Is it over? Is it finally over? I mean the slaughtering of the bears last week of course. Not quite yet, as the bulls are just too close to 1150 to stop now. It would shock me if they didn't push up a little more and put in a double top. After that, well that another story...

It should be quite obvious to everyone by now that the big institutions haven't been buying or selling while this light volume market floats up to the clouds everyday. Why? Because they already bought at the low last February the 5th. They are now waiting for a final top to be put in before they unload again... to the unsuspecting public of course.

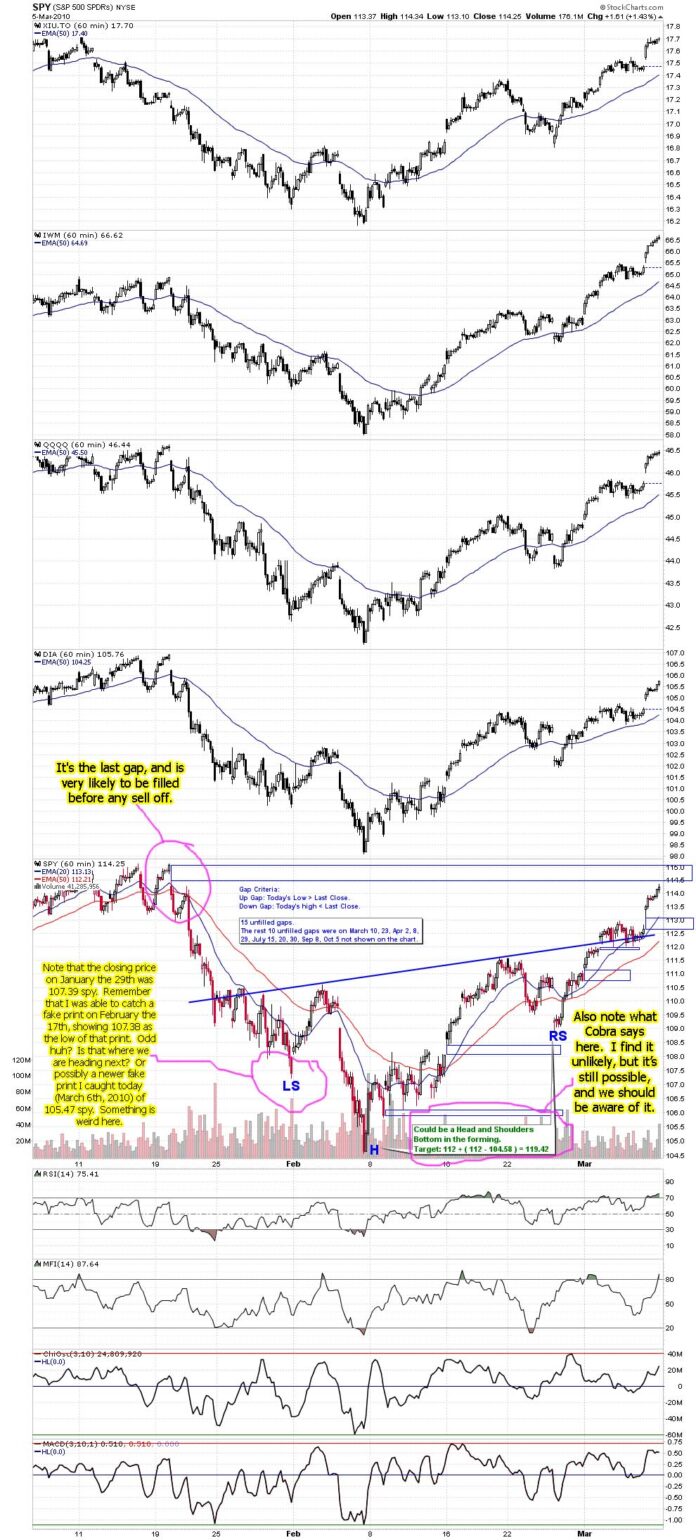

Look at this chart below (from Cobra's website) that shows where all the gaps are on the way up from that 104.58 spy low. (He drew rectangle boxes to point them out). Notice that there were also gaps on the way down from 115 to 104, and that all of those gaps have now been filled... except for one. That area between 114.50 and the 115.14 high still hasn't been filled. That's why the market will continue up on Monday or Tuesday most likely, and fill that gap.

