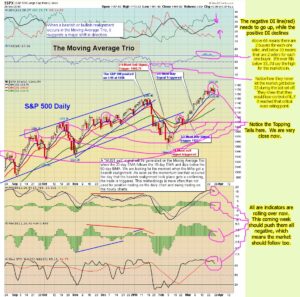

What can be said that hasn't already been said? The market is insanely overbought now, and way too many indicators are rolling over now and pointing down. The MACD Histogram's on the daily charts are pointing down, and have crossed over the zero line on many different indexes. The MACD averages are rolling over and touching, or have already crossed over it.

So yes... we should correct down next week, but will we? Friday is a holiday next week and the market is closed. That means only 4 trading days... and yet the government is still going to release the jobs report on Friday. Why didn't they move it up to Thursday? Does that mean that the number is horrible? Probably so...

Regardless, unless the big institutions start the selling, any retail selling will be bought up on light volume. That doesn't mean I don't think we won't sell off some next week. I could easily see the 1150 spx support level being tagged sometime next week.

However, breaking that support level and heading on down to the support area around 1115 spx, is probably not going to happen next week... UNLESS, some big political news happens to scary the market! That's really what we bears are hoping for, isn't it? It's sad that they won't let the market trade up and down fairly, so both bulls and bears could profit. If that happened, then we wouldn't look forward to some war to break out, country to go bankrupt, or terrorist attack to happen.

Instead, they manipulate the market to such extremes that the only way it will fall is on some horrible news like that. I really don't want to profit from something so negative, that could have people dying, just for the market to sell off. Why can't they let it happen naturally, from bad earnings, jobs reports, etc... so that the market could actually be valued fairly is beyond my understanding.

Yes, I know they want to steal everyone's money, and make all the profit they can. However, it could still be done without creating chaos, and putting innocent people on the streets by bankrupting the company they work at, just to eliminate the competition like Goldman did to Lehman brothers.

The point I guess I'm getting too, is that I don't see a big sell off without some really bad news (possible war event, another country bankruptcy announcement, terrorist attack, swine flu, Greece defaults, you name it?). The first level down is of course the 1150 area, then 1115 area, and finally the 1075 area... where I caught a 107.38 spy fake print and Sundancer caught a 107.82 spy fake print.

Ultimately, I think we are headed there... probably within the next month. But, the government is smarter (more evil and corrupt is more accurate of a word), then I am... which means they could manipulate this market sideways in a choppy fashion throughout the next 6 months or so, and finally crash it in the fall.

A move down to 1115 might be all we bears get from them, as the weekly chart is still pointing up. It needs to rollover soon, if we are to state that 1180 is the high. If we manage to take out the 104 (spy) level, then I think the weekly chart will roll over and the market is done!

That stupid fake print tells me that we won't take it out, but instead rally back from that level and either put in a new high in the summer months or trade sideways in a range until this fall. It's a really tough market to forecast, as it doesn't follow any patterns that can be tracked accurately. Of course that's the way they want it... as we'd all be rich if it were easy to forecast.

So, let's not get our hopes up until volume comes back into the market. That's unlikely to happen next week, as most traders will be waiting for the job's report on Friday. Again, I do suspect that we will hit 1150 next week, as many traders will take some profit ahead of the report. Plus, the end of the month and quarter window dressing is now over, and the big institutions can dump the shares they just bought, (so they could report to their clients that they owned them... as their clients will assume they have owned those companies for the entire 3 month quarter, but we know they only owned them for a few days). That's window dressing my friends... clean up your house before the relatives come over for one day, and trash it the rest of the year!

Anyway, let's hope for something bad for the market too be announced... but not bad for people of course. I don't want innocent people too be hurt or die for the bears to profit a little... but I wouldn't shed any tears for the thugs in Washington DC, or banksters!

Red

Thanks Red – always enjoy your posts. Hope you had a good weekend. Bracing myself for the week ahead.

Typical week I guess. It's slow at work next week, so I'll be around more… not that you guys need me or anything. LOL

Glad you will be around. They don't need me either – it's all about moral support! If the markets rush higher this week, I may be quiet as I will avoid staring at every tick.

I don't blame you, I wouldn't want to watch every tick either. LOL

Monica, hang tough.

Red, stop bitching and go short. lol

LOL… I like bitching. It's why people read the blog. (It's certainly not my forecasts).

