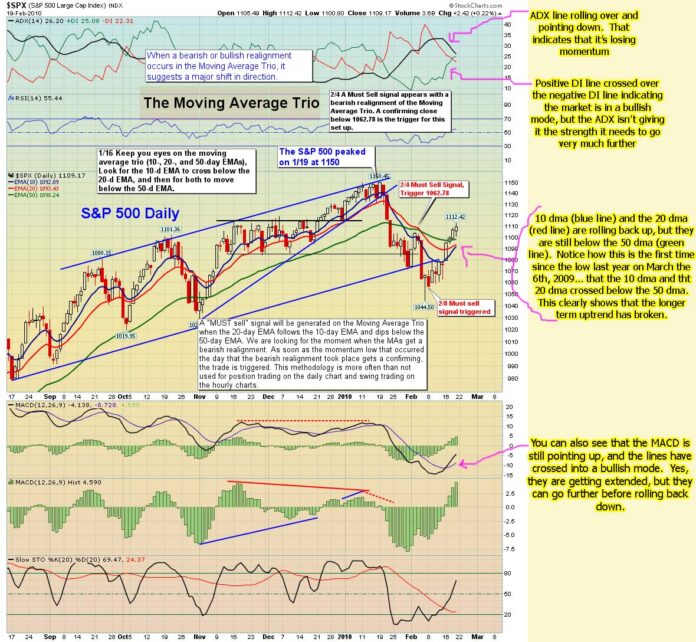

Bullish Monday again? Yes, it's possible... I know us bears can't seem to believe that the market could go higher, but it can. When you look at the technicals, the ADX (advance/decline line) clearly shows that the bulls are still in control. The adx line is now rolling over and starting to point down, just as the positive line is rising up, and crossing over the negative line. What does that mean?

Simple... it means that the advancing move is losing momentum, but at the same time the positive di line is giving a bullishly cross over the negative di line. This indicates that although the market itself is losing steam, the bears are too. The di line (directional indicator) that is negative is the bears line. When it rises the bears are starting to gaining power, but they also need the the adx line advance upwards too... showing that the momentum is also gaining power.

If you have one of the positive (green line) or negative (red line) di lines pointing up, then that line is in control. So, if the positive line is above the negative line, then the market is in a bullish mode. In the reverse, if the negative line is above the positive line, then the market is in a bearish mode.

Ok, now that seems simple enough, but where does the adx line come in? The adx line simply shows the strength of whichever line is on top. Any time the adx line starts to go down, then the market is losing power for the current trend. Right now, we are seeing the adx line (black line) starting to point down, while the positive di line just crossed the negative di line.

So, even though the di lines had a bullish cross, that bullish move can't go too much further without the adx line rising up with it... giving the positive di line the strength it needs to rally up some more. That leaves us in a sideways market until the adx line starts moving back up again, giving strength to whichever di line is point up at that time.

Hopefully that makes sense to you? This means that the up move doesn't have much further to go next week, and that the down move can't happen until the adx line gains strength again by pointing up, at the same time the negative di line must also go up and crossover the positive line.

Just looking at the other indicators you would see how much the market is overbought. But, it can remain overbought for much longer then you can believe it could. It's the same thing on being oversold, as it could remain oversold longer then you might expect too.

It's all about how much strength (measured by the adx line) the market still has. Once it loses strength, it doesn't have much further to go in that direction. That why I'm expecting the market to be in a sideways mode next week, until the adx line cycles back down to the bottom and then gets ready for another momentum move... up or down?

This means I'm not expecting a big sell off on Monday, because there isn't as much momentum left (adx line) behind the move... in either direction. Monday could pullback a little, or go up a little? However, if adx line continues to roll back down, then I'd expect some profit taking by the middle of the week, but no big pullback.

A move down to the 1080-1085 level should be a good support level on any profit taking that should occur sometime this week. This market will pullback, but it's not ready for the larger move down yet. It appears that may not happen until the first week of March. I still believe it's coming, because the monthly charts are clearly pointing down now. They don't turn on a dime! And, the weekly charts still putting in a bear flag.

The new larger trend is now down, but in the short term, we could chop around all next week, and really not go anywhere. Here's a breakdown of where we are on each time frame...