In the chart above, note that the closing price on January the 29th was 107.39 spy. Remember that I was able to catch a fake print on February the 17th, showing 107.38 as the low of that print. Odd huh? Is that where we are heading next? Or possibly a newer fake print I caught today (March 6th, 2010) of 105.47 spy. Something is weird here.

Maybe that print was always there, and I just missed it? I don't know? It's an old print now, as the date is from December 14th, 2009. Here's another one when I go back 6 months on the chart (I only went back 3 months in the chart above).

The low on November 18th, 2009 was 103.78 spy (that's the fake print number, not the real low for the day). Again, maybe these prints were already there, and maybe they don't mean anything. But, you should still keep those numbers in the back of your mind, as the previous major fake print of 1047.28 SPX did play out as the market dropped to 1044.50 just a month later on February the 5th, 2010. Of course it pierced the fake print level a little, but the hard reversal back up... with very large volume, was a clear sign that the fake print was accurate.

Back to next week...

What will cause a sell off to happen, you ask? How about some more bad news too be realized, so that the media will have something to blame the sell off on. The big institutions are going to start unloading those shares soon. When is still unknown? Since they haven't participated in buying on the way up, it's unlikely that they will start buying now, so that the market can push though the double top resistance and start a new bull rally.

I guess it's possible, but highly unlikely at this point. They have had plenty of bad news released in the last month to give them a reason to sell and take profits. I think we are going down to the 104 level for a double bottom. The 200dma is about there now, and probably will be at 104 by the time we get back down there.

How fast it gets there is really based on what level they want to close the SPY on by option expiration. I'm not sure if they will take one week, two weeks, or the rest of the month? Regardless, once they take it down to the level that have targeted (I'm only forecasting the double bottom area. It could only go down to put in a higher low), I do believe it will bounce back hard.

From that point... I don't know? Will the possible double bottom put in a solid support and allow a rally to go up and break the 1150 top? Or, will we only bounce to some Fib level, and then fall back again... taking out the 104 level on that trip?

The weekly chart still hasn't had a cross back down on the moving averages. The 20ma is still above the 40ma, which tells me that the trend is still up. Also, the MACD is still putting in lower Histogram bars and they are still smaller, and rising to the zero mark. Will they cross and and go positive, putting in a lower tower then from the March 2009 area?

That will really depend on how much money the Fed's decide to pump back into the market. Right now, they are trying to pull back the quantitative easing. The average Joe trader doesn't have any money to put in this market, as they are probably trying to draw unemployment right now. The crooked banks aren't going to use their stolen profits to pump the market up more. So, that leaves the government.

At this point, the government is getting a lot of heat from other governments around the world, about the massive printing of the dollar. That of course devalues it, and since other countries hold dollar denominated notes of some kind, they stand to lose billions as the dollar goes down.

Which leads me to believe that the government can't afford to put too much more money into the market. That will put a topside limit on how high the market can go during the summer months. How high you ask? I can't answer that, as the top could already be in, or more stimulus money could push it up higher to 1300 or higher? The 200 week moving average is at 1227.67 today, and then there is the peak in May of 2008 around 1320 area. That would be the next level of resistance. It's too hard too tell right now.

My personal feeling is that they will go down to sideways throughout the summer, not taking out the 1150 high, but not totally crashing below 900 either. Then later this year, a big sell off. The in-between area from Spring to Summer could go either way?

Ok, enough of the longer term picture...

Let's move on to next week. Since there will probably be a ton of people waiting to go short at 1150, I don't think it will happen. Instead, I see two possibly scenario's. One, we go just shy of 1150, maybe to gap window on the 60 minute chart... which is about 114.50 spy, just a hair above where we closed on Friday. Then the sell off starts, not allowing the retail trader to get in on a short position. Or two, we go up to the 1150 level and pierce it by going a little higher. Anyone who went short would get squeezed, which would be the fuel needed to push up another 10 points or so.

Either way, a sell off is likely to occur afterwards. I really don't see the market getting through the double top, as a lot of bears are going to jump on at that level. I think they will continue adding short positions on any pierce of that level too. With that much selling pressure, and institutions wanting out of their long positions too, where is the money going to come from to rally higher? Will Goldman buy at 1150? I think not...

