I should have a weekend post by Sunday. In the mean time, I'm looking for an up day Monday. I got out of my short position around 1043 Friday, and went long. More on the weekend update.

The Bears are Dancing Today…

The Bears are celebrating today as the market took a nice correction down! After-hours RIMM disappoints and the market sells off even more! It's about time the Bulls take a breather. How long can those longhorns keep snorting crack anyway?

This should make for another down day tomorrow. I'm still looking for 1040 SPX before getting out of my shorts and going long over the weekend. I'm buying in the money calls on the SPY so I don't get killed with the time value evaporating.

The plan is to go long until the magic 1100 area is hit. It could be 1108-1120, but I'm looking to get out around 1100, or around the magic turn date of October 5th-7th. We'll just play it one day at a time.

Now, back to my spy business...

I spent the day following the girls around over at Evil. I always wondered how Douala got all that inside information she delivers to us everyday. I snapped this picture of her stealing top secret information...

Then, I followed Anna while she went shopping today. She's pretty happy today as the market took a nose dive, (which meant that she has extra cash to shop with). She was talking about buying new black bikini, but it looks like she ended up buying a blue one. Here she is getting ready to cross the street... although she seems a little lost?

Finally, on to Keirsten...

She was a tough one to get a picture of as she caught me following her. But a great spy always gets the job done. Here she is at work stealing files that contain the details of Goldman Sachs' trading program.

Man! You guys just don't know what these ladies have to go through to give you evil rats all those secret trading tips. Being a hot trader babe is a big job...

That's all for now, this is your Private Dick Red signing off.

Mole Caught with 2 New Hot Trader Babes…

While everyone is enjoying the change of tone over at Evil Speculator (Mole is on vacation), with Anna and Keirsten at the helm, I secretly snapped this picture of Mole with 2 new hot trader babes.

Is over for Anna and Keirsten? Many have stated that it's a lot nicer now since Evil Mole is gone. This could be bad for Mole's reputation. Let's face it... with Mole around, if you get out of line, he'll send over some goons to kick your ass.

With Anna and Keirsten, you will be put in "time-out", and given a piece of caulk to write "I will be a nice poster" a thousand times on the blackboard. I believe that this is not the reputation that Mole wants to portray to his evil rats. He's more into "Bitch-Slapping" you silly!

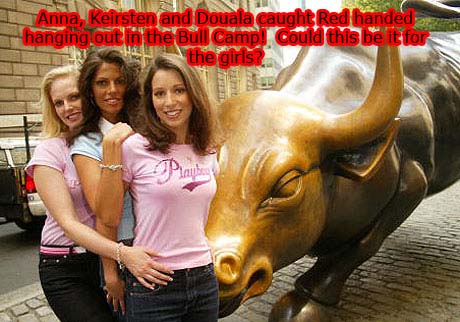

It's not looking good for the girls, as I also caught them in this picture! Yes, that's Anna, Keirsten, and Douala... with a Bull!

Traders! Mole is really going to be upset now. Is it over for the ladies at Evil? Will they be replaced by new trader babes (strippers probably... knowing Mole)? Inquiring minds want to know!

This is your Private Dick Red signing off!

The Fed Never Disappoints…

Once again the Fed changed nothing, and said basically nothing. The market rallied first with a nice head fake upside breakout, then sold off hard... with a huge spike in volume. Today's volume was about 226 million shares, of which almost all of it was in the last 2 hours of the day.

The 108 (SPY) level was hit and rejected hard. I still believe we will see 104 by this Friday. Then up next week to the end of the month. A small sell off (not worth gambling on) in the first day of the month of October, and a finally rally to 110 on or about October 5th-7th.

Once that high is reached, that will be "Gap Fill" from 2008. This will be probably the closest we will get to a crash over the following week. The market should drop hard and fast from this level. Finally destination will be around 900. Of course not during the first week, but for this first wave one down 900 should be great support. That could be in November sometime?

A nice wave 2 up, (probably in December when volume is light and the market can be manipulated higher), and then wave 3 down early next year. Look out 2010!

Waiting for the Fed…

Looks like the markets are waiting for the FOMC meeting tomorrow before making any big moves. I still am short and looking for a nice down move until this Friday. Most FOMC meetings in the past have caused the market to rally. I believe it will be different this time around.

