I'll start off by saying that next week should be a boring week, and preferably skipped or simply not played all together. It's a holiday week with Thanksgiving right smack dab in the middle of the week... on a Thursday no less. Instead of falling on a weekend date, where the trading wouldn't be too overly light, it's going to cause very light volume throughout the whole week.

So, what do we know about light volume? It usually means an UP day... that's what. I don't think that any of the news out next week is "market moving", meaning something that traders wait for before going long or short. Couple that with the sell off we just had over the last few days, and you have the making of an UP week.

I believe the whole week will chop around going nowhere. There is now some serious resistance up around the 1100 area. You still have the "Great Wall of China" between 109.68 and 110.34 (spy) that still hasn't been "confirmed" as being pierced through. Remember, we jumped over the entire area by a gap open on the 16th this week.

That was exactly what I said must happen if the bulls wanted to go higher to capture the 1108 spx level... which they did! But, gaping over the area of great resistance means that the resistance is still very much intact, as they haven't went through it to break it down... so too say. Going over it is basically cheating.

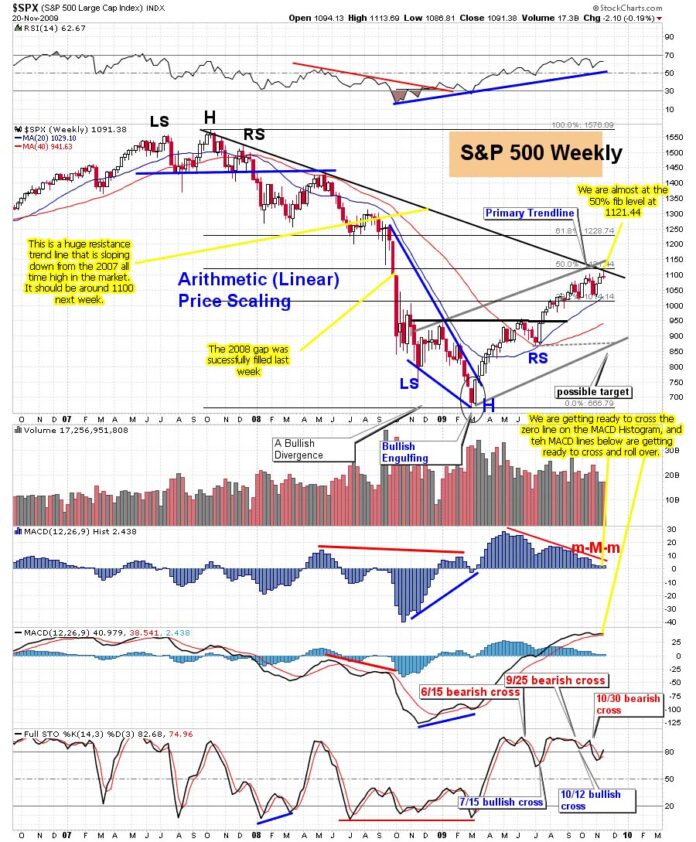

So, now that you have been caught, you are now back where you started from... under the great wall of China. To show you how important this level now is, I want you to take a look at the chart below. Notice that we now have a downward sloping trend line to cross, as well as the 50% fib level at 1121.44. There is also the fact that we have now officially closed the gap from October 2008. The only thing left to do is rally to 1121.44 for the exact 50% fib level to be reached. However, that isn't required or necessary, as the 1113.69 high last week is technically "close enough" to be considered the 50% fib level.

So the big question is... what is going to happen next week? Well, I think that the light volume will allow the market to go back up and form a right shoulder as shown on the chart below. Remember, the light volume in the holiday week coming up is one of the reasons that should allow this to happen.

Keep in mind that a choppy/sideways market is great for day traders, but horrible for short term option swing traders. So, how do you play this market next week... if you decide to play it at all? Some of you might want to wait until after next week is over, and get on board the short side the following week... as I expect it to be down hard.

However, if you still want to play it then here is how I plan to do it. I'm looking to purchase deep in the money calls on Monday, once I see that the selling has stopped and the market looks like it is forming a base. I'm expecting Monday to be an UP day, so buying at the open is the idea. Of course, if the futures are down hard in the morning before the open then I'll wait and re-think the position. But, I really don't see that happening right now, as there isn't any news event that can cause more selling before the open on Monday.

Continuing on... The reason for the "deep in the money" call is to avoid the time decay that will occur as the week progress forward. Remember, time is your enemy when buying options, but your friend when selling them. So, a more advanced position to take would be to purchase deep in the money calls and sell at the money calls. This is called a vertical debit call spread. For example...

Buy the FYNLA 105 SPY call option for $5.50 (ask price on Friday's close), and sell the FYNLF 110 SPY call option for $1.92 (bid price on Friday's close). Your cost to do this is the difference between the 2 prices, or $3.58 per option.

Since the closing price of the spy on Friday was 109.43 the 110 call would have 57 cents of actual value in it, and the remaining $1.35 ($1.92-$0.57) is a combination of time and volatility. The VIX, which measures the volatility, is currently pretty low (when compared to the high last year). So, most of that amount is time value. Regardless, the bottom line is this....

Of the entire price of $1.92, only 29.6875% is actual value (57 cents). That means that if the stock didn't move for the entire week the remaining $1.35 in time and volatility value would slowly erode away. Since you sold the option instead of buying it, you would be able to benefit from the decay, as the price to buy back the option, and close the position, would be a lot less.