Most likely Goldman will be selling on every touch of 115, providing even more resistance to the unsuspecting retail bulls. We could trade flat for a few days, bouncing up to 115, and down to 112.50 while the big boys unload their shares. The problem with that idea is that they have very large positions, and when they really decide to sell their shares, the market will sell off hard.

However, it won't be the bears pushing the market down, it will be the big institutional bulls. So, I can see some light at the end of the tunnel now, as I believe this bull train is coming to a stop. Get your boarding tickets out bears, and be ready to climb aboard. Next stop... Dark Territory.

Red

_______________________________________________________

Update for Monday...

No point making a special post for Monday as this was about the flattest day of trading I've seen in a long time, and nothing has changed. The volume was the lowest all year, with only 106 million shares traded on the SPY. Since Monday's are usually the most bullish day of the week, and the spy only moved up .01 cents, not making a double top as many people expected... I'd say that's pretty bearish.

A big move is coming... up or down, who knows? I suspect down, but the market seems to fool me every time I say that. So, I'll only forecast a big move (I've ate enough crow to fill my belly for many weeks).

Red

Dear Dragon,

You say that there was a fake print of 105.47 on SPY which you managed to catch.

Am I right in thinking that it happened on friday March 5th (you mentioned March 6th) and that it is no longer on the charts but it was there at some point during the day?

No, actually I just logged into my account on Saturday and there it was? It could have been there on Friday too, as I wasn't logged in on that day, so I wouldn't know.

The one year holding for 15% cap gains is up this week from the march lows

Do you have a link for that info?

Red,

I found this:

http://en.wikipedia.org/wiki/Capital_gains_tax#…

History of the US Financial system in 10 minutes—

I updated the list below from a December post I did and got a bunch of good comments….so chime in, if there are important things I missed, please comment and I will add.

For me the little summary below was a great “view from 20,000 feet”. Imagine that….less than 200 years ago, the British were rampaging through Washington with troops and burning the White House

http://oahutrading.blogspot.com/2009/12/10-minu…

Very nice post Steveo…

Here is what stands out to me…

—1862: John Rockefeller founds a company to refine oil (later renamed Standard Oil)—

—1869: Goldman Sachs is founded by German immigrant Marcus Goldman and (in 1882) Goldman's son-in-law Samuel Sachs—

—1902: a female journalist, Ida-Minerva Tarbell, exposes Standard Oil's dubious practices—

—1913: John Rockefeller is worth $212 billions, 1/44th of the USA economy, and establishes the Rockefeller Foundation “to promote the well-being of mankind throughout the world”—

—1913: 2% of USA citizens control 60% of the national product (Morgan and Rockefeller alone control 20%)—

—1914: The Federal income tax is introduced—

—1929: stock markets crash around the world (“great depression”)—

—1929: the richest 1% owns 40% of the nation's wealth, while workers' productivity has increased 43% since 1919—

—1932: 10,000 banks have failed since 1929, GDP has dropped 31% since 1929, the stock market has lost almost 90% of its value from boom to bust, and unemployment reaches 23.6%—

—1933: the Federal Deposit Insurance Corp is created to insure deposits in banks and thrift institutions—

The Rockefeller family clearly own this country. They are part of the Illuminati here in America. They write laws that benefit them and screw the public, just like the Rothschild, and Vanderbilt do in Europe.

Our history is written by the rich, and therefore much of it is left out. Especially the things that would threaten their monopoly of the country.

Goldman Sachs is just a front-man company for them, as I'm sure they have major influence of what they do too.

You missed the creation of the Federal Reserve Bank in 1913. That was of course created by crooked banksters. The “print of money” to pay bills, or stimulate the economy was a right assigned to congress, by the Constitution. But, a little bribery to the congressmen and senators of the time period, and that right was given away.

JP Morgan wasn't mentioned, but he was a big player back then too. He was funding Alexander Graham Bell, Thomas Edison, and Nikola Telsa. Telsa originally invented a way to send electricity through the air for free, and many other free technologies.

But Morgan clearly told Telsa that “he couldn't profit” from electricity sent through the air, as he couldn't cut them off if they didn't pay their bill. So, he backed Bells' wired system (which was rumored as being stolen from Telsa).

