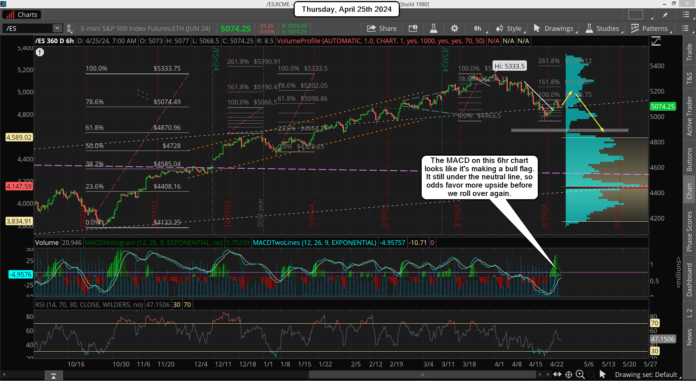

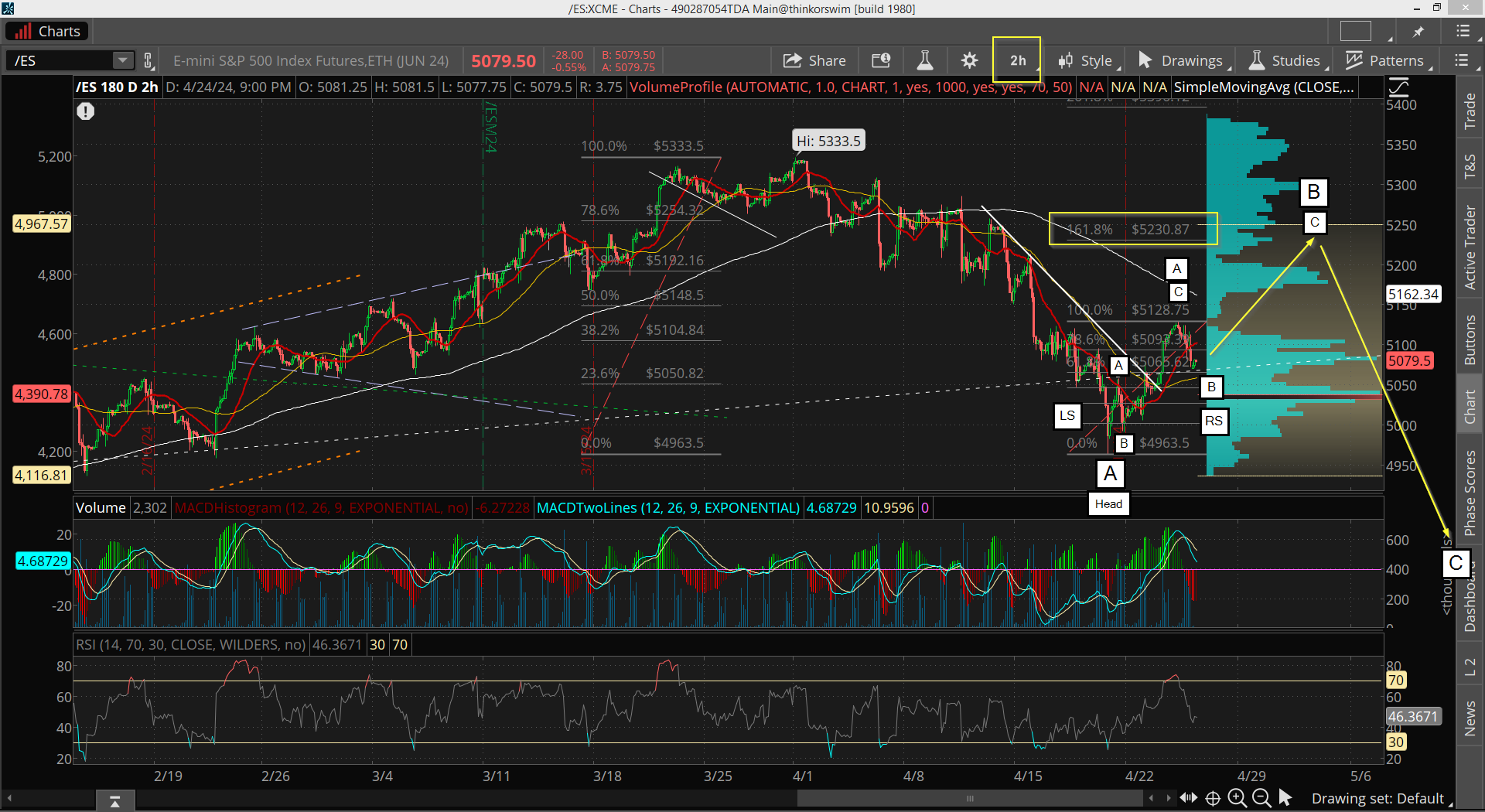

As expected we had a pause day yesterday being up part of the day and down part of the day, but closing about flat. Then afterhours we dropped more, which is making a nice inverted head and shoulders pattern as shown below on the 2hr chart.

Using my FET system it projects a high of 5230.57, which is higher then the 50% retrace I was looking for, but it's something to keep in the back of my mind as possible. It would be around a 70% retrace of the down move from the top if it happens. I'll just be looking at the technicals and the typical turn zones, which is around the end of this month.

We have the GDP numbers and Jobless Claims out this morning, so a nice move up or down should happen. From a technical point of view we should go up, but we could drop hard too. I don't think it's going to happen anything is possible. I know at some point we are going down to hit the FP on the SPY, but I lean toward more upside first.

Next Wednesday is May the 1st and we have another FOMC meeting, so if we can rally up into it then I think we could top out and drop hard after it. Most of the time FOMC meetings are non-events that commonly have the following Thursday and Friday going up some. Then the following week the market can pullback if the technicals are overbought, or rally if still bullish.

My point is that they are usually bullish when all the dust settles. It's about time for a shock I think. The weekly chart is still putting downward pressure on the market and a rally up into the meeting will get all the short term charts overbought, and the daily will have come back up from oversold, so it can roll back down again.

These technicals suggest another move down is coming, and I have the FP too. Seasonality is usually weak in May as well, so there's lots of reasons to think that this coming meeting could shock the market.

Have a blessed day.