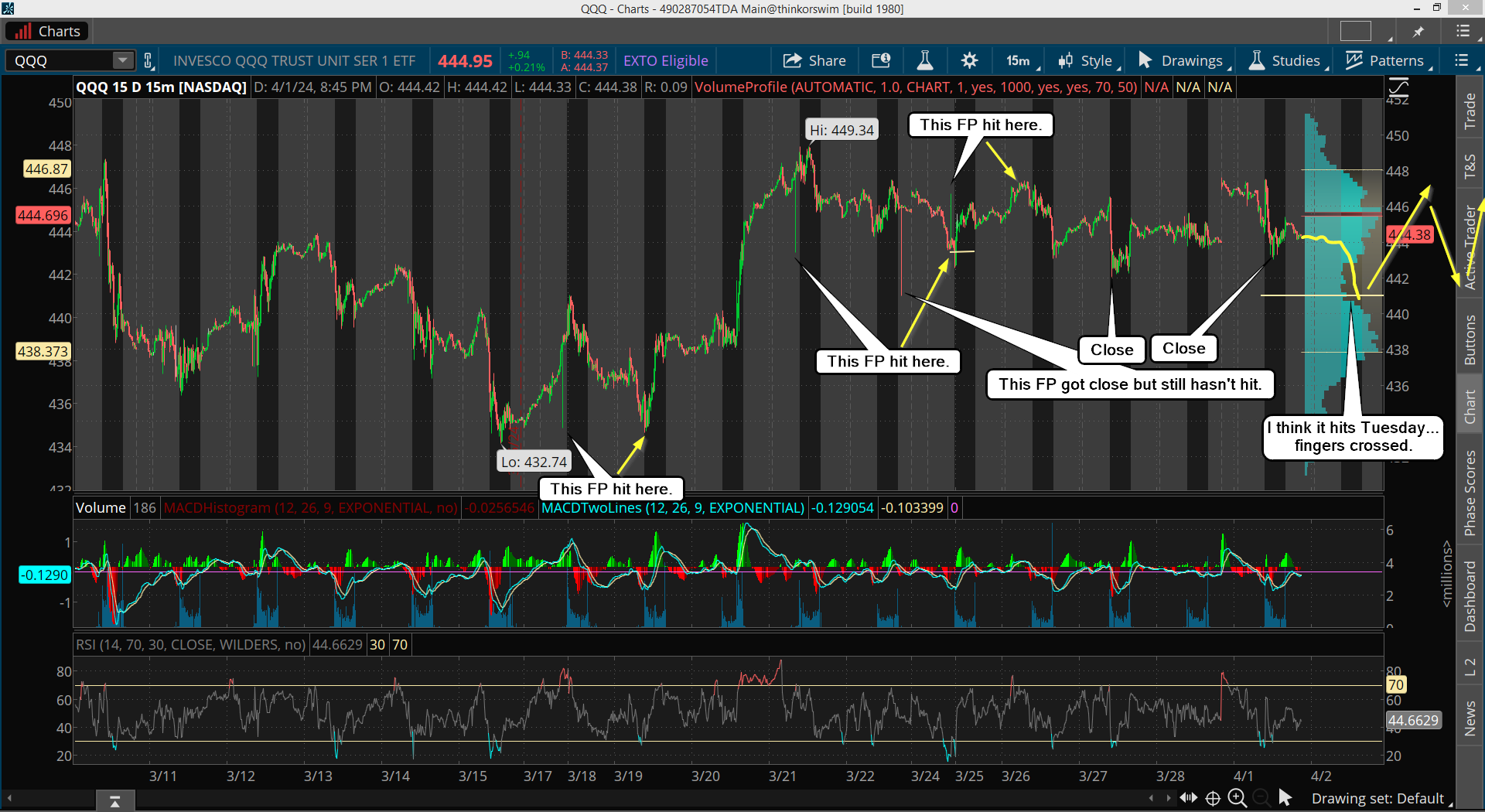

Yesterday did indeed pullback after hitting my FET of 5334, which the technicals supported it as well because the RSI and MACD was overbought on the 6hr chart and the 2hr. They will likely become oversold today, which is great as the QQQ pulled back too and is getting closer to hitting and piercing the FP of 441.00, which is where I'll go long again at. Here's that chart...

As far as "where should the market rally to next", I have a shorter term FET of 5367.59, which would be my best guess. Beyond that would be 5435.02, but that's really reaching in my opinion. The larger FET of 5334 is likely going to keep the market in a range until the next turn date can hit, which is the 8th, or the 21st (19th is the trading day as that's a Sunday).

I can see the FET of 5367.59 hit but I don't see the higher one just yet as the 5334 is a larger Fibonacci Extension Target, so a nice pullback should happen from it. We could dance around for weeks though and pierce by 30-50 points I guess, but we should not start another large rally up until a good pullback happen from it.

So I'm thinking the market will be in a 100 or so point range for the next 2-3 weeks, whereas it doesn't make any new significant higher high. Maybe the next rally up only makes a double top? That's what I'm leaning toward. Everyone will short it, but it won't pullback that much and instead will just continue in that 100 or so point choppy range.

It could top next Monday on the 8th but I get the feeling it will pullback that date to skip it and wait until Friday the 19th (OPEX) and then Sunday night in the futures it might squeak out a slightly higher high (the 21st is the exact turn date) but by the open on Monday the 22nd it's below Fridays high. It's from that high that I think we will get our 5-10% pullback. This of course is "if" this all plays out like I think it's going to, which is anyone's guess.

The month of May is weak anyway from a Seasonality stand point, so I'd lean more toward the pullback starting in the second half of April and going into May instead of topping on the 8th and having most all of April in the correction. The last 11 days of the month would be more likely in my opinion, not 22 days of it.

As for today, I'm on the lookout for the FP on the QQQ to get hit as the MACD's and RSI will likely be oversold on the ES when that happens too. Then I'll go long again and wait for them to get overbought again to exit. I wouldn't be shocked to see just a fast 2-3 day squeeze and then back down again into next week. Rinse and repeat to frustrate bulls and bears both. Then rally into OPEX on the 19th for a higher high of some amount. Maybe it goes nuts and reaches the 5435.93 FET but again... I lean toward the lower one at 5367.59.

Have a blessed day.

I got a preliminary sell signal today with the market being up. Another will trigger tomorrow unless the market is up big. They were on the brink of triggering a couple of weeks ago but the market did a fakeout and went higher. I don’t think it will be following that outcome again. They last triggered in early January.

The market could still go higher but it means that the trend should soon be down. But the individual indicator will still be in decline. There will be stronger sell signals with a continued decline.

I just now got back online. A tornado hit my area Monday around 11am EST and I’ve been without power since then. It’s back on now… finally! The local volunteer Fire Departments building was hit hard. Lot’s of trees down and power lines. I’m fine… no damage to my home. I’m just glad it didn’t last but about 30 seconds I’m told. I’ve never seen a tornado in my area in all my life. There’s too many hills around for them. Very weird for sure.

Is that West Virginia?

Yes, I’m in the tristate area in southern Ohio. West Virginia is right across the river from me and I’m 20 minutes from Kentucky too.