Morgan didn't care about anything but profit. It wasn't enough to profit from the building of the infrastructure to put out free electricity, as he wanted to people to be dependent on his wired system.

How much money is enough? How many times do you have to take someone's money? Isn't one time fair enough? Do you really have to constantly take their money month after month? When does “doing something for the good of mankind” overshadow greed?

I'm for capitalism, but too much greed is why the world is broke, and the rich are so rich. I personally would love to arrest all of those greedy crooked billionaires that do nothing for the world, other then rob the public blind.

We have had technology to run car on water since the 70's, and technology to get over 200 mpg with gasoline. Do you see in our world today? Of course not…

Why is everyone so evil and greedy? How can we live in a world of peace, with all the greed? It's sad really. I could care less about how much money I have. I simply want freedom, and peace. Unfortunately, the greedy crooks have made it mandatory to work to make money, just so we can eat.

Your post made me think a lot about the world we live in. I look forward to a new world where everyone is equal, and all the basic technology needed to survive is free.

I don't know if it will happen in my lifetime, but if the market goes down to Dow 3000-4000, by 2012, I suspect that a revolution will force these “Green Technologies” out into the public.

I hope so…

Thanks for making me think tonight Steveo.

Red

No link needed,IRS code

Stocks held longer then 1 year pay 15% cap. gains

Market bottom march 9 2009 ,it only grows from here

Duh… I should have known that! But I never hold that long… That's a lifetime to me. I swing trade options only, so I'm either in cash or an option spread… but never stock. Thanks for the update.

Profits on futures traded on indices instantly get 50% of their value treated as long term capital gains.

No kidding. Wish i had some of them there profits!

Does that mean they will pay me back 50%… since I lost money this year, instead of making a profit? LOL.

This is not something people want to hear, especially not those with a bearish bias. The truth is, the market is experiencing an extremely bullish momemtum acceleration. What this means is every pullback will be bought and a new high followed. Short term it is overbought and a sharp pullback is expected. But following the pullback will be a catapult to a new high.

We have a runaway train accelerating downhill. It will crash a lot of bears. If you are short and the goddess Fortuna smiles upon you, then count your blessing, don't fight the reversal that follows.

I hope this helps to shed some light on what comes next. If this helps to spare some pain in the months ahead, be sure to donate to Anna's animal rescue fund (over at HOB).

After the pullback… to whatever level it stops at, new highs could happen? The trend is pointing up currently, and the pullback is not likely to change that.

But it could of course? It really depends on how far the pullback takes us? Will it be really shallow and only make it to 111.50, or a little deeper and go to 109.00? If it falls to 104.00 again, I believe the trend will turn down at that point.

I'd like to see that, but I don't know if it will go that far down? I see some type of pullback coming… how deep is another question?

A smaller pullback would keep the uptrend intact. If that happens, then we will most likely break the 1150 top this Spring and Summer.

Yes, a sad day for the bears. I think the bears should just take the next 6 months off, and wait for this fall. It should be exciting about then.

much can be learned by observing the behavior of markets around containment points, the $RUT has been the tell for the last month so we'll focus on it

http://www.flickr.com/photos/47091634@N04/44162…

the last 5 days the $RUT has blown through 2 containment points in a uni-directional manner, if you study the above chart very closely you'll see how the $RUT reacts when blowing through consecutive containment points

Now what is interesting to note is the last two times this has happened it's marked an inflection point.

First time it happened was on 9/9/09 & 9/16/09 then the $RUT went on to dance sideways for 5 days which marked a top for 3 months.

Second time this happened was on 10/27/2009 & 10/30/2009, one trading day later on 11/2/2009 the $RUT put in a bottom that has held for 4 months and counting.

At any rate, this week has important implications for longer term setups.

Gm, Sundancer, Thanks for the update. Up or sideways is my guess.

I got your reply email by the way… just let me know whenever.

On another note, here is some comments from Master che trader David Gott (whatever that means? But he's pretty good and many follow him)

Comments….

> 3/7/10

>

> 4:11EST

>

> ESH10:

>

> The move up from 1114.00 to 1138.75 bothers me;

>

> We should have pulled back below 1114.00 before

> the breakout;

>

> Which we didn’t instead we went parabolic.

