I was really looking for the market to roll over hard today, and it looked like it was going too... until some news rumor was released that said they were going to bailout Greece. That news was all the excuse the market needed to rally up to that 1080 level that I thought it could go too, but was highly unlikely. The news said that Germany was going to bail them out, and then it was later reported as false. Coincidence? Maybe? Or, maybe it was designed to shake out all the bears?

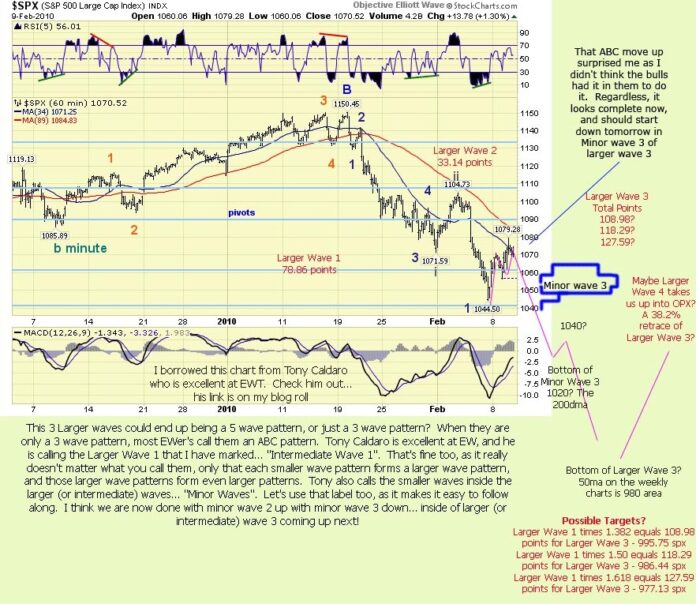

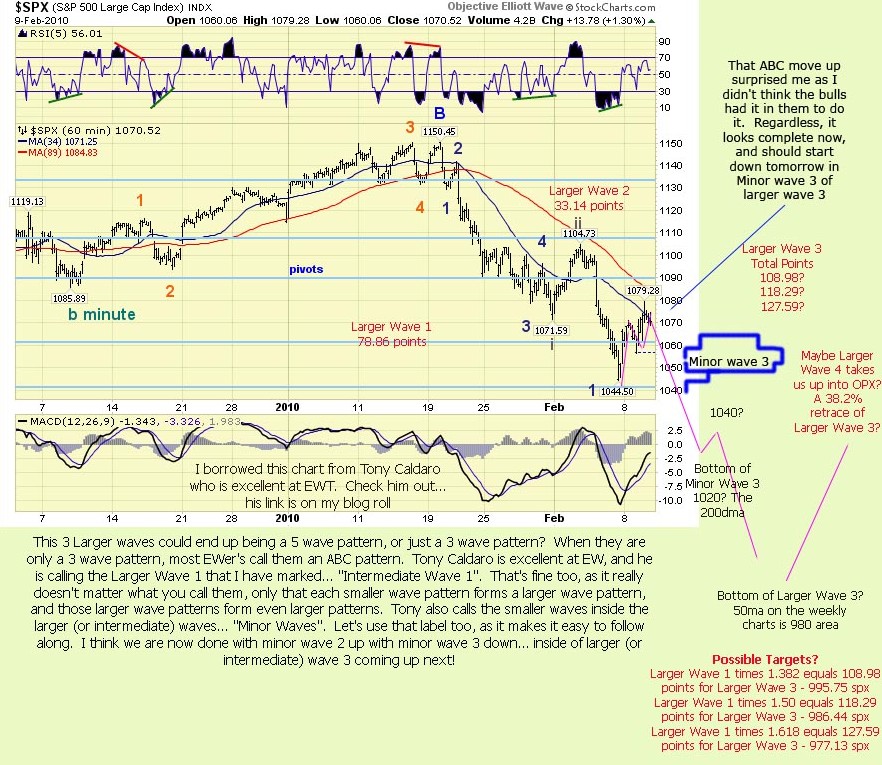

I really didn't think it had the energy left to rally up that high, but the market will fool you when you least expect it too. This doesn't change my belief that we are going down... it only delays it for another day. Looking at the chart below, you can see that we tagged the upper trendline around 1080, and we are now getting ready to start minor wave 3 down, inside larger/intermediate wave 3 down.