However, after the quick sell off, I'm still looking for the market to rally to the 1100 range next week. The 104 and 102 spy targets are good support and one of those area's should be a short term bottom this Friday.

The dollar sold off hard today, which should have caused the market to rally 100-150 points on the Dow. Yet it only managed about 50 points. They may be "de-coupling" from each other. At some point the market will wake up and realize that a falling dollar isn't good for the market anymore.

Also, volume was extremely low again today. That should pick up tomorrow, and Thursday and Friday. If 107 spy breaks to the upside, I'll cut my losses and go long to 110... the final top I believe.

Market down on light volume? That’s a change!

Market down on light volume? That's a change!

Today the market traded about 150 million shares. That's another light day, which normally has a positive effect on the market. Usually the buy programs come in and rally the market higher at the close. That didn't happen today. What is going to happen with higher volume the rest of the week? I suspect a nice down move is coming, and it will take many by surprise.

The Fed's are auctioning off $195 Billion Dollars worth of Treasury Bonds on Tuesday, Wednesday, and Thursday. I look for the dollar to rally during that time period, then collapse back down after the auction is over. Since the market has been trading the opposite of the dollar I expect the market to fall when the dollar is rallying.

Then, on Friday, I expect the dollar to be forced down again and the markets should rally the following week to that magic 1100 SPX number. But for this week I'm looking for a low of 104 SPY or 102 on EOD Thursday, or Friday.

Red

Weekend Update…

Weekend Update...

Since most of the other blogs out there are focused on technical, (and since I'm not an expert at TA Elliott waves, Forks, Fib's, and Astrology), I decided I do this post on my "Gut Feeling"... backed up by some evidence.

During the last 6 months or so I've seen the market break all the rules and go "against the grain"... so to speak. It should have corrected many times in the past, but didn't? Why? Well, I think we all know the answer to that... Government Manipulation, (or the Plunge Protection Team... aka PPT). Now, I'm not going to debate whether or not it's right or wrong, or if they really exist. I'm only saying that someone is controlling this market, which makes predicting it illogical.

In any case, let's look at some evidence from the past, and try to make a prediction anyway...

Did you notice all the late day "Buy Programs" that come out of nowhere when the market seemed ready to sell off? They seem to work extremely well when the volume was light during the trading hours. Many other times those buy programs happened during the pre-market or after-hours. Conclusion, in a low volume environment they clearly were able to manipulate the market up.

Recently however, the volume has been slowly increasing, which is putting a damper on the huge moves up. Last Monday through Thursday the volume went up steadily from 175 Million shares, to 195, 215, and 225, (with each day gaining less because of the increased volume). Then, on Friday, we dropped down to 150 Million shares of volume. We should have rallied up on Friday hard as the buy programs can easily prop up the market with this low volume.

But, it didn't happen? Why? Were the buy programs not triggered? Looking at an intra-day chart you can see that they were in fact triggered. But, they didn't have enough juice left in them to push it up but 2.81 points. That tells me that the buy programs are having less and less effect. It should have been up the usual 8-10 points with such low volume. Looks like somebody's very tired! Could they be running out of steam?

So, how can they push up the market higher to reach that critical 1100 mark, like they are dying to do? Can you say "Short Squeeze?" That's how they've done it in the past. They sell off to a critical support level to draw in the bears, and then kick in the buy programs to kick start the market. Once it starts the bears are squeezed and have too buy to cover their shorts. The rally accelerates just as planned... until all the bears are squeezed out.

It looks to me like this recent run up has squeezed out every last bear breathing. That's why they can't get the market to move up any higher... there is no one left to buy! Even the bulls won't buy at these levels. So, how do you get the market to move back up again? Simply... trick the bears into coming back into market with a nice sell off to a critical support level. Then, kick in the buy programs and squeeze the bears again. That should be enough juice to rally to the precious 1100 level... where the final top of Primary 2 will be.

More evidence...

Let's talk about the might dollar. Ever notice how the dollar seems to get a bid just before a big Fed Auction? It has happened many times in the past, and each time the dollar would collapse back down after the auction was over. Hmmm, does that sound fishy to you? Sure does to me... Well, guess what's happening next week? You guessed it... another Fed Auction! Only this one is really BIG! This time they are going to auction off $112 Billion Dollars (of worthless IOU's).

