OR

Will the week kill the last bear, as the bulls continue up on Bullish Monday and then trade sideways the rest of the week? Or, will the week slaughter the bulls by crashing down multiple days in a row? It's any body's guess at this point!

The market is a cruel mistress that likes to butter up the bulls by feeding them hype-hay, only for the sole purpose of getting the bulls fat enough... too later make steak dinner out of them. Neither bull nor bear is safe in such a treacherous environment. Both will eventually be slaughtered, as the master loves to eat them both.

Lately, the masters have been eating bear for dinner, but I think they are ready for a new kind of steak... "Bull Steak", as too much of the same thing can get quite boring. We all need a change from time to time... and the masters are no different.

And fortunately (for the masters)... next week should bring in a lot of volatility as all the earnings are announced (meaning it's "open season" for both bulls and bears). Of course all the companies will lie and spin their numbers to whatever they want them to be. But I suspect that most "insiders" have either already sold their shares, or will shortly. They know first hand... how bad their earnings really are.

With all this sideways to slightly up trading movement in the market, the company owners have had plenty of time to unload their bloated stocks to the unsuspecting public... at top dollar of course. But, now that earning season is upon us next week, what kind of numbers do you think they will report?

Of course they are going to lie a little (more like a "lot"), and maybe fudge a number or two (more likely "double" the real number), and the earnings will look OK, and the stock won't tank... right? Maybe? Or maybe the numbers are too bad to be able to fudge enough where they are believably to the market.

Think of it like this... these last 3 months have been horrible for bad weather across the country as snow was everywhere. We already remember from previous job's numbers that the government blamed the bad report on the weather, stating that people weren't able to go to work because of the snow, etc... Now, if they didn't go to work, to make money to pay bills, and have extra to spend... do you really think they went shopping and out spending money?

Of course not! People aren't spending money... because they don't have any extra too spend. What is that going to do for the earnings for next week? American's are broke, and it isn't getting better. Yes, they can continue to spin the numbers, and fool the public... but at some point (like now) the crap is going to hit the fan!

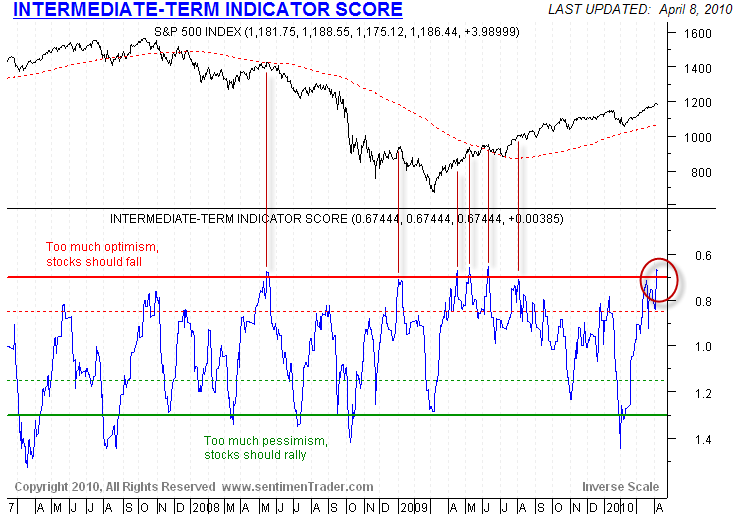

The "Bullishness" is as high as it was in 2007. Look at this chart from Cobra's blog. It's from Thursday, so it's probably higher now, as the market rallied again Friday.

Cobra gets permission to post it from time to time, but it is from a subscription service at www.sentimentrader.com, so I want to give credit to where it's from. It's a few days old now, so hopefully no one minds that I posted it here.

The point to notice here is... "this isn't the the time to go long"! Of course day-trading is different, but not swing trading or investing, as that's like committing suicide right now. Yes, it could continue up some more, and you can continue to pass the gun around the table... spinning the chamber, and pulling the trigger while aimed at your head.

Each time you have a 1 in 6 chance (5 empty chambers, and 1 with a bullet in it) of shooting yourself, so the odds seem good... right? It's like saying that everyday is a new day in the market, and there is a 50% chance the market will go up, and 50% chance it will go down. Same thing with flipping a coin... right?