>

> Generally when this happens we head back to the

> region where the pullback should have occurred.

>

> This move up from 1084.50 was basically one

> large trader

>

> Therefore on the next anticipated pullback or

> dip all the traders that missed this move up, which was majority of the traders

> will buy into this move, which should push it back down…

>

> In other words for the short term (1 to 3 days)

> I’m expecting a pullback

>

> Reaching 1143.50 or not before this anticipated

> pullback will determine the depth of the pullback and also when and where this

> large trader takes profit, I wouldn’t be surprise to see him switch sides for a

> sweet profitable swing trade..

>

> Basically he’s the market.

>

> Another thing that bothers me, is this; the

> move up from 1114.00 was to easy..

>

> Don’t get me wrong; we will make new highs,

> although I’m expecting a pullback beforehand.

>

He sends this out through email, and I don't know where to sign up to get on his list? (Someone forwarded it too me). I don't even know if it's private information or not? I don't believe he's charging for it though?

But clearly, he has access to what is going on down on the trading floor. So, I thought I'd post it.

HI Red, Nice Post.

Thanks G…

Unfortunately I don't think us bears will see the big crash until later this year. But, I'll take any sell off they give me at this point.

I posted that email exactly as it came too me, but it seems odd thinking that all the dip buyers will push the market back down? Did he make a mistake in his post? Shouldn't that say that the dip buyers will push the market back up? What am I missing here?

> Therefore on the next anticipated pullback or

> dip all the traders that missed this move up, which was majority of the traders

> will buy into this move, which should push it back down…

the only weekly setup that is remotely intriguing is the $VIX weekly

The $VIX currently has 4 consecutive lower closes than opens on it's weekly and since the $VIX peaked during the 10/20/08 week the $VIX only has one sequence longer than 4 consecutive lower closes than opens. That sequence which ended @ 6 originated during the 11/24/2008 week and terminated during the 12/29/2008 week

Expanding our time parameters to the 8/13/2007 week as our starting point we see 2 more occurrences where there were 4 consecutive lower closes than opens and 1 occurrence where there was 6 consecutive lower closes than opens which terminated during the 8/18/08 week.

update 9:32 est operators gapped the $VIX up 3.5% while the markets opened flat. Important implications for the weekly setup.

Doesn't this mean at some point we'll the $VIX will go back down to fill the gap?

it certainly can, however I don't have any setups/probabilities telling me when it could happen

Sundancer

Is your bias long or short on equities based on what you see with the VIX ?

thanks

the weekly setup on the $VIX gives a greater probability for a negative weekly close for equities, combine the $VIX weekly setup with the $RUT setup I talked about in my other post this morning and the upside potential for the market this week seems limited

Carl this morning:

March S&P E-mini Futures: Today's range estimate is 1131-1145. I expect the market to reach 1200 over the next three months.

1126-1140 estimate for last Friday

1131-1145 /ES range estimate for today

1140 right now so -9 to +5 from here

Quite large ranges, no?

I think 15 point ranges are typical for Carl. Haven't gone back to check for sure.

A 10 to 15 point range is normal.

So much for my memory.

I try not to use it for anything 🙂

SPY reached it's containment pt. this morning

http://www.flickr.com/photos/47091634@N04/44172…

SPY danced with it's containment pt. for a whopping 9 minutes today, I'll talk about downside de-leverage points tomorrow

Carl is now long one unit /ES at 1138.50

1138 is the midpoint of his range for today

Wow… up .01 cents on the SPY, with 105 million shares traded. That's got to be a record for the lowest volume this year.

Either we are going to explode much higher or sell off big… as something is certainly brewing…

the $SPX 1131.56 gap left @ 10:10 on friday tells you all you need to know

Carl at days end:

1131-1145 estimate today for /ES (14 points)

1136 -1140.50 actual today (4.5 points)

range today was within 2-3 points of Carl's midpoint

Trades: Bought 1 unit of /ES at 1138.50

Did not sell it.

Grade: incomplete

Looks like Carl might have to take it up the #&*&#*! tomorrow. He can't be right everyday, can he?!