But, who wants them when the dollar is worth less and less each day? No one is the answer... of course! (That's why they've been secretly buying them back themselves, through 3rd party's so no one notices). So, the Government is stuck in-between a rock and a hard place. On one hand they need to rally the dollar so that the auction will be a success, and they will find buyers. On the other hand they know that a rally in the dollar will collapse the stock market. However, they also know that they have run out of bears to squeeze. Which means that they don't have enough power to push the market higher either.

So, the logical thing to do is to buy the dollar up until the auctions are over. That will also drive the market down, which will bring in more bears. After the auctions are done and all the suckers buy more worthless bonds, sell the dollar and buy the market back... creating another short squeeze on the bears. The market will then rally again. It's a Win Win deal! Problem solved... correct?

Well, at least too me it seems so. I don't see any other way to rally this market higher without bears to squeeze. The Friday action clearly shows that the buy program failed to rally the market much higher. They can't buy the entire market themselves... at best all they can do is light the fire to get a rally started. They still need buyers to come in and continue the rally higher. Those buyers are reluctant bears that are forced to cover. The bulls aren't buying at these levels.

That means that there are NO willing buyers. So, you have to force someone to buy, (aka... the bears)! I truly think that this is their only option. They must buy the dollar. It fact, I believe this support of the dollar already started on Friday. Notice on the intra-day chart of the UUP the HUGE Spike in Volume at the close. That's 3 1/2 Million shares! Was that a buy program? I think so... and I think more buying will happen next week. Which will tank the market. Then, come Friday, the buying ends!

The following week they will push the dollar back down, which will strike a match to the market, and the fire will start burning hot again! Look out 1100... here we come! Talk about pain! Let's slap the Bulls in the face and tease the bears with plastic fish!

Bottom Line...

I think the market will correct down all of next week, and should find a bottom at the 102 SPY area, or the 99.5-100.00 SPY area. Whichever it's at Friday should be the low. The following week should rally back up toward that 1100 area. Needless to say, I went short Friday, and will go long this coming Friday... assuming all this guessing is correct?

The other possible scenario for next week is to go down on Monday to 1040, then rally Tuesday, Wednesday and Thursday to 1100, and finally sell off on Friday... starting P3 down. I think they would like to be able to control the market in that fashion. But, I just don't think they have enough juice left to push that high without more bears to squeeze. The bears have been burnt so many times that many of them are hesitate to jump in. So, that makes me believe that more support levels will need to be broken before there are enough bears back in to squeeze hard enough to reach 1100. I don't think one down day to 1040 will make enough bears jump in.

Although in the past 30-40 point rallies could be achieved over several days with light volume, that last hurrah to 1100 is going to be up against normal to heavy volume next week. Pushing 30-40 up in that kind of volume will be extremely hard too do without other buyers. So, even though the market is so close to 1100, I believe it will be tougher to get that last few points then the first few. That's why I favor the "down all week" scenario, instead of down on Monday and up to 1100 by Friday.

Think about a marathon runner in a 100 mile run. Those first 50 miles were easy. Then, you need a to take a break for a little while. You then regain your strength and push on for another 20 miles. You take another break as the toll on your body is hard and it's a real effort to keep going. So, the next push is only 10 miles, before you need to take a break again.

Looking back... that first 50 miles was easy (the March to mid-May run up), and that next 20 miles wasn't too bad (the early July to mid-August run up), but this last 20 miles seems harder. Why is that? The first 50 was easy. Could it be that you are running out of energy? I think the market is too!

Again, this is not technical analysis, but instead just some hypothetical predictions based on what I've seen in the market over the last 6 months. Of course I could be wrong and they snort that last bag of cocaine up there nose, and 1100 here we come! However, I just don't think that's possible without a decent size pullback. That end of day buy program in the s&p is a big sign telling me that they are out of juice. Couple that with the huge volume in the UUP in the last 10 minutes of the day, and that says too me that they need to crash before taking another hit of speed to get high again.

Red

Expecting a pullback Monday…

I don't believe this insane crack driven rally is over yet, but I do expect a pullback Monday. The levels to look for are 1040 SPX, and if that breaks then look for 1020 (although I don't expect 1040 to break on Monday). The rest of the week should be down. After that, I think the rally will continue higher to the magic 1100 number.

The Bulls are not going to stop until that level is achieved. Too much of a pullback here will prevent them from re-gaining control, and pushing on up. That's why I think 1040 will hold. Once the 1100 mark is hit that should be the top of P2, and P3 will begin.