We all know that's not true, as the odds DO change when the outcome is the same multiple times in a row. While in theory, it is logical to state the odds as even... and that is logically correct, but humans are not logical in their actions. Maybe they are in their thinking, but their actions are done on impulse.

Take the coin for example. If you flipped the coin in the air 20 times in a row and every time it landed on heads, what are the odds that it would land on heads the next flip? Would you think it would be 50%? Seems logical doesn't it? Here's the problem with that thinking... the person who flipped it 20 times in a row is probably pretty amazed that it landed on heads every time.

In fact, I'd say that he changes the way he tosses the coin because he is actually trying to toss it the same each time. But he can't, because his mind will remember all those previous times in a row that it landed on heads. He will change something, causing the coin to land on tails.

The same thing would happen if you were to spin the chamber of the gun 20 times. You would try too hard to continue spinning it exactly like you did the last time, and "Bang"... you kill yourself.

The stock market is no different. While next week should have a 50-50 chance of going up or down, the reality is that everyone who trades the market knows that it's been up the last 6 weeks in a row, and that will prevent them from believing that the odds are the same for another up week.

They all know the past history of how many times the market has been up 6 weeks in a row, and what happened on the 7th week. Emotions are what makes these odds vary on the stock market, tossing a coin, or playing Russian Roulette.

And yes... I'm very aware that computers are now the largest traders in the market, with Goldman's program leading the pack. But, who programed the computers? Humans did of course. And what parameters did they use to program them with? Human emotions is the correct answer. The super computers are designed to play (or I should say... steal money from) human retail traders, who are emotional in their trading decisions.

If the computers simply took greed, fundamentals, and emotions out the equation... the market would be at about DOW 3,000 now. But add in those factors, add you can quadruple the price. People aren't logical in their actions, only in their thinking (and that's only the really smart people).

Which again, brings me back to the market next week. Logic says the market has an even chance of going up as down next week. Emotions though... gives a different chance. Odds are much higher for a large down move next week, then even a small up move.

While many will disagree with my conclusions on "odds", I'll simply wish them the best of luck. If they decide to go against the odds, and place their chips on the Bull next week, (in my humble opinion)... the odds are highly stacked against them.

Red

P.S. Should the fall begin next week, and should you bears get really excited... like I know you will, let's not forget our downside target captured here in this picture by our friend Sundancer...

Once we hit that target, we bears should be getting out of our shorts and put on our bull suit. Yes... I know, it's hot, dirty, and smelly as bulls roll around in the mud, while we bears tend to clean ourselves in the river... but at least you won't go hungry again. So suck it up (your pride I mean... mine too), and go long when all hell is breaking loose! By the way, that target should line up with the 107.38 spy print I got last month.

Burned by going short,No balls to go long heavy ,so it the defined loss play

TZA 7.00 calls @ .03 cents

Excellent post Red

Here's a big picture view of $SPX daily containment pts.

Now the origin of the setup that gave us the Feb. 5 low came way back on May. 4 2009 when $SPX busted through purple containment and never looked back.

The common theme many of you are starting to see is containment pts. always get backtested. The Feb. 5th low terminated @ purple containment.

http://www.flickr.com/photos/47091634@N04/45102…

You'll notice on the chart the light blue line $SPX busted through on 7.16.2009 didn't get backtested. Guess what, it's going to get back tested next.

I'd estimate, that if it follows a similar decline as the previous one to 1044, that it should take about 3 weeks to hit the light blue line.

Since the line will continue rising, it should be around the 1060 area by then. That would be about the 10,000 level on the DOW too.

So, the destination is known, and the time to get there should put us into early May. What's not known, is whether it starts this week or next?

It is still possible that this week could end up, and make it the 7th week in a row. Not likely, but possible.

I haven't heard of any scheduled meeting, with Obama or one of his henchmen talking this week, so maybe they plan on letting the earnings do the talking for them?

They usually talk when they want to keep the market from falling, with the except of when Obama wanted the last sell off to start, so he came on TV and made empty threats to the banks.

That's when we dropped to 1044 of course. Now of course, the earnings could be the blame, or maybe some news out of Greece or one of the other bankrupt countries.

This story is interesting…

http://www.cnbc.com/id/36388741

Especially the part about…

“It is hoped that the finance ministers can make a very strong statement (of support for Greece) before financial markets open Monday”

Why is so important I wonder? Hmmm? Something's brewing…

http://finance.yahoo.com/news/Eurozone-nations-…

could this be the final push?

