Will we get another crash this year?

I think we'll at least see a 20%+ correction, but crash... probably not.

(to watch on youtube: www.youtube.com/watch?v=FDwL7nKP6jc)

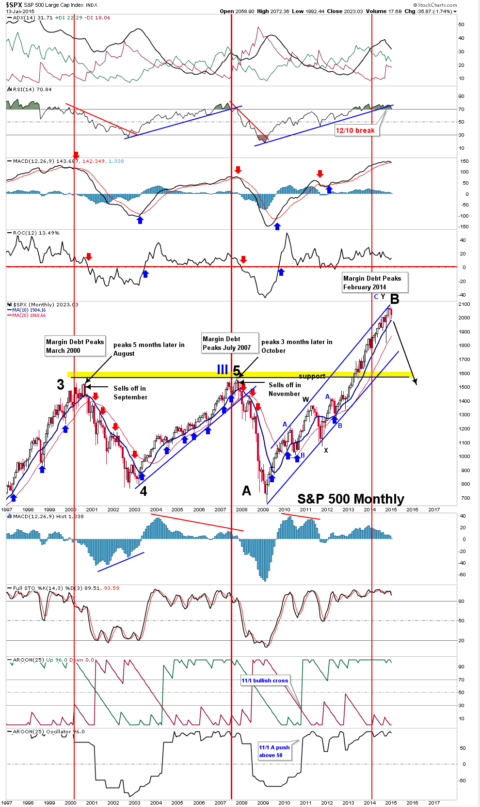

I guess if the correction is fast enough you might call it a mini-crash, but the next BIG Crash is still a couple of years off I believe. I'm looking for an early pullback in January/February and then a push back up into mid-summer, with July being the most likely month to top out in. What I'm looking for is a move similar to the 2011 drop that bottomed at 1101.54 SPX on August 8th, then bounced and made another lower low on October 3rd of 1074.77 which most elliottwave chartists call "Primary Wave 2" down with the current rally up since then being one very long Primary Wave 3 up.

So we are looking for a Primary Wave 4 down this year and it should be 20%+ if it's going to be similar to P2 down. This monthly chart tells us a lot from a technical point of view. We can clearly see the MACD's losing momentum and looking ready to go negative soon. How long it takes is just a guess but I think we'll have at least one month close down (probably this January) and then a few positive months into mid-summer before losing the zero line on that MACD chart. Possibly we tread along it for the first half of 2015 staying between zero and maybe +5 or so?

Looking at the rising channel we can see that lower blue line is coming in around 1750 which I believe we could very well see hit later this year. While it's possible that it breaks and we go down and hit the horizontal support level just under 1600 from the two prior tops in 2000 and 2007 I suspect they won't let it drop that far. Remember, there is very likely one more very larger "blow off top" rally coming (Primary Wave 5) that should top out in 2017 sometime... so I don't think they'll let the market collapse too far this year.

Medium Term Outlook

Clearly we have already started selling off this January as I write this post so that's no big surprise. Looking at the weekly chart we the MACD's going negative and price level still inside the rising wedge. Back in October of 2014 we seen the market breakdown through that lower trendline of support but rally back above it before the week closed out... saving the market once again from a much bigger collapse.

We notice now that the MA 40 is around 1974 on the SPX in this chart and that's just slightly above that lower support line on the rising wedge. So, if they plan on rallying up to new higher highs into mid-summer they need to hold that zone on a weekly close to avoid a bigger drop. However, the monthly chart looks much weaker this time around then back in October when they pierced it once, which leads me to speculate that the support line won't hold this time if it's broken. My guess is that we'll hold it on the first hit, then lose it later this month or early February after riding the support for a few weeks.

By letting the trendline break with a deeper correction they can then have a more sustainable up move afterwards. It would create a new channel and level of support for the bulls and give them the opportunity to rally into mid-summer to backtest the broken trendline on the current rising wedge, which would of course be at a much higher level by then.

This is the best scenario for the bulls I think as without a decent correction I just don't think they will be able to rally up to 2100-2200 like they want to do. Trying to stay inside that rising wedge all the way out to mid-summer (where I suspect we'll top at) will be a tough feat for the bulls... especially with the threat that Janet Yellen will speak of a future interest rate rising happening in the near future. While I don't know if they will actually raise it this year just the hint of it will be enough to scare the bulls and excite the bears.

As we all know the market rallies and sells off in front of any planned events and not when they actually happen. It's the old "sell the rumor, buy the news" saying that keeps the market always doing something today in anticipation of something in the future. This is why the market is always on edge every time the FED's release the minutes of the latest FOMC meetings.

So from a technical point of view, combined with the fear of some future interest rate hike, it won't be likely that the market can continue rising until mid-summer while staying inside that wedge. It's getting too bearish on the monthly chart now to support the weekly holding that lower support trendline. This is why I think it will break this time around and then rally back up later this year for the possible backtest.

The monthly chart has support from the MA 20 at 1868 area, which "could" be the zone that we'll see this January, February, or March before turning back up to rally hard looking for that higher high into mid-summer. If they don't allow the market to correct that far and instead manipulate it to stay inside the rising wedge on the weekly chart then I don't think we'll see much of a higher high into mid-summer. At that point I'll lower the odds of seeing 2200+ and forecast that we'll end somewhere in the 2100 area with a lot of sideways range bound trading between now and that top.

On the flip side if they allow the deeper correction then I'd expect to see 2200+ in mid-summer with a more steady rally happening along the way as opposed to the range bound wild swings up and down we've been having over the last several months. While this range is over a 100 points wide right now I think it will end if they just allow a bigger correction to happen... as therefore a more powerful rally can start. Failure to allow the correction means we'll likely see more of these wild and crazy moves up and down until summer while they try to stay inside that rising wedge.

Short Term

While it's been a very steady and controlled move down this week the daily chart is getting oversold and due for a bigger rally here soon then the one day (or intraday) moves we've recently had. The short term support is at the 200 day moving average around 1965, which could be hit this week if they are going to do a "flush out" move before bouncing. It lines up nicely with a double bottom area of 1972 from December 16th, 2014 which should add to the support as well. It's an obvious level that everyone see's and is currently acting like a magnet for the market, drawing it closer every day it seems.

However, we all know that when something it very well seen by the masses SkyNet will usually do the opposite so the sheep lose money again. So that "flush out" move to that zone should be tricky and fool the sheep so they get shaken out of their positions at a lost. How will SkyNet do it? That's a great question and one that I can't answer unfortunately.

It could gap down to that zone Thursday morning and reverse back up all day squeezing the bears that are expecting a crash, and continue that squeeze into Friday recovering a large amount of the move down, while making all those bears holding January 16th puts expire worthless and futures traders start buying back their shorts at a lost (which is how the bulls get these huge rallies in the first place).

