The following is by Karen Starich, who uses astrology to forecast events in the financial markets. She offers the premium service Astrology Traders for specific dates, economic insights, and in-depth analysis of future events in the various markets that are covered.

In light of the last couple of articles posted on Market Astrology, I thought it might be helpful to add an explanation about how financial astrology works. To do this I am going to use gold and silver as an example because many investors are familiar with the trading history of the metals over the last 30 years and longer. A 30 year cycle is important because the planet Saturn has an orbit of 29+ years and also rules gold.

With financial astrology there are cycles in sectors of the economy based on the orbits of the planets as well as the planets that rule certain sectors of the economy. Cycles, or orbits, of the planets are very important for determining long term trends. The planets all have varying orbits with the outer planets Uranus, Neptune, and Pluto being the slowest. Pluto's orbit is 240+ years. Pluto is transiting Capricorn now which is ironic in a cycle where we are reliving the "Tea Party" in politics just as we had in the 1760's when Pluto was in Capricorn the last time. There are planetary cycles and then there are also eclipse cycles which act as exclamation points and triggers for the planetary cycles to act.

Gold and Silver

Gold and silver are very interesting because they represent a history and tradition of money as well as well as an asset for investment. We have had many cycles of boom times and then bust with both gold and silver. Astrology is useful in determining the boom and bust cycles so as not to get caught off guard. The very long term picture for both metals is up, however there are some very significant planetary events that have occurred in recent years that help to give the investor confidence in what is the "real" trend.

As I mentioned eclipses are important exclamation points for the planets to emphasize a theme. Total eclipses carry the most power and then the degree and sign of the eclipse suggest where the power will come from. The most powerful and critical degree in the zodiac is 0 degrees of a cardinal sign. The cardinal signs are Capricorn, Cancer, Aries, and Libra. The four signs are called the cardinal cross, and in mundane astrology represents the axis of world power, money trends, and war.

The Power of Solar Eclipses on the 0 Degree Cardinal Cross

Solar Eclipses on the 0 degree of the cardinal cross are very rare. There was an eclipse at 0 degree Capricorn in December 22, 1889. This eclipse was the hand writing on the wall for silver and gold in what would become the famous "Silver Panic of 1893." In 1889 the South Node was conjoin the eclipse and opposing the United States Venus at 3 degrees Cancer (silver, wealth , and the security of the people). The Sun rules gold along with Saturn (the ruler of Capricorn and government restrictions) in an eclipse at the 0 degree of Capricorn would bring a diminishing effect to gold and silver. The eclipse suggested there would be a government takeover of the metals. When Mars, in it's fourth pass to the point of the eclipse in 1893, triggered the 0 degree of Capricorn a bank run ensued with a panic as people made a run on the banks to redeem their silver for gold. The bank run led to a depletion of the gold reserves in the U.S. Treasury. Ironically, in order to keep the Treasury solvent, the United States had to borrow 3.5 million ounces of gold from J.P. Morgan and spoiled the game speculators had been playing on the chances of a Treasury default.

The Panic Circular

The bankers' had two major objections to silver coinage.

- Silver coinage expanded the monetary base (inflation) impacting negatively the bonds, dominated in dollars and held by the banks.

- The type of inflation was occurring outside the bankers' control. The inflation was good however for the miners and farmers as it allowed them to pay off their debts.

On March 11, 1893 the American Bankers association produced the leaflet titled "The Panic Circular" which was distributed to each national bank president:

"You will at once retire one-third of your circulation and call in one-half of your loans. After this you are to advocate an extra session of congress to repeal the purchasing

clause of the Sherman Law, and act with other banks of your city to push for it's unconstitutional repeal...The future of national banks...depends upon immediate action, as there is an increasing sentiment of...silver coinage."