Thanks Sundancer. Maybe tomorrow will be the blow off top. Maybe the greek news is there for the operators to sell into.

The coin tossing stuffs are wrong, Red.

If you toss 20 heads, the next one is always 50 -50, so is the one after that, and so forth. Every individual toss is ALWAYS 50-50 irrespective of what has transpired in the past. It is called independent random event. We can get bogged down by the extremely low odds of flipping 21 heads consecutively. You have to look at it this way. The odds of flipping 20 heads consecutively is extremely low. But once you have achieved 20 heads, the odd of slipping another head, is still 50-50.

Stock market returns are not random. Just that factors that affect the returns change over time and exert varying degree of influence at different time. This confused the academics and lead to incorrect conclusion.

SC = Smart Coin. Ever heard of the smartcoin theory, Red?

Take 100 coins and flip them. You keep those that turn head and discard the tails. Repeat the process until you end up with one coin. That is your SMART COIN. See? This coin has managed to always turn up on it head. THis coin has intelligence! It beats 99 coins! You have the data to prove that it has turned up on its head consecutively in every single toss! What happens when you toss it again next time?

There are smart coins everywhere. 😉 You can find them whereever you have a bunch of coins. There is always one that always turn up head first. LOL

I'm speakless…

🙂

Great name then SC!

The Poland bad news is getting a lot of coverage – do you think that could trigger anything?

Are you talking about the plane crash? That's all the news I can see. Sounds like it's not a good idea to oppose the banksters and fly, as the planes seem to have problems for some odd reason.

http://www.bloomberg.com/apps/news?pid=20601087…

hmmmm i didnt see or know any of that – that is worrying indeed.

What i meant was that over here in UK its getting serious airtime coverage – obviously not over there !

Can you find a link and post it?

mainly on the news channels Sky and BBC – live coverage of it all who – what -when – where – most of the day nopt so much on the internet.

I suppose we do have lots of Poles living over here though so thats going to have a biug affect on coverage

http://news.bbc.co.uk/

http://www.google.co.uk/search?q=polish+plane+c…

http://news.google.co.uk/news/story?hl=en&clien…

Jim Cramer the wise predicted that it is 1000 days of bull market….

Those who shall not have faith shall suffer.

We are heading for land of milk and honey and vodka and pot and low calorie hamburgers and beer.

I guess that means I'll be sitting on the sidelines for the next 1000 days then… as I sure as hell ain't going long!

Red just asking what is your logic of fighting the tape ?

Yes I am bear by heart but the two questions are:

When bond bubble bursts why do you not think there should be a superbull market in stocks ?

Where do you think bond investors are going to go with the money ?

Bond market is 10 times bigger than stocks and 100 times bigger than commodities….

No one in the world can deny the biggest bubble in the known history is happening in bond market…

I frankly do not see logic against stocks right now…

Personally I think Cramer might have a point here. Think about it: after the dot-com bust of 2001 and 2002, we enjoyed a five-year bull market (2003-2007) before the next crash. Given that the crash of 2008 was more severe than the dot-com bust, I expect we'll enjoy at least a five-year bull market this time.

The goal? Such that retail investors start using “buy and hold” again so the Street can again siphon off their hard-earned money.

Until the next crash comes, that is.

Again, well written and interesting post Red. Thanks as always!

You know Monica… I never plan any post. I just start typing and what is on my mind is what the post is about. I start with one idea, and branch off from there.

Then I search the internet for pictures that relate to what I'm talking about. Sometimes I can't find exactly what I'm looking for, so I create my own in Photoshop with pieces of other images.

Not really the best way to run a blog I guess, but it's just a few of us here anyway… so who really cares?

I have a feeling there are more than just a few of us 🙂 Well your stream of mind consciousness is highly organized!

LOL…

Maybe the bad guys are reading the posts?

😉

That's not what I meant but yes, it could be the case as well. Maybe my mother is reading the posts as well! Just praying that tomorrow is the last gasp up. Think it maybe – we'll have to see if there is a reversal at end of day followed by a move down on Tuesday.

Not that astrology has worked lately, but we have a turn date on Tuesday…

http://astrocycle.net/ShortTerm.php

If I do think we are turning, you think May or June puts at this point? I hate to be finally in the right position but wiped out due to time decay.