Or they could just rally it up from the current level staying above that obvious target zone and pushing that thrust move down until next week or the week after. I'm thinking (guessing... speculating) that a nasty solid (or almost solid) red candle bar close on the weekly chart for this week isn't something they want to happen as it will then increase the odds of the following week tanking even deeper and breaking the 40 MA around 1974 on the weekly chart. Some how I get the feeling they will start a squeeze from the current levels (falling short of hitting the 200 DMA of 1965 and/or the double bottom of 1972) and save the move down lower for next week and/or the week after.

I think the 200 DMA will not be the short term bottom before a bigger bounce. It doesn't line up to me. I see SkyNet fooling the sheep with a break of that zone to a lower level. While I'm sure there will be a bounce from it as the big boys buy it I don't think it will hold as the low for them to rally up to new all time highs from. I think that we'll see a short lived bounce and then another push lower into the end of this month.

I'm guessing will bottom around the next Legatus meeting January 29th-31st, 2015... which also is the same time frame of another FOMC meeting (http://www.federalreserve.gov/monetarypolicy/fomccalendars.htm). Too much coincidence for me to think a big turn in the market won't happen during that time period. Therefore I think we'll bounce this week and hold the 40 MA on the weekly and the lower rising trendline on that rising wedge, and then over the next 2 weeks into the end of January we'll see a break of that line with a target zone of 1750, 1820, or 1868 being hit.

The 1750 estimate is from the monthly chart as that's where the lower trendline is on the rising channel. I give it low odds of hitting but it's still possible. The 1820 area is from the October 15th, 2014 low and would be of course create a double bottom. I give it medium odds of being hit. The 1868 level is from the 20 MA on the monthly chart and it makes the most sense too me of being hit due to the expected turn date zone of being at the end of this month.

It would also fool a lot of sheep that (once at that zone level) would naturally be staying short expecting to exit and go long at the double bottom of 1820... which brings us back to the current market level today as being in a similar zone of just 20-40 points shy of another expected double bottom where the sheep would again want to exit their shorts and go long. Since SkyNet's job is to steal the money from the sheep I find it unlike to be hit this week as I previously suggested.

It's all about mis-direction as you know. Anything too obvious to happen simply won't happen... at least not when everyone is expecting it to happen. Therefore I'm looking to be fooled as that's SkyNet's only way to profit... and it does it very well. After we rally up next week to get everyone bullish again we'll be looking for the sell off to continue into the Legatus/FOMC date zone.

Red

As I said in the post and video I think we’ll hold the line this week so the closing price tomorrow keeps the weekly candle from breaking the rising wedge (around 1970-1970 SPX), so a Friday rally could happen (should happen) to make the puts expiring tomorrow worthless.

But next week is another story I think, as I fully expect the selling to continue until the end of January, right into the Legatus meeting and the FOMC meeting before turning back up.

The daily bollinger bands for the SP are just below today’s lows and the lower band is curling up which should provide support until it flares open again so I am guessing a little bounce tomorrow (or possibly a big one). It’s 13 trading days off the top as well.

All the indices are also at intra month support and near the Dec. low support so that could spark a short term bounce but the daily trend should be down after the brief 2 day counter trend move last week which is about as long as a counter term pop should take. The Dow tested intra month support 13 tds out as well in double ninen.

SP also could not take out yesterday’s lows which is also a dubious condition that could see a pop tomorrow. Nasdaq and $rut definitely did but they are at Dec. lows area again which could provide some resistance.

Looks like the college championship game 1987 ritual was centered on Urban Meyer after all. Notice the 12-15 (87) QB RB combo that led the way for Ohio St. LeBron was even doing intra game tweets that were being aired by the broadcast (led of course by the pretty boy Ohio State grad with the ’69 bday so should have been a’87 high school grad…..more later….even Tebow was there as part of the broadcast crew—so it definitely had the feel of the grand ritual bowl even though BAMA wasn’t a part of it….something is going on with Ohio though….17th state admitted on March 1 early 1800s, admitted retroactively)

$vix couldn’t break above its high from yesterday as well and was finding resistance from its upper Bband.

Technical Analysis wise we should gap tomorrow and drop hard… but SkyNet likes to fool the sheep and do the opposite of what most think will and should happen. If the chart was flipped upside down we’d have a bullish setup… which would most likely play out. But when it’s a bearish setup it usually gets manipulated the other way.

And the VIX is making a similar pattern to what it did the week of January 15th where it went up to around 25, pulled back to around 20, went back up to 25 area again, failed to break through and then dropped hard back to 14 over the next week or so.

While I’m certainly not expecting a drop again to 14 I could see a pullback to hit the rising trendline of support on the VIX around 18 or so… which should be 2040 area on the SPX, and then we should drop again I think. Tuesday the 20th of January is my best guess for the next shorting opportunity.

Max pain theory – price action toward expiration conspires to cause maximum losses for option holders. I’d rather be an option seller early in the cycle and cover short options as expiration approaches.

Totally agree. If there is any gap down tomorrow morning I expect it to reverse hard by the close of Friday. Right now in the afterhours market I see the SPY, IWM, QQQ, dropping lower… which is a good hint that they are taking out the bulls’ stops now and will wipeout the bears tomorrow.

They did the opposite last night. But I could see the market dropping as well since I got out of some puts today but I have plenty of positions anyway. Let’s see how the bbands look tomorrow.

Best guess… they pin the SPY around 200 today.

Looks like we already got some denouement. The Swiss franc moving about 30% in a matter of minutes against the euro earlier in the week should qualify. Then the Swiss market has been obliterated the last two days coming off a 52 week, presumably all time high.

It could be a long weekend. Some major astro activity on Monday and Tuesday, most notably the new moon and the next US trading day will be 9955 days from a certain little event.

A bounce of the intramonth lows on Friday similar to bounces in late March 2000 and the aforementioned certain little event. RTH is mimicking the pattern closest to 27 years plus ago while the SP and others are doing a variation of double ninen so far.

Get ready for your 12s in tomorrow’s NFL final 4. Don’t have any occultic analysis. Should be the Belacheat’s vs. the NFC. Can see a case for the PEDHAWKS (which would appeal to the masses) or the 1929 champ Packers. Belacheat was the d-coach on the 1987 Superbowl champ Giants and a former head coach of the Cleveland Browns, currently the home team of the occulticly favored Johnny Bozo, their 1st round pick at the 22 spot last year ago. The Browns have had a history of taking QBs lately in the 1st round at the 22nd pick. Previously Brady Quinn and Brandon Weedon.

The operators retired Johnny Ritual for the season Week 16 when they had him fake an injury that put him on IR for the season. Anymore exposure of Bozo’s play would have destroyed any football playing credibility that was left with him. He looked like an Average Joe tossed out to play QB amongst the roid monsters.

The ECB speaks this Thursday January 22nd about possible stimulus. If the market rallies into that event then it should be a “sell the news move” which implies more downside into the FOMC meeting the 28th/29th and Legatus meeting 29th-31st.

If the market sells off into the Thursday meeting then I’d expect a rally from that news into end of this month and then another turn back down in February.

