Well gang... it's Friday! Aren't you happy? You can go party now... except that you are addicted to trading now and view the stock market as your party. Then add in the fact that you are no longer 18 years old and can't handle the hangovers you get at your current age. So you now look at the weekend as a time to do chores around the house while you look forward to Monday coming where you can gamble some more in the casino called the stock market. Funny how things flip flop as you get older. The weekends now sucks you have spend them around the house doing things while your trading Monday through Friday (aka... your work or job) is what you look forward too. Such is life...

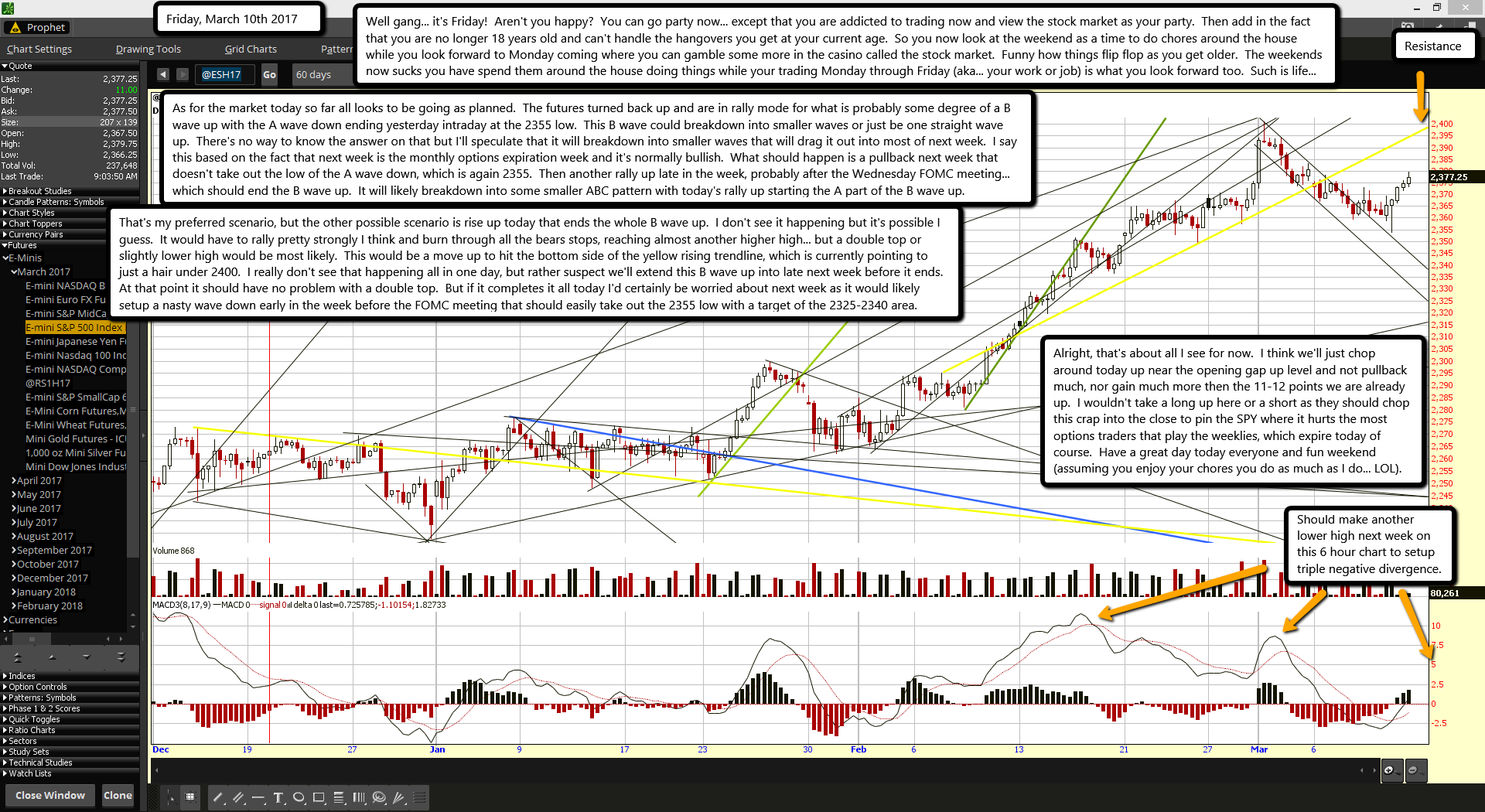

As for the market today so far all looks to be going as planned. The futures turned back up and are in rally mode for what is probably some degree of a B wave up with the A wave down ending yesterday intraday at the 2355 low. This B wave could breakdown into smaller waves or just be one straight wave up. There's no way to know the answer on that but I'll speculate that it will breakdown into smaller waves that will drag it out into most of next week. I say this based on the fact that next week is the monthly options expiration week and it's normally bullish. What should happen is a pullback next week that doesn't take out the low of the A wave down, which is again 2355. Then another rally up late in the week, probably after the Wednesday FOMC meeting... which should end the B wave up. It will likely breakdown into some smaller ABC pattern with today's rally up starting the A part of the B wave up.

That's my preferred scenario, but the other possible scenario is rise up today that ends the whole B wave up. I don't see it happening but it's possible I guess. It would have to rally pretty strongly I think and burn through all the bears stops, reaching almost another higher high... but a double top or slightly lower high would be most likely. This would be a move up to hit the bottom side of the yellow rising trendline, which is currently pointing to just a hair under 2400. I really don't see that happening all in one day, but rather suspect we'll extend this B wave up into late next week before it ends. At that point it should have no problem with a double top. But if it completes it all today I'd certainly be worried about next week as it would likely setup a nasty wave down early in the week before the FOMC meeting that should easily take out the 2355 low with a target of the 2325-2340 area.

Alright, that's about all I see for now. I think we'll just chop around today up near the opening gap up level and not pullback much, nor gain much more then the 11-12 points we are already up. I wouldn't take a long up here or a short as they should chop this crap into the close to pin the SPY where it hurts the most options traders that play the weeklies, which expire today of course. Have a great day today everyone and fun weekend (assuming you enjoy your chores you do as much as I do... LOL).