- Monthly Charts - Down Trend

- Weekly Charts - Up Trend, but forming a Bear Flag

- Daily Charts - Up Trend, but almost topped out. Very Over Extended

- 60 Minute Charts - Up Trend, but again... very over extended.

- 15 Minute Charts - Sideways Trend, and extremely over extended.

With each chart in different trends, you can now see why I think we will chop around next week. What we are waiting for is for all the trends to line back up in the same direction, along with the adx line bottoming... and ready to rise upward, giving fresh momentum to the trend in control.

Clearly, the monthly chart has the most power, and it's pointing down. We need to wait for the weekly chart to line back up and start pointing down too. Then the daily, 60 minute, and 15 minute chart would be the last to all line up. If you can be patient enough for this too happen, then you can ride a really nice long trend down.

In the meantime, we will just have to take it one day at a time. Let's see what Monday brings first, and go from there. If we start to pullback at any time during this week, we should remember that fake print of 107.38 spy that occurred last week. It could be the place that the market will bounce from? We'll just try to remember that for when some profit taking does finally happens.

On a side note... the market seems a little strange here lately, almost like it's fight between the good and bad forces that control the market. Maybe Obama is really trying to be the good guy here, and keep the crooked banksters from dumping their shares and crashing the market? It's hard too tell about him, as he's clearly been a puppet for the banksters since they put him in office last year.

Is he finally taking a stand and supporting the America people instead of the crooked banksters? I doubt it... it's probably just a political move since he and the Democratic party is losing popularity every day now (and election time is coming up later this year too). Sorry, I still don't trust him or support him. He's just as worthless as Bush was. Just a puppet on a string, that's pulled by the Rockefellers, Rothschilds, Vanderbilts, and all the other familys in the Illuminati that run this world.

What most people don't understand is that the United States of America isn't broke... it's the Federal Reserve that's broke! And they are a PRIVATE entity (bank) that owns a Private Corporation called "The United States of America Corporation". The Federal Reserve is run by crooked banksters that want to keep all of the profit that they've stolen from American's and push off all the debts and liabilities onto the country of Americia (aka... the taxpapers). Does that sound fair too you?

If you like to listen to an audio by an insider named Benjamin Fulford by downloading this file (right click and save as). If you would like to go to website, the link is here. Scroll down the page to see Benjamin Fulford's link. He also did some video's and they can be found here.

Many of this things haven't happened yet, which tells me that there is a fight between the good patriots of America and the crooked banksters. Last weeks' weird action shows that something big is going to happen soon. When is the big question?

Red

Absolutely fantastic chart.

You're welcome Monica Dear… I just love saying “dear” when talking to a woman. 🙂

Nothing wrong with being called “dear”. It's been a long time though!

Great explanation Red. Learned a lot from this post – thanks.

I was debating if I should say this or not. But I have decided to err on the side of caution. Look, Monica, you just blew 10k on an option trade. If you are working with a 7 figure portfolio, then ignore what I have to say. I once blew a 6 figure portfolio shrugging off 10k loss here, 15 k loss here, fighting the market. It was easy to just shrug it off thinking that the next big win would recoup everything. But before long, it added up. Unless such loss is only 1-2% of your portfolio, it is going to kill your portfolio over time. If a particular trading method keeps producing the same undesirable result, do not keep throwing money at it hoping the outcome will be different. Hoping and wishing, is not a valid trading strategy.

I am speaking from experience, hoping that others do not have to go through the same learning process. So take it for what it is worth. My email is DCSmartCoin a t G mail. Anyone struggling with similar problem is welcome to drop me a note. I will be more than happy to share some of my past experience.

SC, where did this come from? I just appreciate Red providing free information, and liked his chart, think he is a caring person. I made a VERY stupid move by blowing 20K on an option trade. I appreciate your concern but I am already aware of my folly and don't really want someone to make me feel worse. I have a 6 figure account and I realize that a loss like that is inexcusable and I don't plan on trading options again before seriously understanding them. However, the way I see it, as a trader (or investor I suppose), you have to pick your time frame. I don't claim to be a day trader, I have too many obligations to focus on the day to day technicals nor do I think I would be any good at it- that is why I read blogs like Red's and others so I can accumulate and dissect the information and form my own conclusions about trends. I am so grateful that there are people like Red out there. While there are convincing bullish arguments, I feel that the bearish ones are more convincing, so i have stuck to my plan and will continue to do so until we reach new highs. NO ONE can predict the future and trading (or investing) involves serious RISK if you are taking a long term approach. I am willing to continue to take that risk and have my mental stops in place.