Once it starts, it should fall quite fast, and not allow any bears to get short. That's probably why they ran the tape up today too... to squeeze out all the bears, and suck in some more bulls. I didn't see this move coming, or I would have waited for it. Of course if I had seen it, they wouldn't have done it. Just the way they like it... trick everyone.

From looking at the charts, it appears that they must start minor wave 3 down, (inside larger/intermediate wave 3) tomorrow, as they've hit their upper target zone now, and must either bust threw it, or fall hard. There is no doubt that we are at a crossroads here, and either fall hard or rally hard. I have too trust the charts, and they still point down.

That's why I remained short today, even though that ramp up put my positions underwater a little. These wave 2 up's are always violent and are designed to shake out the bears. I remain short, and un-shaken. I still see this week as down, with a fore-casted low of 1020. No one said trading was easy, and no one is always right. I was wrong on Monday being a huge down day, and wrong again on today selling off.

Could I just be off a day or two? I believe so, and hope so... Even though "hope" is a useless emotion, and shouldn't be brought into trading... I'm crossing my fingers on this one. The thing that keeps me confident is the Technical Analysis. It still is extremely bearish on many, many charts.

The fact that the market couldn't break through 1080 was huge, as that resistance held firm. There are 3 different trend lines intersecting at that level. It's going to have too gap above it to break through it. That means some commitment on the bulls, and I just don't see it. The volume going up was so low, it wasn't hardly reading on my charts, yet the sell off volume was huge.

That tells me that retail traders bought the Greece rumor and drove up the market, and big intitutions sold it. I'm not buying into this rally. It may seem like I'm being stubborn, but I'm not. I'm just sticking to my belief in what I see in the charts... which is bearish still.

As you may know, I use a lot of different ways to see where the market is going. I use Technical Analysis, Elliottwave, Support and Resistance Levels, and tie all those together with news events. They all still tell me we are going down. Right or wrong, I stick with my forecast. I remain short.

Red

Okay red, I am going to be looking for you at least on Nightline. Nice Post

Well G… something just ain't right, and I can feel it in my bones. I think I'll pass on Nightline, but I'd sure like too be right on this one. I haven't every been so heavily short, and it's worrisome of course, but I've also never been this heavily convinced that we're going down.

I have to stick with what the charts tell me, along with the news, and of course my gut. I'm riding this puppy out until a break of 1080, and conformation.

I'll be heavily underwater if that happens, but I will take my loss like a man… if that happens? I'm betting it doesn't.

Good Luck to us all…

Great post Red. I'll be taking my beating like a woman! I have the same gut feel as you but my gut feel hasn't served me well in the past!

Well, the TA's are still bearish. That's why I'm still short. If we have something like a terrorist attack on Thursday, you know the market will crash.

I don't want that too happen, but Ayatollah Ali Khamenei is threating something?

Yes, but it wouldn't be the first time they tried to scare us. But with the market at a crossroads, maybe this time it will happen. Hope not though.

I think he wants oil to go higher. Might be time to board a British ship and take hostages. Again.

hey Red don't fight the full/new moon syndrome i've got burned too many times finally got my hard head straight on it ….new moon to full down full moon to new moon up new moon is the 15th i think…..I think this wave bottoms at midnight tonight then basically up into mon futes…..

Next week could very well go up into opx rrman. But, I think a huge sell off is come first. Down this week, and then back up next… is very possible.

Another thought on that — remember last year January? Israel invaded … was it Lebanon? Oil went up huge in just a short time, caused the SPX to rally with it, too.

Dreadwin is right that too many people are expecting it to go down tomorrow. That is what worries me most.

Actually Monica, I think most people think that the 10% correct is now done, and we're going back up to 1300 or something. I feel like I'm the only bear left right now.

I have a friend who is Iranian who is “in the know”. I just sent him that article to get his thoughts. I'll let you know if I hear back.

The stage a lot of stuff Monica, and blame on middle easterner's when it's really our government doing the whole thing. It's all about money, power, and control.

I don't doubt it.