If you ever wonder why you can’t find out the truth about the coming direction of the market this image should help you understand why: http://reddragonleo.com/wp-content/uploads/6-corporations-own-all-media-propaganda-outlets.png

I’m sure those nice folks on the various financial news media outlets are there help you make money so you can retire with a nice large 401k account, right? Surely they are telling you the truth as they want YOU to make all the profit and NOT their greedy wallstreet owners, right?

Afterall we all know that there is always a winner and a loser on every trade and I’m sure they want you to be the winner as the company that owns them isn’t in the business of “dis-information” that might lead you the sheep to be on the losing side of the trade while their sponsors are on the winning side, right?

… and I have some oceanfront property for sale in Kansas for anyone interested.

The master operator from Omaha has a company that is having a customer appreciation day tomorrow Wednesday Jan. 21st offering 1/2 off of everything. Take advantage of the ritual!!!!

I know I will be gorging on some questionable food tomorrow with maybe a milk shake or some ice cream treats thrown in.

The inverted H&S on the ES with a 1970 head and 2025 neckline projects a move of 55 point higher or 2080 area. This ECB news tomorrow is about the only thing I could see sparking the start of that move. Failure to gap up huge Thursday tells me it’s a “sell the news” event and the IH&S will then likely fail.

In the past we’ve seen them leak out news before the event and most of the time they did it to goose the market higher as they knew traders would sell it because it only equaled whatever was forecasted and didn’t surprise with more. So my guess is that any pop higher we see Thursday should be sold into the end of January.

Unless we gap up HUGE Thursday (meaning like 30-40 SPX points) I would sell it as I believe it will be a knee jerk reaction to the ECB stimulus that won’t likely hold. That assumes they announce something more then the expected $50 Billion Euro’s per month that the market is expecting.

If they only do what the market expects then we could gap down and go. Either way, gap or gap down I think we go down into the end of this month where the FOMC meeting and the Legatus meeting give us our turn back up.

What I don’t know is “when” they will make the announcement as they are in a different time zone then us and could release the news before our US market opens. The only thing that would get me bullish is a 30 point or more gap up from some really larger then expected QE program from them. If they say $80 Billion Euro’s or $1 Trillion then I’m a bull… otherwise I’m a bear.

While it would be nice to see a 10-20 point gap up to get a great shorting opportunity at it’s more likely that I’ll have to chase the gap down. That’s fine though as I think we’ll see move down of around 100 SPX points or more, so chasing it will still be profitable I believe.

The announcement is 4:40 am Pacific time tomorrow. It was leaked earlier today that it was going to be $50 billion a month QE.

Mercury goes into retrograde today so maybe today was a trickster move. Sun also enters Aquarius following the new moon in Aquarius. Let’s see what news they really deliver tomorrow. I need to process some more info to see how the markets might have reacted to the leaks. Euro popped a little bit but the Swiss bailed on their peg because they see the euro nosediving and they don’t want to be tied to a nosediving euro, IMO of course. Also need an impetus for the Germans to bail.

That’s before the market opens so I guess whatever reaction they have might fad by the open if it’s a move up. If it’s a move down then I’d say we stay down until the open and continue into next week. I see nothing bullish here at all. I’d love to see a gap up to short, but I’m not expecting it.

Upside target could be as high as 2080 area: http://screencast.com/t/os8a2udcj

The $cpci (index put call ratio) index skyrocketed on Friday, quite some unusual activity coming off of trillion Euro QE euphoria.

The euro is also in a precarious position. It dropped below its day Bband on Friday and has dropped below it on the weekly. There was a hollow bar for Friday’s action but don’t know if they really work for a market that trades nearly 24 hours a day. So there’s a chance for a big rally or the opposite but judging by today’s events I don’t see an impetus for a pop but we’ll have to wait a few hours. At least closer to the Euro open but the $dax futures were indicating a decent drop is awaiting the open.

I think we’ll see a 100 point move start on the SPX within a day or two after today’s FOMC meeting, but I don’t know which direction?

Some interesting hits for tomorrow. I’ll make a post since I don’t thing I can jinx myself since it seems like every company beat in after hours today.

First, market today had a reaction bounce off the last several intramonth lows / support around SP 1986 but the Dow actually did make new intramonth lows and made it down to its lower BB.

Anyway tomorrow is a big Tebow day. Harking back to the original 316 Tebow day on January 8, 2009 when he played in the national championship game under his handler, Urban Meyer (a most definitely respected QB whisperer who definitinely coached up his 3rd string QB #12 this year in 3 matches), the current defending national championship coach of Columbus based Ohio St (capital of Ohio as well—-did u notice the NHL held its All Star game for the first time last weekend in Columbus??) and ascending star assistant coach of the 1987 Ohio State team that defeated Oregon on 9-19 of that year. Another Ohio side note: BAMA head coach Nick Saban, national champ 3 of the last 5 years also originates from Ohio, Toledo area I beleive. Then there’s the infamous MIAMI of Ohio which seem to be the football coaches cradle of the U.S. and former school of current Pittsburg QB #7 who won a Superbowl before NO so line up the Superbowl rituals going all the way back to that one.

Tebow original John 316 game was played on 1-8-2009. Tomorrow 1-30 will be 2213 (see the #22 number again) days later or 316 weeks 1 day later. It’s also 10031 days from his 8-14-87 birthday. It’s 1118 days from his other 316 day, 3 years later in 2012 when he took down the Pittsburg Steelers in the first round of the playoffs 29-23 after throwing the game winning 80 yard TD pass to #88 for the first play of overtime.He finished the game with 316 yards passing for a 31.6 yard average per completion. (10 for ??).

Current Bronco’s QB Popgun is #18. It looks like he will be staying around after the Bronco’s current coaching staff headed by coach Fox (see Foxcatcher, another 1987 era flick) was sacked last week. The Bronco’s are bringing back their old backup QB #8 to 1987/1988 Superbowl destroyee QB #7 who currently serves as the “GM” or Bronco’s figurehead.

Broncos have a 10-18-1 historical record vs. Pittsburgh.

It’s Gene Hackman’s 85th birthday as well and a certain website has caused an internet furor with a headline stating that Hackman has GONE see GONE GIRL. They also called him America’s greatest living actor which might be a stretch (part of the ritual hyperbole??) but it’s a very good article so I do recommend it.

Just realized tomorrow is 136 ==ie-1-30-15. The unveiling of the Miami Thrice #–136—on 7-9-2010 was one of my hits for tomorrow. 1666 days ago, 238 weeks ago ie 211. It’s also 238 years from 1776. Might need to stay up all night long.

Well we got some minor denouement on Friday but in the end, the markets still held above the intramonth support levels aka SP 1986/7. I thought we might get some Tebow time in the last hour when the indices broke below their intra day lows but the slide was contained. But it was a very unusual trading pattern for the day. Small gap down, decline to new lows by midday. Then bounce to unchanged with a hour and a half to go and then a slide into the close to new intraday lows with the Dow down 250.

Maybe this is the start of the slide. Most technicals are pointing down with most indices below their once again downtrending 9 and 18 day EMAs. A certain component of a certain indicator back in negative territory.