Do I agree with Red's non market theories? – perhaps not although I don't doubt that there is some manipulation of the markets going on. But, I don't care, his arguments are interesting and fun to read.

Again, I appreciate your concern but I have learned my lesson.

I am not trying to make you feel bad at all. Nor was I commenting on your opinion on Red's work. Eventhough it is really none of my business, I just felt a bit concerned when it looked to me like someone is happily dancing through a minefield. If you know what you are doing, then disregard everything I said and forgive my intruding.

I don't think too many people are happily dancing through any of this! And it's never easy as far as I can tell! I'll let you know in 3 years if I know what I am doing 🙂

Benjamin Fulford needs some serious medication.

http://www.projectcamelot.org/benjamin_fulford….

Ninja. 10,000 assasins. Him becoming Finance Minister of Japan. Japan's $5trillion foreign reserves…. wtf.. Delusion

Red, you have a better chance in becoming the next Rod Steward than any of those becoming true.

None of my business. But you need to pull back from the edge. You are falling over the deep end big time. This is not going to end well. It is one thing to dabble in conspiracy theories about PPT and Goldman Sach etc. But when you start believing in things that are simply NOT true, it is called delusional. It is a medical condition.

You must have watched the video… yeah, that's a little strange, I agree. The audio talks about the banksters some, and that's the only one you really need to listen too.

The video is not about the market, per-say… and I don't think any of the dire dark things he mention in it are going to come true.

The whole point in sharing the audio is to keep people aware that this market is controlled, and that it really boils down to about 6 big banks, and a few hundred people that are destroying America.

Greed and power… that's what these people want, and it's why we have the financial crisis that we currently have.

No. I just read his bio. His bio tells me there is no need to waste time on what he has to say. The whole crew missed their true calling in life. They should be writing fictions and scripts for Hollywood and make millions!!!

A lot of Hollywood movies were written from information given to them by “insiders” in various parts of society. Steven Spielberg once quoted that he didn't make fiction movies. Hollywood has been given many scripts that were based on true events.

Yes, this is going a little off topic for this blog, so I won't go to far into it. I'll try to keep it related to corruption in the system, and such… I think we can all agree that “corruption” is real.

Red, those guys in that camerlot project whatever, are not 'insiders'. They are fringe elements of the society with delusion. They are not 'in' on anything. They are on the outside looking in. They can't hack it in their own field or profession.

There is no modern day Ninja. There are no 10,000 ninja assasins. And Japan does not have $5 trillion foreign reserve. Japan does not even like immigrants let along letting a whitey become Finance minister. It is all insane babbling of a mental patient.

Why are you even listening to that bunch?

The people on Project Camelot are NOT insiders… they interview insiders like any journalist would on main stream TV. Their outlet is on the internet because main stream TV wouldn't be allowed to broadcast what they cover.

The only person so far that has made it to main stream TV, that was first interviewed by Project Camelot, was Duncan O”Finioan (http://www.projectcamelot.org/duncan_o_finioan….).

He was featured on Jesse Ventura new show called Conspiracy Theory Manchurian (http://www.youtube.com/watch?v=8YQsYj2ZFf4). It takes time for people to finally come to their senses, but it will happen with time.

The “insider's” are simply people that have come forward from different parts of the government, and other organizations, to tell the people at Project Camelot what is really going on.

Of course I don't agree or believe every witness, insider, or whistleblower, interviewed on the site, but I'm open to listen to others inside those various organizations.

If you want to know why the country is going down the toilet and all the necessary reforms are not enacted, listen to Charlie Munger, Warren Buffett's right hand-man.

http://www.slate.com/id/2245328/pagenum/all/

That's an interesting read… funny, but poetic in how it describes America. Sad but true…

update 8:30est

SPY trading 111.55

I wrote a post on friday talking about the importance of the SPY 111.38 level and how the last four times the operators have gapped the SPY either over/under the level. Well this morning looks like the operators are going to jump the creek again over the 111.38 level.