Monica… that's not nice for a lady to say. (ROFLMAO)

Monica,

As I write this, /ES is 1135.50, which puts Carl down 3 points. I've seen Carl stopped at a 3 point loss before, but no idea if he has a stop on this one.

In his latest post, he says

For the time being I see support in the 1131-33 range.

I marked /NQ and /ES at the end of the after hours session, and both are (as I write this) at or a bit below those levels.

Things can indeed get worse, but right now it doesn't fell like an ugly open for tomorrow.

I have TNA over night, so I rather hope Carl does well on this trade 🙂

Sounds like he is starting to get on your nerves 🙂

TNA opened up (7 cents this time) for the 6th day in a row. TNA closed up 0.6%.

We are in a Full Moon Trade, which favors TNA.

After six days, this trade is up 16.3%.

Volume for TNA was the lowest since Jan 8th (39 trading days)

$RVX (VIX for $RUT) closed 4.0% higher with TNA up 0.6%. A divergence, as these normally go in different directions.

TNA has been up 17 of the past 19 days.

The high for TNA today was $52.26, highest high since November of 2008

Ultimate Oscillator for TNA peaked at 78 nine trading days ago and has generally fallen since then but has remained above 50 and is currently 71. Indicating continued strength for TNA. There was a bit of a divergence as the Ultimate Oscillator dropped 3 points while TNA rose 0.6%, but that sort of divergence happened last week and TNA continued to rise.

Bollinger Bands for $RVX (VIX for $RUT): today’s candle closed higher & farther from the lower band and the lower Bollinger band is **off the chart** but seems to be falling. Hard to read, but looks like $RVX is rising, bad for TNA. This very thing happened last week and TNA kept rising.

Bollinger Bands for $RUT: The small white candle for $RUT rose along side the rising upper Bollinger Band, indicating that $RUT is rising. Good for TNA

Bollinger Bands for $RUT:$RVX ($RUT vs VIX for $RUT): today’s small doji candle dropped, the first such drop in 9 trading days. Not sure what to make of this. Perhaps this indicates TNA might drop tomorrow.

Overall, it looks like TNA continues to distance itself from any congestion and might continue rising tomorrow.

The view from Americanbulls

TNA is a HOLD (wait for a possible SELL-IF signal after the close on Tuesday, for a possible sell at some point Wednesday). Today was a White Spinning Top, indicating a normal up day. TNA is now up 40% since the buy signal on Feb 9th. TNA was $36.69 at the time, and closed today at $51.79.

TZA is a WAIT (wait for a possible BUY-IF signal after the close on Tuesday, for a possible buy at some point Wednesday). Today was a Black Spinning Top, indicating a normal down day. TZA is now down 30% since the sell signal on Feb 9th. TZA was $11.04 at the time, and closed today at $7.66.

Summary: The candles today changed nothing.

Red, everything you have written I agree with. gonna short, again, tomorrow. My belief is commodities will lead on the market lower, and that is their general tendency. Gold being the herald, up or down. do you have any thoughts in this regard? tia

The USO (oil) is very toppy and ready to pull back some. It has some heavy resistance at 40.50, but might pullback before it gets there.

GLD is above all the moving averages and should bounce off the 20ma and 50ma as they are merging together around 109.

However, it could go either way on Gold, as a rise in the dollar, and sell off in the market should push Gold down. But, if the sell off in the market creates fear, because it's falling too fast, then Gold was rise as a flight to safety would occur.

So, I'm bearish on the USO, but neutral on the GLD, is it could go either way? But yes, most all commodities are overbought now, and should pullback soon.

Carl just now:

March S&P E-mini Futures: Today's range estimate is again 1131-1145. I expect the market to reach 1200 over the next three months.

1131-1145 estimate today for /ES (14 points)

1131-1145 estimate yesterday for /ES (14 points)

Owns 1 unit of /ES at 1138.50 from yesterday (currently down 5 points)

Range today is -2.50 to +11.50 from current (1133.50)

GM Earl, Watching TZA go down again. What you doing?

Good Morning, Gcocks.

Had some TNA overnight. Watching it go up today.

Good for you. I am glad somebody is on the right side of the market. However don't get mad at me because I need it to come down for a while.

No problem. I need one days notice so I can get out of the way 🙂

How about an hour notice? Help a poor guy out!!! LOL

I'm doing the one day at a time thing 🙂

Market seems to want to go up. TNA is getting silly at this point.