But things might continue to hold up into 2-6 which has been a key date for me for awhile now. Partially for at least a year. Didn’t know what it would mark but now it looks like a ceremonial top. More here later. Off to a Superbow preview.

Just going to do a cursory Super Bowl preview now with maybe an occultic analysis for tomorrow but really don’t see a clear 1987 parallel here unless this harkens back to the 1986 Superbowl when the BEARs destroyed the Patriots but really don’t see that here. The Patriots are a pseudo dynasty now with this being possibly their strongest team in years so it’s really hard seeing them getting blown out. Anyway, the operators appear to be pumping up the PEDHAWKS into a fan favorite with DEFLATE GATE literally BLOWING things out of proportion and making the Belacheats appear extra villainous and making them even more reviled amongst the masses.

First of all this game sets up a matchup of old school cheating vs. new school cheating. The Belacheats ascended into primacy in 2002 when their DBs bludgeoned the Rams’ receivers relentlessly while the refs stood around and did nothing about it. The PEDHawks have made defensive holding an art form doing it in a more refined and subtle matter while jacking up their DBs into linebacker size and strength through their innovative drug regimen. But Belacheat has learned from the PEDHawks and brought his team into the modern NFL fold. He signed one of the PEDHawk DBs (the one who missed the playoff run and SuperBowl after being banned for PED use #29 I believe) and installed him as one of his starting corners while signing lockdown corner Derell Revis as his other starting corner. He has #29 start against the opponents #1 receiver. #29 beats up on the WR while getting help from a Pats safety. Revis then plays shutdown corner on the #2 receiver without any help.

I believe the line opened with the PEDHawks, the reigning champs as a 1 point favorite and then moved to pickem and last I heard the Belacheats were a slight favorite. This doesn’t seem to make sense because the Pats seem to be a more complete team with an elite starting QB and a successful innovative coach who should have his team prepared. He should gameplan against Seattle’s QB #3, keeping him contained and not allowing him to scramble. I don’t understand how opposing teams continually allow #3 to run around all over the place but then again that is part of the operators’ script. Seattle no longer has Percy Harvin around to take pressure off of #3 and RB #24. Seattle’s WR corp is also pretty weak and depleted after key receivers left the team last year in free agency.

The Belacheats are universally reviled and Deflate Gate has amped up the fan hate. And boy have they been BLOWING up the controversy the last two weeks but that is part of the ritual. ie the coming deflation of the stock market……11 of 12 balls being deflated in the AFC Champ game. So the 1 or 2 point Patriot favorite line seems like a ploy to entice the masses to take the PEDHawks who they already are backing.

But I haven’t been following the SB hype the last few days so I need to hear how the commentators are framing the matchup. If every commentator appears to be favoring the Patriots, the go the opposite but I don’t see that happening since Seattle is the defending champ.

Maybe I’ll get into an occutlic analysis tomorrow.

The PEDhawks are back again as a favorite for the SuperBowl. Late money, apparently the public has driven the Hawks back to being a 1 pt favorite. They did open up as a 2.5 favorite on Jan 18 but within an hour, big money surged behind the Belacheats and drove the line to a pick em. Then NE moved to a 1 or 2 pt favorite until on Saturday late money, public money backed the PEDs in droves driving the line to make Seattle a 1pt favorite.

Well for some occultic analysis:

So far all I am seeing is a 1987 motif attached to the New England Belacheats as maybe some sort of surrogate rituallee for the 1987 SB winning New York Giants. The Giants tend to be ritualist marker for upcoming denouement having won SuperBowls in 1987 and 2008 and a SB destroyee in 2001 (to the Ravens) and involved in another SB victory around 1990 1991 at the time of a smaller bear market but cataclysmic real estate bust. Bill Parcells head coach of the 1987 SB champ Giants left the Giants after the SB win in 1991, left coaching for a little bit and then returned to coaching with the Patriots. After he left the Patriots, Seattle coach Pete Carroll coached the Patriots for 3 years before being followed by Parcell’s 1987 d-coordinator Belacheat who has held the job since then.

Carroll previously had coached the NY Jets for 1 year in 1994. Parcells took the job a few years later with Belacheat as his d-coordinator…(after his Patriots stint).

The current Patriot’s dynasty saw its ascendancy with the 2002 Super Bowl “win”. 3 wins and 2 losses since 2002. This will be the Patriots 8th Superbowl, currently their overall record is 3 wins 4 losses. (Parcells got them to a SB appearance around 1996).

I don’t really see any 1987 connection here. Carroll was d-coordinator for the Minnesota Viking in 1987 and I believe they won their division in 1987 but they were hardly a power in the 80s.

There is some sort of ritualistic symbolism tying to 1776 and the US’s founding going on with the Patriots and I am starting to see the importance of this a little clearer but I still don’t quite get it unless it’s being applied to Washington. 1776 is 238 year ago or 211. The Patriots hometown is FOXboro ie former Broncos coach FOX and FOXcatcher the movie and Dupont Estate near Valley Forge….in the movie Dupont does like to call himself a Patriot and his forebears produced ammunition for the US army during the early years of the republic.

Minnesota finished with an 8-7 record in 1987, made the playoffs as a wildcard and eventually lost to eventual SB champ Washington in the NFC title game. They beat NO in NO(Mardi Gras) in the wild card game and SF in the next round.

Then there’s Patriots QB #12 and his Michigan connection. Michigan, a Bradley state and recently saw the hiring of a new coach Jim Harbaugh, the celebrated 1987 Michigan graduate and former Michigan QB who started in the 1987 Rose Bowl against Arizona State. Michigan fell to ASU 22-15. Phoenix also a Bradley city and the host of this year’s SuperBowl. Might need to dig into the Phoenix connection a little deeper. The NFL did browbeat Arizona into passing the Martin Luther King holdiay several years ago or they would never host another SB. King did have a 1929 birthday. He would have been 86 years old as of a few weeks ago.

I forgot to mention earlier that the Patriots also had the Tebow factor. Tebow played briefly for the Pats after his Broncos, Jets stints. He and his occultic entourage also flashed a 1987 against the Belacheats on December 18,2011 after scoring the opening TD for the Broncos. Several weeks later he faced the Belacheats in the playoffs after his infamous 316 performance the week before (1-8-2012) against Pittsburgh but the Pats easily handled his Broncos.

Then there is the Urban Meyer, Belacheat, Tebow connection….all seeming to share a fondness for Aaron Hernandez…well don’t know Tebows views on the matter.

If I had to guess (based on the technicals in the charts mostly) I think we’ll bounce a little today and Tuesday and then rollover. But it really depends on how much we bounce? A big rally (not likely) should mean it will not rollover on Tuesday but push out until later in the week. Hard too tell right now.

With the FOMC meeting behind us and Legatus just ending a “turn” seems likely. Many would say that the turn would be to the upside as we are oversold on many short and medium term charts but the larger ones (weekly and monthly) suggest we will go down and break the rising support line on the weekly chart from 2011.

