I guess the market will never go down. Good Times are here again as the Dow reaches 11,000. Next up... 12,000 --- with 25% unemployment, instead of the 17% we currently have. The more people are unemployed and underwater on their house value, the better the economy... right?

That's what the media is feeding the unsuspecting pigs (I mean public). Get them to borrow their last dollar from their maxed out credit cards and buy, buy, buy! Don't miss the rally, the bull is just starting... so says the media!

At this point, I see no way to make money shorting this pig! It just keeps getting fatter and fatter. How much slop can this pig eat? Apparently enough to go up another week... or month, or year? Who knows? I've never seen such a huge disconnect between the "real" world... which sucks right now, and the "twilight zone"... in the market.

Unless the earnings are really bad this week, and I seriously doubt it, the market will probably just trade sideways to the usual slow grind up. I feel I like I'm on an old dark century torture table, that slowly stretches my arms and legs... one notch at a time. I can hear my bones start to crack, as the Obama Gangster Gang smiles and laughs as they slowly rotate the wheel, and the rope tightens as it pulls me a little more apart.

It would be nice if the ropes would snap, and free me from this torture table, but I just can't see any reason for the market to fall this week. Although I can't find any technical reason to go long at this point, (the only reason you really need is the fact that the printing press is still going strong). Without the mass printing of our money, which is then given to Goldman... who pockets half of it, and uses the rest of it to push up the market... this market would have corrected a long time ago.

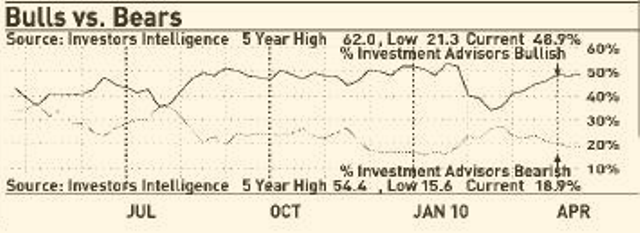

However, nothing really matters as long as they have tons of free money to buy up the market. It's not going to fall, until every bear is dead. Someone sent me this chart showing the extremely low level of bearishness in the market currently, as it's at 18.9% now... with 48.9% of the people bullish.

The 5 year low was 15.6% bearish, and 62.0% bullish. So, I guess we have a little ways yet to go? It seems that we are going to head up to 11,816 dow first... before rolling back down to 107.38 spy. So, I'm going to go long here with every last penny I have... (about 6 cents, as I held back the money I got from pawning the wife).

You know, if there is one thing I can say, that's 100% accurate and true... is that "This market is really wearing me out!" I think I'd be better off as a "Buy and Hold" retail investor right now, as everything is smelling rose too them presently. Of course it will eventually be their turn on the torture table, but right now it's my turn... and my poor old body can't take too much more of this torture.

Just kill me and get it over with! Stop with the slow grind... day in and day out! I can't take the torture anymore. Rally up to 12 million and get the damn P2 over with... please!

Red

LMAO.. Give me liberty or give me death?

I have an idea. Just buy a call, Red. That should end this bull run instantly. LOL

That's what I'm doing tomorrow. I'm taking my 6 cents and buying an April 130 SPY call. Surely it will hit that target by this Friday…

If you buy the 130 call, the market will promptly go to 103! LMAO

Unless WWIII breaks out in a few days, our April puts will be kaput.

I didn't realize that VIX closed below the Lower BB yesterday. Buying may puts and vix calls this morning.

Don't know if you have seen this on Stockcharts (and you guys probably know all this stuff anyway) but thought it was helpful. SC, explains the ARMS indicator.

http://stockcharts.com/school/doku.php?id=chart…

Carl’s morning call:

June S&P E-mini Futures: Today's range estimate is again 1188 – 1200. The 1200 level is strong resistance so a break of 20-30 points is likely to start this week. The dull, listless trading makes me think this market has to go higher to attract enough sellers to generate a break bigger than 20-30 points.

1190.50 -1195.75 actual yesterday (5.25 points)

1188 low last night

1188-1200 estimate for today (12 points)

1191 currently, so estimate is -3 to +9 from here (bullish)

Interesting – I think I will get short now just in case 🙂 No use worrying about a few points to the upside.

Morning Monica,

Just guessing: Carl doesn't go long for these few points.

Does he ever go short?

Not that I've noticed, but Dreadwin has seen it.

Looks like Carl does want those few points after all 🙂

Guys check this out. Mole has 1060 as a possible target as well although he doesn't think it will get there. Just read this VIX commentary from him.

http://evilspeculator.com/?p=15403#comments

Carl is now Long one unit at 1190.50

CRAP CARL!

His projected low for yesterday (1088) hit overnight exactly, so perhaps it's all upside today.

Thanks – I think I will hang on now.