Mar 26 Friday Close: System sell signals in effect. Market either corrects sideway or down over the coming weeks. A mini crash warning is also in effect. (Not P3.) Overbought condition, over valuation, rising yield pressure, extreme optimism, and finally, trend indicators turning down.

In Wall Street speak,” better buying opportunity ahead” lol

Thanks SC.

Sounds like buy the dip would be a better option. Enjoyed reading all the post here tonight.

Leo:

Thanks for your candid opinion (and bitching :-). There has ALWAYS been manipulation in the stock market since the market was invented some 400 years ago. That's the whole point: the house playing with everyone else's money. The important point for us retail investors is how to ride the waves up and down to profit.

That said, I do think the Street is trying to discourage active investing like what we do and promote “buy and hold” instead. That's why they gave the market diminished volatility to make it hard to trade.

That makes a lot of sense too me too. Lower the volatility so they can sell options to retail traders, knowing that those options will decay in time and become worthless… allowing them to keep all the money.

In a high volatility market, it's harder for them to control the movement of the market and thus they could lose out on some options that they sold. Once a market gets moving to the downside, it's like trying to stop a runaway train… it ain't easy.

They wouldn't have succeeded back in March of 2009, without the massive printing of stimulus money… which was supposed too go to help stimulate the economy, not the stock market and the greedy banksters.

So, it's just another lie to the public like “Weapons of Mass Destruction” was when Bush used that term. At least he stated that Saddam had the weapons.

Obama has the weapons now, and it's called “The Printing Press”… the real weapon that destroys!

I will be hanging tough this week as I watch my money erode quickly. If Sundancer is right, we have to endure one more week of excruciating pain. And if he isn't, well then I go broke! Here is an interesting article. Bullish? I think not.

http://www.zerohedge.com/article/capitulation-b…

I don't think I've showed this chart before

$SPX weekly containment

http://www.flickr.com/photos/47091634@N04/44731…

during the early november low, $SPX backetested max contain (teal line) and $SPX hasn't looked back.

the next weekly containment pt. is @ 1193 area

$DJI weekly containment setup

Purple line on $DJI weekly containment was @ 10,962 last week, high last week for $DJI = 10,955

Next containment pt. in weekly sequence = 11,090

for those trading the $NDX (QQQQ), the weekly purple containment pt. has important implications

http://www.flickr.com/photos/47091634@N04/44724…

the bull will be dead when the $NDX gets consecutive weekly closes below weekly purple containment

It looks like we might get a ranged bound week, of rising in the morning and selling into the close. Whipsaw galore! Lure in more retail bulls and wear out the bears. Nothing ever changes with these crooks.

The coming 3 day weekend would be the perfect time to release some really bad news. The month of March would be over, and enough time would have passed so Obamacare wouldn't be blame for the sell off.

Although, I don't think this sell off will be the start of P3. I think the market will churn higher in the summer months… but fall should be a bear feast!

Carl’s morning call:

June S&P E-mini Futures: Today's range estimate is 1163 – 1175. I think a strong move upward has started. The ES should reach 1200 in April on its way to 1225 or so.

1156.50 -1169.75 actual Friday (13.25 points)

1171 high last night

1163-1175 estimate for today (12 points)

1166.25 currently, estimate is -3.25 to +8.75 from here (bullish)

ES will go lower before it gets to Carl's 1200 and 1225, if and when.

Good morning, SC.

You sound confident. Do you gve a downside target?

If historical pattern holds, then 1120 is most likely the next target. 1070 is probably the max low.

Historically, current condition has resulted in a 10% decline over the coming weeks.

My confidence is based on the pattern in price trend, market breadth, volume pattern, over valuation, extreme optimism (based on various measurement and none of that is related to how loud blog bears moarn), and spike in yield pressure.

It appears the die is cast. While anything is possible, it appears that the odds of the market overcoming all those adverse conditions would require divine intervention. But then again… We do have the unholy trinity of He Who Knows What is Best for US, Bernanke and Blankfein…..

So, 1120 before 1200. Fine by me 🙂

Carl is Long one unit at 1168.50

Interesting article from Zero Hedge (Anna posted it in OBB). It shows that last weeks' rally was from a whole lot of shorts covering.

http://www.zerohedge.com/article/capitulation-b…

Posted it this morning! See below.