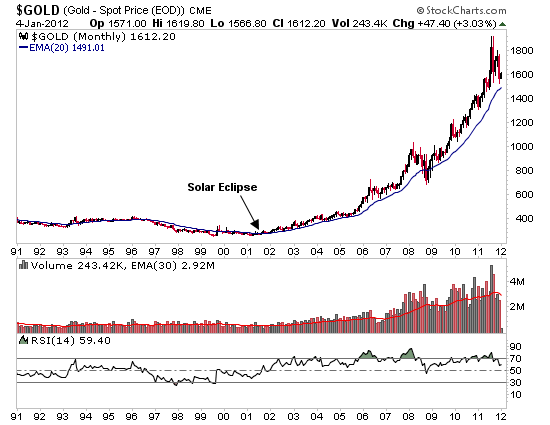

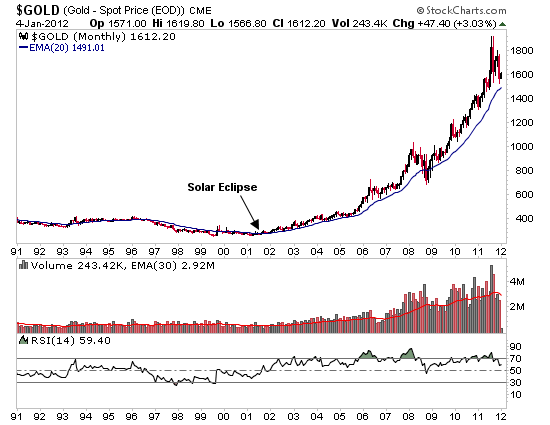

Solar Eclipse June 21, 2001

There would not be another total eclipse on the cardinal cross for over 100 years. In June of 2001 a total eclipse would take place at 0 degrees Cancer, an exact opposite of the eclipse in 1889. The 2001 eclipse in Cancer has an entirely different meaning. The moon (home and security) rules the sign of Cancer and silver. After the eclipse in Cancer we witnessed on September 11th an attack on the security of the nation and the beginning of the long bull trend in precious metals. The eclipse shows the promise of a very long trend that will support the metals, particularly silver, as people gradually become more aware of the threat to their security in paper money.

Banks vs Gold and Silver

The banks are going to continue to perpetuate a fear in the accumulation of gold and silver. In today's market we have banks like J.P. Morgan (JPM) that send out their own "Panic Circular" to their cartel friends to short the metals and miners,or in the case of MF Global just steal the accounts ready to take delivery. The effects of the 2001 eclipse favors the public and not the banks, their efforts are losing strength in creating a panic however there are risks again in the astrology. I predicted a sell off in the metals at the end of December and advised my Astrology Traders subscribers to have short positions to hedge their physical holdings.

I advised a silver trade with a GTC order for Silver Wheaton (SLW) in the range of $26.50-$27.50. Going forward there is continuing stress on gold more so than silver. The game of fiat currency for the bankers' is coming to an end and there is a very strong likelihood for a move towards a gold standard in 2013-14. The stress on gold could be an attempt to pullback as much gold as possible into central banks before moving to a gold backed currency.

There will be another solar eclipse at 0 degrees Cancer on June 21, 2020. The eclipse will be a very rare repeat of the 2001 eclipse, again reinforcing the metals.

SPY Trend update:

http://niftychartsandpatterns.blogspot.com/2012/01/spy-trend-update.html

Red

Bull Bear ratio AAII 74%…….YikesDown from here……for awhile http://markethighsandlows.wordpress.com/

Gold, BITCHEZ!

Spread the word!

Don’t forget Silver

And water too guys, as you know the gangsters are going to make that is short supply soon too! New price for a bottle of water… 10 Federal Reserve Notes.

Or one silver dime.

Bank of America Chart Analysis: http://goo.gl/JL1U4

Amazon Chart analysis:

http://niftychartsandpatterns.blogspot.com/2012/01/amazon-support-at-weekly-trend-line.html

One of two things will happen this month…the market will fail now, which will prompt more money printing, or the market will ramp until the Fed meeting, then fail when more printing is not done.

jobs report helped pull down my gold longs.http://www.marketwatch.com/story/us-g…

click on my name for the new roadmap.

still thing there is much more room for gold longs but can i hold until 2020.

S&P

I would not sell physical metals in the next shake out. Better to hedge your phyz, short the heck out of it on paper, play their game and watch the tug of war with deliveries at the low artificial price. Backwardation to the max!

Here is a video the S&P 500, oil, silver, dollar, and gold as well.

http://goo.gl/eaNQu

Here is an article on S&P 500 and gold.

http://goo.gl/nZPuo

Interesting stuff IMO.

Apple negative divergence:

http://niftychartsandpatterns.blogspot.com/2012/01/apple-negative-divergence.html

Hey Red,

Did you see Obamas speech at the Pentagon, which ended precisely at 11:11? Notice that today is 01-05-2012 has 1+5+2+0+1+2=11

Check out the clip 🙂

http://www.youtube.com/watch?v=t5Gu6fhGQ1w

LOL… good catch BH. Those gangsters love their rituals.

that’s military scheduling too. everything gets planned to the second.