Well, they did have 7 weeks straight up from the March, 2009 bottom. So, it's possible we could go up for another week.

But, I think Sundancer feels pretty strongly that we will turn this week. I hope so too. Maybe you should split up you puts and buy half your spreads in May and half in June? Just a thought…

Not a bad idea. If you feel convinced that the market will not get to SPY 122 and that instead it will go down quickly (not that you or I do), couldn't you also buy 119 puts and sell 122 puts, rather than buy 119 puts and sell 106 puts? Or is that just the same as doubling down on one side rather than hedging your bet?! And, lets say you sell those 106 puts and the market rallies but you still feel that the market is headed severely lower by expiration. Doesn't it make sense to buy back those puts in that case since they are now worth less and you will make money on them (since you sold them)? Just want to make sure I understand all this correctly.

The goal is too “never” have to buy them back Monica. You want them to expire worthless… never reaching below 106 by opx.

And NO, don't sell 122 puts! If the market goes down you will lose the difference between the 122 and the 119 on every put.

That's $3 per contract. The odds are heavily against the bulls at this point, regardless of what the media is going to spin this week.

Volatility is going to come back into this market this week, and there will be some selling. How much is unknown? But the upside here is severely limited now.

Gotcha. Thanks for the explanation. Let's say SPY reaches SPY 106 by before May opex but then bounces back to 107 to close opex out. Would I still have to pay out on the 106 puts I sold (I guess I would if someone exercised them)? And I will get money for selling them upfront (which should be reflected in my account immediately) but as they get closer to 106, they will continue to show a greater loss in my account, right? But as long as SPY doesn't reach 106 and they don't get exercised, that loss won't be realized, right? One more thing – if I thought that the SPY were to tag 106, am I better off selling 105 puts or are the premiums so low for them that it just isn't worth it?

Selling naked puts? Better pray that Israel does not attack Iran.

Not gonna do it.

Thanks Red. We'll see.

Your article is always useful.

Thanks.

Monica,

The ideal situation is for the market to close at 106 on opx. But, that's not likely to happen. So, you know that you can't make any more money if the market goes below 106, so you will close out your spread when it hits 106… regardless of when it hits that target.

The closer it is to opx, the less it will cost you to buy back the 106, and that's why you want it to expire at 106 (making it worthless) exactly on opx.

But, that's not likely to happen. You know that the market makers will rally the market before opx (usually 1-2 weeks prior),so that they don't have to pay out all those people who went short at higher levels above 106.

There could be a whole lot of people who go short at 110, and making that strike price the one with the highest open interest (example only). They would rally back up to close at 110 then, so they wouldn't have too pay those people any money.

If that happen, of course your 106 would still expire worthless (just like it would at 107, 108, 109 or 110), but you would lose $4 per contract on your 119's.

Instead of selling them at 106, when they would be worth $13 (119-106), you would only get $9 (119-110) for them. So, the point is simply this… the max you can get from the 119's is $13, which you can't get unless the market closes at 106 on opx.

That's rare, so I wouldn't count on it to happen. Instead, just remember to close out the position if the market hits 106, regardless of when it hits it.

I think I finally really get it. Thanks so much for your time Red and have a good day at work. If we open below 1192.22 I will initiate the position and if not, I will hold off until the end of the day.

Carl’s morning call:

June S&P E-mini Futures: Today's range estimate is 1188 – 1200. I think a break of 20-30 points will begin this week from approximately the 1200 level.

1183 -1191.75 actual last Friday (8.75 points)

1198.50 high last night

1188-1200 estimate for today (12 points)

1192 currently, so estimate is -4 to +8 from here (bullish)

Thanks Earl of.

Poor Smokey drown today it seems… You know they will close this day out above 11,000. Total Insanity!

I think I will go short at Carl's projection – around 1204 on the S&P since we didn't open below that key level of 1922.22.

At this point… it seems like suicide to go short at any level.

And that is probably the best time to short!

Here's a chart showing the debasement in 08' relative to where the SPY likes to rest (move sideways).

http://www.flickr.com/photos/47091634@N04/45148…

the 1st of 2 debasement gaps from 08' was initiated @ SPY 119.18 which is why you saw all that dancing on friday in addition to weekly purple containment. Closing above the 1st debasement gap in addition to purple containment throws some caution flags up in the air.