Now the opening tick will be interesting because of the co-relational 1/22/2010 open which was SPY 111.20 and the 2/19/2010 close which was 111.14. Remember the 1/21/2010 close was 111.70 so a open within .10 or .15 of 111.70 will fit the bill.

Sundancer, I watched that on Friday. I think we climb today.

From Carl just now:

March S&P E-mini Futures: Today's day session range estimate is 1100-1116. The market will reach 1200 over the next three months.

Note:

1093-1107 last Fridays estimated range

1100-1116 todays estimated range

Earl, do you have any TNA?

Gcocks, all cash

Feel sleepy right now. Probably will wait until I wake up to do anything.

That's a good place to be.

$RUT Monthly Update

continues to push right up against the max contain pt.

http://www.flickr.com/photos/47091634@N04/43786…

if the max contain pt. fails then the $RUT will go and test the top of the breakdown candle form Oct. 08' which is @ 676.21 and important HL @ 679.52

Sundancer, I agree if it breaks it has a lot of room to run. I am in TAZ so I am hoping it holds the line. Nice post

Bot TNA at $44.45, starter

Had to run an errand and missed the open (and a better place to be buying TNA)

Out of TNA

Carl is now long one unit (/ES) at 1104.50

In TNA $44.29, starter

SPY 120 min chart

http://www.flickr.com/photos/47091634@N04/43795…

spy backing into its 20 on the 60 min, we're in period 31 of this cycle

Added TNA $44.05

Added TNA $44.05

For those who browse the blog world for guidance, this site may be of interest to you.

http://garyscommonsense.blogspot.com/

IF you are looking and waiting for P-3,

http://garyscommonsense.blogspot.com/2010/02/th…

Out of TNA Net gain on the day of exactly $0.00

I really thought you sold at the high. When it ran up to 44.55 I was sure you sold out. My Tza was up a whole $133.00 on the day.

By my rules, I should have sold when it dipped below $44.52

Expected more upside. Expectations can kill.

That is just not like you. I am surprised. However, there is always tomorrow.

I think I was mesmerized by seeing no sell points (those green lines on my charts) on TNA for the next $2 move up.

In the past, no sell points has meant a rapid upward move.

But, anything can happen.

When the market started to turn on Feb 11-12, I mentioned that technology and foreign stocks were leading the turn in momentum. Money is flowing out of those two sectors now. Odds are for the rally taking a breather in the coming days. Just bear in mind that it isnt the start of yet another P-3. No P-3 likely until summer.

SC, any thoughts on financial holding up so well in light of new banking regulations, under water mortgages, commercial loans. etc. Does not make sense to me.

Short term movement can be attributed to many different factors with each one exerting varying degree of influence at different time. In short, impossible to know what is driving what, until after the fact. That is why all the news channels are in business.

That is a fancy way of saying I got no clue but still like to pretend that I am knowledgeable.

If you look at the daily KRE, RKH, BKX, they are looking bulllish. If you only look back over the last few years, the current pattern is very bullish. But if you look further back, you would find that bullish pattern can quickly fade away into a bearish pattern. What that tells us is that we shouldn't be jumping in joy just b/c the financials are strong. Especially since we are partying on a frozen pond… where the ice is looking a bit thin…

Nice, I think the Sun is shining brightly on that pond.

Carl's projections on /ES

1100-1116 todays estimated range (16 point range)

1103.50-1112.75 todays actual range (9 point range)

/ES stayed in Carl's range today by 3-4 points.

Carl bought /ES at 1104.50 and sold at 1108.50 (+4)

Grade: B

TZA gapped down at the open and improved some but closed down 0.6% today.

We are in a New Moon Trade (favors TZA).

[ After five days, this trade is *cough* DOWN 10.4% ]

(In the recent past, moon trades has been in the area of 10% down, only to bounce back to near even by the end of the trade.)

Volume today for TZA was the lowest in 34 trading days.

$RVX (VIX for $RUT) closed 0.3% higher. This is the second day in a row that $RUT & $RVX both closed higher. (Normally, they go in opposite directions)

TZA has now been down nine days in a row.