Hi zstock

you might find my comment to BH interesting

Hey Bighouse

I have studied numerology and notice too the repeat of the dates 11 and 22, which are the master numbers. Have you noticed the major events seem to always fall on the 11th or 22nd day of the month? What is even more interesting to me , since i am an astrologer, is that the peak dates (planets in aspect to the charts of the U.S. and Fed charts) of transits that i would consider once in a lifetime, are always exact to the minute on the 11th or 22nd day of the month. What are the freakin odds of that…

Yes…Their are no accidents…

i still have this nagging cold. I can’t seem to shake it.

getting behind on my work too. means, i have to catch up on the week end.

other than that, things are pretty good.

smart meters, i’m getting video’s in my email about them, with these notes.

do not show this to anyone, just yet.

if you haven’t been keeping up with the smart meter technology, then what you don’t know, is they are as powerful, if not more powerful, than a spy cam, put in your living room.

MSFT Weekend update:

http://niftychartsandpatterns.blogspot.com/2012/01/msft-weekend-updated.html

Jan earnings, pull up a July 2011 DIA CHART–I think Jan might trade like that. leave the AUG PART OUT.

this notebook tablet cost $10,000, but with mass production they might get the price down to $500

http://www.20min.ch/ro/multimedia/stories/story/Un-etonnant-tour-de-magie-avec-un-iPad-16286844

Red,

NEW Improved and Adjusted trading Bands gives new sell in gold

Past this around gang, and show your support by signing up…

http://americancensorship.org/

I keep track of these things.

Q3 spx 500 earnings beat the street by 4%.

Q4 starts next week. expectations have been lowered by 2.5%, since last Nov.

You may be right. Bernanke’s daily overnight euro ramp is starting at this moment.

here’s something i was thinking about.

I have many stocks RSI 68 -72, which get ready to report earnings in a couple of weeks. what the market really likes, is the day before earnings, that the stock is at rsi 50. the market likes this A LOT!!!!only one conclusion then.you slow guys try and follow me here, ok…This means the market will do everything it has to to bring all these rsi 68-70 stocks, down to rsi 50, within 2 weeks. that’s not good news for the bulls.

Well, the very fact that Bernanke & the Criminal Cartel continue to ramp this market is good for the bulls, even if they do have to bring a stock down first before the big ramp. Might be good for a big correction in a quarter or two?

QQQ Weekend update:

http://niftychartsandpatterns.blogspot.com/2012/01/qqq-weekend-update.html

Gang, I have been very busy with other stuff and I’m not able to do a new post tonight. Sorry about that. I’ll try to get a new one up as soon as possible. Right now I don’t see anything big happening on Monday, so I’ll try to at least to a video update tomorrow night.

COPPER Triangle pattern:

http://niftychartsandpatterns.blogspot.com/2012/01/copper-in-triangle-pattern.html

Looks like The Bernank Criminal Gang is doing what is usually does when pretty much all public companies will miss their earnings. Let that one company go down, but RAMP up the rest of the market to offset.

i think you’re right. these guys are sector rotating, within the sectors.

Amazing how they use the same script, especially with a blank check. Human nature I guess. Or maybe demon nature, in Bernanke’s case.

i like reds describe, the best…lizard reptile cannibals.

What about Cannibal Humanoid Undead Demon Lizard Reptile, or CHUD-LR. Sounds like a new type of weapon.

i found this movie on youtube…

Resident Evil Extinction

http://www.youtube.com/watch?v=CTgu0gKQ248&feature=related

Nice.

Ha, future history!

SPY Trend update:

http://niftychartsandpatterns.blogspot.com/2012/01/spy-trend-update_10.html

Red, are u still alive. Did not hear your comments for a while, except the updates

Thanks for asking… YES, I’m still alive. I’ve just been very busy working on other projects right now and haven’t had the time to make a new post or an update. The market isn’t doing anything right now anyway, so I’m not missing anything… that’s for sure! LOL

By the way, the next Legatus meeting is this coming Feb 2-4 I believe. I wonder if we’ll have a top in the market shortly after that is over with? The last one was off by 3 days, but the market did peak and sold off for quite awhile afterwards. Let’s see what this meeting brings?