In May SPY puts and VIX calls.

$SPX monthly bull/bear containment

http://www.flickr.com/photos/47091634@N04/45173…

2 containment pts. of great interest

Orange (VST)

Teal (max contain)

The orange line has been a great bull/bear dividing line on the monthly. It gave great definition to the bear mkt. into the low in 02'-03'. Contained bull structure into 07' high and contained the bear structure into 09' low. So far the orange line has contained the 2 major reactions of the current bull. This month orange containment is around 1100, next month it will be 1120-1130 area. The bears are running out of time.

Teal (max contain)

Has provided definition in the $SPX since the 9/01' low. All the dancing in the last 9 years has been around max contain. We're right back there again. It spent 8 months from 01'-02' dancing with max contain. 9 months in 03'-04'.

Thanks Sundancer. So far 119.50 is holding this morning. It's a real fight between the bulls and bears.

Jim Cramer has been factored in by the market…

Also I guess popular front page indicator has been factored in…

Market adopts way faster than in 70/80/90/00 and has factored in most of the things faster than you can imagine.

May be it is TV channels/internet based retail brokers…..

Market is way smarter….

and is becoming smarter and smarter….

I guess old wisdom does not work… (Not more than with 50% chance, which is a coin flip chance…)

Check out probability of H&S and any popular patterns working out in any directions in ordinary stocks and please tell me your opinions….

Funny part is in Japan candlestick wisdom patterns have been factored in and have near 49%-51% probability of working. (Ref: Encyclopedia of Candle sticks..) This has taken many years but it has happened in Tokyo.

American market is way too faster and adopts to most known and popular market indicators to make then non profitable trading events….

It is called law of diminishing return…..

We broke the 119.50. It's a miracle.

Carl just sold one unit at 1187.00

For once, I think I outsmarted Carl. It really is a miracle!

Lately it seems Carl trades not at all, or poorly.

Maybe he got let go from GS 🙂

I think Carl outsmarted Carl today. He got stopped out, and didn't get back in when things finally went his way. He had the right idea.

Day's not over, so anything can happen 🙂

Nevermind, we both got outsmarted!

Bid on SPY on Ameritrade is 19.18, ask is 19.57. WTF?

Carl has revised his range for today downwards 7-8 points.

1188-1200 original estimate for today (12 points)

revised to 1181-1192 (11 points)

LOD may be in *if* the bull structure is to continue

Orange (VST containment) has supported $SPX on the daily since the origin of the upward thrust 2.12.2010

Today it's in the 1188.50 area

http://www.flickr.com/photos/47091634@N04/45182…

That's that support line from 1044.50 spx. I don't see it breaking this week. When it does, the bulls are in trouble. But for now, I think we melt higher into Friday.

ERIK hADIK POINTS OUT EVERY APRIL THAT THE 19TH has a treacherous history

The energy that follows after the 19th thru May 4th confirms,IMO< we could see the balloon burst during this time period.

The ARMS index for the last 7days IS WAY OVERBOT

10day is at a VERY LOW 642

Ive been tracking it for 7 years, and have never seen the 10day that low

I still have potential for 11,200 this week as the MATH @ 62% retrace suggests, but it doesnt have to.

I see no reason to chase 200 pts, when IMO< IM expecting a repeat of APRIL2000

THere is a MEETING of negative ENERGY on April26 and again on May 3rd to 6th which

NOW, once May4th arives, we must make sure we dont STAY

in negative mode, even tho we will be enjoying its benefits.

IT WONT LAST

and the normal rebound will taek over.

Jay

Hey Jay…

Good to hear from you. I hope all is well on your site, you guys have all been making some dough. Personally, I suck at calling this market, but I'm excellent at losing money… so just ask if you want to know how. LOL

I'd agree with you that I think would should sell off next week, but I said that this week, last week, the week before that, and the week before that, etc…

One day I'll be right… and of course I'll be long that day!

Jay – thanks for this.

today ends flat to slightly lower, for OPX Tuesday that is pretty crummy, which tells me that we end around as I mentioned 118 to 119 on SPY for OPX.

Google estimate 6.58 whisper 6.73 Will do videos on Optionsblackboard.com on AMZN for up to earnings…

$SPX

3.14.2007 : 6.1.2007 81 days (12.94% upward thrust led to 3.4% correction, which led to sideways trading for the next 39 days)

2.5.2010 : ???????? April 27 =81 days

April 23 = 77 days (co-relational to 9.23.2009 high)

April 24 = 78 days (co-relational to 1.19.2010 high)

2007 uni-directional thrust 12.94% : 3.4% correction

2010 uni-directional thrust 14.81% : 3.89% = 1152.56

2009 uni-directional thrust gave us a 3.92% correction (8.17.2009 low)

up tomorrow

http://stockcharts.com/h-sc/ui?s=vix&p=D&b=5&g=…

filled the gap more downside on the vix and upside for the equities.

