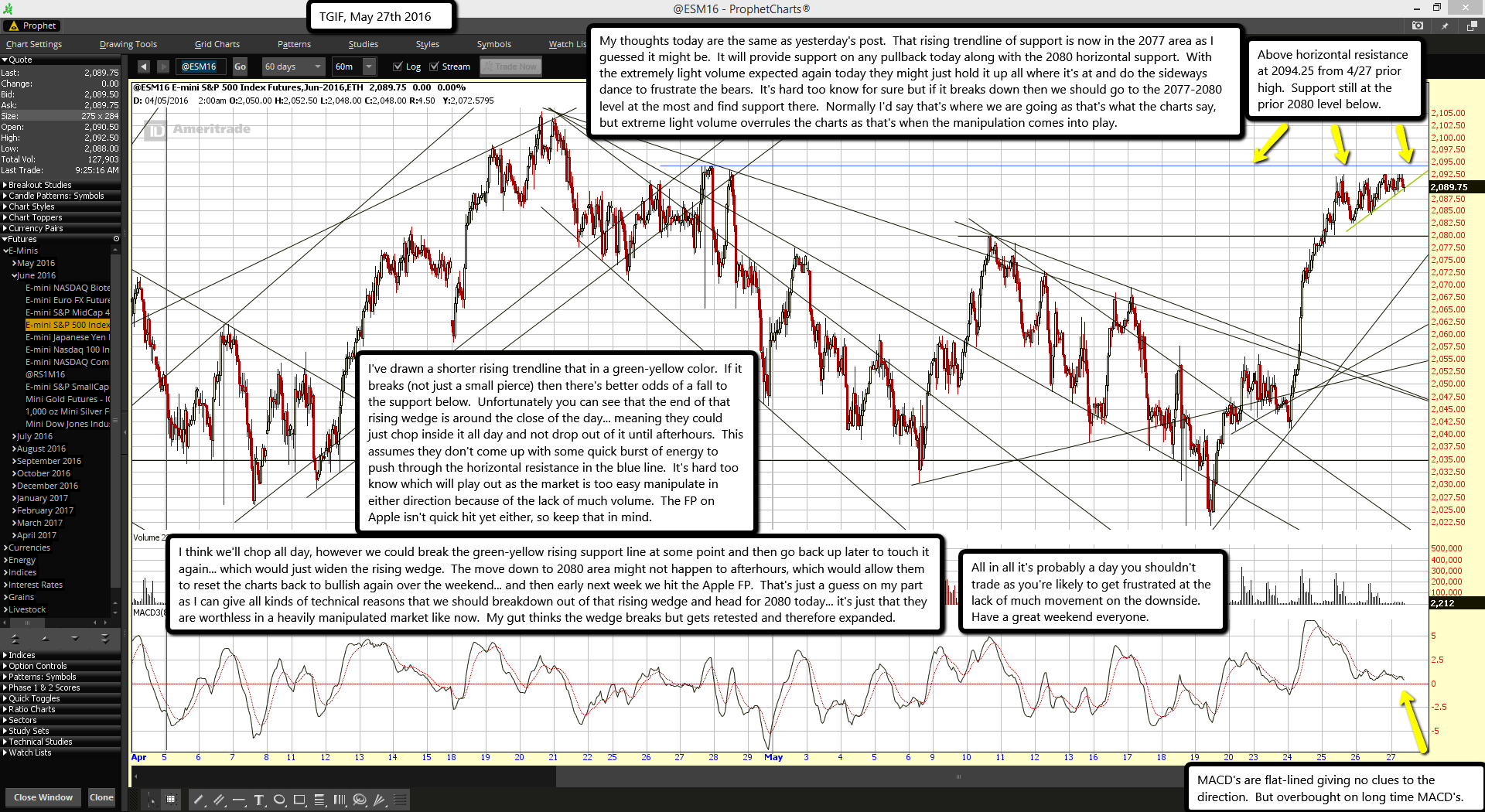

Above horizontal resistance at 2094.25 from 4/27 prior high. Support still at the prior 2080 level below.

MACD's are flat-lined giving no clues to the direction. But overbought on long time MACD's.

My thoughts today are the same as yesterday's post. That rising trendline of support is now in the 2077 area as I guessed it might be. It will provide support on any pullback today along with the 2080 horizontal support. With the extremely light volume expected again today they might just hold it up all where it's at and do the sideways dance to frustrate the bears. It's hard too know for sure but if it breaks down then we should go to the 2077-2080 level at the most and find support there. Normally I'd say that's where we are going as that's what the charts say, but extreme light volume overrules the charts as that's when the manipulation comes into play.

I've drawn a shorter rising trendline that in a green-yellow color. If it breaks (not just a small pierce) then there's better odds of a fall to the support below. Unfortunately you can see that the end of that rising wedge is around the close of the day... meaning they could just chop inside it all day and not drop out of it until afterhours. This assumes they don't come up with some quick burst of energy to push through the horizontal resistance in the blue line. It's hard too know which will play out as the market is too easy manipulate in either direction because of the lack of much volume. The FP on Apple isn't quick hit yet either, so keep that in mind.

I think we'll chop all day, however we could break the green-yellow rising support line at some point and then go back up later to touch it again... which would just widen the rising wedge. The move down to 2080 area might not happen to afterhours, which would allow them to reset the charts back to bullish again over the weekend... and then early next week we hit the Apple FP. That's just a guess on my part as I can give all kinds of technical reasons that we should breakdown out of that rising wedge and head for 2080 today... it's just that they are worthless in a heavily manipulated market like now. My gut thinks the wedge breaks but gets retested and therefore expanded.

All in all it's probably a day you shouldn't trade as you're likely to get frustrated at the lack of much movement on the downside. Have a great weekend everyone.