If it breaks by this Fridays’ close then we should expect move down into the 1800’s on the SPX before bottoming and having a rally to new highs into mid-summer. Of course if we have this move down now to such deep lows then the move down from the summer high might not be as larger. But we’ll cross that bridge when we get there.

Based on what I’m seeing the charts right now it’s looking like a nice rally up is about to start… probably on Tuesday. How high could it go? As high as the 2030-2040 area from what the patterns suggest.

This will be invalidated (of course) should we breakdown lower today into the close as then there’s a vacuum below which spells a much larger drop. But for now the 200dma on the SPX is holding and that (along with many oversold charts) suggest a nice rally is about to start.

Christie is getting attacked for defending parents’ rights to not poison (“vaccinate”) their children. The vitriol of the pro-forced poisoning thugs is becoming more extreme.

http://www.nj.com/politics/index.ssf/2015/02/parent_activist_defends_christies_longtime_support.html

https://www.youtube.com/watch?v=Nbn3NWMVLDc

Truly sad how evil (and insane) these criminals are dchris81… thanks for the link.

“Every child does not need every single dose of every single vaccine…

we have to bring some rationality to this conversation”

https://www.youtube.com/watch?v=25Fv3ocO9gs

We’re seeing the 3rd intraday high happening right now and it should breakout to the upside here if it’s going for 205-206 SPY. Otherwise we could drop back to fill the gap first before attempting another run up higher (if they plan on going higher?).

Failure here is bad for the bulls and “could” put in the high for the week even? Not sure yet but it’s looking weak now, and we are in the last hour of the day where there should be more volume. If however they do go up some more then I’d look for 205-206 SPY area for a top.

Since I don’t see that happening today I’d guess that we’ll see it Thursday after a possible pullback on Wednesday before that last squeeze up early Thursday.

Today should be a down day. I’d look to short any attempt to rally back up and fill the gap this morning. But tomorrow and Friday is still undecided. We could still put in another higher high then yesterday before the week ends. So I’m only looking for a one day move down (today… Wednesday) and possibly more (depends on how far we go down).

We’ve now made a new higher high then yesterday. Wednesday is the middle of the week and rarely puts in the high or low for any given weekly close (7% chance it’s the high for this week). So that suggests we’ll see a higher high Thursday or Friday of this week before rolling over.

There’s the downside move… a surprise and tricky one (of course). Don’t know what to think now? Wednesday’s rarely (7% of the time) put in a high or low for any given week. So do we still go up tomorrow? Odds say we do, but charts say the top was just put in right before that fast drop.

Well, as usual SkyNet tricked us all again. That fast down move yesterday into the close was done to work off some short term bearishness so they could ram it higher again today. Since the move down yesterday was the move I was expecting (although I was thinking it would start a new downtrend), I now think we won’t see another move down start until they push it much higher then I was expecting.

I was kinda looking for that gap fill from 01/27 to be the end of this rally up and then we’d rollover. We’ve past that level now and appear to be headed for a “bear squeeze” from the triple top we are currently at.

They say there are no triple tops (we know there is), as they are broken. My experience only tells me that triple tops don’t happen often. The reason is that they are usually broken on the 3rd hit of some important resistance or support level.

Of course the rare times that they aren’t broken the market reverses hard in the other direction. If we would have stopped yesterday around that 2052 SPX gap fill from the 01/27 low of the day and rolled over to the downside we would have only had a prior double top (from 01/09 at 2064 and 01/22 at 2064) with the 2052 high not making up into what we’d call a “triple top area”.

Clearly we are within that zone now with today’s current high of 2059 being within 5 points of the prior 2 highs. This is close enough in my opinion to call this a triple top. So the odds now favor a breakout to clear out stops above 2064 and create a bear squeeze up another 10-20 points higher.

On the rare chance that we don’t breakthrough the sell off to follow should drop quite nicely. If so, I’d expect some kind of low to happen next Thursday/Friday. But again, odds now favor them squeezing the bears (nothing new there, as they hate the bears) by breaking out of this triple top range.

Had they not pulled that little stunt yesterday with the quick drop to work off the short term overbought conditions we would probably be starting the down move today. But gangsters will be gangsters and stealing the sheep’s money is what they do best.

Timing the release of bearish news right when the charts are lined up in a certain setup is a master art that they do perfectly. Getting them to release this Greek news right at 3:30 pm EST (just as that 2052 gap was filled), which was like 8:30 pm their time has to tell you it was planned.

Who releases news late at night after your normal business day is closed? No company or government does… unless they want it released at a certain time, which we all know that’s exactly the case. Everything in the market is planned and the release of the news is ALWAYS scheduled around what in the charts and what the criminals what to happen.

SkyNet knew how the technicals in the charts were setting up for a big move down and it had to stop it before it happened. So a quick flush down to wipeout that alignment was done and it basically will buy them a day or so longer for the bulls, and higher prices.

But even more is that “if” they can get it up over this triple top zone and start the bear squeeze they could turn the charts back up to allow them to make a run for that prior all time high. Personally I don’t think they will do that, as I believe we are going to remain in a range bound zone for awhile longer, but never under estimate the manipulation these criminals can do.

So I don’t have any prediction on which way the market is going next. It’s the toss of a coin at this point. The charts say we fail to breakout and drop, but the manipulation of SkyNet says we go up and squeeze the bears. For now I just wait and watch for some new setup to appear.

Someone asked this question on a different blog I read and I thought my answer was work reposting here:

…”johnnymagicmoney says:

February 5, 2015 at 11:57 am

so charts are psychology and humans create computers which the models are derivatives of their psychology but I wonder if any work has been done to study how the models run by computers are negating the pure psychology element (in essence partially destroying the value of wave theory or any techincal) of the market even though they are dervivatives of the human mind. How have algorithims made these moves less predictable versus before? I have seen so many situations in the charts where the it really looks likely that it will drop and it doesnt and visa versa to a degree that I question elliot or any technical analysis less than before. Am I making sense? Its like cocaine’s derivative in crack………..change a couple molecules and its worse even though its still coke!! How has the algorithims destroyed historical tehncial analysis is my question when in the past it was pure psychology emanating from orders from human beings??”…

……………………………………………….

My answer was….

Simple answer:

The markets were created to steal money from the sheep, and they’ve done ever since it all started. But in order for “them” to steal the money they have to get the majority of the sheep on one side a trade so they can take the other side and then program SkyNet to run the market in that direction.

In the past technical’s worked quite well, as did elliottwave and Fib retracement levels. But that was back when only “they” had access to those studies and charts. Now with the internet the sheep have gotten the same access that the wolves have had. This means the sheep can attempt to follow what the wolves are doing and get on the same side of the trade as them.

This naturally won’t work as the wolves can’t steal the sheep’s money if the sheep know what the wolves are doing or about to do. So they had to rewrite SkyNet’s algorithms so it wouldn’t follow commonly seen technical’s, elliottwave, retracement levels and chart patterns.

