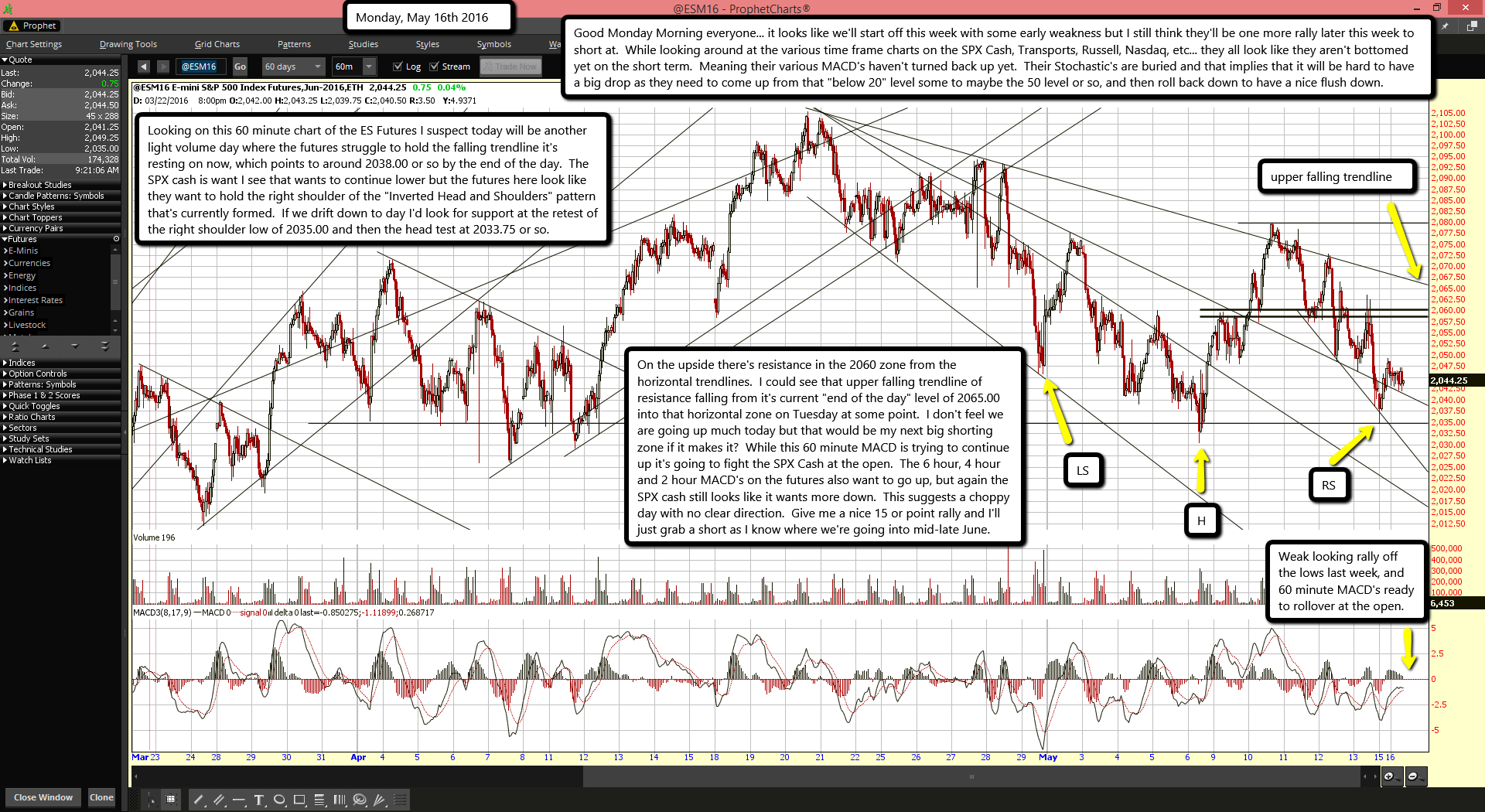

Weak looking rally off the lows last week, and 60 minute MACD's ready to rollover at the open.

Good Monday Morning everyone... it looks like we'll start off this week with some early weakness but I still think they'll be one more rally later this week to short at. While looking around at the various time frame charts on the SPX Cash, Transports, Russell, Nasdaq, etc... they all look like they aren't bottomed yet on the short term. Meaning their various MACD's haven't turned back up yet. Their Stochastic's are buried and that implies that it will be hard to have a big drop as they need to come up from that "below 20" level some to maybe the 50 level or so, and then roll back down to have a nice flush down.

Looking on this 60 minute chart of the ES Futures I suspect today will be another light volume day where the futures struggle to hold the falling trendline it's resting on now, which points to around 2038.00 or so by the end of the day. The SPX cash is want I see that wants to continue lower but the futures here look like they want to hold the right shoulder of the "Inverted Head and Shoulders" pattern that's currently formed. If we drift down to day I'd look for support at the retest of the right shoulder low of 2035.00 and then the head test at 2033.75 or so.

On the upside there's resistance in the 2060 zone from the horizontal trendlines. I could see that upper falling trendline of resistance falling from it's current "end of the day" level of 2065.00 into that horizontal zone on Tuesday at some point. I don't feel we are going up much today but that would be my next big shorting zone if it makes it? While this 60 minute MACD is trying to continue up it's going to fight the SPX Cash at the open. The 6 hour, 4 hour and 2 hour MACD's on the futures also want to go up, but again the SPX cash still looks like it wants more down. This suggests a choppy day with no clear direction. Give me a nice 15 or point rally and I'll just grab a short as I know where we're going into mid-late June.