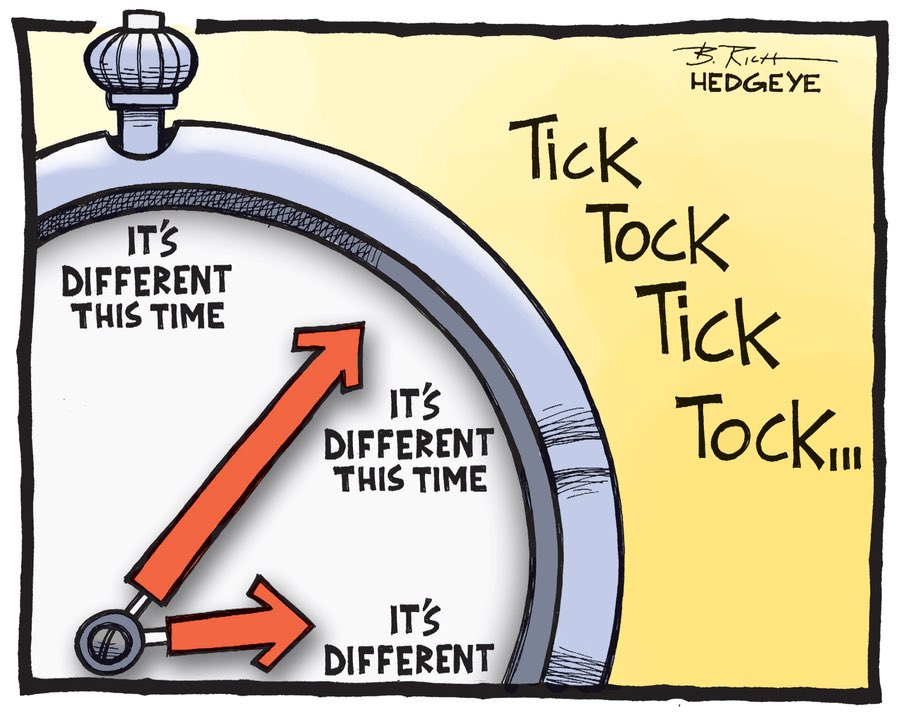

Nothing has changed as the market is just waiting for the right time to rollover. Yesterday was just another light volume day with a float higher that really never went anywhere. It's trying to breakout but it's looking super tired right now, and I just can't see it grinding up to 6300+ for some blow off top. Maybe we reach 6100, but I really don't see it in the charts. It feels like the market is just waiting on a reason to rollover but trying to time the exact date or price level is super hard. I still think we are very close now.

Have a blessed day.

Wave 1 from the 2009 low: March 6,2009 to May 1,2011. Wave 5, from October 13,2022 would end on December 6, 2024 if Wave 1= Wave 5. It’s also 111 weeks from the 2022 low. The Nasdaq topped at 666 weeks off the 3-6-09 low in November 2021.

My weekly exhaustion indicator for the SP 500 has hit its minimum threshold for exhaustion. (the components have met) The daily is pretty much there now as well. Transports and financials are selling off with the big indices at new highs.

The Toronto Stock Exchange is showing major signs of exhaustion.

The first four days of the month usually establish a range and it can remain in the range or head in one initial direction. We could still be putting in a peak the next couple of days. A break of the 13 day average would mean something more substantial is occurring.

We are super close now to a big drop. Just need a trigger. I think it starts this week.