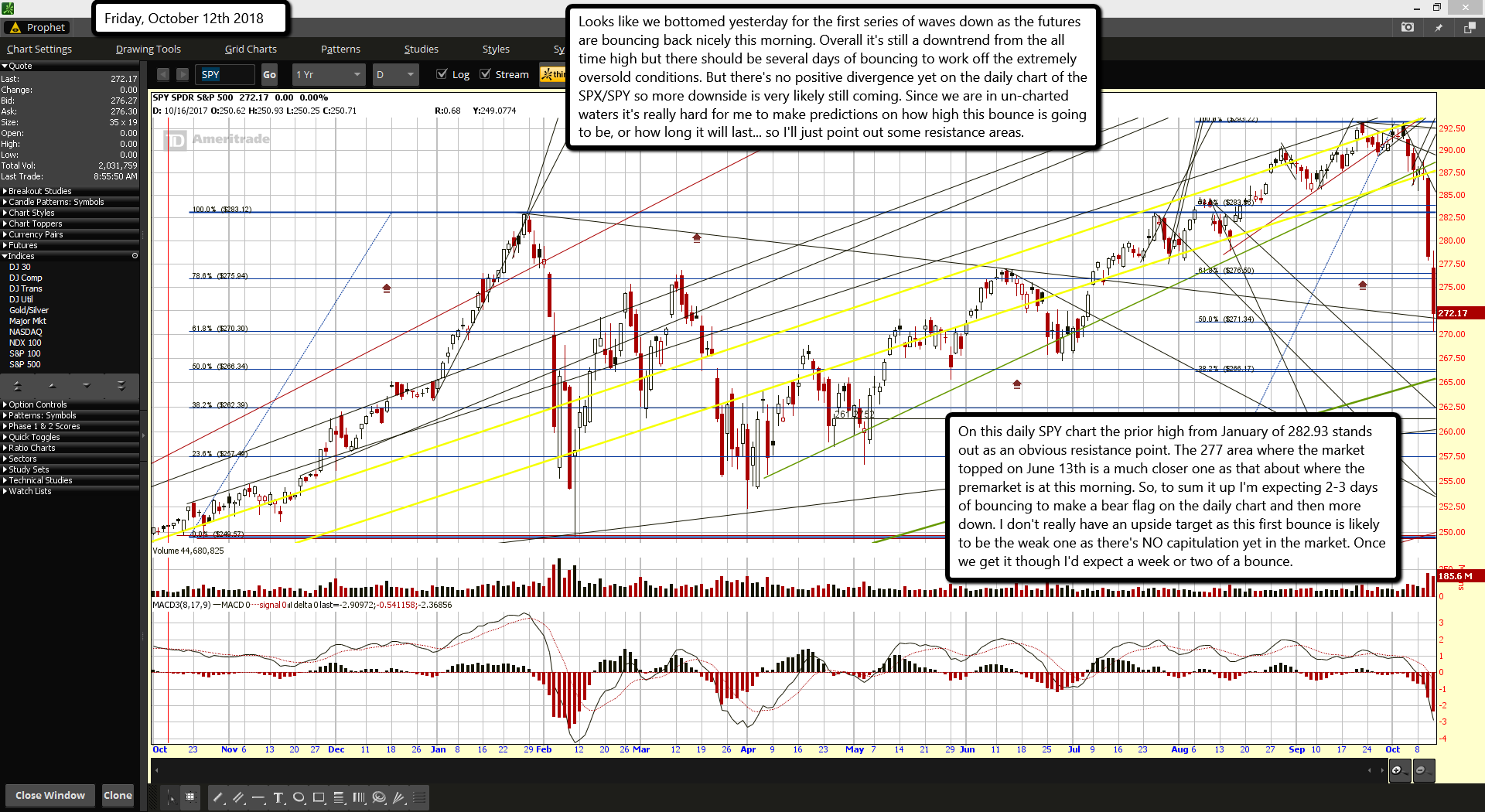

Looks like we bottomed yesterday for the first series of waves down as the futures are bouncing back nicely this morning. Overall it's still a downtrend from the all time high but there should be several days of bouncing to work off the extremely oversold conditions. But there's no positive divergence yet on the daily chart of the SPX/SPY so more downside is very likely still coming. Since we are in un-charted waters it's really hard for me to make predictions on how high this bounce is going to be, or how long it will last... so I'll just point out some resistance areas.

On this daily SPY chart the prior high from January of 282.93 stands out as an obvious resistance point. The 277 area where the market topped on June 13th is a much closer one as that about where the premarket is at this morning. So, to sum it up I'm expecting 2-3 days of bouncing to make a bear flag on the daily chart and then more down. I don't really have an upside target as this first bounce is likely to be the weak one as there's NO capitulation yet in the market. Once we get it though I'd expect a week or two of a bounce.