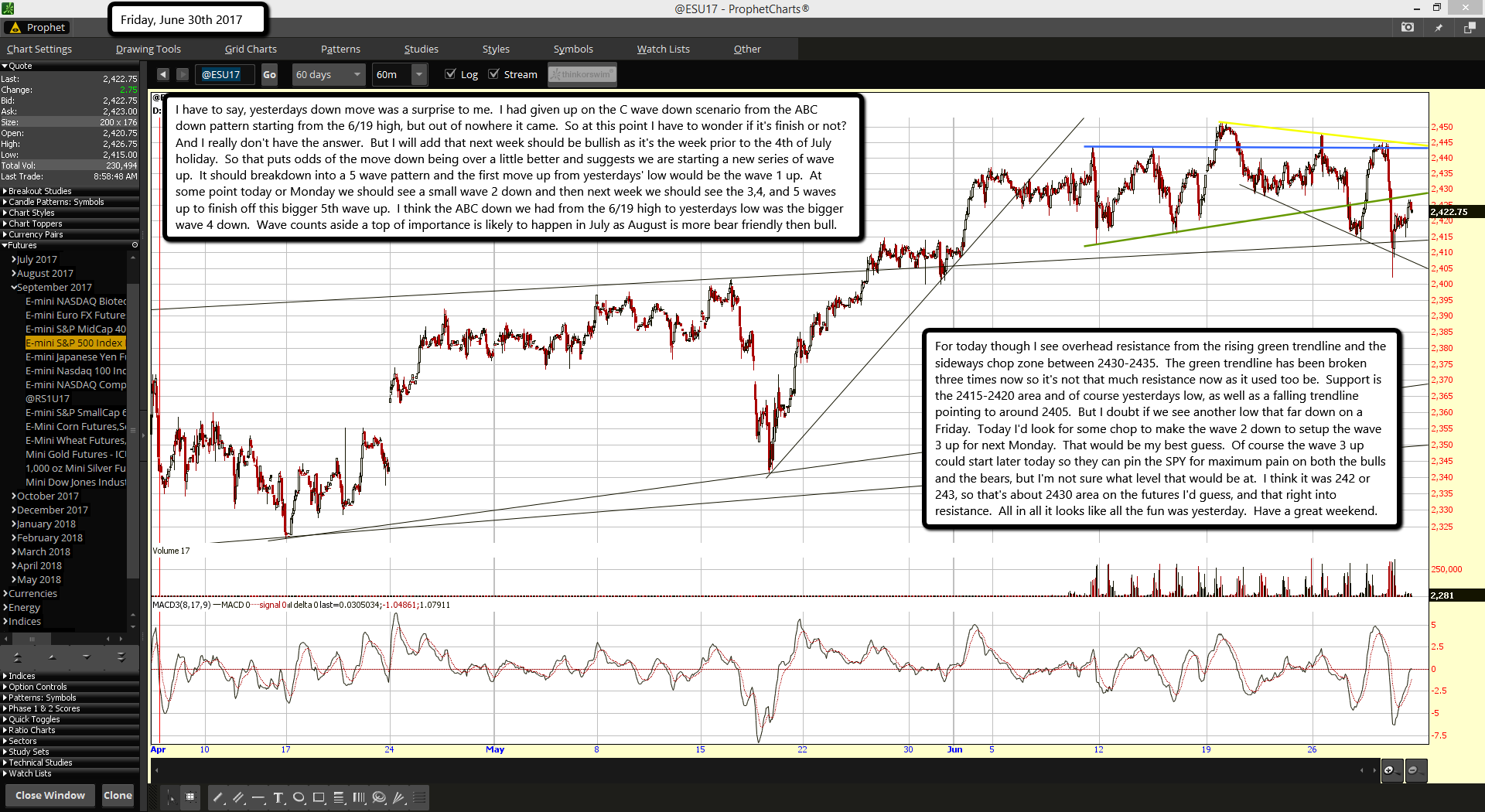

I have to say, yesterdays down move was a surprise to me. I had given up on the C wave down scenario from the ABC down pattern starting from the 6/19 high, but out of nowhere it came. So at this point I have to wonder if it's finish or not? And I really don't have the answer. But I will add that next week should be bullish as it's the week prior to the 4th of July holiday. So that puts odds of the move down being over a little better and suggests we are starting a new series of wave up. It should breakdown into a 5 wave pattern and the first move up from yesterdays' low would be the wave 1 up. At some point today or Monday we should see a small wave 2 down and then next week we should see the 3,4, and 5 waves up to finish off this bigger 5th wave up. I think the ABC down we had from the 6/19 high to yesterdays low was the bigger wave 4 down. Wave counts aside a top of importance is likely to happen in July as August is more bear friendly then bull.

For today though I see overhead resistance from the rising green trendline and the sideways chop zone between 2430-2435. The green trendline has been broken three times now so it's not that much resistance now as it used too be. Support is the 2415-2420 area and of course yesterdays low, as well as a falling trendline pointing to around 2405. But I doubt if we see another low that far down on a Friday. Today I'd look for some chop to make the wave 2 down to setup the wave 3 up for next Monday. That would be my best guess. Of course the wave 3 up could start later today so they can pin the SPY for maximum pain on both the bulls and the bears, but I'm not sure what level that would be at. I think it was 242 or 243, so that's about 2430 area on the futures I'd guess, and that right into resistance. All in all it looks like all the fun was yesterday. Have a great weekend.