Then they make sure to keep those algo’s secret so they can again go back to stealing the sheep’s money. You’ll notice that counting waves today isn’t anything like it was before the sheep had access to the same level of access to TA’s, EW, etc…

Simply put… if a pattern is seen by too many sheep “they” (SkyNet) will trick them and not allow that pattern to work. So when we are all expecting nice wave counts with typical 23.6%, 38.2% counter trend waves to happen we aren’t likely going to see them.

The huge bear squeezes up that we’ve had recently from the October 15th low of 1820 last year, December 16th low of 1972, January 6th low of 1992, January 15th low of 1991 and recent low of 1989 are perfect examples of straight up moves with next to nothing on pullback waves for waves 2 and 4 or a B wave.

SkyNet knows we sheep are NOW counting the waves with charting analysis programs that available to every trader on the planet with internet access. So it doesn’t give us some nice predictable Fib level pullback to get long at. It’s just one huge move up with small pullbacks of 5% or so intraday.

They force you to chase it up not knowing when it will end and they trick you by blasting through the easily known resistance levels on the way up as well as wave count estimated percentage lengths. So C doesn’t equal some nice 1.618% length of A anymore, nor does B pullback 38.2% or some other nice Fib level.

It’s much, much harder now to predict the market then ever before as the more sheep that use TA’s, EW, Fib’s, etc… the more likely they won’t work. If the masses see it then SkyNet will manipulate the market so the pattern fails.

There’s no easy way to figure it out either as SkyNet is of course tied into the release of news events that will move the market in one direction or the other. That was the case yesterday when that negative news about the ECB liquidity problem was conveniently released at 8:30 pm their time (3:30 pm EST) right when the SPX filled the 2052 gap low from 01/26.

I was actually expecting the market to remain flat yesterday with a gap up today to fill that gap, which would have been shortable. But running it up yesterday to fill the gap and then releasing the news perfectly timed to dump the market quickly worked off the overbought condition I was seeing on the short term that would have produced a much deeper sell off if it would have happened today at the open.

They timed that sell off during the last 30 minutes of the day so they could have the afterhours session and the morning session to save the market… which they did. If it would have happened at the open today traders would have had the entire day to sell it down, and that’s not what they wanted to happen…. so it didn’t.

They caught traders off guard during that last 30 minutes of the day yesterday and got some new bears short in the market from that news. They used those shorts to squeeze the market up afterhours and this morning.

Nothing in these world is random as all the news is controlled and released based on what “they” want to happen in the market. This isn’t new as it’s always been this way, but even more so today as there are only 6 companies that own 100% of every news media outlet out there.

So it’s much easier for them to hold back the release of some negative piece of news until such time that the squeeze out the last bear, which they then release the news when none of the sheep are short (of course the wolves are) and down goes the market.

As for today…

What are the majority of the sheep looking for now? Is a squeeze coming as more retail shorts pile in from this obvious triple top zone we are at now (which are said to be rare as they usually breakthrough them)? Or is a dump happening with all the sheep long?

I wish I knew the answer as I’d take a position but I don’t. It’s a toss of a coin for me predicting the next move here and it’s not a trade I want to take. But SkyNet knows the next move as it see’s all the sheeps’ hands. It knows where all the bulls’ and bears’ have their stops at and will steal the one with most… after all that’s what’s it’s programmed to do.

Often it’s not that these setups won’t work…

but that they will work AFTER they run your stops first.

Very true… SkyNet makes you capitulate first and then it reverses the other direction. So at this point I’d say we will hit 211.80 SPY first and then sell off.

I wonder if today is the high rather than it unfolding over the next few days. The low of the year last year was made on February 4, basically 360 degrees ago, in a similar manner to the topping process of the last few days.

Tomorrow will see Jupiter opposite to the Sun, a possible Jupiter Rising day???, definitely an Ascending one to mark 2-6 as a very special day. Two days off the full moon while a unheralded grand cross occurs between Pluto, Uranus, Rahu, and Sirius.

Or we could chop sideways for a couple of more days since today is only 26 days off the top.

The Tulip bubble topped on 2-3, 378 years ago and we know Prechter loves the Tulip bubble. (a repeat comment made last year since 377 years from 1637 seemed more numerologically appopriate but the only tulip bubble bursting we got was the Bitcoin meltdown). So maybe the 78 is more appropriate for the year ’15. Anyway, it should be 377 years from the Statue of 3 Lies year of 1638. Which brings us to Facebook day, on 2-4 marking the 11th year of the founding of the online institution by the illustrious Harvard grad.

Based on what I currently see in the charts I give it high odds of a reversal back down today after the gap up open.

There was the reversal down I was expecting. Now (since it’s Friday) they should recover and chop around the rest of the day.

Someone I follow on Twitter posted this chart and was talking about gaps as shown in yellow and a range bound market as shown by the blue line. I don’t think they know what a FP is and clearly didn’t pay any attention to the 211.80 SPY print on this chart from late December.

I never seen it on any of my charts but it’s on their charting system. I can only suspect that we’ll see that level hit at some point this year… probably this month if we are about to breakout of this range soon? http://reddragonleo.com/wp-content/uploads/spy-fp-211-80.png

Down next week is likely with a Thurs/Fri low, then up the following week for the monthly option expiration. Possibly that will be the week we hit that FP of 211.80? Of course that depends on how low we go next week.

Janet Yellen will appear at Congress on February 24, 2015 to deliver her semi-annual Humphrey Hawkins testimony. Last Year Janet spoke on 2/11. I just have that gut feeling we move higher and touch 2118 soon. Just a hunch.

Could be, but I just don’t get the feeling (based on the charts and other stuff…) that they will breakout to the upside next week. I see a pullback next week with and estimated Thurs/Fri low. Then a rip higher the following week (which is option expiration week, and it’s usually bullish anyway). So that week or the week after it we could see that FP high hit. Therefore we could be going up into the 24th for Yellen to Yell some more… LOL.

This guy says about what I’m thinking will happen too. His forecast of slight pullbacks before a move higher lines up with a Thursday/Friday low for this week and then a ramp up next week (which is option expiration week and is bullish about 80% of the time). http://joefahmy.com/2015/02/07/video-new-highs-coming-soon/

Looking at the premarket chart of the ES futures it’s got a nice “cup and handle” pattern and it’s all in a rising channel. This suggests we’ll drift down some early but as long as we hold the lower trendline on that rising channel I think we’ll see the market turn back up and head north into Thursday.

The projected move on the ES is about 25 points high to 2085, or about 2090 on the SPX. Since the market is rigged to the bullish side 80-90% of the time I don’t see any reason for this pattern to fail and not play out.

Now if this happens by Thursday morning then I think we’ll see some selling the rest of that day and possibly Friday as well. So we could still see a low put in this week, but I don’t know how low? For now I’m on looking at this C&H pattern and will watch it play out.

I’m a little shocked that the cup and handle pattern failed, especially knowing how rigged the market is to the upside. We have also not made a higher high today either. So far the high this week was yesterday (Tuesday). This tells me that we have around a 70% chance of dropping lower Thursday (as long we don’t go up today higher then yesterday).

