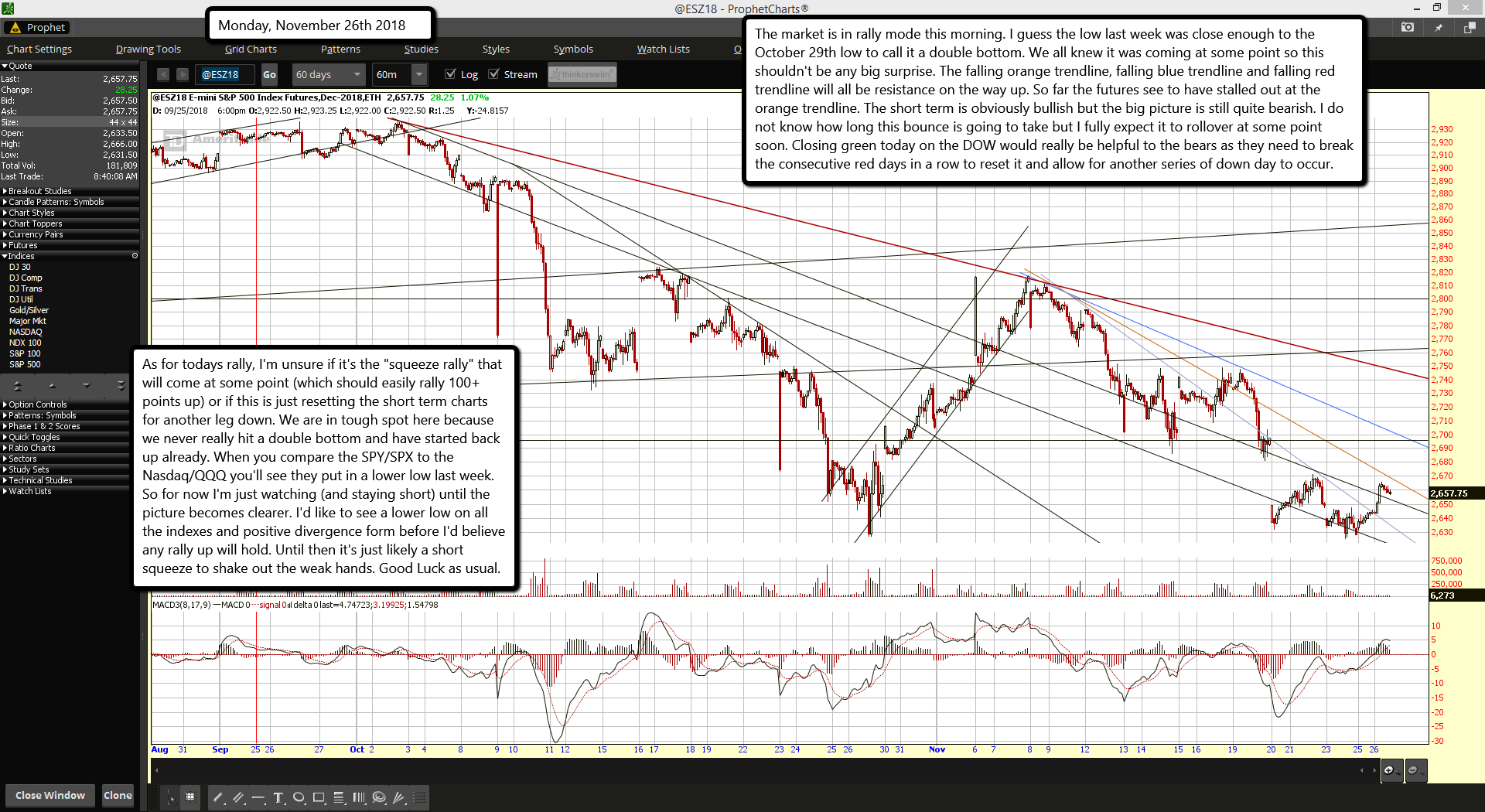

The market is in rally mode this morning. I guess the low last week was close enough to the October 29th low to call it a double bottom. We all knew it was coming at some point so this shouldn't be any big surprise. The falling orange trendline, falling blue trendline and falling red trendline will all be resistance on the way up. So far the futures see to have stalled out at the orange trendline. The short term is obviously bullish but the big picture is still quite bearish. I do not know how long this bounce is going to take but I fully expect it to rollover at some point soon. Closing green today on the DOW would really be helpful to the bears as they need to break the consecutive red days in a row to reset it and allow for another series of down day to occur.

As for todays rally, I'm unsure if it's the "squeeze rally" that will come at some point (which should easily rally 100+ points up) or if this is just resetting the short term charts for another leg down. We are in tough spot here because we never really hit a double bottom and have started back up already. When you compare the SPY/SPX to the Nasdaq/QQQ you'll see they put in a lower low last week. So for now I'm just watching (and staying short) until the picture becomes clearer. I'd like to see a lower low on all the indexes and positive divergence form before I'd believe any rally up will hold. Until then it's just likely a short squeeze to shake out the weak hands. Good Luck as usual.