If we don’t have a top now, I would imagine a top after that (and after a vicious ramp job) time frame as QE3 is not announced.

Well, that comment was meant to be replied to you, but it got posted wrong ACP.

It’s obvious too me that there is a secret QE3 in the market right now, which is what’s holding it up and stopping the collapse from happening. Otherwise, we’d already crashed by now. The charts are manipulated and they will likely turn them back up bullish for a short period… at least to hit the 1320 spx area. After that, who knows?

Yeah, QE2.5 never ended, plus there’s this:

http://research.stlouisfed.org/fred2/series/WOTHAST

Foreign currency denominated assets…ie the Fed is ramping the euro, as well as buying MBS to ramp US stocks. I always joked about how the Fed was going to bail out the entire World, but never expected it to actually happen.

WOW! …and that really isn’t a powerful enough word to describe that chart!

Interesting that they started this program in 1963, which just happens to be when Kennedy was assassinated.

i thought the fed “is the world”

speaking of which, JPM on fri, has to beat the street by 17 cents if it wants to go above its 200 day 37’s

CRUDE Oil Testing resistance levels:

http://niftychartsandpatterns.blogspot.com/2012/01/crude-oil-testing-resistance-band.html

SILVER Chart analysis:

http://niftychartsandpatterns.blogspot.com/2012/01/silver-above-resistance-line-below-50.html

Failed rally? Dead stop at 1296. To ramp or not to ramp; that is the question.

Obama appoints another criminal banker to Chief of Staff. As a social experiment, let me know how hard it is to find the ‘bad stuff’ from the criminal media.

I haven’t been watching ACP… who did he appoint? Let me guess… Gangster George Soro’s, Gangster Warren Buffet, (too old actually)… how about Gangster Donald Trump? LOL

Jacob Lew.

Jacob Lew…

http://whitewraithe.wordpress.com/2011/06/07/zionist-washington-ensuring-end-of-america

Gangsters hiring one gangster to replace a current gangster. They like incest I guess… keep it in the family!

Explains why they get dumber…

I guess the new gentleman is going to fix the unemployment from 8.6% to under 7% by the end of year, accounting book wise. not the real unemployment.

INTC reached it’s short sell area.

http://zstock7.com/?p=6213

i have overnight short sell signals on QQQ, wow.

we’ll see.

At this point, “we’ll see” is exactly my sentiment also.

http://www.wavegenius.com/wp-content/uploads/2012/01/Jan10dow.jpg

Dow 20,715? That would be massive inflation!… which is totally possible.

do u have any extra toilet paper

Withdraw some from your ATM. Might be a little rough though.

i will get leaves from outside, no cost

Too many closet bears out there.

Red,

22 week cycle high 10th or 11thLow due on the 18th sold gold today—-see postCheers

my signals say downtrend day, within 48 hours.

signal has batted 100% since sept. (read more, click here)

each time i post this info, i wonder to myself, is this the one that messes up.

I’m calling it! Today is the high of the year!

Edit: Maybe.

DIA 131 by may, then sell in may. that’s one of my scenarios.

That wouldn’t surprise me, once the euro short squeeze happens.

BAC high today was 6.66….Just saying

S&P 500 Analysis after closing bell:

http://niftychartsandpatterns.blogspot.com/2012/01/s-500-analysis-after-closing-bell_11.html

Here is Maria speaking with scum bag Evelyn De Rothschild back in 2008. Guess what he is invested in?

http://www.youtube.com/watch?v=7Fw1RMKWypo&feature=related

David Rockefeller’s Shocking Confession

http://www.youtube.com/watch?v=p8zWLOnNe6o&feature=related

Unfortunately, too many people are busy collecting free benefits to care.

Alcoa posts a loss, announced it’s shutting down 12-15% of its smelting capacity, all 5 smelters in the US

and Europe, and the CEO laughably announces that aluminum demand will increase in 2012

kicking off today’s little mini rally. Singapore’s 4th quarter GDP expected to be negative with most other

emerging nations in similar situations. China’s PMI contracting the last 2 months and housing prices down

around the last five months. GSCI Industrial Metals Index (which includes aluminum) down 30% off its

2011 highs….(can’t manipulate this index since almost all of its components aren’t traded on a commodities

exchange)

And the pundits continue to push the US economy is fine line when it’s apparent that we’re in the phony

war stage of recession with the hard down phase about to commence.