Just a wild guess here. It could be due to unwinding of the hedge against all those puts they sold to Mole and crew …..

Too Funny… I see he put his site back up. Everyone knew that he wouldn't shut it down.

I don't know how many account has gone bust following his Pee 3 calls.

I love what Tim Knight said about EWers… EW prediction can be summed up : “Market is going down. But if the market goes up instead, then in will go down sometime in the future…” LOL

Carl is Long second unit at 1168.25

VIX action quite interesting.

If both the $VIX and the markets close up, statistically speaking, the next day is likely to be red.

Interesting, only thing is that VIX may not close up. We shall see.

$VIX is going to print 16.90

Thank you.

AAPL gapped an important TL on the daily

http://www.flickr.com/photos/47091634@N04/44728…

Value : Date Ritual

very simple observation on the AAPL monthly setup

http://www.flickr.com/photos/47091634@N04/44736…

During Reversal Months the high of month comes near the open of the month.

Days like this is when you wish you had your paddleball around.

tick tock tick tock. . . . .

***if*** QQQQ closes below it's opening price of 48.23 then it will have 4 consecutive lower closes than opens

Frequency of more than 4 consecutive lower closes than opens

111 trading day: 1 (terminated 12/8/2009)

222 trading day: 2 (terminated 8/11/2009)

fine then.. so tomorrow it will open at 40, and close at 41. happy? lol

the operators spoil all the fun, I'm showing 48.23 for a close

Well that means now the count can start over again. lol

Hope springs eternal… lol

If only that were the case! Dread, VIX closed down. Looks like we are headed higher tomorrow.

Maybe. DRV (3x bear real estate) was green today. Not all sectors are participating in the ramp up.

Dreadwin,

I have DRV with a green bar, but closing down 3 cents from Friday's close, so not the traditional green.

Stockcharts shows DRV's Friday close at 8.61 as does AB and Google. Today's close is 8.64.

Part of IB has it 8.61 also. IB chart has it 8.65.

Consistency would be nice.

I stand corrected.

$SPX daily containment still holding

http://www.flickr.com/photos/47091634@N04/44735…

What's that next level up at? Not that I think we are going there, but anything is possible.

1204 is the brown line

1220 is the grey line

As you know the $SPX isn't going to print 1200 and magically fall so either 1191-1193 or 1212-1221

Do you feel we are going higher to one of those levels first, before a sell off, or do you see the current overhead resistance holding and us falling something this week or next.

many setups are converging here:

Monthly/Quarterly close on Wednesday: a high month/quarterly close would be a nice fastball down the middle of the plate

1191-1193 would be ideal

terminal moves don't have corrections; this a bulls worst nightmare

Right now it is mine 🙂

your day in the SUN will come, it's always darkest before the SUN rises

Thanks Sundancer.

If it hits the 1191-1193 area and then falls, it paints a long term head and shoulders pattern (with descending neckline) dating back tot he end of March (2000). Don't know if that matters.

interesting setup

And, everyone and their mother thinks we are going to get to 1200 so that usually means the opposite.

looky there – the VIX is almost down on the day. Red – If I am understanding Sundancer correctly, we make new highs this week with a reversal date being either on 4/1 or 4/4.

That 3 day holiday weekend is perfect for releasing bad news on the market.

Perhaps, but I feel that the sell of is already in the cards and that news doesn't matter. But, there will have to be something blamed as a catalyst. Job numbers on Friday when the market is closed (odd) but I think it would have to take something bigger, like the onset of a war in the middle east, to make this thing budge. I also think the government would prefer to blame it on something external, rather than internal economic issues.

Smart girl… now you're thinking like a government thugs. You've been hanging around here too long and reading my post. I've corrupted your mind by giving you the red pill. LOL!

Thanks a lot Red! A lot of good it is doing me! Seriously though, I do think the government has always been involved and I think that natural forces in the end sort of account for this – no one is bigger than natural forces. It's all in the cards. We will never know for sure.

Well, there has always been corruption and manipulation in the market… every since it was created. Just in the 1929 Great Depression the government was still on the gold standard… which meant that the control they had of the market was limited.

Fast forward to March of last year, and that's when the budget cap for the PPT was lifted and an unlimited amount of money was available to buy and control the market. That's why it truly is 100% controlled right now.

