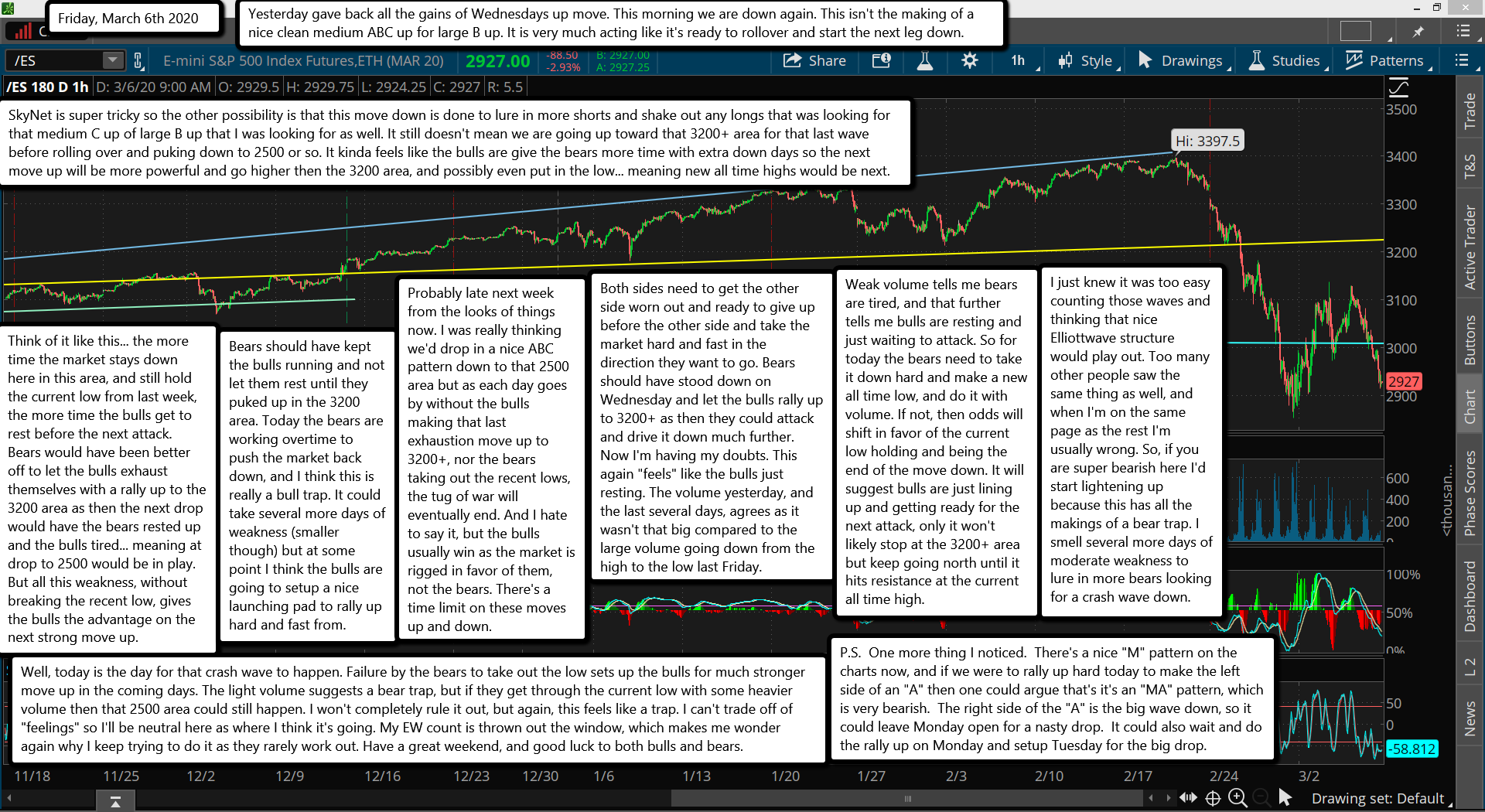

Yesterday gave back all the gains of Wednesdays up move. This morning we are down again. This isn't the making of a nice clean medium ABC up for large B up. It is very much acting like it's ready to rollover and start the next leg down.

SkyNet is super tricky so the other possibility is that this move down is done to lure in more shorts and shake out any longs that was looking for that medium C up of large B up that I was looking for as well. It still doesn't mean we are going up toward that 3200+ area for that last wave before rolling over and puking down to 2500 or so. It kinda feels like the bulls are give the bears more time with extra down days so the next move up will be more powerful and go higher then the 3200 area, and possibly even put in the low... meaning new all time highs would be next.

Think of it like this... the more time the market stays down here in this area, and still hold the current low from last week, the more time the bulls get to rest before the next attack. Bears would have been better off to let the bulls exhaust themselves with a rally up to the 3200 area as then the next drop would have the bears rested up and the bulls tired... meaning at drop to 2500 would be in play. But all this weakness, without breaking the recent low, gives the bulls the advantage on the next strong move up.

Bears should have kept the bulls running and not let them rest until they puked up in the 3200 area. Today the bears are working overtime to push the market back down, and I think this is really a bull trap. It could take several more days of weakness (smaller though) but at some point I think the bulls are going to setup a nice launching pad to rally up hard and fast from.

Probably late next week from the looks of things now. I was really thinking we'd drop in a nice ABC pattern down to that 2500 area but as each day goes by without the bulls making that last exhaustion move up to 3200+, nor the bears taking out the recent lows, the tug of war will eventually end. And I hate to say it, but the bulls usually win as the market is rigged in favor of them, not the bears. There's a time limit on these moves up and down.

Both sides need to get the other side worn out and ready to give up before the other side and take the market hard and fast in the direction they want to go. Bears should have stood down on Wednesday and let the bulls rally up to 3200+ as then they could attack and drive it down much further. Now I'm having my doubts. This again "feels" like the bulls just resting. The volume yesterday, and the last several days, agrees as it wasn't that big compared to the large volume going down from the high to the low last Friday.

Weak volume tells me bears are tired, and that further tells me bulls are resting and just waiting to attack. So for today the bears need to take it down hard and make a new all time low, and do it with volume. If not, then odds will shift in favor of the current low holding and being the end of the move down. It will suggest bulls are just lining up and getting ready for the next attack, only it won't likely stop at the 3200+ area but keep going north until it hits resistance at the current all time high.

I just knew it was too easy counting those waves and thinking that nice Elliottwave structure would play out. Too many other people saw the same thing as well, and when I'm on the same page as the rest I'm usually wrong. So, if you are super bearish here I'd start lightening up because this has all the makings of a bear trap. I smell several more days of moderate weakness to lure in more bears looking for a crash wave down.

Well, today is the day for that crash wave to happen. Failure by the bears to take out the low sets up the bulls for much stronger move up in the coming days. The light volume suggests a bear trap, but if they get through the current low with some heavier volume then that 2500 area could still happen. I won't completely rule it out, but again, this feels like a trap. I can't trade off of "feelings" so I'll be neutral here as where I think it's going. My EW count is thrown out the window, which makes me wonder again why I keep trying to do it as they rarely work out. Have a great weekend, and good luck to both bulls and bears.

P.S. One more thing I noticed. There's a nice "M" pattern on the charts now, and if we were to rally up hard today to make the left side of an "A" then one could argue that's it's an "MA" pattern, which is very bearish. The right side of the "A" is the big wave down, so it could leave Monday open for a nasty drop. It could also wait and do the rally up on Monday and setup Tuesday for the big drop.