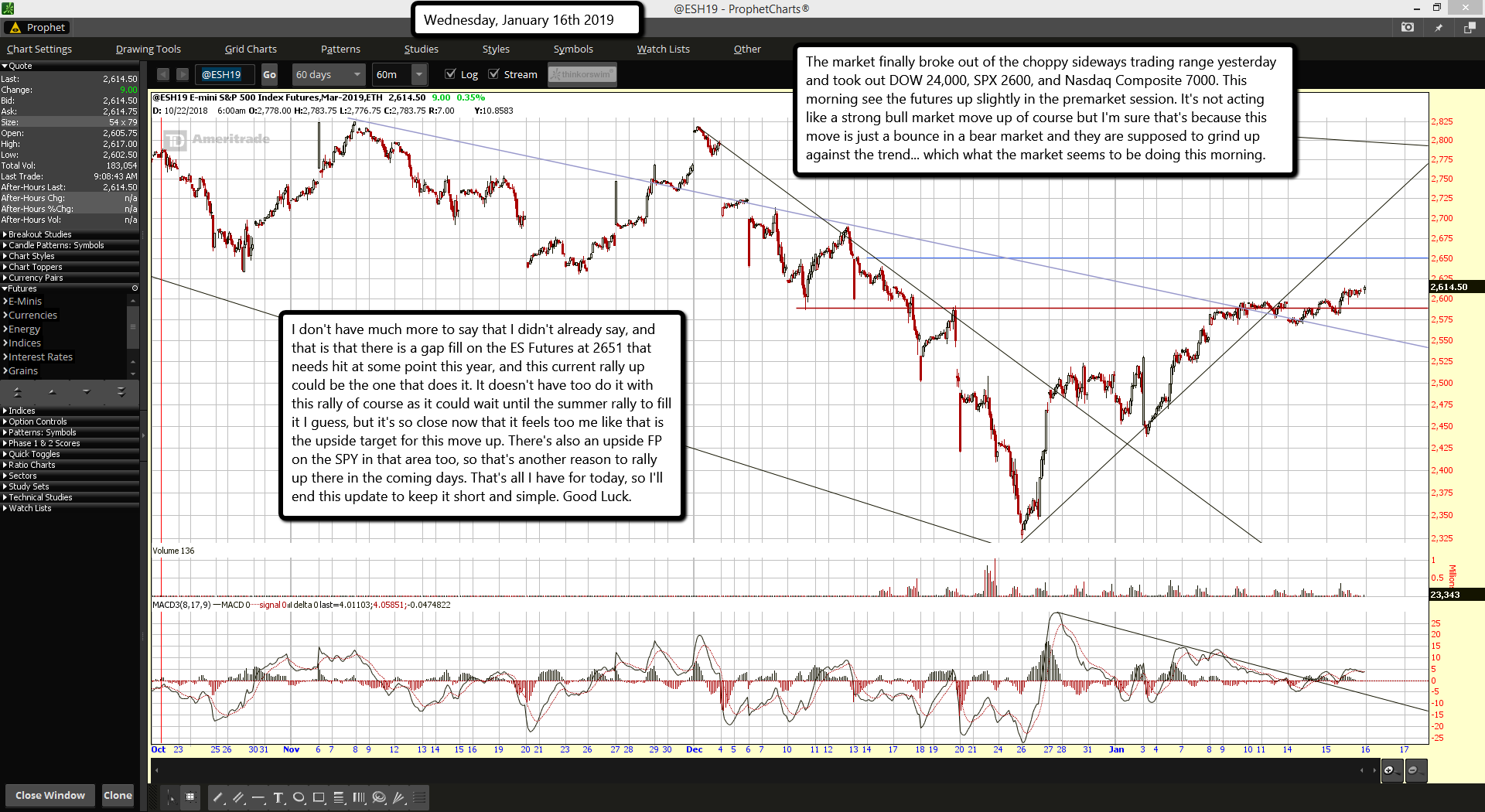

The market finally broke out of the choppy sideways trading range yesterday and took out DOW 24,000, SPX 2600, and Nasdaq Composite 7000. This morning see the futures up slightly in the premarket session. It's not acting like a strong bull market move up of course but I'm sure that's because this move is just a bounce in a bear market and they are supposed to grind up against the trend... which what the market seems to be doing this morning.

I don't have much more to say that I didn't already say, and that is that there is a gap fill on the ES Futures at 2651 that needs hit at some point this year, and this current rally up could be the one that does it. It doesn't have too do it with this rally of course as it could wait until the summer rally to fill it I guess, but it's so close now that it feels too me like that is the upside target for this move up. There's also an upside FP on the SPY in that area too, so that's another reason to rally up there in the coming days. That's all I have for today, so I'll end this update to keep it short and simple. Good Luck.