Of course it won't last forever, as massive selling later this Fall won't be that easy to stop. That's why we could ultimately hit a Dow 3000-4000 within a few short years.

Horrible? Yes! I don't want to see it, as it will cause huge chaos and massive unemployment. But, we are headed that way if they continue this manipulation game.

Well, since none of us will have jobs, be better sure as h-ll figure out how to make money, either in this market, or by growing food, or bartering necessities! Problem is, I don't think the government is really going to allow people to short the market all the way down.

It wouldnt happen. If things get too badly, then QE2 , QE3 will be executed. They will burn the fan and floor it. Fiscal prudence be damned.

Dow will be at 30,000. But a loaf of bread will be $50……

$DJI setup

$DJI currently has 3 consecutive higher closes than opens

In the last 111 trading days, 7/8 times the $DJI had 3 consecutive higher closes than opens it went on to a 4th consecutive higher close than open

Carl at day’s end:

1163-1175 estimate for today (12 points)

1165.25 -1171 actual today (5.75 points)

Today was inside Carl’s range.

Trades:

In /ES at 1168.50 and 1168.25, did not sell. (1168.75 currently)

Grade: Incomplete

TZA opened down 1.2%. Gap from $7.17 to $7.16 was not filled. TZA was down 0.1% at the high, and closed down 1.5%.

We are in a New Moon Trade, which favors TZA.

After nine days, this trade is down 3.8%, and owns TZA over night.

Volume for TZA was roughly average.

$RVX (VIX for $RUT) was down 3.7% today with TZA down 1.5%. No divergence.

TZA had been up 3 days in a row, but down today. Not good for TZA.

The low for TZA two days ago was $6.70, the lowest TZA price ever. The low today was $6.99, 4.3% above that low. Good for TZA.

Ultimate Oscillator for TZA bottomed at 20 twenty four trading days ago and has generally risen since then but has remained below 50 for twenty two days and finally broke above 50 yesterday and today. Indicating the end of weakness for TZA. Good for TZA.

MACD on the monthly chart crossed over upwards three days ago and is moving up. This last happened 2 months ago. Good for TZA.

Bollinger Bands for $RVX (VIX for $RUT): today’s black candle closed below the Top Bollinger Band. MACD has crossed from below and is rising. Looks like $RVX will be falling. The last time $RVX closed above the Top Bollinger Band (like what happened two days ago), $RUT fell for 10 days. Good for TZA.

Bollinger Bands for $RUT: The doji candle for $RUT is in the congestion area. The top Bollinger band is falling, and $RUT seems to be in a mature topping formation. MACD has crossed down. Good for TZA.

Bollinger Bands for $RUT:$RVX ($RUT vs VIX for $RUT): today’s doji candle rose to just below the congestion area. The upper Bollinger Band is falling. Looks like a confirming that the topping process is continuing. Good for TZA.

TZA had a lower high, higher low and lower close – neutral for TZA.

Money flow for the Total Stock Market was $351 million flowing out of the market on a slightly up day. Generally good for TZA.

I will post the AmericanBulls candlestick interpretation a bit later.

Overall, it looks good for TZA for tomorrow.

The Daily view from Americanbulls

TNA remains a WAIT (wait for some kind of buy signal). The sell was at $55.61. TNA closed today at $55.38, down 0.4% since the sale. The candlestick today was a White Spinning Top Candlestick (complete indecision between Bulls and Bears).

TZA remains a HOLD. The buy price was $7.04. TZA closed today at $7.06, up 0.28% since the buy. The candlestick today was a doji (a tug-of-war between buyers and sellers).

Two recent TZA Buy signals have failed and may perhaps serve as a warning:

Buy at $7.33, sell at $7.14

Buy at $7.11, sell at $7.05

Buy at $7.04, now up 0.28%

For that matter, recent TNA Buy signals have also been uninspiring:

Buy at $55.36, sell at $55.43

Buy at $55.69, sell at $55.63

Summary of $RUT based ETFs & a few popular ETFs:

(Market positive):

Not very reliable BUY-IF: UWM(2x), URE(2x), IYR(1x)

Wait: DRV (-3x), SRS(-2x)

Highly reliable BUY-IF: SPY, DIA

Hold: IWM(1x), DRN(3x)

BUY-IF: QQQQ (Bullish Homing Pigeon Pattern, not very reliable, followed by Doji)

(Market negative):

Wait: TNA (3x)

Hold: RWM (-1x), TWM (-2x), TZA (-3x)

Action for Monday: none

Hey everyone, I come here and to other blogs as a way to get some kind of therapy , it calms me to read intelligent posts from

real traders and not idiotic investors and fund managers.