$RVX is trying to creep up. $RUT RSI at 74.77. Crazy!

Crazy can be nice, but it never lasts very long 🙂

Carl just went long second unit at 1138.75

general of the bull army AAPL is running out of room to run as it's running into it's controlling TL on the weekly

http://www.flickr.com/photos/47091634@N04/44195…

Out of TNA

SPY's containment pt. still in control

http://www.flickr.com/photos/47091634@N04/44202…

update 4:01 SPY's containment pt. remains in control

for those will eagle eye's, the 1131.56 $SPX gap on friday will tell you what you need to know

http://www.flickr.com/photos/47091634@N04/44203…

Hi Sundancer,

Here is a weekly SPX chart with a channel indicating, to me at least, that we can head to 1230ish before heading back down. Any thoughts?

http://screencast.com/t/ZDEyYTBiOD

Thanks in advance.

this chart is the reason why the operators haven't let the $SPX run yet like they have with the $RUT and $NDX

http://www.flickr.com/photos/47091634@N04/43590…

consecutive monthly closes above that purple line and we're going to test the all time highs,

what would cause such a move; currency event

Now do I think this is a very probable scenario; no

The time element co-relational to the regulatory aspect of the market can be very telling

SPY 1/21 -1/22/2010 = 2 trading days

114.27 – 109.09 on ~ 690,000,000

SPY 2/16/2010 – 3/5/2010 = 14 trading days

108.86 – 114.34 on roughly 3.5x total volume of 1/21-1/22

SPY controlling TL update

http://www.flickr.com/photos/47091634@N04/44198…

update 4:01 est SPY was rejected @ controlling TL

Carl sold both units at 1143.25

Carl at day’s end:

1131-1145 estimate today for /ES (14 points)

1134 -1145.25 actual today (11.25 points)

Missed the low by 3 points, nailed the high.

Trades:

Bought 1 unit of /ES at 1138.50 yesterday, sold it today at 1143.25 (gain of 4.75 points)

Bought 1 unit of /ES at 1138.75 today, sold it today at 1143.25 (gain of 4.50 points)

Grade B

Carl and you had a better day than me.

Carl is good at this. So far 🙂

Great post Red.

The view from Americanbulls

TNA is a HOLD (wait for a possible SELL-IF signal after the close on Wednesday, for a possible sell at some point Thursday). Today was a White Candlestick, indicating a normal up day. TNA is now up 42% since the buy signal on Feb 9th. TNA was $36.69 at the time, and closed today at $52.38.

TZA is a WAIT (wait for a possible BUY-IF signal after the close on Wednesday, for a possible buy at some point Thursday). Today was a Black Candlestick, indicating a normal down day. TZA is now down 31% since the sell signal on Feb 9th. TZA was $11.04 at the time, and closed today at $7.55.

Summary: The candles today changed nothing.

TNA opened down 0.9%. First down open in 7 days. Filled that gap right away and was up 3.3% at the high. TNA closed up 1.1%.

We are in a Full Moon Trade, which favors TNA.

After seven days, this trade is up 17.2%.

Volume for TNA was fairly high (3rd highest in 16 trading days)

$RVX (VIX for $RUT) closed 2.4% higher with TNA up 1.1%. 2nd divergence in a row, as these normally go in different directions.

TNA has been up 18 of the past 20 days.

The high for TNA today was $53.56, highest high since November of 2008

Ultimate Oscillator for TNA peaked at 78 eleven trading days ago and has generally fallen since then but has remained above 50 and is currently 69. Indicating continued strength for TNA. There was a bit of a divergence as the Ultimate Oscillator dropped 2 points while TNA rose 1.1%, but that sort of divergence happened last week and TNA continued to rise. Two days in a row for this divergence.

Bollinger Bands for $RVX (VIX for $RUT): today’s candle closed higher & farther from the lower band and the lower Bollinger band is **off the chart** but seems to be falling. Hard to read, but looks like $RVX is rising, bad for TNA. This very thing happened last week and TNA kept rising. 2nd day in a row for this.