It took 26 weeks of sideways action to finally clear the 2nd debasement gap area from SPY 107.15 – 110.34.

It took 41 weeks of sideways action to finally clear the terminal weekly debasement area.

Those looking for clues as which de-leverage pt. will be hit first. Should the $SPX trade above 1218 then the probability increases significantly that the $SPX is @ it's next resting area. Meaning sideways action for a considerable amount of time. Should we not get a hard reversal this week then you can look to late 05' to early 06' to see what kind of boring market we're in for.

The bad news is for traders in general, volatility is compressing to a 20 pt. range for the entire week.

Puts things in a different perspective – thanks. You mean the volatility is compressing this week due to the levels on the VIX? And if we stay in a tight range this week, I guess that means that test of 1060 will have to wait a long time.

i'll post a monthly chart later showing the time implications the bears are up against in order for a debasement to be initiated

you'll see the extinction of bears, day traders as the market falls asleep and the only ones that are left are those that are buy&hold.

Thanks – I'd imagine that would most likely be the goal of the government. But don't we have to test that containment at 1060 at some point and doesn't it seem timing wise, that we should get there sooner rather than later? I guess we could keep climbing higher/sideways and that containment line would go up as well so that the eventual drop wouldn't be that great.

yes the chart i posted yesterday with the light blue containment is going to get re-tested, When? Now or after the terminal de-leverage pt. is hit.

The parameters that I defined above will help us determine the time element.

Alright – look forward to seeing the monthly chart.

FWIW they will pin the SPY @ 118-119 for OPX GLTA

see my reasoning on optionsblackboard.com

Anna, I did see that. Thank you.

thank you Monica and good luck gal!!

http://www.optionsblackboard.com/obb-experience…

Red saw a fake print last week at 117.65. I wonder when/if that one will play out. If we get to that level, I would imagine that a lot of sellers would come in taking it lower so if you think we are pegged between 118-119 for Opex, maybe that 117.65 number can't happen until next week or at all for that matter.

Hey girl not all of them play out….for sure I don't trade off of them unless I see that the tape has not gone near the amount of the false print

Yes, makes sense.

Always like this analysis:

http://www.thedisciplinedinvestor.com/blog/2010…

$SPX

we're 66 days from the 2.5.2010 low & 14.81%

7.8.2009 low : 9.23.2009 high 77 days 24.25%

11.2.2009 low : 1.19.2010 high 78 days 11.76%

last 3 downward thrusts

5.57%

6.54%

9.21%

Anna just posted a link to Mr. Topstep.

http://www.youtube.com/watch?v=UGTDfnU_ZNY

I used to watch their video's all the time. They are calling for more upside… 1234-1236 spx

Can you say… “Elimination of a Species”

I really wonder how often these guys are right. I remember when Tim (second guy) was calling a top in the S&P at 1018.

Yeah… they've been wrong just as much as they've been right. It really boils down to what Government Sachs wants to do. I wish there was some insider, that works for GS, that would come post here and tell us what they plan to do next. That would be nice.

In our dreams 🙂

SPY turned over a considerable amount of volume given the .45 range 105,000,000 @ the close

Still in cash.

Carl at day’s end:

1188-1200 estimate for today (12 points)

1190.50 -1195.75 actual today (5.25 points)

Today was in Carl’s range by 2.50 to 4 points.

Trades: no trades today

Grade: C (lost no money)

It would be nice to get a grade “C” everyday… I'm flunking with “F's”… LOL

Carl seems to have lost interest in trading, and when he does try something — boom! Tough market.

I think Carl knows he is a good trend trader and perhaps he feels like right now, the trend may not be as clear. Who knows though.

TNA opened up 0.27%. A week old gap from $55.95 to $56.03 was not filled. Today’s gap was filled. TNA was up 1.9% at the high, and closed up 1.26%.

We are now in a Full Moon Trade, which tends to favor TNA.

AmericanBulls has TNA with a Hold signal. This trade bought TNA at $56.50, and closed today at $61.04, up 8.0%.

Volume for TNA today was below average for the past 24 days.

$RVX (VIX for $RUT) was down 1.6% today with TNA up 1.26%. No divergence.

TNA has now been up 7 of the last 13 days. Chop generally. Drifting higher.

The high for TNA yesterday was $61.44, the highest TNA price since November of 2008.