Carl at day’s end:

1188-1200 estimate for today (12 points)

1185 -1195.75 actual today (10.75 points)

Carl revised his estimate to 1181-1192 after his low didn’t hold.

Trades: In /ES at 1190.50, out at 1187.00 (loss of 3.5 points)

Grade: D (lost some money)

TNA opened down 0.57%. An old gap from $55.95 to $56.03 was not filled. Today’s gap was filled. TNA was up 0.88% at the high, and closed up 0.67%.

We are now in a Full Moon Trade, which tends to favor TNA.

AmericanBulls has TNA with a Hold signal. This trade bought TNA at $56.50, and closed today at $61.45, up 8.7%.

Volume for TNA today was below average for the past 25 days.

$RVX (VIX for $RUT) was down 0.7% today with TNA up 0.67%. No divergence.

TNA has now been up 8 of the last 14 days. Drifting higher.

The high for TNA yesterday was $61.58, the highest TNA price since November of 2008.

Ultimate Oscillator for TNA rose for the 7th day, from 68 to 70 today on a up day. A reading of 70 is Very Good for TNA.

MACD on the monthly chart crossed over to the upside 6 days ago and is rising. Good for TNA.

Bollinger Bands for $RVX (VIX for $RUT): After yesterday’s white candle spiked below the bottom Bollinger line and closed above it, today’s black candle was entirely above that bottom line. MACD seems to have topped and is coming down. Looks like $RVX might fall tomorrow. Good for TNA.

Bollinger Bands for $RUT: Today’s white candle for $RUT has been progressing upward, staying close to but below the top Bollinger Band (4th day in a row). It looks like $RUT may be riding the top Bollinger Band higher. MACD may be working back up. Good for TNA.

Bollinger Bands for $RUT:$RVX ($RUT vs VIX for $RUT): today’s doji candle closed just below the upper Bollinger Band, after a close five days ago above that band. The upper Bollinger Band is rising. Looks $RUT could keep rising. Good for TNA.

TNA had a higher high, lower low and higher close – Good for TNA.

Money flow for the Total Stock Market was $257 million flowing out of the market on an UP day. Bearish – Bad for TNA.

I will post the AmericanBulls candlestick interpretation a bit later.

Overall, it looks good for TNA.

Wonder if it will take 4 days to fill the gap again. Where exactly is the gap?

That's a question for you bull/bear. Thanks!

Looks like 15.54 on the VIX?

The Daily view from Americanbulls

TNA was a Hold yesterday, and rose today, remaining a Hold. The TNA buy was at $56.50. TNA closed at $61.46, up 8.7% since the buy. The candlestick today was a White Candlestick (normal buying pressure).

TZA was a Wait yesterday, fell today, and remains a Wait. The candlestick for today was a Black Spinning Top (complete indecision between bulls & bears). The TZA sell price was $6.51. TZA closed today at $6.30, down 3.2% since the sell.

Three recent TZA Buy signals have failed and may perhaps serve as a warning:

Buy at $7.33, sell at $7.14

Buy at $7.11, sell at $7.05

Buy at $7.04, sell at $6.51

For that matter, recent TNA Buy signals (until this last one) have also been uninspiring:

Buy at $55.36, sell at $55.43

Buy at $55.69, sell at $55.63

Buy at $56.50, up 8.7%

Summary of $RUT based ETFs & a few popular ETFs & stocks (Market positive): +16

Hold: GS(up 3.6%), QQQQ(up 2.0%), IWM(1x, up 3.3%), UWM(2x, up 7.0%), TNA(3x, up 8.7%), SPY(up 0.68%), DRN(3x RE, up 16%), URE(2x RE, up 6.2%), IYR(1x RE, up 3.0%), GOOG(up 3.5%)

Wait: RWM(-1x, down 2.9%), TWM(-2x, down 6.0%), TZA(-3x, down 3.2%), DRV(-3x RE, down 16.4%), SRS(-2x RE, down 10.8%)

New Confirmed BUY: AAPL

Transition to Market Positive: -3

Not Very High Reliability SELL-IF: SCO (-2x oil),

Not Very High Reliability BUY-IF: USO (oil), UCO (2x oil)

Transition to Market Negative: +3

Low reliability SELL-IF: ERX(3x energy),

Low reliability BUY-IF: ERY(-3x energy),

Not Very Reliable SELL-IF: DIA

Market Negative: -2

New Confirmed Sell: AMZN

Hold:, DTO(-3x oil, down 10.3%)

Comment: Bullish overall, Bearish Oil, Bullish Energy, Bullish $RUT, Bullish Real Estate

Action for TNA or TZA for tomorrow: None

Jay – thanks for this.

Nevermind, we both got outsmarted!