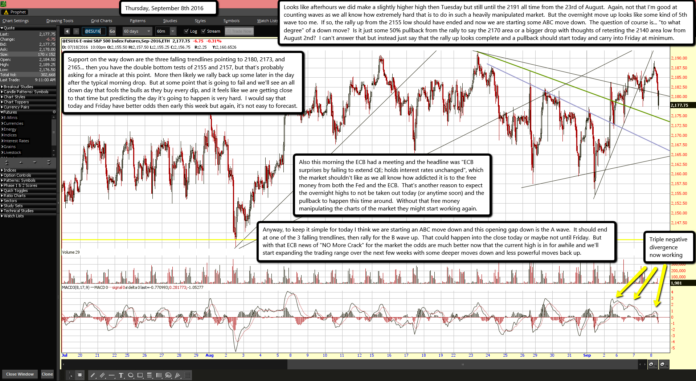

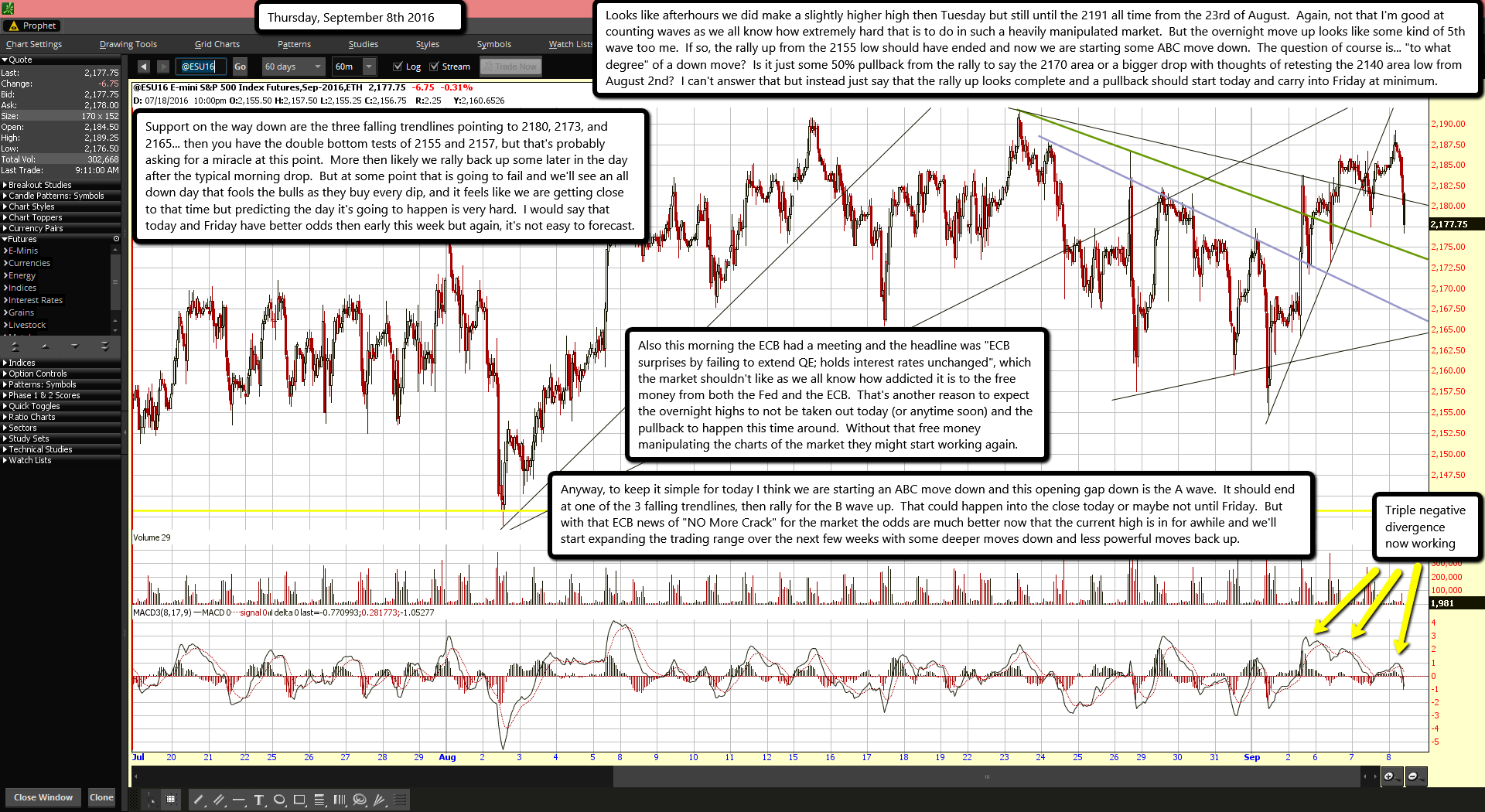

Looks like afterhours we did make a slightly higher high then Tuesday but still until the 2191 all time from the 23rd of August. Again, not that I'm good at counting waves as we all know how extremely hard that is to do in such a heavily manipulated market. But the overnight move up looks like some kind of 5th wave too me. If so, the rally up from the 2155 low should have ended and now we are starting some ABC move down. The question of course is... "to what degree" of a down move? Is it just some 50% pullback from the rally to say the 2170 area or a bigger drop with thoughts of retesting the 2140 area low from August 2nd? I can't answer that but instead just say that the rally up looks complete and a pullback should start today and carry into Friday at minimum.

Support on the way down are the three falling trendlines pointing to 2180, 2173, and 2165... then you have the double bottom tests of 2155 and 2157, but that's probably asking for a miracle at this point. More then likely we rally back up some later in the day after the typical morning drop. But at some point that is going to fail and we'll see an all down day that fools the bulls as they buy every dip, and it feels like we are getting close to that time but predicting the day it's going to happen is very hard. I would say that today and Friday have better odds then early this week but again, it's not easy to forecast.

Also this morning the ECB had a meeting and the headline was "ECB surprises by failing to extend QE; holds interest rates unchanged", which the market shouldn't like as we all know how addicted it is to the free money from both the Fed and the ECB. That's another reason to expect the overnight highs to not be taken out today (or anytime soon) and the pullback to happen this time around. Without that free money manipulating the charts of the market they might start working again.

Anyway, to keep it simple for today I think we are starting an ABC move down and this opening gap down is the A wave. It should end at one of the 3 falling trendlines, then rally for the B wave up. That could happen into the close today or maybe not until Friday. But with that ECB news of "NO More Crack" for the market the odds are much better now that the current high is in for awhile and we'll start expanding the trading range over the next few weeks with some deeper moves down and less powerful moves back up.