The market finally filled the gap from October, 2008 today! Now What? It's funny as I posted on my weekend post that the market would have to Gap UP on Monday to cross the huge resistance level between 109.62 to 110.34, and what did it gap open at... 110.38! How's that for avoiding that mine field? Just jump over it instead.

Ok, now that the gap is filled... where's the market going next? I think they are going up to the next resistance level at 112.30 to 112.50 (spy) by the end of the week, but a small retracement could happen tomorrow as the 6o minute charts are rolling over.

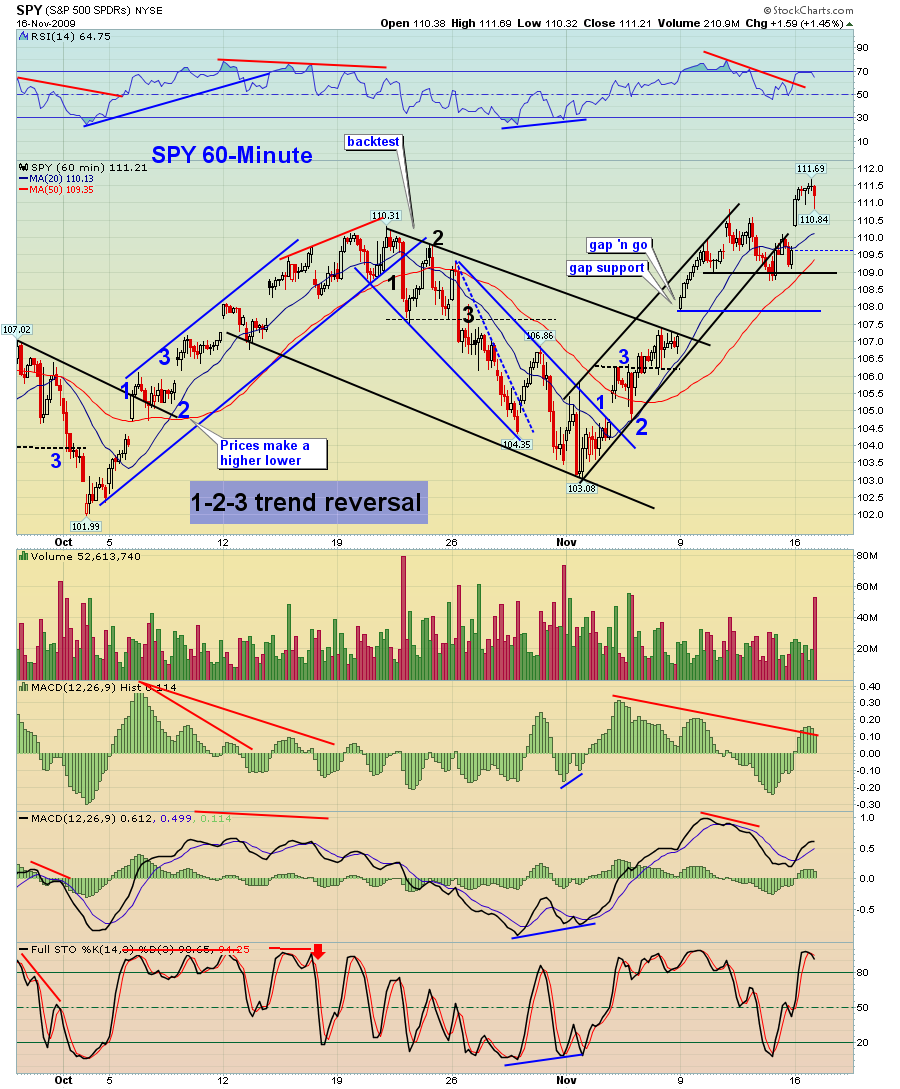

The chart above is from "The Chart Pattern Trader". You can check my blog roll for his links. Notice the big sell volume into the close. If it wasn't for that last red candle the spy would have traded less then 200 million shares today. Which of course means an UP day. That last candle pushed it to 210.9 million... just a little over. However, the rule is still pretty accurate... over 200 million equals a down day, and under 200 means an up day.