Ultimate Oscillator was 20.81 last Friday & 21.86 today, increasing when TZA closed lower. A bit of a divergence.

Bollinger Bands for $RVX (VIX for $RUT): the lower BB was touched last Friday, but did not touch today, which might be indicating that $RVX will be rising (good for TZA).

Bollinger Bands for $RUT: the upper band rose, moving higher away from $RUT, which might be indicating that TNA will continue to rise (bad for TZA).

Overall, it looks like TZA might fall again tomorrow, but the divergences in place might be warning of a rise in TZA (finally).

So is it heads or tails.

I favor TNA, but leery of the divergences, and the 9 days in a row. Tends to move me to inaction. Or waiting to decide once I see where TNA opens tomorrow.

TZA gapped down at the open and improved some but closed down 0.6% today.

We are in a New Moon Trade (favors TZA).

[ After five days, this trade is *cough* DOWN 10.4% ]

(In the recent past, moon trades has been in the area of 10% down, only to bounce back to near even by the end of the trade.)

Volume today for TZA was the lowest in 34 trading days.

$RVX (VIX for $RUT) closed 0.3% higher. This is the second day in a row that $RUT & $RVX both closed higher. (Normally, they go in opposite directions)

TZA has now been down nine days in a row.

Ultimate Oscillator was 20.81 last Friday & 21.86 today, increasing when TZA closed lower. A bit of a divergence.

Bollinger Bands for $RVX (VIX for $RUT): the lower BB was touched last Friday, but did not touch today, which might be indicating that $RVX will be rising (good for TZA).

Bollinger Bands for $RUT: the upper band rose, moving higher away from $RUT, which might be indicating that TNA will continue to rise (bad for TZA).

Overall, it looks like TZA might fall again tomorrow, but the divergences in place might be warning of a rise in TZA (finally).

So is it heads or tails.

I favor TNA, but leery of the divergences, and the 9 days in a row. Tends to move me to inaction. Or waiting to decide once I see where TNA opens tomorrow.

I've pretty much decided I don't want to own TNA tomorrow at any price under $44.23 — the primary pivot.

Carl's projections on /ES

1100-1116 todays estimated range (16 point range)

1103.50-1112.75 todays actual range (9 point range)

/ES stayed in Carl's range today by 3-4 points.

Carl bought /ES at 1104.50 and sold at 1108.50 (+4)

Grade: B

When the market started to turn on Feb 11-12, I mentioned that technology and foreign stocks were leading the turn in momentum. Money is flowing out of those two sectors now. Odds are for the rally taking a breather in the coming days. Just bear in mind that it isnt the start of yet another P-3. No P-3 likely until summer.

SC, any thoughts on financial holding up so well in light of new banking regulations, under water mortgages, commercial loans. etc. Does not make sense to me.

Short term movement can be attributed to many different factors with each one exerting varying degree of influence at different time. In short, impossible to know what is driving what, until after the fact. That is why all the news channels are in business.

That is a fancy way of saying I got no clue but still like to pretend that I am knowledgeable.

If you look at the daily KRE, RKH, BKX, they are looking bulllish. If you only look back over the last few years, the current pattern is very bullish. But if you look further back, you would find that bullish pattern can quickly fade away into a bearish pattern. What that tells us is that we shouldn't be jumping in joy just b/c the financials are strong. Especially since we are partying on a frozen pond… where the ice is looking a bit thin…

Nice, I think the Sun is shining brightly on that pond.

Out of TNA Net gain on the day of exactly $0.00

I really thought you sold at the high. When it ran up to 44.55 I was sure you sold out. My Tza was up a whole $133.00 on the day.

By my rules, I should have sold when it dipped below $44.52

Expected more upside. Expectations can kill.

That is just not like you. I am surprised. However, there is always tomorrow.

I think I was mesmerized by seeing no sell points (those green lines on my charts) on TNA for the next $2 move up.

In the past, no sell points has meant a rapid upward move.

But, anything can happen.

For those who browse the blog world for guidance, this site may be of interest to you.

http://garyscommonsense.blogspot.com/

IF you are looking and waiting for P-3,

http://garyscommonsense.blogspot.com/2010/02/th…

This time it may be different. So good luck to us all. Don't bet the farm, unless you got other farms.

Added TNA $44.05