Standard and Poors earning’s estimates for the SP has the 4th quarter earning estimates

dropping sequentially from the prior quarter, a very rare occurrence since 4th quarter earnings are up

80% of the time going back the last 80 years. Negative to positive preannouncements for the 4th Q are at 3.3 to 1,

the highest level since the 4th quarter of 2008 according to WSJ.

I have an epic Tebowmania post but I am afraid it would be too time-consuming to put together for today.

He did throw for 316yards on Sunday for a 31.6 completion average and I did notice there is a major Bradley date for 3-16 but I will include that later in the major post.

The gangstas in Vegas though made a killing on the Bronco’s-Steelers game. Tebow and Company were 9 point home dogs to the Steelers but Tebowmania prevails with another miraculous walkoff score by Tebow in overtime. And the public continues to eat this stuff up with this game being the highest rated of the 4 over the weekend

Funny the buildup to that game (Broncos-Steelers). Elway telling Tebow that he needs to pull the trigger after his abysmal Week 17 performance in a 7-3 loss to the Chiefs and former nemesis QB Kyle Orton. Rotoworld and other sites announcing that Tebow’s backup Brady Quinn would be taking reps with the first team and might come in and play if Tebow struggled. Every analyst of course picking the Steelers. One betting expert coming on the 4 letter morning radio show on Friday claiming that the wise guys were taking the Steelers despite the 9 points and the sheeple/ modern day bucket shop players were set up for the shearing.

CRUDE Oil analysis:

http://niftychartsandpatterns.blogspot.com/2012/01/crude-oil-pauses-near-golden-ratio.html

Google falls to 50 Day SMA:

http://niftychartsandpatterns.blogspot.com/2012/01/google-falls-to-50-day-sma.html

MAYBE THE bears can take over next week—OPX week.

Looks too me that the bears have been sleeping for the last month and a half. Wake up must be coming soon…

JPM reports fri morning. market reaction could go either way.

Or do what they do best & just ramp SPX all the way to 1425, which no one expects.

Also, if the market breaks 1296, it’ll be a first time ever for a retracement that size, which means money is being created specifically to disallow a correction. To put it simply, I believe a break of 1296 means the Fed will have specifically directed that 1300 will be broken to nullify the bear market.

i never knew one could nullify a bear market. good to know.

i half expect the DIA to get to 128, if the earnings are good.

V-shaped recovery is an example of what I call a BS nullified bear market, that will eventually fail, like the recovery in 2003. Epic fail on that one, but it took years.

According to Evil Spec, today could be the smallest VIX range ever.

I am planning on doing a write-up about JPM for Friday.

http://marketsectors.blogspot.com/

This was in reply to zstock7 below. I forgot to hit reply.

Just don’t have the creativity today to put together my epic Tebowmania post but I’ll add on to the post below about Tebow’s statistical

game. 10-21 passing for 316 yards at 31.6 yards per completion. A number all too familiar to Tebow:

http://www.tebowseyeblack.com/2012/01/tebow-316.html

http://www.wallstreetmanna.com/2012/01/tebow-316-yards-2-td-passing-rushing.html

Yes, all of this occurred on the 3rd anniversary of the Florida NCAA championship game appearance where the 3:16 reference was featured.

Sunday’s game was also the highest rated event on TV since last year’s Superbowl. I knew something was up when they gave that game

the prime Sunday afternoon slot when on paper it appeared to be the most boring of the bunch.

It’s also the highest rated first round game since ’88 according to Kevin Depew’s twitter. Remember that 88. It was featured throughout

that game. Game winning TD to #88.

And Alabama won the NCAA national championship on Monday as suggested by Bradley’s ode to the ’29’92 ritual.

A sign of the end times as Tuscaloosa Alabama is one of the featured cities in Bradley’s ode. On the 19th anniversary, tornadoes hit

Tuscaloosa and now the national championship when all season long Alabama had been an afterthought to LSU’s much heralded season w/

LSU even winning the first matchup in Tuscaloosa. Today 19 years 2xx days later.

Eugene, Oregon another city mentioned in Bradley’s ode. Oregon wins its first Rose Bowl in 100 years on January 2 while

the Miami Thrice made an appearance in Eugene back in October. Eugene also considered the anarchist capital of America with

many deployed into the Occupy movement. Time Magazine makes the Protestor it’s Person of the Year.

And Bradley’s band made a comeback this year with a new singer of course. It looks like they will be playing in LA on 1-22-12, a day of importance???