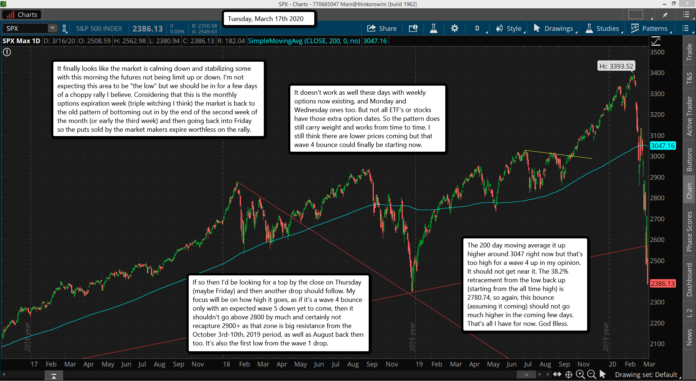

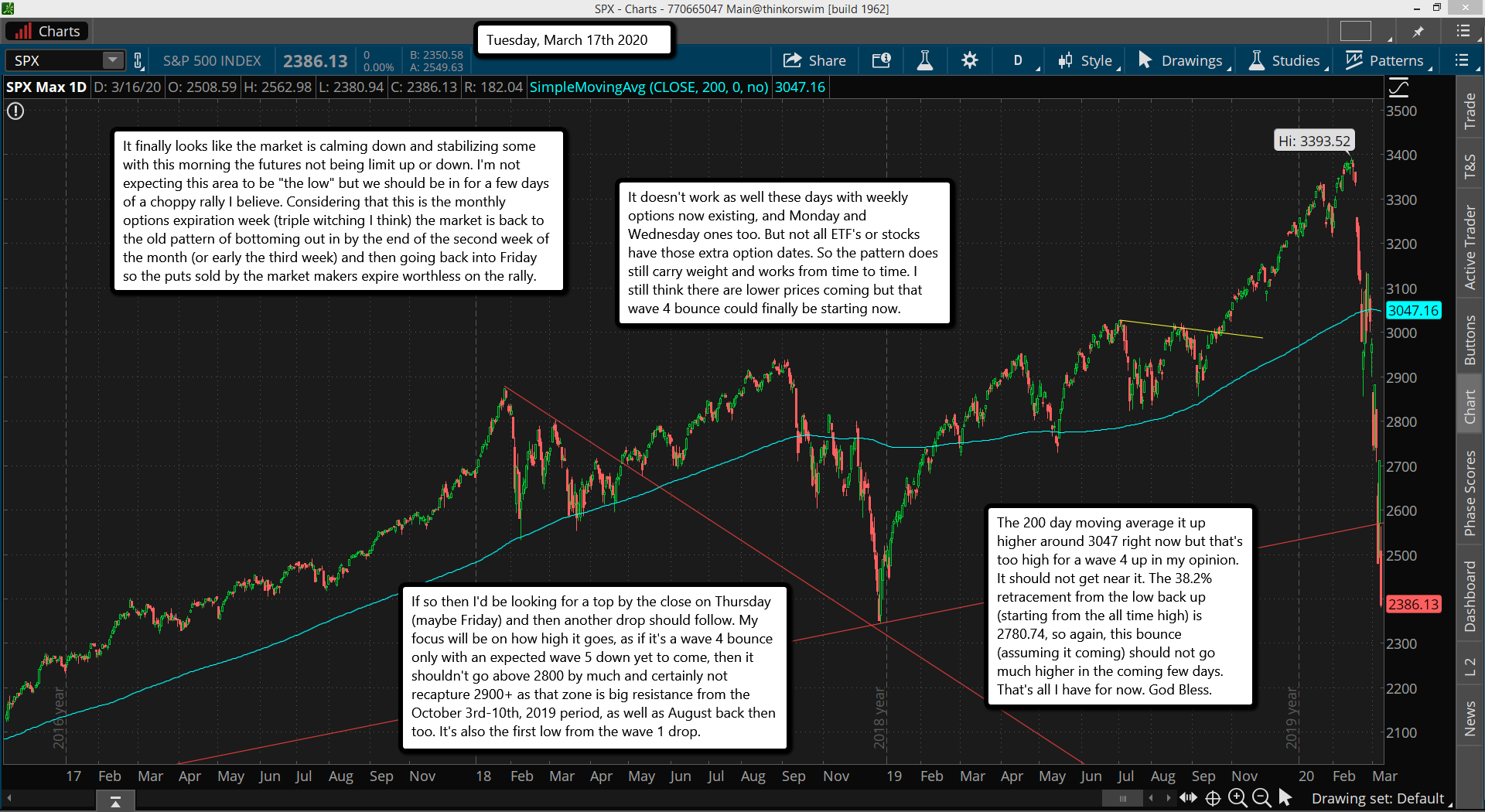

It finally looks like the market is calming down and stabilizing some with this morning the futures not being limit up or down. I'm not expecting this area to be "the low" but we should be in for a few days of a choppy rally I believe. Considering that this is the monthly options expiration week (triple witching I think) the market is back to the old pattern of bottoming out in by the end of the second week of the month (or early the third week) and then going back into Friday so the puts sold by the market makers expire worthless on the rally.

It doesn't work as well these days with weekly options now existing, and Monday and Wednesday ones too. But not all ETF's or stocks have those extra option dates. So the pattern does still carry weight and works from time to time. I still think there are lower prices coming but that wave 4 bounce could finally be starting now.

If so then I'd be looking for a top by the close on Thursday (maybe Friday) and then another drop should follow. My focus will be on how high it goes, as if it's a wave 4 bounce only with an expected wave 5 down yet to come, then it shouldn't go above 2800 by much and certainly not recapture 2900+ as that zone is big resistance from the October 3rd-10th, 2019 period, as well as August back then too. It's also the first low from the wave 1 drop.

The 200 day moving average it up higher around 3047 right now but that's too high for a wave 4 up in my opinion. It should not get near it. The 38.2% retracement from the low back up (starting from the all time high) is 2780.74, so again, this bounce (assuming it coming) should not go much higher in the coming few days. That's all I have for now. God Bless.