I'm looking for a move down to 900 area before any serious retrenchment back up. I'm guessing that this will be wave 1 down inside P3. Of course there will be up's and down's on the way to 900, but the larger 2 wave up should occur at that level.

As for how high the wave 2 up goes... well I think that will depend the strength and speed of it. If it moves up fast and with heavy volume, then the 50% or 61.8% Fib number should be a good point of the wave 2 peak. If it moves slower, then it might only make it to the 38.2% or 50% level.

After that move is done, then wave 3 down of Primary 3 should begin. That's when the bulls will be getting slaughter by the hundreds! Steak... it's what's for Dinner! Yummy!

The Bulls are getting tired…

Today was basically a flat day. The market is struggling to go any higher without a pullback first. I'm looking for a pullback to the 1044 SPX first, and if that fails to hold... then on down to 1027. As long as that area holds, then a rally back up to 1108 to fill the gap from 2008.

I leave you with a nice video by Tim Knight of Slope of Hope. More examples of how crooked and manipulated this market really is...

I'm looking to get short tomorrow (Friday), as long as we don't break 1070 SPX. If so, then I'm staying out until the final top is in at the 1108 area.

Mr Top Step calls 1100 the top on the SPX…

We all know that most TA, Fib's, Elliottwave, and Astrology has been worthless lately. That is of course because of the obvious manipulation by the government. The video by "Mr. Top Step" says that the market is going to 1100, and then correct back down to 900. I'd be careful going too much short. (Of course going long is risky too. I'm just sitting and waiting for the top to be reached).

If we have a small pullback I might go long... that's MIGHT?

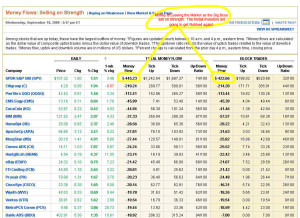

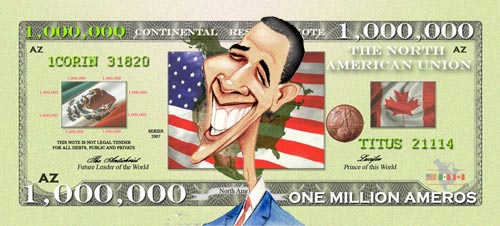

Money flow is coming out of the market at record amounts…

Once again the retail investor are going to get robbed, as the insiders are selling into strength. Once the market reaches the 1100 SPX gap fill area a big correction down to 900 or so will occur. This could start by the end of next week.

Most retail investors will be taken by surprise again, as the insiders are already positioned short on the market. As always, in the real world, the crooks always win and the good guys lose. This isn't some fairy tale TV cop show.

http://online.wsj.com/mdc/public/page/2_3022-mflppg-moneyflow.html

Will the Dollar ever bottom?

As most people are aware, the dollar has been falling like a rock. Many are expecting it to bounce back up and regain it's position as world currency. But, what if the massive printing of the dollar has been pre-planned in an effort to destroy it? Why you ask?

Welcome to the "New World Order"... introducing the Amero Dollar! Your new replacement for the current dollar. Think I'm kidding... I'm not!

This new currency has been planned for a long time now. Is Obama just continuing to carry out the plan by destroying the current dollars buying power, so everyone will accept the new currency? Thanks again Obama. You never seem to surprise me.

Mole’s Evil Bar…

After following Mole for almost a year now (without contributing... sorry Mole), and Tim's blog since about March or so of this year, I decided to finally pitch in a help. Since I seem to be really good at losing money, I decided not to post my thoughts... yet (wax on, wax off, I'm learning!).

But, in defensive of Mole... who seems to have been "One UP'ed" by a poster from Tim's site with the bar scene, I decided to post Mole's Evil Bar. Got Ya Tim! (Just kidding... I like both of you guy's)

P.S. I'll let Mole add the names on the people as I don't want to offend anyone, or leave any regulars out.

Got the Blogroll loaded up…

I'm amazed at how many sites I read and follow. I'm sure I left someone out, but that's most the blogs I read daily (some every other day).

Got Disqus to work now!

I now got disqus to work... Yipee! I also fixed the height problem with the footer. Next will be to change the color of the text over top of the footer to something that you can see... or just delete it?