Ok, expected down move tomorrow with 70% chance no longer valid as we have a breakout on most ETF’s now with new higher highs then yesterday. So at this point the cup and handle pattern is likely back in play for now. Expected high is 2085 ES or 2090 SPX. (Of course we could gap up and pullback back tomorrow before we go up that high).

I see the charts as very overbought now and if tomorrow has a weak gap up of only a few points I think it’s a sell. They need to clear 2075 area on the ES to even have a chance to run the stops in my opinion. Otherwise I see the technical’s in the charts pulling the market down.

Only a stop run by SkyNet can get it going up to the cup and handle expected high of 2085, and who’s to say that it’s still a valid pattern? We did breakdown from it some earlier today, which tells me the pattern may or may not work?

I think today is short. As I said earlier the cup and handle pattern projects a high of around 2085 ES (about 2090 SPX) and from the looks of the open we are about to have we could creep up there today. Maybe it only makes it to 2080 ES, or just 2075 where it hit twice afterhours yesterday and premarket this morning, but I think it’s time to start looking for a short.

perhaps. However, the odd favors higher market into end of month.

Yes, I do see a higher market by the end of the month. But a pullback here is overdue and I think we’ll see it drop 20-40 points in the near term before we go up to that FP around 2118 SPX.

That is a drop of 1.9% assuming a 40 points drop. Is this worth the SHORT?? not me.

It’s worth it for me as I’ve changed my trading to day trades mostly as it’s easier for me to make money on. Predicting out more then 2 or 3 days is tough with this rigged market, so I just focus on what makes me money.

Of course the bullish setups seem to always play out so forecasting 2085 SPX on that cup and handle pattern was a pretty sure bet.

we are very close to 2118. Is this supposed to mark a top?

If we hit it tomorrow “before” the FOMC then it’s “possible” they will say something the market won’t like and cause the sell off to start Wednesday after 2:30 pm.

However, “most” FOMC days end near the high for the day after some whipsaw action up and down around the release of the minutes. So as long as we don’t hit that FP area Wednesday before the meeting then I’d put the odds of it happening Thursday morning, which I think would be a great short.

Do note that it’s common for them to go past the FP before topping and turning back down as it’s only a signal that it will be hit, not that it’s a “turn” level. But considering everything else it looks likely that we’ll turn back down shortly after the print is hit.

According Mahendra Astrology … this week is very negative for the market. The FED statement is on Wed may have some verbiage that could affect the market. Estimate of a correction at about 3-5%

Well, I’ve not seen Astrology work too accurately in the past but with the timing of the FOMC meeting and the 211,80 SPY FP just about 25 SPX points higher it certainly seems likely that a turn down is coming soon, so I’ll be expecting the “unexpected” from them this Wednesday, meaning Mahendra could right on this one,.

looks like a bull trap…..

How accurate is this Mahendra person?

I haven’t found him to be very accurate, at least not on the info he puts out for free on his site. Possibly he is more accurate with those that pay him? I don’t know? I just don’t think astrology works too well on the short term. Maybe on the multi-year picture, but it’s too easy for them to manipulate things on a daily basis.

A lot has dropped from his subscription his losers are more than winners. Also his letters contradictis his call. He loves obama and think the fed is doing a fine job. That should tell you his personality.

New moon in Aquarius in about an hour. Tomorrow 2-19 will be the 212th anniversary of the founding of Ohio, or when the US created its boundaries and constitution.

The stock market indices putting in an identical pattern to the euro top from last year and a certain little historical top triple ninen years ago. (for the Nasdaq then, SP has joined in the pattern here).

Thursday is a 20 day, or an 11 as 2 (zero means nothing and is dropped) simply 1+1, so it’s possible we have a top tomorrow Geccko.

With all the time spent up here around 2100 SPX it’s highly likely there will be a stop sweep all the way up to 2125-2130 before topping and rolling over. Whether or not we see that on Thursday, February the 20th or not is anyone’s guess?

This is also around the FP area of 211.80 SPY as well. Actually the SPY should be a little higher if we hit 2125, which is common as we all have seen them go 5-10 points higher then other FP’s in the past. The move up should of course trick everyone into thinking the bull is going to run much higher, like 2200… but that’s just the time there’s no long left short as everyone is on the bull bus.

Where do you see it rollover?

Not sure? I’m looking for a gap up bear squeeze to hit at least 211.80 SPY, and if it goes past it some then I don’t see it going past 2130 SPX at max, so I’d be inching into shorts after the FP is hit.

It’s clearly a signal from the insiders and the 2130 SPX target is just based on it hitting the rising trendline on a daily chart that starts at1985 on July 3rd, 2014, connects to 2075 on 11/28/2014 and further touches 2093 on 12/29/2014.

Projecting out further puts it in the 2025-2030 area, which of course rises as time goes forward. But for this week that’s the zone. I’d like to see some news related gap up some morning soon, possibly Friday, next Monday or Tuesday?

It should run out of “bear buy stops” within the first few hours I’d think and then collapse back down. Of course if the ES squeezes up at say 8 am to 2115-2125 then you’ll know the buy stops are already cleared out and we should see it drop within minutes of the 9:30 am open. What day that happens is the real question?

The 10 and 5 day TRIN was at .80 yesterday and 5 and 10day Trinq (nasdaq) was at .77. Very low numbers and such low levels have been rare in the algo/ bot era if not nonexistent.

Been boning up on my Greek and Roman mythology lately in particular the origins of St. Baalentine’s Day. They even have a Valentine heavy in the recently released Kingsman flick.(released of course on Valentine’s eve or the start of the ancient Lupercal festival—-Wolf of Wall Street!!!!)

Getting close to the 211.80 SPY FP target, but based on the time left today I think we’ll see it hit on Monday, (possibly Tuesday if they need to drop it one more time on Monday to lure in enough bears to make the squeeze up to hit the FP area.)

Do remember though that most FP’s are pierced through before the actual turn in the market happens. That means that we could go up as much as 10 SPX points higher then the FP before we roll over. So while the FP is around 2118 on the SPX we could see 2128 or so before topping.

New SPY FP: http://screencast.com/t/N7zYAEeNVl3

The Greeks will not go with the Germans condition imposed on them for the extension. They will refuse it. The Greeks don’t want to be part of the EU.

I could see the market open in the deep red and before the week ends the SPX will see 2040ish. The Naz almost to the 5100 all time high but it will not go above it.

I too was a little concerned that we might have topped on Friday with that Greeks issue have some decision (supposedly?) this Sunday. We were very close to the first FP and I don’t know which one is valid… if either?

But on the other hand I’ve went short too many times in the past when I seen such important meetings/decisions that were scheduled over the weekend as I always assumed the worst and was expecting some huge gap down. Unfortunately I was wrong on practically every one of them and got creamed with my short position.

So while it’s very possible we’ll see exactly what you suggest I just can’t go short on that kind of speculation anymore. It’s cost me too much in the past. I’ll just have to wait to see what happens and if it does I’ll have missed the best spot to short on Friday and I’ll just try to catch a bounce.

