In my weekend post I stated that I didn't know where or when the market is going to correct. Well... it looks like we might have a clue as to "where" the market is headed? When is another question that I don't have the answer too... yet.

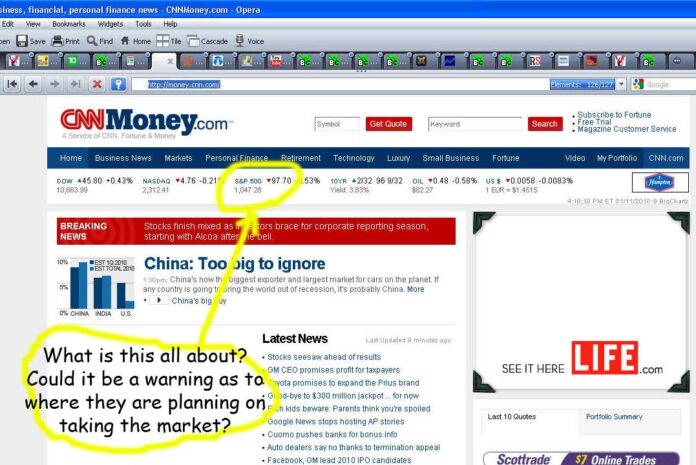

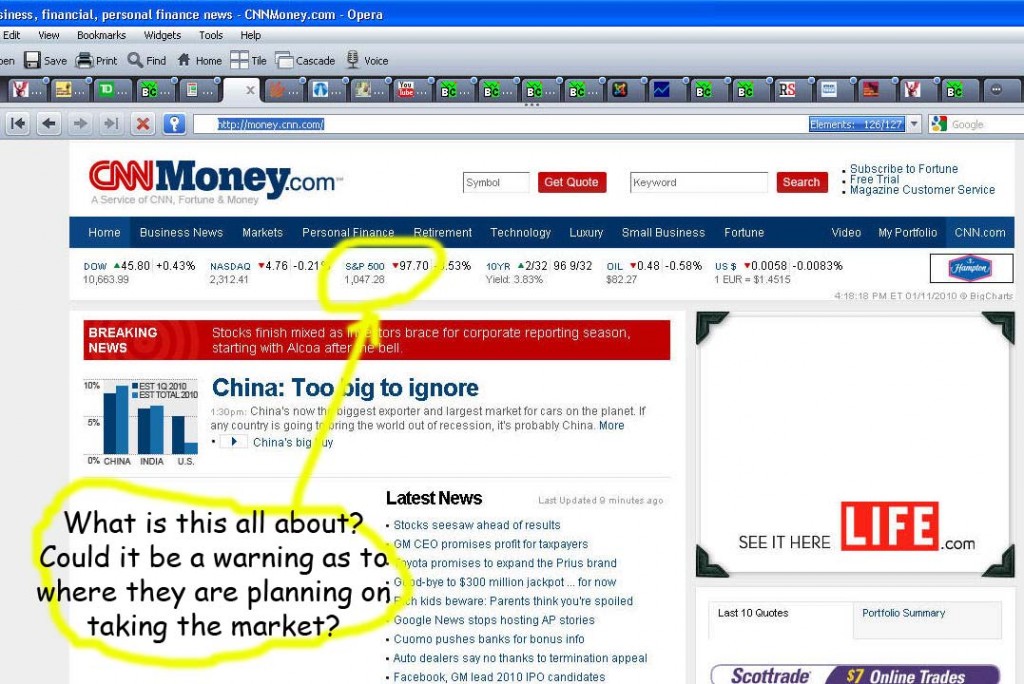

This is what CNN had on their website after the close today. I heard it was also on Yahoo too. It only lasted about 5 minutes, before they corrected it to show that the S&P was up 2 points... instead of 97 points down! But, I managed to "screen capture" the image for you.

It may have been just a simply mistake, but I've heard rumors that the people who control this market (yes... it's manipulated, and very heavily lately) sometimes post fake numbers to let some of their friends know where they plan on taking the market. Most of the time they do it on an intraday candle, but this time it appeared on the closing print of the day.

You can call me crazy if you want too, and maybe you're right? Maybe this is just a mistake... and maybe it's not? What if we continue to float sideways to up until the month of January is over, and then drop 97 points (or just to hit the 1047 level), in the month of February?

Many people believe the old saying that the month of January will set the tone for the rest of the year. If that's true, then I believe they will make January close out positive, so that they rest of the year won't experience another sell off like 2008. That doesn't mean that we don't go down and correct some, but it means that we shouldn't take out the March 2009 lows this year.

I could see us move down and up throughout the entire year, and still be above the March low when the year closes out. Between now and early February we could see them push it on up to the 61.8% Fib level, and that would be the high for the year.

Or, they could go flat until February... sell off 97 points (or to the level of 1047?), and then rally up to the 61.8 Fib level in the Spring and Summer months? It's hard to say right now, but I'm pretty confident that they are going to close out January positive, and that a sell off will occur in February. From how high... I don't know? I don't see much more upside, without a drop of 20 points or so... but anything is possible in this low volume market, and even a 20 point drop might be too much to ask for?

My plan is simple now... Stay out of this market until early February, and I'll know more then as to about "when" the sell off should happen.

Red

we have them now batman

Short ES,

Full Disclosure, plumb loco.

Who's plumb loco? Me or you… or both? LOL!

Hi REd

100 pts in 6 days from Jan 22 to Feb 2 has been my outlook for a while now.

Jay

I think it will be next month… but it's coming, that's for sure!

Nice red, interesting…

Take care

Joe

Remember this post Joe, as I think we'll see our 97 point in early February.

More pressure on equities tomorrow

http://online.wsj.com/article/SB126333757451026…

I seen that too. Google will be hit hard tomorrow… that's for sure. But, I think the market will go sideways to slightly up for the next 3 days… until OPX is over, then down some more. (That's on my latest post).

Thanks for dropping by…

Red

Check the option pain for qqqq and spy. looks like more downward pressure though. option pain for qqqq is 44. Thats were option writers will make the most money

More pressure on equities tomorrow

http://online.wsj.com/article/SB126333757451026…

I seen that too. Google will be hit hard tomorrow… that's for sure. But, I think the market will go sideways to slightly up for the next 3 days… until OPX is over, then down some more. (That's on my latest post).

Thanks for dropping by…

Red

Check the option pain for qqqq and spy. looks like more downward pressure though. option pain for qqqq is 44. Thats were option writers will make the most money

Remember this post Joe, as I think we'll see our 97 point in early February.