I'm a bear at heart and believe the the entire worlds financial system will collapse in 10 to 15 years.

I been trading from home full time for 5 years. I was 50% to 200% short at the beginning of Jan 08 and covered just before the elections. I was holding, C,LEN,HIG,M to name a few.

The run up in 09 took me by surprise. I didn't make as much as 08 but I did learn some things I'll never forget.

1- it's in everyone's best interest to have markets rise. Fund managers will lie P/E's of 30 to 80 are normal,the government will spin economic reports -omit food and energy from inflation , are you kidding me? unemployment reports ,add census workers, add cash for clunkers to the GDP ect ect.. you get my point.

2- the PPT does exist

3- when the dollar gets weaker it's bullish for the market , when it gets stronger it doesn't matter.

4- when multi year support is broken it's a bear trap.

5- bad reports are great because it's not as bad.

6- new traders and investors will end up broke in the future “buy the dip ” it's easy man!

7 – SPX support and resistance does not matter, I follow the NAS and RUT , from now on.

8- what caused the pull back? never mind support and resistance in this BS bull market…. yep, took me a year of 09's BS to get that into my head. for example, in Jan this year when we were crashing ( I shorted lightly BTW ) I wrote down the 3 things that caused the pull back, Greece, Obama's bank reform, and Bernanke's reappointment . I put the post it note on my monitor and it was January 29th when I covered because all 3 of these were taken care of or starting to get ignored, on Feb 4th, I went long 25% in, the 5th when JPM bought up the whole market that Friday I went 50% and 100% all in when we hit 1010 on the SPX or 2250 on the NAS.

I'm all in cash now, hoping for a pull back, and run into earnings, if AA, and INTC report and act like that did last quarter, “go down” I will be shorting very heavy on that day.

also, for this Fridays employment report, I heard a guy on the floor today suggest if it's a good number the markets will go down because interest will soon rise because everything is better!! and if they don't get 250k and it's like 100 k or less a double dip could be in the works!!!!

good luck

TraderJohn,

Could you add a comma or a period or something to #6 above. Not sure what you intended to mean.

Thanks for stopping by TraderJohn… and welcome to the matrix. We need all the original thinkers we can get, so post more often and join in the discussion when you can.

You will find everyone here friendly and intelligent. By the way, your post was very informative. It's nice to see others waking up and see the truth.

Red

Hi TraderJohn. Nice post I went all cash Friday. Crazy market.

Hey everyone, I come here and to other blogs as a way to get some kind of therapy , it calms me to read intelligent posts from

real traders and not idiotic investors and fund managers.

I'm a bear at heart and believe the the entire worlds financial system will collapse in 10 to 15 years.

I been trading from home full time for 5 years. I was 50% to 200% short at the beginning of Jan 08 and covered just before the elections. I was holding, C,LEN,HIG,M to name a few.

The run up in 09 took me by surprise. I didn't make as much as 08 but I did learn some things I'll never forget.

1- it's in everyone's best interest to have markets rise. Fund managers will lie P/E's of 30 to 80 are normal,the government will spin economic reports -omit food and energy from inflation , are you kidding me? unemployment reports ,add census workers, add cash for clunkers to the GDP ect ect.. you get my point.

2- the PPT does exist

3- when the dollar gets weaker it's bullish for the market , when it gets stronger it doesn't matter.

4- when multi year support is broken it's a bear trap.

5- bad reports are great because it's not as bad.

6- new traders and investors will end up broke in the future “buy the dip ” it's easy man!

7 – SPX support and resistance does not matter, I follow the NAS and RUT , from now on.

8- what caused the pull back? never mind support and resistance in this BS bull market…. yep, took me a year of 09's BS to get that into my head. for example, in Jan this year when we were crashing ( I shorted lightly BTW ) I wrote down the 3 things that caused the pull back, Greece, Obama's bank reform, and Bernanke's reappointment . I put the post it note on my monitor and it was January 29th when I covered because all 3 of these were taken care of or starting to get ignored, on Feb 4th, I went long 25% in, the 5th when JPM bought up the whole market that Friday I went 50% and 100% all in when we hit 1010 on the SPX or 2250 on the NAS.