I feel like it's pretty mixed. But we shall see. If we happen to gap up in the morning substantially, what will you do?

I'll wait to see where it goes Monica. I will make that decision when I cross that road. It could go sideways tomorrow, and then fall on Thursday. We'll see tomorrow. I'll post it if it's time to bail.

k – thanks. I have a feeling one more day of torture is in order, especially if that iranian news report comes to fruition.

If we gap up, I'll sell my calls at the open. The pit traders will try to close the gap. A lot of charts over at Trading to Win are suggesting that a turning point comes at around 10-11am tomorrow. I'm betting that our near term high is set then, and we probe downwards, maybe retest the 1050 level.

Yeah! You are turning slightly bearish then? There is hope. I can sleep well tonight. Thanks Dreadwin 🙂

I'm actually bearish. I moved my 401K into 66% “safety plays” and 33% long (from 100%) in December at SPX 1120 because I expected a plunge. I got out of small-caps, commodities, international markets, etc. I rotated into things like PASAX (check the chart — it's still up from where I got in on Dec. 24th, if you include the dividend), bonds, health care (which hasn't worked so well), etc.

What do we need to get new highs? Bears (to short squeeze). We ran out of Bears last month at 1150. What do we need to get more Bears? Lower prices and bad news.

I'll be a believer in P3 when I see a 10% down day in AAPL.

Thanks Dreadwin – I'm not trying to give you a hard time. I know you know this stuff. I feel better that we are in the same direction for tomorrow.

I just made a $VIX chart.

http://www.screencast.com/users/dreadwin/folder…

In my opinion, the $VIX is looking short term bearish. The critical things to watch are the RSI trendline and the Slow Stoch.

If that plays out, the indexes go up. No way around it.

You're right… it looks bearish. The market could go sideways to slightly up tomorrow… kind of a “pause” day, which would be bullish and bearish for the vix.

I'm hanging until Thursday for sure, as a terrorist attack would change everything. I admit, I missed the best entry for this market, but I'm staying awhile longer.

Thanks for the vix chart though, as it's clearly looking bearish.

Thanks for the chart. You are right that it looks like it could turn over. The MACD looks like it has nowhere to go but down. It will be interesting to see how this plays out.

I'd be curious to see what the VIX looked like before the plummet in equities last year. Certainly when things are overbought, they sometimes continue on up, no?

A good place to go for that kind of thing is vixandmore.blogspot.com and check old posts in the archives.

A range of 15 to 30 was what was playing out in 2007-2008.

Thank you very much sir! Off to bed. Hope something happens soon, one way or another.

dreadwin,

Nice chart.

Nice place Leo has here.

Like the chart.

That rally up was on such light volume that I couldn't hardly see the bar on my charts. Yet, the sell off was a huge red bar of volume. That was all retail traders buying the rumor of the Greece bailout, while the institutions were selling.

That's not bullish by any means…

Maybe. Volume on SPY was substantial today, and pretty heavy during that rise.

See $VIX chart in other comment.

I think we still have more wave 2 to come. If the purpose of wave 2 is to make bears reconsider, it hasn't done that. Almost all of the EW blogs are in “P3 is here!” mode. A short squeeze from this level 1070ish to 1100ish would be absolutely brutal. At 1104 or so (a retest of 4 of 1), bears would flip out and maybe capitulate.

That said, the market doesn't seem to have the juice to get there. I don't know. Maybe bulls took some profits on the way down and kept their powder dry.

My trading plan has me long in real estate, expecting the short squeeze to come tomorrow.

It's times like these that put hair on your chest… if you know what I mean. You either score big, or lose big. We'll see what happens tomorrow I guess? I'm most worried about what that idiot Ayatollah Ali Khamenei is going to do on Thursday.

Since there is also 2 tons of explosives missing from Kinder company (owned by Goldman Sachs), he could be planing so terrorist attack? I hope not, as I don't want people to die so the market will go down. I just want it to correct like it should. I'd rather see some financial crisis then a terrorist attack happen. Let's hope that's not it…

Yeah, I totally know what you mean.

Opex is next week, and there are way way way too many people holding puts. Forgetting about manipulation or geopolitical events, the expected behavior of the market is to cause the most pain, and I think the market will do what it can to shake people out of their puts.