Bollinger Bands for $RUT: The white candle for $RUT rose along side the rising upper Bollinger Band, indicating that $RUT is rising. Good for TNA

Bollinger Bands for $RUT:$RVX ($RUT vs VIX for $RUT): today’s candle dropped, the 2nd such drop in 10 trading days, and 2nd day in a row. Not sure what to make of this. Perhaps this indicates TNA might drop tomorrow (same warning as yesterday).

Overall, it looks like TNA continues to distance itself from any congestion and might continue rising tomorrow. Divergences are stacking up, but TNA keeps rising.

The view from Americanbulls

TNA is a HOLD (wait for a possible SELL-IF signal after the close on Wednesday, for a possible sell at some point Thursday). Today was a White Candlestick, indicating a normal up day. TNA is now up 42% since the buy signal on Feb 9th. TNA was $36.69 at the time, and closed today at $52.38.

TZA is a WAIT (wait for a possible BUY-IF signal after the close on Wednesday, for a possible buy at some point Thursday). Today was a Black Candlestick, indicating a normal down day. TZA is now down 31% since the sell signal on Feb 9th. TZA was $11.04 at the time, and closed today at $7.55.

Summary: The candles today changed nothing.

TNA opened down 0.9%. First down open in 7 days. Filled that gap right away and was up 3.3% at the high. TNA closed up 1.1%.

We are in a Full Moon Trade, which favors TNA.

After seven days, this trade is up 17.2%.

Volume for TNA was fairly high (3rd highest in 16 trading days)

$RVX (VIX for $RUT) closed 2.4% higher with TNA up 1.1%. 2nd divergence in a row, as these normally go in different directions.

TNA has been up 18 of the past 20 days.

The high for TNA today was $53.56, highest high since November of 2008

Ultimate Oscillator for TNA peaked at 78 eleven trading days ago and has generally fallen since then but has remained above 50 and is currently 69. Indicating continued strength for TNA. There was a bit of a divergence as the Ultimate Oscillator dropped 2 points while TNA rose 1.1%, but that sort of divergence happened last week and TNA continued to rise. Two days in a row for this divergence.

Bollinger Bands for $RVX (VIX for $RUT): today’s candle closed higher & farther from the lower band and the lower Bollinger band is **off the chart** but seems to be falling. Hard to read, but looks like $RVX is rising, bad for TNA. This very thing happened last week and TNA kept rising. 2nd day in a row for this.

Bollinger Bands for $RUT: The white candle for $RUT rose along side the rising upper Bollinger Band, indicating that $RUT is rising. Good for TNA

Bollinger Bands for $RUT:$RVX ($RUT vs VIX for $RUT): today’s candle dropped, the 2nd such drop in 10 trading days, and 2nd day in a row. Not sure what to make of this. Perhaps this indicates TNA might drop tomorrow (same warning as yesterday).

Overall, it looks like TNA continues to distance itself from any congestion and might continue rising tomorrow. Divergences are stacking up, but TNA keeps rising.

Great post Red.

Carl at day’s end:

1131-1145 estimate today for /ES (14 points)

1134 -1145.25 actual today (11.25 points)

Missed the low by 3 points, nailed the high.

Trades:

Bought 1 unit of /ES at 1138.50 yesterday, sold it today at 1143.25 (gain of 4.75 points)

Bought 1 unit of /ES at 1138.75 today, sold it today at 1143.25 (gain of 4.50 points)

Grade B

Carl and you had a better day than me.

Carl is good at this. So far 🙂

Carl sold both units at 1143.25

SPY controlling TL update

http://www.flickr.com/photos/47091634@N04/44198…

update 4:01 est SPY was rejected @ controlling TL

this chart is the reason why the operators haven't let the $SPX run yet like they have with the $RUT and $NDX

http://www.flickr.com/photos/47091634@N04/43590…

consecutive monthly closes above that purple line and we're going to test the all time highs,

what would cause such a move; currency event

Now do I think this is a very probable scenario; no

The time element co-relational to the regulatory aspect of the market can be very telling

SPY 1/21 -1/22/2010 = 2 trading days

114.27 – 109.09 on ~ 690,000,000

SPY 2/16/2010 – 3/5/2010 = 14 trading days

108.86 – 114.34 on roughly 3.5x total volume of 1/21-1/22

update 4:01 SPY's containment pt. remains in control