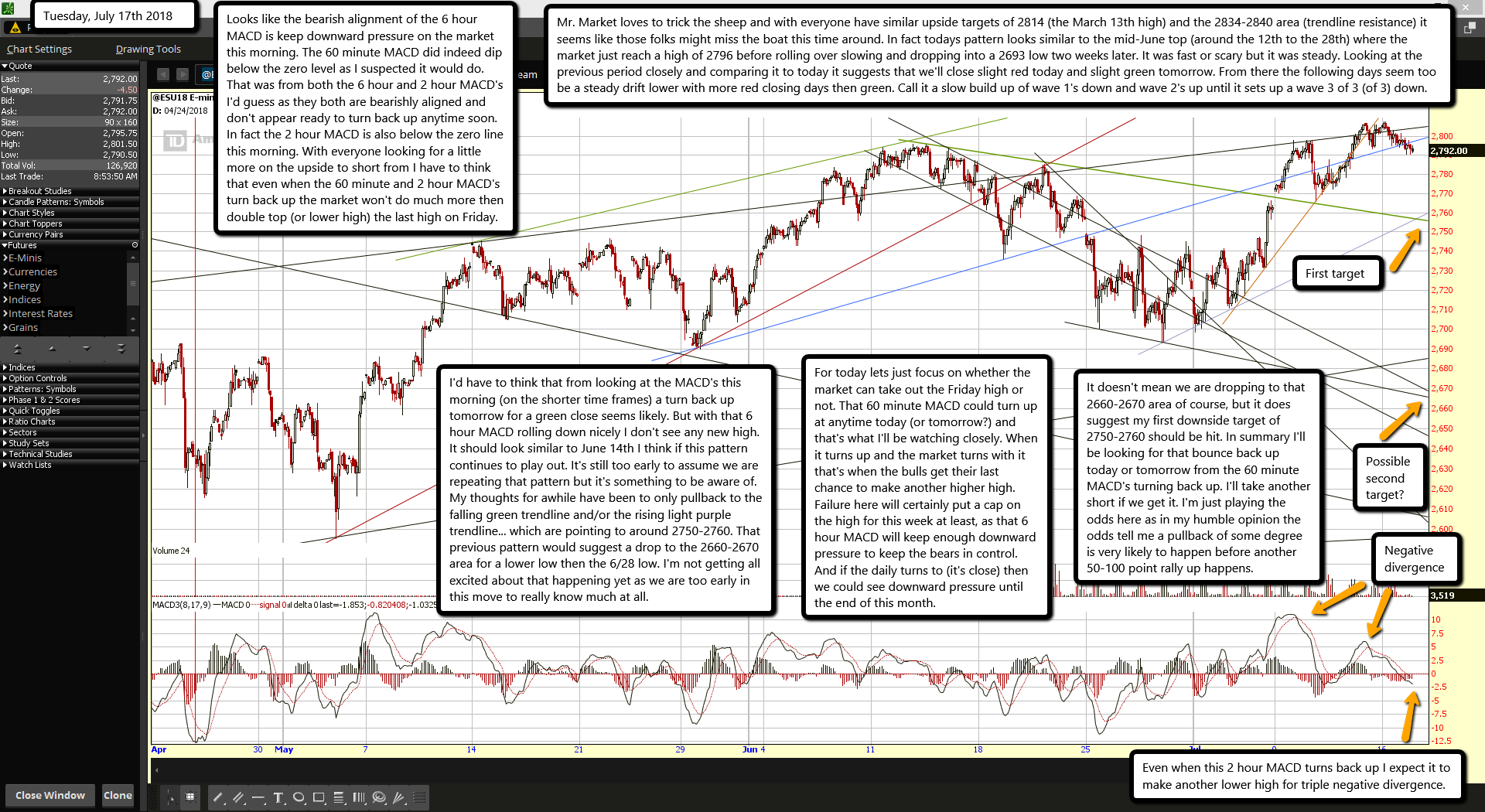

Looks like the bearish alignment of the 6 hour MACD is keep downward pressure on the market this morning. The 60 minute MACD did indeed dip below the zero level as I suspected it would do. That was from both the 6 hour and 2 hour MACD's I'd guess as they both are bearishly aligned and don't appear ready to turn back up anytime soon. In fact the 2 hour MACD is also below the zero line this morning. With everyone looking for a little more on the upside to short from I have to think that even when the 60 minute and 2 hour MACD's turn back up the market won't do much more then double top (or lower high) the last high on Friday.

Mr. Market loves to trick the sheep and with everyone have similar upside targets of 2814 (the March 13th high) and the 2834-2840 area (trendline resistance) it seems like those folks might miss the boat this time around. In fact todays pattern looks similar to the mid-June top (around the 12th to the 28th) where the market just reach a high of 2796 before rolling over slowing and dropping into a 2693 low two weeks later. It was fast or scary but it was steady. Looking at the previous period closely and comparing it to today it suggests that we'll close slight red today and slight green tomorrow. From there the following days seem too be a steady drift lower with more red closing days then green. Call it a slow build up of wave 1's down and wave 2's up until it sets up a wave 3 of 3 (of 3) down.

I'd have to think that from looking at the MACD's this morning (on the shorter time frames) a turn back up tomorrow for a green close seems likely. But with that 6 hour MACD rolling down nicely I don't see any new high. It should look similar to June 14th I think if this pattern continues to play out. It's still too early to assume we are repeating that pattern but it's something to be aware of. My thoughts for awhile have been to only pullback to the falling green trendline and/or the rising light purple trendline... which are pointing to around 2750-2760. That previous pattern would suggest a drop to the 2660-2670 area for a lower low then the 6/28 low. I'm not getting all excited about that happening yet as we are too early in this move to really know much at all.

For today lets just focus on whether the market can take out the Friday high or not. That 60 minute MACD could turn up at anytime today (or tomorrow?) and that's what I'll be watching closely. When it turns up and the market turns with it that's when the bulls get their last chance to make another higher high. Failure here will certainly put a cap on the high for this week at least, as that 6 hour MACD will keep enough downward pressure to keep the bears in control. And if the daily turns to (it's close) then we could see downward pressure until the end of this month.

It doesn't mean we are dropping to that 2660-2670 area of course, but it does suggest my first downside target of 2750-2760 should be hit. In summary I'll be looking for that bounce back up today or tomorrow from the 60 minute MACD's turning back up. I'll take another short if we get it. I'm just playing the odds here as in my humble opinion the odds tell me a pullback of some degree is very likely to happen before another 50-100 point rally up happens.