Now, “news” and “events” are the big wildcards here. What made me the most suspicious today is the “lack of reversal” after the German govt denied the imminent Greek bailout.

Should we get to 1100ish, we're setting up a monster inverse head and shoulders pattern that could play out to new highs. (Just like in November!).

RED, I ADMIRE THE WAY YOU LISTEN TO OTHERS WHO ARE OPPOSED TO YOUR SHORT SIDE, RESPOND TO THEM WITH FACTS AND CHARTS, AND NOT WAVER FROM YOUR STANCE.I HAVE A QUESTION, ASSUMING YOUR RIGHT, WHY WOULD THE PPT ALLOW THIS MARKET TO CASCADE.THEY SEEM TO FIRE IN BUY PROGRAMS TO PREVENT SUCH AN EVENT.TONIGHT ON FAST MONEY, WHEN RICHARD RUSSELL ,WHO HAS BEEN AROUND FOR 50 YEARS, SAID THE DOW COULD FALL 3000 POINTS,THE PANEL QUICKLY STATED THE PPT WOULD NEVER LET THAT HAPPEN.I AM WITH YOU ON THE SHORT SIDE,BUT ITS TOUGH TO FIGHT A PRINTING PRESS WITH UNLIMITED INK AND PAPER.

TY, I think they want the market to go down so they can steal everyone's money again. Use it to finance their secret projects, and just pocket some too of course.

RED, I HAVE BEEN READING YOUR BLOG FOR AWHILE. IT APPEARS YOUR STARTING TO GET A LARGER FOLLOWING.IT IS WELL DESERVED.AFTER YOU RING THE REGISTER ON THIS SHORT CALL, WE WILL HAVE TO WAIT IN LINE. GOOD LUCK

Well TY… I'm learning more every day, and will share it freely… right or wrong? I hope I learn to get more right then wrong, and we can all profit nicely.

Some good education for everyone tonight, is to go watch “The Chart Pattern Trader's” video tonight. He's good, and well worth watching.

His link is in my blog roll…

Red,

Wall Street manipulators having fun by fooling both bulls and bears alike.

It appears that this correction is over. Just rumors can make pigs fly (both here and in Europe). We may be right directionally, but someone else make money. This is a dangerous market for sure.

Yes… very dangerous. I'll hang in there for a little while long. But, by Thursday or Friday I'll have too close out the position if we don't start the down move by then.

Red – Im still right behind you but very worried what these jackasses might try and do – the Sage of Ohama says that the market will always get you in the end i hope it takes out the PPT and their evil cohorts.

It's a risk… that is true. However, I think they want it to go down, and will not come to the rescue.

Someone was saying that there is going to be a ramp up into the weekend before selling starts again Tuesday after the 3 day weekend – what think yeh of that?

No, everything tells me it's going down this week into Friday, and then back up into OPX

well red if the market doesn't tank today the legatus theory can officially be put to bed, it didn't work in May 09 or Oct 09 and if it doesn't work now, the mojo appears to have worn off R's crystal ball

Technicals say that we are getting ready to start Minor wave 3, inside Intermediate wave 3. With or without the 'mojo', we should still be going down.

This is my post for TNA as of last night. As I type this, TNA is down 14 cents from yesterdays close.

TNA was up 4.1% today, nearly forming a doji. A gap up that didn't quite fill. Friday's hammer effect delayed by a day, perhaps.

For the 2nd day in a row, today had a higher high and a higher low. To me, that remains a positive sign.

Volume today for TNA was higher than normal.

We are in a Full Moon Trade, generally positive for TNA.

[ After eight days, the trade is DOWN 7.0% ]

Tony (man has no last name) still says this Full Moon bullishness is canceled out by the Jan 15th Solar Eclipse, creating a Panic Cycle. Not good for TNA, but he seemed wrong today.

RVX (VIX for RUT) was up and down all day and ended lower.

Based on the up day today after Friday's hammer, and based on the /ES & /NQ futures being up as I write this, it looks like tomorrow will be another up day for TNA. This way of looking at things has been dreadfully inaccurate in the past. World events dominate at times.

Watch out for Thursday Earl… Iran is a wildcard now!

