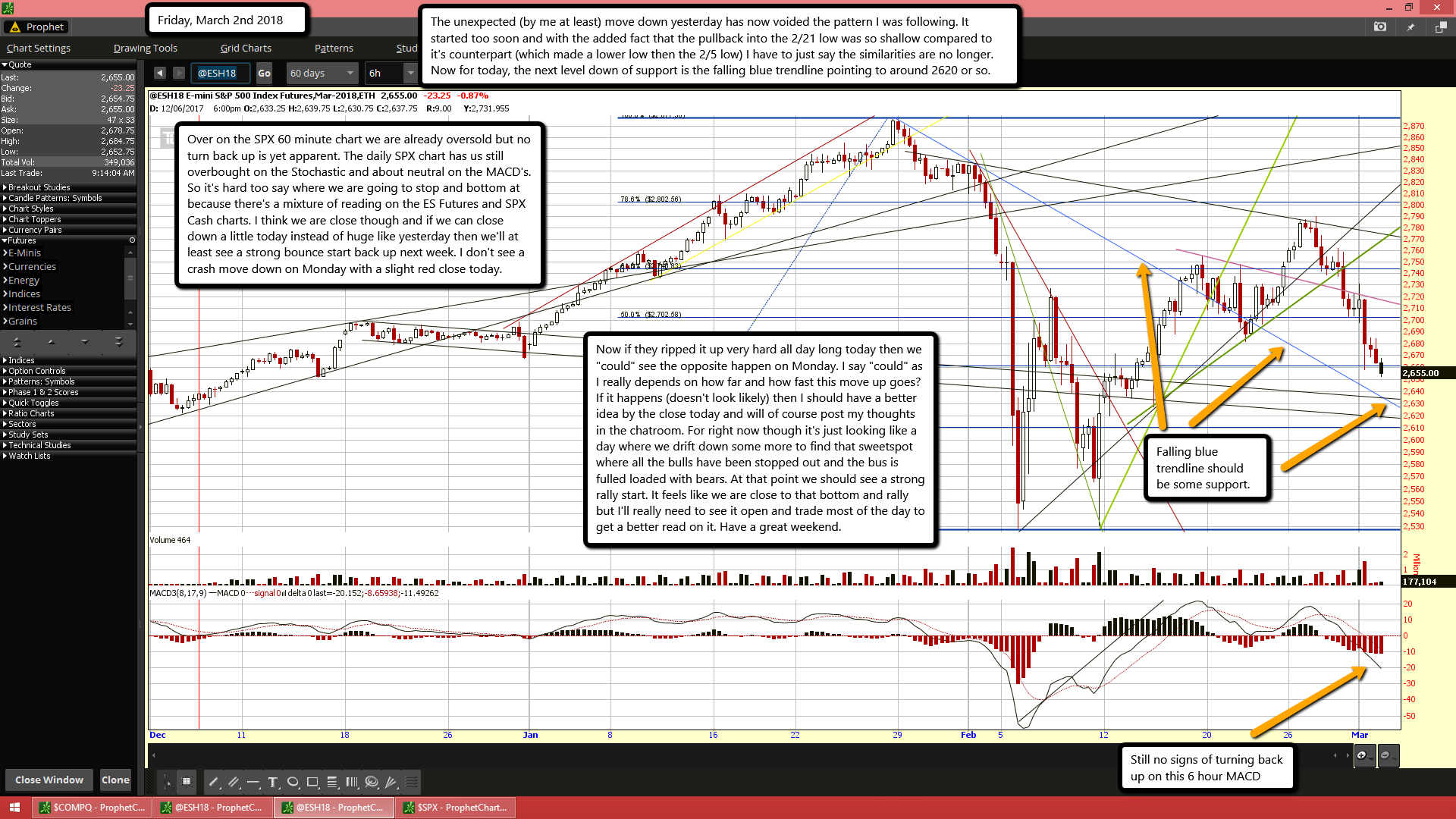

The unexpected (by me at least) move down yesterday has now voided the pattern I was following. It started too soon and with the added fact that the pullback into the 2/21 low was so shallow compared to it's counterpart (which made a lower low then the 2/5 low) I have to just say the similarities are no longer. Now for today, the next level down of support is the falling blue trendline pointing to around 2620 or so.

Over on the SPX 60 minute chart we are already oversold but no turn back up is yet apparent. The daily SPX chart has us still overbought on the Stochastic and about neutral on the MACD's. So it's hard too say where we are going to stop and bottom at because there's a mixture of reading on the ES Futures and SPX Cash charts. I think we are close though and if we can close down a little today instead of huge like yesterday then we'll at least see a strong bounce start back up next week. I don't see a crash move down on Monday with a slight red close today.

Now if they ripped it up very hard all day long today then we "could" see the opposite happen on Monday. I say "could" as I really depends on how far and how fast this move up goes? If it happens (doesn't look likely) then I should have a better idea by the close today and will of course post my thoughts in the chatroom. For right now though it's just looking like a day where we drift down some more to find that sweetspot where all the bulls have been stopped out and the bus is fulled loaded with bears. At that point we should see a strong rally start. It feels like we are close to that bottom and rally but I'll really need to see it open and trade most of the day to get a better read on it. Have a great weekend.