This chart shows me that the market could go down some tomorrow while the MACD and Full STO's roll to the down side. However, the daily still has some room up to go. Meaning that the market could dip down tomorrow and rally back up to that next resistance level at 112.30-112.50.

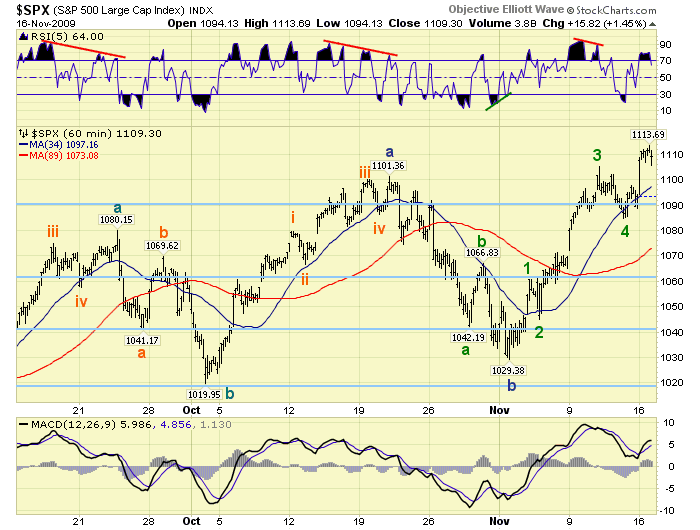

Let's also look at the chart below from "The Elliottwave Lives On", (again the link is found on my blog roll under Tony Caldaro). Notice how this up move from the 1029.38 low is almost complete with the final 5th wave still in play, or possibly ended today?

I'm not sure if we push to the 112.30-112-50 or not? I suspect that we will... mainly because this is OPX, and the market makers don't want to pay out any money to the put holders. After OPX is over this Friday... we'll that's another story!

So, if you are stuck in any short positions, tomorrow might be your best chance to get out without too much pain. I'm not sure how low we dip tomorrow, but looking at the charts would indicate the first logical target of around 1096 to fill the gap open from today. Next would be the 1090 level, but I'm not sure if it will go that low? After that is the 1076-1080 area for the gap from the 9th. I really doubt that we go that low during OPX, but anything is possible.

Next week though is a different story. Over the next couple of weeks... starting next week, or possible at this Friday's close, I believe we will go down to the 1030-1040 area before any decent bounce back. From there... I don't know yet. Let's wait till we get closer before answering that question.

Red

Hello Red,

I like to learn what you mentioned in the 3rd paragraph: the rule is still pretty accurate… over 200 million equals a down day, and under 200 means an up day.

Would you please explain more details about what you mentioned the rules of volume.

Thanks,

Lucky Fish

Hey Lucky,

I hope I'd answered your question in tonight's post. Thanks for asking, and sorry for not getting back quicker.

Red

Hello Red,

I like to learn what you mentioned in the 3rd paragraph: the rule is still pretty accurate… over 200 million equals a down day, and under 200 means an up day.

Would you please explain more details about what you mentioned the rules of volume.

Thanks,

Lucky Fish

Well said Red, I took profits Friday of last week but should have held due to my researched showed that this week would be strong. This data comparred to your analysis and a few other folks pointed to WED/Thurs being strong. Im sure selling will start Thurs and go into Fri due to folks not wanting to hold over the weekend??

Wednesday

Housing Starts/CPI 8:30 ET

Crude Inventories 10:30 ET

Thursday

Jobless Claims 8:30 ET

Leading Indicators/Philadelphia Fed 10:00 ET

Thanks for the info JoeMarc,

I wish I could say that some or any of that new matters, but the market will probably ignore it and rally on up as I've posted in tonight's post.

Red

Thanks for the info JoeMarc,

I wish I could say that some or any of that new matters, but the market will probably ignore it and rally on up as I've posted in tonight's post.

Red

Hey Lucky,

I hope I'd answered your question in tonight's post. Thanks for asking, and sorry for not getting back quicker.

Red