Iran is bothersome. Worrisome, even. I don't think they mean well. But it's a celebration day for them. If they start something, instead of celebrating, they will all be ducking and running for cover. I predict they announce some new weapon system.

I don't know what it is… but I'm worried too.

Earl, Nice post, Thanks,

one of these days I'll get enough money so I can be a trader.

I'd say tomorrow is key with retail sales. If a rotten (low) # than this well facilitate wave 3 to the down side. If that Greece fix it manuever is to work that was not a good showing from the bulls. When (if) 1020 S&P 200dma is approached I'm selling my puts.

My two puts worth $270 when bought is my entire life savings and my total trading account. Such is the life of a radical.

Hang tight bensjoyce, and don't panic and sell early. I'll tell you when I'm going to close out the positions. Probably on Friday at the close, but I'll post it when I do.

This is a micro wave 2 up, with the micro wave 1 completing at the lower early today. Coming up later today… around 2pm forward, is Micro Wave 3, inside Minor Wave 3, inside Intermediate Wave 3, inside Primary Wave 3! That's a lot of 3's folks! Can you say “BIG Sell Off” coming?

Hi Red, it may not happen today but I think it will happen. Hopefully before our options expire worthless!

Yes Monica,

I believe it will come tomorrow. Hang on!

Don't count on the Iranians bombing us though! Might not happen 🙂

aussie jobs report came out. very good one. that clearly means dollar down and spx up tomorrow unless some other news shadow that good aussie job report.

Hi Red

at least your commentators are making solid & logical contributions to your outlook. Ive got numerous ANONS making stupid and erroneous comments. My members are great, and make solid contributions. BUT some of the anons are either expecting tooo much or reading the jaywiz blog while standing on their heads

The daily guidance has been terrific. Im going to back tack and numerate its percentage.

I wrote to expect a high today between 10& 11am, and we got it at 10am, DUUH someone was looking for 10;30?

what the He__??

Expecting a low today with HUGE rally tomrrow

Jay

You should switch to the disqus platform for your comments. It will make it harder for the anon's to post. Most won't take the time to setup fake accounts. Sure, some will, but it will knock a lot of them down.

You do have some good people there, and I read you're comments several times a week (not everyday, as I get busy sometimes). You've been right quite a bit lately… but you're call for a rally tomorrow seems puzzling?

I was wrong on Monday and Tuesday being the “Big Sell Off” days, but I know believe we will sell off hard into the close, and won't stop until Friday or so… making a new low around 1020…

We'll see I guess? Good luck to both of us, and thanks for stopping by…

My crystal ball now tells me that “The Top Is In”… it's all down hill from here.

$CPC is off the charts, the 100 ma on the 60 for the CPC is higher than it was back on July 8

This rollcoaster is at the top, and about to rollover hard…

When you say CPC is off the charts you mean the put to call ratio is very high and therefore this is bullish?

as of 2:15 EST the S&P is 6 points below yesterday's high. Yest. high and todays comback is on the “good news” for Greece. The point being is that we have a lower high on double good news for Greece, (second day in a row) and the bulls can't do it yet.

Hi PC ratio doesn't mean the market is gonna take off like a rocket ship but it does mean a floor has been put underneath the market

Combine the hi PC ratio with a statistical approach to the markets given the dow jones hasn't had 5 straight down weeks in over 250 weeks, this week has a snowballs chance in hell of finishing down

TNA closed up 0.5% today, after falling below the low of yesterday.

After two days in a row with higher highs and higher lows, today had a lower high and a lower low. Small amounts, but lower is lower. To me, that is a negative sign.

Volume today for TNA was normal.

We are in a Full Moon Trade, generally positive for TNA.

[ After nine days, the trade is DOWN 6.5% ]

Tony (man has no last name) says this Full Moon bullishness is canceled out by the Jan 15th Solar Eclipse, creating a Panic Cycle. His Panic Cycle seems played out, but runs until Feb 14th.

RVX (VIX for RUT) ran up early then fell all day.

Based on the slightly lower low and slightly lower high today, TNA for tomorrow is not attractive, long or short.

Earl, Nice update thanks, Sold half my TZA this morning. Actually got stopped out with profit. Then bought a smaller position this afternoon.

