Last Friday was a nothing day as the market just went to sleep and didn't move up or down more then a few points. It's been a week now of "basing" to setup the next big move, which should hit my Fibonacci Extension Target of 5334 on the ES (5296 SPX). And it actually did in the Sunday futures... finally.

But there is still that one downside FP on the QQQ yet to be hit at 441.00, which will likely be pierced too. I don't know when that's going to happen of course as with the futures made another new higher high in the Sunday night session, and hitting my FET of 5334, I'm really puzzled as to why the FP wasn't hit first.

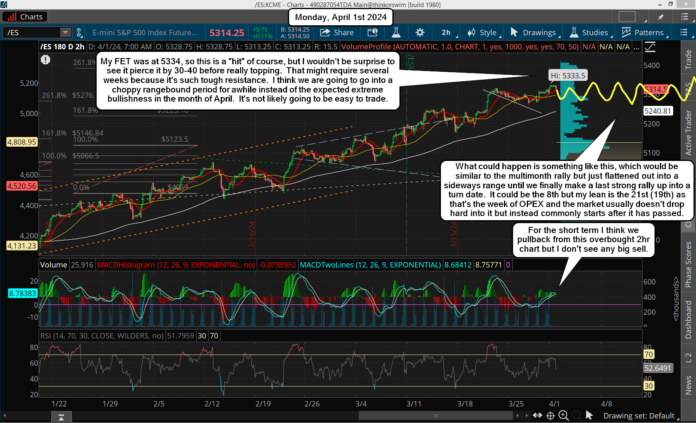

Possibly they don't plan on hitting the FP until later, and from a much higher price? Ideally we continue this rally into next Monday, April 8th as it's a turn date. But I cannot rule out that instead we only rally into this Wednesday or Thursday and then pullback Friday and next Monday to bottom there instead (maybe that's where the FP is hit?).

This common theme happened a lot in 2021 as every time the market got close to a turn date it would top prior to it, and drop into it so it became a low and therefore could continue the rally up.

This could happen again, there's no way to know for sure. If so, then I'd look for the next turn date on April 21st and May 2nd after that. Eventually we will top into one of them instead of bottoming, and then we'll see a good correction of 5-10% I think. For now though I'm still sitting in cash and I'll continue waiting on the FP on the QQQ to get hit first, and that's where I'll take my shot again at another squeeze higher.

Along the way I will miss a lot of moves up and down but I have had much better success being patient and waiting for the right time to enter a trade then just trying to always be in one. If I'm wrong the fake print, then so be it. I also follow the technicals and we have not reached an oversold enough position on the 2hr or 6hr chart in my opinion to produce another 2-3 day 100-150 point squeeze. (In fact they are looking close to overbought now.)

To me, this looks like a short as it's hit my FET and we are at the beginning of a new month where it's common (not always) there are "turns" that happen. I mean that over the past many months I've noticed that around the end of the month (29th, 30th, 31st, or 1st) the market will turn. It might not be very much, but it does happen a lot. Possibly we pullback only to the FP from this new high? Hard to say for sure. I'm not really interested in shorts right now, so I'll just let this play out.

Have a blessed day.