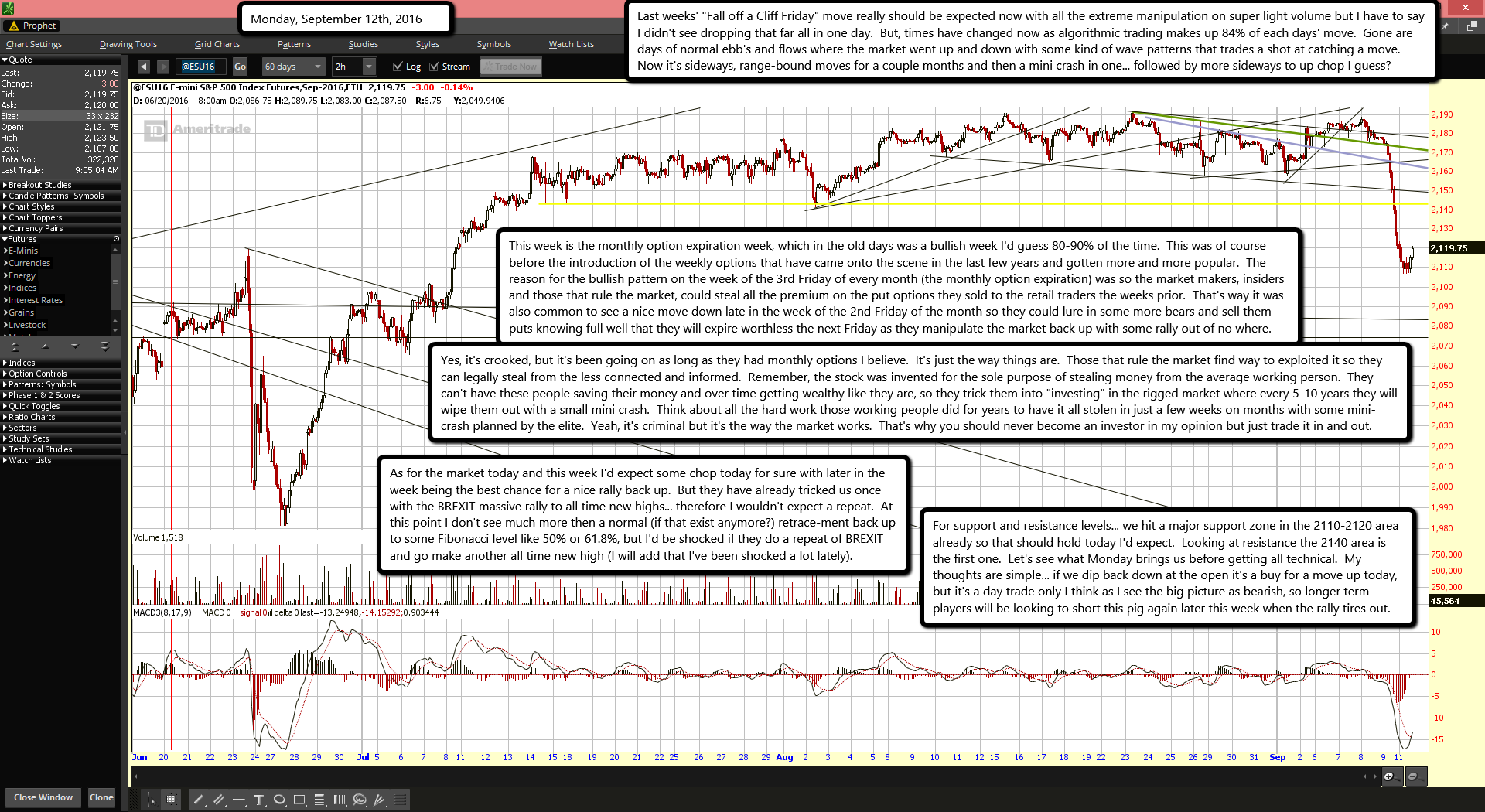

Last weeks' "Fall off a Cliff Friday" move really should be expected now with all the extreme manipulation on super light volume but I have to say I didn't see dropping that far all in one day. But, times have changed now as algorithmic trading makes up 84% of each days' move. Gone are days of normal ebb's and flows where the market went up and down with some kind of wave patterns that trades a shot at catching a move. Now it's sideways, range-bound moves for a couple months and then a mini crash in one... followed by more sideways to up chop I guess?

This week is the monthly option expiration week, which in the old days was a bullish week I'd guess 80-90% of the time. This was of course before the introduction of the weekly options that have came onto the scene in the last few years and gotten more and more popular. The reason for the bullish pattern on the week of the 3rd Friday of every month (the monthly option expiration) was so the market makers, insiders and those that rule the market, could steal all the premium on the put options they sold to the retail traders the weeks prior. That's way it was also common to see a nice move down late in the week of the 2nd Friday of the month so they could lure in some more bears and sell them puts knowing full well that they will expire worthless the next Friday as they manipulate the market back up with some rally out of no where.

Yes, it's crooked, but it's been going on as long as they had monthly options I believe. It's just the way things are. Those that rule the market find way to exploited it so they can legally steal from the less connected and informed. Remember, the stock was invented for the sole purpose of stealing money from the average working person. They can't have these people saving their money and over time getting wealthy like they are, so they trick them into "investing" in the rigged market where every 5-10 years they will wipe them out with a small mini crash. Think about all the hard work those working people did for years to have it all stolen in just a few weeks on months with some mini-crash planned by the elite. Yeah, it's criminal but it's the way the market works. That's why you should never become an investor in my opinion but just trade it in and out.

As for the market today and this week I'd expect some chop today for sure with later in the week being the best chance for a nice rally back up. But they have already tricked us once with the BREXIT massive rally to all time new highs... therefore I wouldn't expect a repeat. At this point I don't see much more then a normal (if that exist anymore?) retrace-ment back up to some Fibonacci level like 50% or 61.8%, but I'd be shocked if they do a repeat of BREXIT and go make another all time new high (I will add that I've been shocked a lot lately).

For support and resistance levels... we hit a major support zone in the 2110-2120 area already so that should hold today I'd expect. Looking at resistance the 2140 area is the first one. Let's see what Monday brings us before getting all technical. My thoughts are simple... if we dip back down at the open it's a buy for a move up today, but it's a day trade only I think as I see the big picture as bearish, so longer term players will be looking to short this pig again later this week when the rally tires out.