Gcocks,

TZA is starting to look interesting again. If I can get the closing price ($10.92), I'll pick up some after hours.

See VIX chart in other comment.

And also:

http://www.screencast.com/users/dreadwin/folder…

I do agree about the warning signs regarding lower lows and lower highs. However, compared to the other indexes, $RUT looks pretty good! $RVX has not even touched its 200 day moving average.

I am expecting the triangle to resolve tomorrow. I have no idea which way it resolves, but the $VIX suggests that equities could go up. I did say that yesterday, too. I was at least half-right.

dreadwin, that hammer last Friday should have done more (to the upside in the days following) than it did. I switched to TZA for tomorrow, though the futures (as I type this) say I'm wrong.

currency trader Jason Jankolvky (?sp) on forex tv states that the highest reading ever for short Euro positions ever recorded.

He thinks the top in the dollar is in.

If the Euro rallies strongly then this indicates that stock rally.

BUT, can't they wait a couple of days?

I'll have tonight's post up hopefully by 10pm est., with lot's of charts… and then you can decide which direction we're going?

I can't take another ramp job tomorrow. Ugh! When will it end?!

The VIX still looks bearish to me. At least for tomorrow. Will it bounce? If it is going to do it, it has to do it soon. Really soon.

http://www.screencast.com/users/dreadwin/folder…

If the RSI on the VIX closes tomorrow at 50 or so, I think that trendline I have (badly) drawn gets broken. What does that mean? It means no P3 before opex. In my opinion, of course.

Nice chart. Looks (to me) like VIX wants to go higher.

Looks can deceive me 🙂

Tony just said: This whole correction continues to be a mess. Hard to tell exactly where we are.

Earlier today, Carl Futia (who always offers a range estimate for the day) said: I can't offer a range estimate that I have any confidence in today.

Futures are running up as I type this.

Why am I not in cash?

Tonight's post is now out… sorry it took so long gang.

Tonight's post is now out… sorry it took so long gang.

Tony just said: This whole correction continues to be a mess. Hard to tell exactly where we are.

Earlier today, Carl Futia (who always offers a range estimate for the day) said: I can't offer a range estimate that I have any confidence in today.

Futures are running up as I type this.

Why am I not in cash?

The VIX still looks bearish to me. At least for tomorrow. Will it bounce? If it is going to do it, it has to do it soon. Really soon.

http://www.screencast.com/users/dreadwin/folder…

If the RSI on the VIX closes tomorrow at 50 or so, I think that trendline I have (badly) drawn gets broken. What does that mean? It means no P3 before opex. In my opinion, of course.

Nice chart. Looks (to me) like VIX wants to go higher.

Looks can deceive me 🙂

currency trader Jason Jankolvky (?sp) on forex tv states that the highest reading ever for short Euro positions ever recorded.

He thinks the top in the dollar is in.

If the Euro rallies strongly then this indicates that stock rally.

BUT, can't they wait a couple of days?

I'll have tonight's post up hopefully by 10pm est., with lot's of charts… and then you can decide which direction we're going?

I can't take another ramp job tomorrow. Ugh! When will it end?!

See VIX chart in other comment.

And also:

http://www.screencast.com/users/dreadwin/folder…

I do agree about the warning signs regarding lower lows and lower highs. However, compared to the other indexes, $RUT looks pretty good! $RVX has not even touched its 200 day moving average.

I am expecting the triangle to resolve tomorrow. I have no idea which way it resolves, but the $VIX suggests that equities could go up. I did say that yesterday, too. I was at least half-right.

dreadwin, that hammer last Friday should have done more (to the upside in the days following) than it did. I switched to TZA for tomorrow, though the futures (as I type this) say I'm wrong.

Earl, Nice update thanks, Sold half my TZA this morning. Actually got stopped out with profit. Then bought a smaller position this afternoon.

Gcocks,

TZA is starting to look interesting again. If I can get the closing price ($10.92), I'll pick up some after hours.

Edit: futures ran up a bit after hours and I now have some TZA at $10.90. We both have some now. That's probably not good 🙂

aussie jobs report came out. very good one. that clearly means dollar down and spx up tomorrow unless some other news shadow that good aussie job report.