Now, let's look at the 105 call that you bought. Again, since the closing price of the spy on Friday was 109.43, we simply subract that from the 105 price, and you get $4.43. Since you will be paying $5.50 for the 105 call, the time and volitility value of the option is the remaining amount... which is $1.07.

Now, that means that 80.54% of the value of the option is "real actual value", and the remain 19.45% is time and volitility value. What does all this mean? It means that as the week progresses forward, and the market goes sideways or slightly up... your option doesn't lose much value, but the one you sold did! And that's what you want it to do, so you can buy it back at a cheaper price... and keep the difference of course.

This is really about the safest way I can think of to play a market that is going sideways or slowly up. Time will finally be your friend, not your enemy. Of course if the market goes down, then you will be hurt the most... but that's the risk we all take.

Red

P.S. Per request... here is the latest Mr. TopNotch video. I haven't posted any as he hasn't done one since the 12th. Anyway, here it is again.

Red, whatever happened to the Top Step Notch trader on your video that said he was going to sell his farm going short at 1108.39 on the S&P last week.. Whats his latest video say he is doing?? Thanks

He hasn't posted one in awhile, but I just put it back up for you. It's from November 12th. I'll put up the latest whenever he does one.

Red

Chart of Charts 112109 — Slam Down Bearish

5 and 20 day moving average crossovers say bearish. The market has had it's way with the 10 day for months, so it's bullish call is questionable.

Puts are going to get incredibly expensive soon….if you want them, get them now.

Black Swans do not drift in, they are delivered by a cruise missile in the middle of the night or on the weekend.

You cannot “Conquer the Crash” in a weekend, you need to be planning and acting for months. If you haven't started it may be too late, but still— START!

http://oahutrading.blogspot.com/2009/11/chart-o…

I agree with you Steve that it is very bearish right now, but I really don't see it happening next week. When is the last time you can remember any holiday that had a huge volume down day?

There may have been one or two, but I can't remember any. You need huge volume for the Black Swan to play out. And you need some type of major news event to be the catalyst that starts it.

Unless we (USA) gets attacked over the weekend, or some other crazy event, I'm going to have to stick with the plan that the light volume next week will cause the market to go sideways to up.

Believe me though… I'm very bearish on the economy right now. But, I've also lost a bunch of money fighting the tape, and going bearish all the time. I'm not turning bullish here by any means. I'm only saying that the market should float higher next week and form that right shoulder.

It could turn down hard anytime next week, but I doubt it. I'll be looking for a short entry on Friday, or the following Monday. It all depends on where the market is on Friday.

Red

I am not saying black swan comes this week. They (and their cruise missile) are impossible to predict.

July 4th zone was a big down. The big boys have their minions playing this market 24/7 with most the moves coming at night so that people get whipsawed or miss the moves. So I suspect holiday times even more than a normal week as a time to make a move.

Just saying Red….

But also agree…there will be plenty of time to short after a confirmed downtrend is started….unless government action somehow makes that impossible. That is fully possible, Obama will listen to anything his old school corruption cronies tell him.

you do realize that thanksgiving is always on thursday and never falls on a weekend?

Yes, you're right humble… I should have stated any and all holiday's, as Thanksgiving does indeed “always” fall on a Thursday.

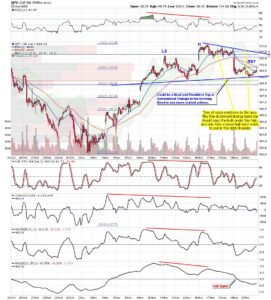

As for the trend line, I didn't draw it. The first chart is from “The Chart Pattern Trader” (see link on right under BlogRoll), and the 2nd chart is from “Cobra's Blog”. I just borrowed them and added everything that is in “Yellow”.

But, any trend line is… and can be, drawn several different ways. There isn't any “set in stone” way to draw them. You can include the intraday high or low, or you can draw it only off the daily closing price.

Regardless of how you draw it, the market is up against some tough resistance around the 1100 area. But, of course, a “breakout” could occur? Many times the market will pop over a trend line and then reverse hard the other way. It's really quite common, as the can “fake out” all the bulls and bears. I just don't see a real breakout without another 5% pullback first.

After that, then the market could make another run for the next fib level around 1228.74 (61.8%). It's going to depend on what the institutions want to do this December. Will they start buying again, and push the market up to that level?

Or, will they continue selling, to lock in gains for the year from the March low? I can't answer that, but December is usually bullish, as the Christmas holiday (whatever day it falls on… LOL) will be coming up and many traders go on long vacations.

So, baring that we don't get some “Black Swan” event as Steveo77 mentioned in his comment, I'd say we will go up next week.

Red.

agree about next week, everything points in that direction.

last year we were coming off of the 11/21 low, for one thing – a

ganniversary hit. for another, 11/20 is a 42 day astro/spiral-calendar cycle

form the 1/1/10 lunar eclipse.

if we are going to have a spike finish to the great upwave from 3/6, the

timing is ideal for the next three weeks.

we, we'll see what ms. market thinks of these plans.

;)-

Looks like the futures are already up 11 points this Monday morning, just like I expected. But, it's already too high to go long at this point. Needless to say… I won't be buying any calls this morning.

At this point, it's best to wait till later in the week and go short. I still don't know if they will re-capture 1114, and push on up to 1120 area, or get slammed down right where they are now?

Cash is a position.

Red

Looks like the futures are already up 11 points this Monday morning, just like I expected. But, it's already too high to go long at this point. Needless to say… I won't be buying any calls this morning.

At this point, it's best to wait till later in the week and go short. I still don't know if they will re-capture 1114, and push on up to 1120 area, or get slammed down right where they are now?

Cash is a position.

Red