Ultimate Oscillator for TNA rose from 63 to 68 today on a up day. A reading of 68 is Very Good for TNA.

MACD on the monthly chart crossed over to the upside 5 days ago and is rising. Good for TNA.

Bollinger Bands for $RVX (VIX for $RUT): today’s white candle spiked below the bottom Bollinger line and closed above that line. MACD seems to have topped and is coming down. Looks like $RVX might rise tomorrow. Bad for TNA.

Bollinger Bands for $RUT: Today’s white candle for $RUT has been progressing upward, staying close to but below the top Bollinger Band. It looks like $RUT may be riding the top Bollinger Band higher. MACD may be working back up. Good for TNA.

Bollinger Bands for $RUT:$RVX ($RUT vs VIX for $RUT): today’s doji candle closed just below the upper Bollinger Band, after a close four days ago above that band. The upper Bollinger Band is rising. Looks $RUT could keep rising. Good for TNA.

TNA had a higher high, higher low and higher close – Good for TNA.

Money flow for the Total Stock Market was $237 million flowing out of the market on an UP day. Bearish – Bad for TNA.

I will post the AmericanBulls candlestick interpretation a bit later.

Overall, it looks good for TNA.

Earl, Nice Work

Does the Greek aid package really solve the problem?

Late yesterday, European leaders hammered out a stop-gap arrangement that would see additional funds made available for Greece to help them battle their deficit. Of note is the fact that the lender of last resort is involved, (i.e. the International Monetary Fund). Again, World leaders in their infinite wisdom keep throwing money around like its confetti ad they fail to tackle and address the moral hazard that is plaguing not only Greece, but other European and World Governments.

Bloomberg News’ piece Greek Aid Terms May Be ‘Red Herring’ Amid Recession correctly points out that Greece’s rescue package from the European Union will do little to bolster economic growth even as it staves off the immediate risk of default. In easy terms, it strengthens the analogy I used in an earlier write up I did about the situation. The package is akin to borrowing money from one loan shark to pay off another but does nothing to help stimulate the economy of Greece so that it can actually comfort lenders to the extent that it can pay back some of that choking debt.

Goldman Sachs’ chief European economist Erik Nielson pointed out that “The real issue will be whether Greece can regenerate growth while cutting the fiscal deficit… “Without growth, the debt is only sustainable if someone will finance them at much less than 5 percent”. He felt that this rate would need to be sustained for at least the next decade.

Making this entire mess even worse is the recent economic data out of Greece that suggests that the economy could contract as much as 4 percent this year, the most in more than three decades, (Deutsche Bank AG estimates) as Greece struggles with a very significant recession.

I read a great analogy of the situation while gathering feedback from various news outlets. One analyst pointed out that the group of European nations merely swerved to avoid a crash in Greece. I can not argue with that thinking.

They have made available monies to a country that has difficulty in managing its books, has lied about its actual fiscal situation in the past and has a contracting economy. Does anyone really expect that the situation will end well? I certainly don’t and maintain that the bandage that has been offered is simply that. Once the glue wears off, the bleeding will start again and by that time, the situation will be worse.

Simon Johnson, a former IMF chief economist, said in a Bloomberg Television interview (quoted in the article above) that the plan increases the risk of “moral hazard” in Europe. He added that “This is not fixing the issue…The Greeks could seize the opportunity. You have taken away their incentive to solve the problem.”

Who are we kidding? That should come as no surprise. It is the same reason why the US companies got bailed out. The people and institutions they owe money to, it those bondholders, corrupted, pressured and influenced the government officials to use taxpayer's money to bail them out, so that those bondholders can get their money back.

It isn't about bailing out Greece. It is about bailing out those banks that lent money to Greece.. Those banks own the European governments. The Europeans like to pretend that they are holier than thou and oh so enlightened. Beneath the cover, they are every bit as incompetent and corrupt and phony as everyone else.

As we used to say 'Right On'!

The Daily view from Americanbulls

TNA was a Hold last Friday, and rose today, remaining a Hold. The TNA buy was at $56.50. TNA closed at $61.04, up 8.0% since the buy. The candlestick today was a White Candlestick (normal buying pressure).

TZA was a confirmed sell on Friday and today has a Wait signal. The candlestick for today was a Black Spinning Top (complete indecision between bulls & bears). The TZA sell price was $6.51. TZA closed today at $6.35, down 2.4% since the sell.