I'm all in cash now, hoping for a pull back, and run into earnings, if AA, and INTC report and act like that did last quarter, “go down” I will be shorting very heavy on that day.

also, for this Fridays employment report, I heard a guy on the floor today suggest if it's a good number the markets will go down because interest will soon rise because everything is better!! and if they don't get 250k and it's like 100 k or less a double dip could be in the works!!!!

good luck

Hi TraderJohn. Nice post I went all cash Friday. Crazy market.

Thanks for stopping by TraderJohn… and welcome to the matrix. We need all the original thinkers we can get, so post more often and join in the discussion when you can.

You will find everyone here friendly and intelligent. By the way, your post was very informative. It's nice to see others waking up and see the truth.

Red

TraderJohn,

Could you add a comma or a period or something to #6 above. Not sure what you intended to mean.

The Daily view from Americanbulls

TNA remains a WAIT (wait for some kind of buy signal). The sell was at $55.61. TNA closed today at $55.38, down 0.4% since the sale. The candlestick today was a White Spinning Top Candlestick (complete indecision between Bulls and Bears).

TZA remains a HOLD. The buy price was $7.04. TZA closed today at $7.06, up 0.28% since the buy. The candlestick today was a doji (a tug-of-war between buyers and sellers).

Two recent TZA Buy signals have failed and may perhaps serve as a warning:

Buy at $7.33, sell at $7.14

Buy at $7.11, sell at $7.05

Buy at $7.04, now up 0.28%

For that matter, recent TNA Buy signals have also been uninspiring:

Buy at $55.36, sell at $55.43

Buy at $55.69, sell at $55.63

Summary of $RUT based ETFs & a few popular ETFs:

(Market positive):

Not very reliable BUY-IF: UWM(2x), URE(2x), IYR(1x)

Wait: DRV (-3x), SRS(-2x)

Highly reliable BUY-IF: SPY, DIA

Hold: IWM(1x), DRN(3x)

BUY-IF: QQQQ (Bullish Homing Pigeon Pattern, not very reliable, followed by Doji)

(Market negative):

Wait: TNA (3x)

Hold: RWM (-1x), TWM (-2x), TZA (-3x)

Action for Monday: none

TZA opened down 1.2%. Gap from $7.17 to $7.16 was not filled. TZA was down 0.1% at the high, and closed down 1.5%.

We are in a New Moon Trade, which favors TZA.

After nine days, this trade is down 3.8%, and owns TZA over night.

Volume for TZA was roughly average.

$RVX (VIX for $RUT) was down 3.7% today with TZA down 1.5%. No divergence.

TZA had been up 3 days in a row, but down today. Not good for TZA.

The low for TZA two days ago was $6.70, the lowest TZA price ever. The low today was $6.99, 4.3% above that low. Good for TZA.

Ultimate Oscillator for TZA bottomed at 20 twenty four trading days ago and has generally risen since then but has remained below 50 for twenty two days and finally broke above 50 yesterday and today. Indicating the end of weakness for TZA. Good for TZA.

MACD on the monthly chart crossed over upwards three days ago and is moving up. This last happened 2 months ago. Good for TZA.

Bollinger Bands for $RVX (VIX for $RUT): today’s black candle closed below the Top Bollinger Band. MACD has crossed from below and is rising. Looks like $RVX will be falling. The last time $RVX closed above the Top Bollinger Band (like what happened two days ago), $RUT fell for 10 days. Good for TZA.

Bollinger Bands for $RUT: The doji candle for $RUT is in the congestion area. The top Bollinger band is falling, and $RUT seems to be in a mature topping formation. MACD has crossed down. Good for TZA.

Bollinger Bands for $RUT:$RVX ($RUT vs VIX for $RUT): today’s doji candle rose to just below the congestion area. The upper Bollinger Band is falling. Looks like a confirming that the topping process is continuing. Good for TZA.

TZA had a lower high, higher low and lower close – neutral for TZA.

Money flow for the Total Stock Market was $351 million flowing out of the market on a slightly up day. Generally good for TZA.

I will post the AmericanBulls candlestick interpretation a bit later.

Overall, it looks good for TZA for tomorrow.

Sounds like buy the dip would be a better option. Enjoyed reading all the post here tonight.