The weekly indices finished with a doji topping bar on the good news of a 4 month extension for the Greeks? Oops, the Greeks still have to give proposals to the Eurocrats on Monday, a little side note that’s not getting too much airplay, proposals that need to be approved by the euro finance ministers. And guess what Monday is Greek Independence Day.

Deep down, I figured they needed to top the market with a false positive agreement with the Trojan Horse trap door ready to be sprung open when the masses were least expecting it.

Monday would be the first market day following today’s Mars Venus conjunction in Aries where those planets will soon be joining in the heated activity of the current Cardinal Grand Cross something that’s kept me aware of Monday’s date along with it being the major Tebow date, ie 3 years 1 month 15 (6) days from the major Tebow 316 game from 1-8-12 as #15…..a 29-23 victory for his Denver team in the first round of the playoffs .

2-23-15 also is 46-15 ie 2×23, 46 being a variation of the Tebow 316. It’s also 163 weeks 1 day from his big 316 game from 2012. 1-8 to 2-23 is 46 days or 6 weeks 4 days.

Its also 1690 days from the unveiling of the Miami Thrice number 136 on 7-9-2010. 1690==79. 1691 days from the DECISION.

97 weeks from Fahrenheit 4-15 (Patriots Day) on Greek Patriots Day. Tomorrow is Washington’s birthday but he doesn’t seem to get the airplay the 16th president does (4-15).

2-23-15 also is 2-11 or 2-5-6. It will be 8338 (11-11) days from the Bradley date in his ode to the ’29 ’92 ritual. Curiously, Bradley’s birthday is tomorrow, 2-22. He would have been 47.

2-23 is also 34 years 9 months (79) from the release of Kubrick’s grand ritual classic the Shining.

993 days from the grand reunion/ demise of Ray Bradbury. 33 weeks 3 days from July 4.

The critical event could come from Germany rather than Greece. https://www.youtube.com/watch?v=wDiZarnqZ_o

Add a 1 to all those 9s from below I guess. I was looking at 2-24 as a “prime date” for quite awhile anyway. It is 38 tds from the December high. 38===24. It’s also 44 or 16 or 24. 2×24=48 which would work with the Tebow 316 ie 3×16 but that isn’t as satisfying as 46. It is 3years 1 month 16 days from the Tebow 316 game but there is 1 1 too many.

It’s also a triple ninen amount of days from a certain little historical event that saw the SP close at 224.83.

It’s also Steve Jobs birthday and one of the revelations of the recent Sony hacking scandal was the controversy building up over another Jobs movie in development.

Also 237 days from Lindsay Lohan’s 7-2 birthday and Lohan has been extra-celebrated tabloid fodder for quite awhile now. 2-24 will be 206 (2-24) days from the release of her CanyONS flick last year. New Hollywood starlet Margot Robbie, Wolf of Wall Street babe, shares the same 7-2 birthday making here 24years+ or 9003 days old. She has a new movie coming out on Friday, her first since WOLF.

All of the European indices minus the FTSE closed above the upper bollinger bands today with an elevated doji bar. The Nasdaq finally made a new high with a subdued divergent RSI level on the 30 min chart but 60 min RSI levels are still a little exuberant.

SP so far has topped out at 311 weeks from the 3-6-9 low. It made an initial high going into May 2011 at 113 weeks (311 reversed). 311-113===198. 198 weeks divided by 11==18. There had been an 11-22 week pattern going in the markets from that May 2011 high with the low of the 2011 correction occuring 22 weeks later on 10-4. 176 weeks up until Friday from that low. 176==113.

Greeks didn’t even submit their “proposals” until late Monday whenever that was. Euro ministers review their “proposals” on Tuesday. One would think that the proposals should have been in place before the 4 month extension was granted but we all know this is a dog and pony show.

I guess I will just watch some of the 23rd Dubai Open to pass some time as things develop.

P.S. Birdman was a bleep movie. Even Foxcatcher which I have analyzed some is a crap movie but at least it’s entertaining in an unintentionally funny way. But they did give it a directing award in Cannes so it must have some occultic significance. It was just a bad year in movies. Nothing really deserved to win. I thought they’d give Boyhood Best Picture based on its 12 years in development gimmick following last year’s winner, 12 Years as a Slave, but they went with Birdman instead. At least I avoided seeing Boyhood.

ES chart analysis: http://niftychartsandpatterns.blogspot.in/2015/02/s-500-futures-outside-daily-range.html

dont know if any of you guys ever looked at this Economist cover with all the weird symbolism..Bottom right corner has some dates, March 11 and May 11 on Alice’s wands

Very interesting. They put out all kinds of symbolism in every magazine, movie and tv series so it’s hard too know where to look sometimes. But certainly the March 3rd date could line up nicely for a top of some kind.

Cool Video explaining the cover: https://www.youtube.com/watch?v=-hzMQiLZW0w

Thanks Red !

I’d like to see the market trade sideways the rest of the day and not break earlier highs already made on the SPY, IWM, QQQ, etc… Then it would give better odds of drop to start Wednesday and last at least 2 days.

The original FP on the SPY of 211.80 has been hit but again these prints haven’t always produced a “turn” in past. They are only targets that they plan to take the market too… not always a stop and turn point, as sometimes they just pause there for awhile and then continue in the same direction.

But considering how overbought the charts are on the short term it’s likely that a turn back down should start soon. Possibly they retake the high today and head up toward the other FP of 212.97 SPY… or just somewhere in-between?

Putting the FP’s aside (as I certainly don’t have the “insider” code to understand how to read it) the technical analysis of the market on various time frames, along with this being the last week of February suggests a pullback soon.

Tomorrow is another historical day for Greek independence. A day when the Greek patriot Alexander announced that the Greek independence movement had the backing of Russia. Hmmm interesting. Beware of Greeks bearing false gifts (to the EU)???

It’s a 25 day as well which is a personal connection. Or 27. James Deen, Lindsay Lohan’s costar in the CanyONS (which was actually released 1 year 207 days ago or 572 days from 2-25) has a 2-7 birthday making him 29 years 18 days old tomorrow.

As for Patriot’s day, tomorrow will be 1year 10months 10 days from Fahrenheit 415 or 111. It will be 1011 days from Quetzi’s return and 995 days from the grand reunion/ Ray Bradbury’s demise. Nothing special is happening astrologically but maybe Mayan mathematics might be taking prescedence. 1011==13×77.7777 1027 days from MCA’s demise. BB’s Sabotage video does have the room 205 reference. Looks like some of the Luperci have been doing tribute covers lately.

I forgot to mention IBB closed above its upper BB as well yesterday. Today it dropped despite the markets’ gains. The Nasdaq was subdued as well but it did finally put in a divergent high on the 60 min chart. I guess today was influenced by the Yellen effect. I thought that it was announced that she would speak on the 25th a few weeks ago.

Hmm, a lot of 92s for tomorrow.