Three recent TZA Buy signals have failed and may perhaps serve as a warning:

Buy at $7.33, sell at $7.14

Buy at $7.11, sell at $7.05

Buy at $7.04, sell at $6.51

For that matter, recent TNA Buy signals (until this last one) have also been uninspiring:

Buy at $55.36, sell at $55.43

Buy at $55.69, sell at $55.63

Buy at $56.50, up 8.0%

Summary of $RUT based ETFs & a few popular ETFs & stocks (Market positive): +11

Hold: GS(up 2.8%), ERX(3x energy, up 6.9%), QQQQ(up 1.4%), IWM(1x, up 3.1%), UWM(2x, up 6.4%), TNA(3x, up 8.0%), SPY(up 0.6%)

Wait: RWM(-1x, down 2.7%), TWM(-2x, down 5.5%), ERY(-3x energy, down 13.6%), TZA(-3x, down 2.5%)

Transition to Market Positive: +1

Highly Reliable BUY-IF: AAPL

Transition to Market Negative: -2

Highly Reliable SELL-IF: DRN(3x), URE(2x), IYR(1x),

Not Very Reliable SELL-IF: DIA

Highly Reliable BUY-IF: DRV(-3x), SRS(-2x)

Low reliability SELL-IF: GOOG, AMZN

Market Negative: -4

Hold:, SCO (-2x oil, up 4.9%), DTO(-3x oil, down 10.5%)

Wait: USO (oil, down 2.5%), UCO (2x oil, down 2.5%)

Comment: Somewhat Bullish overall, Bearish Oil, Bullish Energy, Bullish $RUT, Bearish Real Estate

Action for TNA or TZA for tomorrow: None

http://stockcharts.com/h-sc/ui?s=bac&p=D&b=5&g=…

cLOSED AT 18.66

http://stockcharts.com/h-sc/ui?s=bac&p=D&b=5&g=…

cLOSED AT 18.66

The Daily view from Americanbulls

TNA was a Hold last Friday, and rose today, remaining a Hold. The TNA buy was at $56.50. TNA closed at $61.04, up 8.0% since the buy. The candlestick today was a White Candlestick (normal buying pressure).

TZA was a confirmed sell on Friday and today has a Wait signal. The candlestick for today was a Black Spinning Top (complete indecision between bulls & bears). The TZA sell price was $6.51. TZA closed today at $6.35, down 2.4% since the sell.

Three recent TZA Buy signals have failed and may perhaps serve as a warning:

Buy at $7.33, sell at $7.14

Buy at $7.11, sell at $7.05

Buy at $7.04, sell at $6.51

For that matter, recent TNA Buy signals (until this last one) have also been uninspiring:

Buy at $55.36, sell at $55.43

Buy at $55.69, sell at $55.63

Buy at $56.50, up 8.0%

Summary of $RUT based ETFs & a few popular ETFs & stocks (Market positive): +11

Hold: GS(up 2.8%), ERX(3x energy, up 6.9%), QQQQ(up 1.4%), IWM(1x, up 3.1%), UWM(2x, up 6.4%), TNA(3x, up 8.0%), SPY(up 0.6%)

Wait: RWM(-1x, down 2.7%), TWM(-2x, down 5.5%), ERY(-3x energy, down 13.6%), TZA(-3x, down 2.5%)

Transition to Market Positive: +1

Highly Reliable BUY-IF: AAPL

Transition to Market Negative: -2

Highly Reliable SELL-IF: DRN(3x), URE(2x), IYR(1x),

Not Very Reliable SELL-IF: DIA

Highly Reliable BUY-IF: DRV(-3x), SRS(-2x)

Low reliability SELL-IF: GOOG, AMZN

Market Negative: -4

Hold:, SCO (-2x oil, up 4.9%), DTO(-3x oil, down 10.5%)

Wait: USO (oil, down 2.5%), UCO (2x oil, down 2.5%)

Comment: Somewhat Bullish overall, Bearish Oil, Bullish Energy, Bullish $RUT, Bearish Real Estate

Action for TNA or TZA for tomorrow: None

Earl, Nice Work

As we used to say 'Right On'!

I think Carl knows he is a good trend trader and perhaps he feels like right now, the trend may not be as clear. Who knows though.