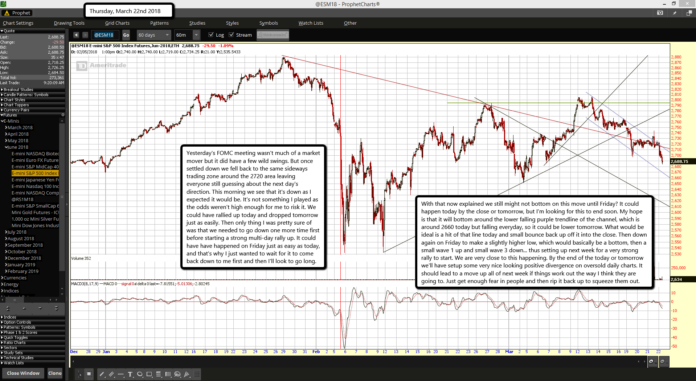

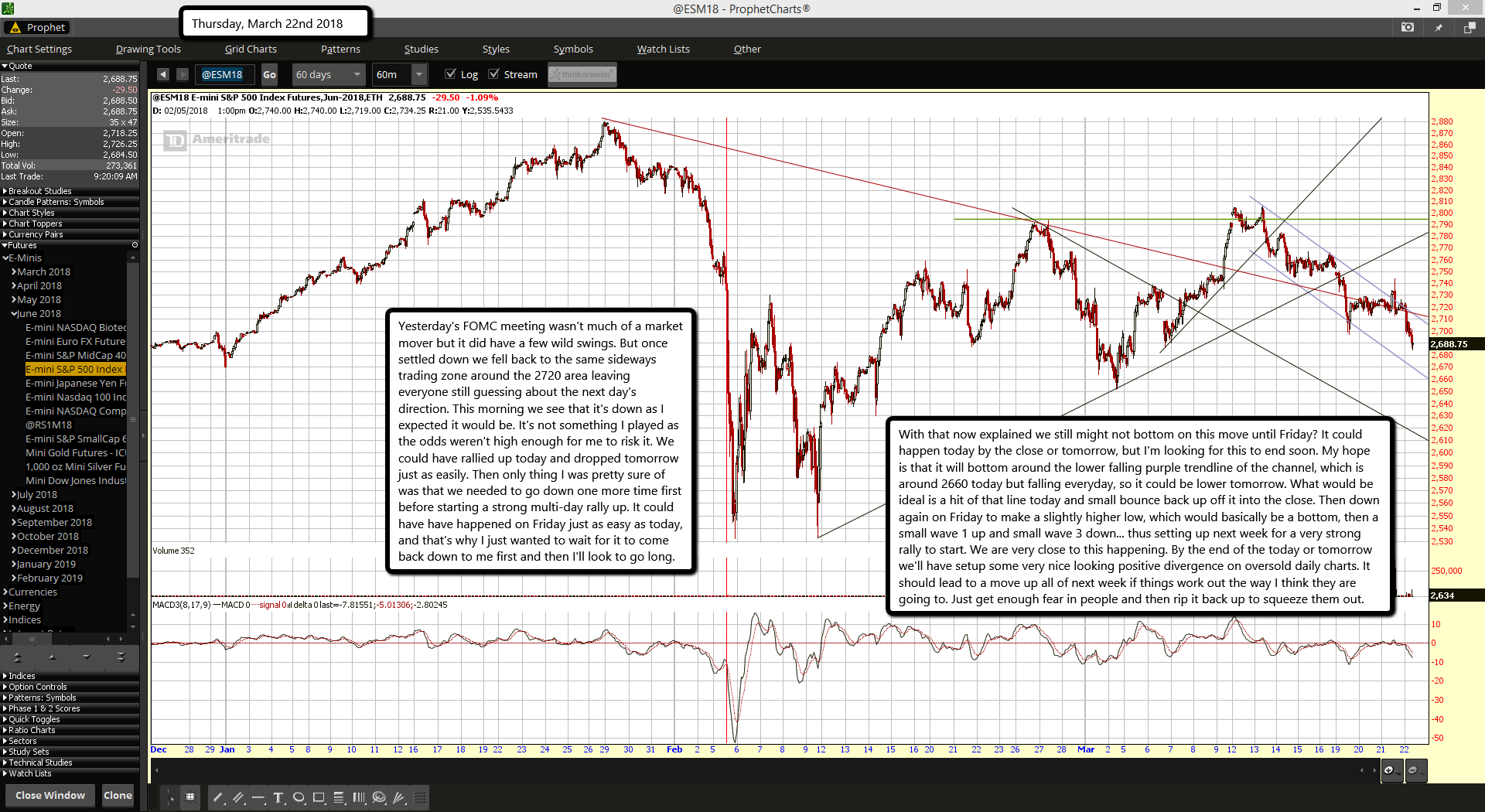

Yesterday's FOMC meeting wasn't much of a market mover but it did have a few wild swings. But once settled down we fell back to the same sideways trading zone around the 2720 area leaving everyone still guessing about the next day's direction. This morning we see that it's down as I expected it would be. It's not something I played as the odds weren't high enough for me to risk it. We could have rallied up today and dropped tomorrow just as easily. Then only thing I was pretty sure of was that we needed to go down one more time first before starting a strong multi-day rally up. It could have have happened on Friday just as easy as today, and that's why I just wanted to wait for it to come back down to me first and then I'll look to go long.

With that now explained we still might not bottom on this move until Friday? It could happen today by the close or tomorrow, but I'm looking for this to end soon. My hope is that it will bottom around the lower falling purple trendline of the channel, which is around 2660 today but falling everyday, so it could be lower tomorrow. What would be ideal is a hit of that line today and small bounce back up off it into the close. Then down again on Friday to make a slightly higher low, which would basically be a bottom, then a small wave 1 up and small wave 3 down... thus setting up next week for a very strong rally to start. We are very close to this happening. By the end of the today or tomorrow we'll have setup some very nice looking positive divergence on oversold daily charts. It should lead to a move up all of next week if things work out the way I think they are going to. Just get enough fear in people and then rip it back up to squeeze them out.