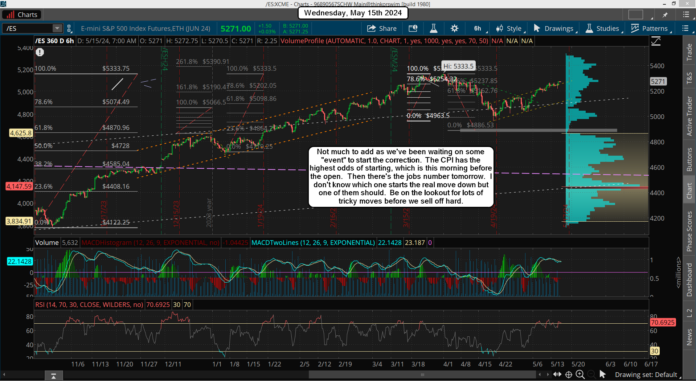

A slow day the first half yesterday but late in the day the squeeze started. This "front running" of the CPI should cause the stops to be run overhead before any turn back down happens.

I don't know if it's going to make a higher high on the ES or lower one, but I wouldn't be shocked to see a new one on the ES and lower high on the SPX cash as there will be an hour of time between the 8:30 am EST release of the CPI number and the 9:30 am open for the cash market. I've seen this before where they do the squeeze in that hour period but by the open it's back down to around the close from the previous day.

In fact you can look at 12/13/2022 as the perfect example, as the CPI came out then and the squeeze on the bears caused a rally up to 4180, but by the open that day the SPX only hit a high of 4100, and that day put in the top for the rally. After that we saw a multi-day decline, which was a "higher low" then the 10/13/2022 low (probably 50% retrace), and that's what I believe most traders are expecting to happen again.

I would think the same thing if I didn't have the FP but since I do I must be open to a flush out drop. Back in 2022 we already had a year of a correction and was below the 200 day moving average, and we were coming up, but currently we are near all time highs and above the average.

This tells me the opposite can happen then what happen then, meaning a lower low is possible this time around. It's certainly not expected by the majority of traders as I know most people are just looking for a higher low to get long at, but isn't that just too obvious? I think it is, but until it happens I'm just guessing I guess. If for some reason the CPI doesn't cause the move then it could happen from the jobs number tomorrow before the open. They are very sneaky, so I wouldn't be shocked to see a move down at the open from the CPI that gets fully reversed into the close to shake out the early bears. Then down for real Thursday after the jobs number comes out.

Have a blessed day.