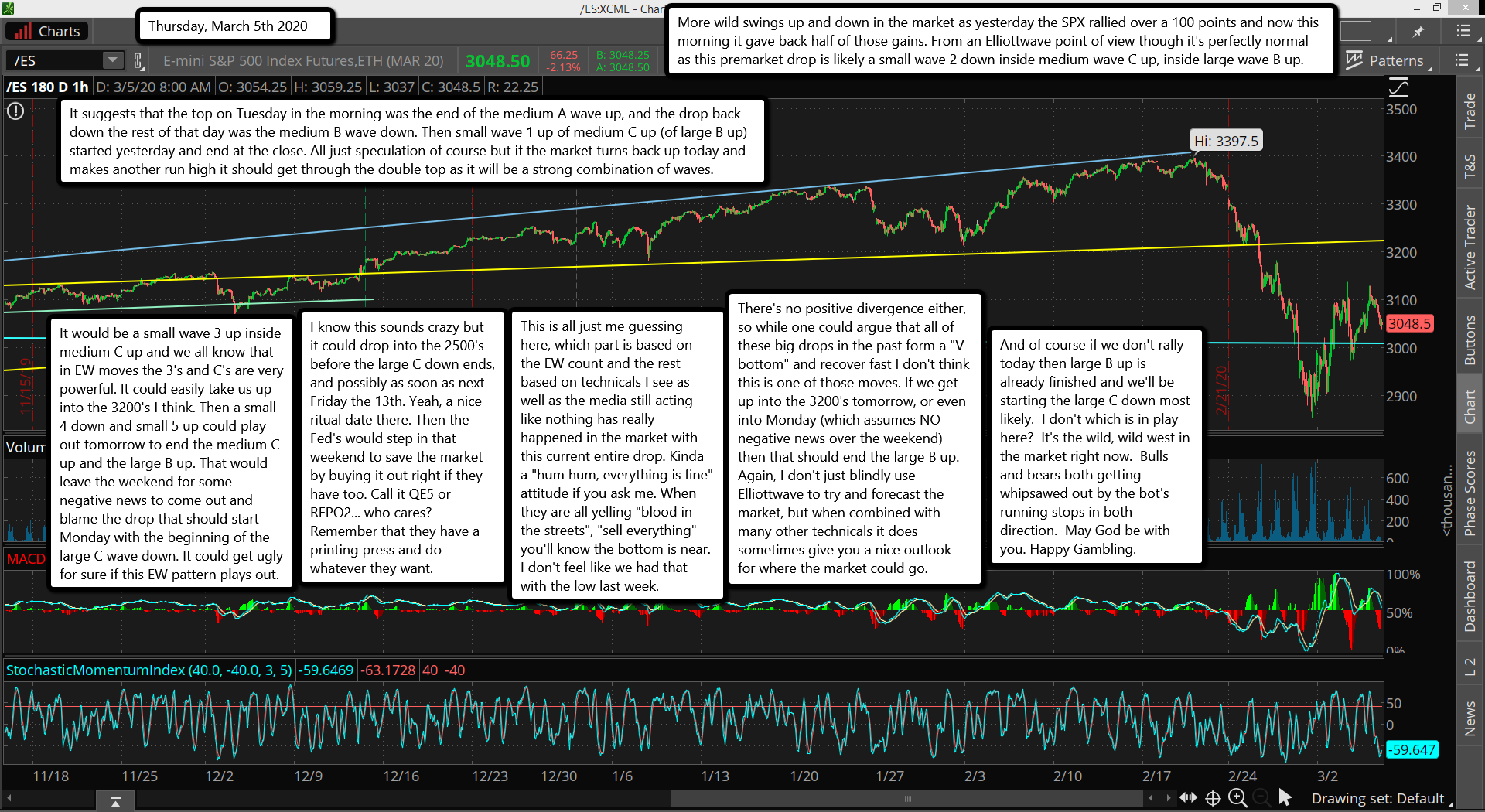

More wild swings up and down in the market as yesterday the SPX rallied over a 100 points and now this morning it gave back half of those gains. From an Elliottwave point of view though it's perfectly normal as this premarket drop is likely a small wave 2 down inside medium wave C up, inside large wave B up.

It suggests that the top on Tuesday in the morning was the end of the medium A wave up, and the drop back down the rest of that day was the medium B wave down. Then small wave 1 up of medium C up (of large B up) started yesterday and end at the close. All just speculation of course but if the market turns back up today and makes another run high it should get through the double top as it will be a strong combination of waves.

It would be a small wave 3 up inside medium C up and we all know that in EW moves the 3's and C's are very powerful. It could easily take us up into the 3200's I think. Then a small 4 down and small 5 up could play out tomorrow to end the medium C up and the large B up. That would leave the weekend for some negative news to come out and blame the drop that should start Monday with the beginning of the large C wave down. It could get ugly for sure if this EW pattern plays out.

I know this sounds crazy but it could drop into the 2500's before the large C down ends, and possibly as soon as next Friday the 13th. Yeah, a nice ritual date there. Then the Fed's would step in that weekend to save the market by buying it out right if they have too. Call it QE5 or REPO2... who cares? Remember that they have a printing press and do whatever they want.

This is all just me guessing here, which part is based on the EW count and the rest based on technicals I see as well as the media still acting like nothing has really happened in the market with this current entire drop. Kinda a "hum hum, everything is fine" attitude if you ask me. When they are all yelling "blood in the streets", "sell everything" you'll know the bottom is near. I don't feel like we had that with the low last week.

There's no positive divergence either, so while one could argue that all of these big drops in the past form a "V bottom" and recover fast I don't think this is one of those moves. If we get up into the 3200's tomorrow, or even into Monday (which assumes NO negative news over the weekend) then that should end the large B up. Again, I don't just blindly use Elliottwave to try and forecast the market, but when combined with many other technicals it does sometimes give you a nice outlook for where the market could go.

And of course if we don't rally today then large B up is already finished and we'll be starting the large C down most likely. I don't which is in play here? It's the wild, wild west in the market right now. Bulls and bears both getting whipsawed out by the bot's running stops in both direction. May God be with you. Happy Gambling.

P.S. There was a "possible" FP on the QQQ yesterday after the close. It was for 209.64 and could be the low for the small wave 2 down? Then a 200+ point rally up for the small wave 3? Crazy moves.