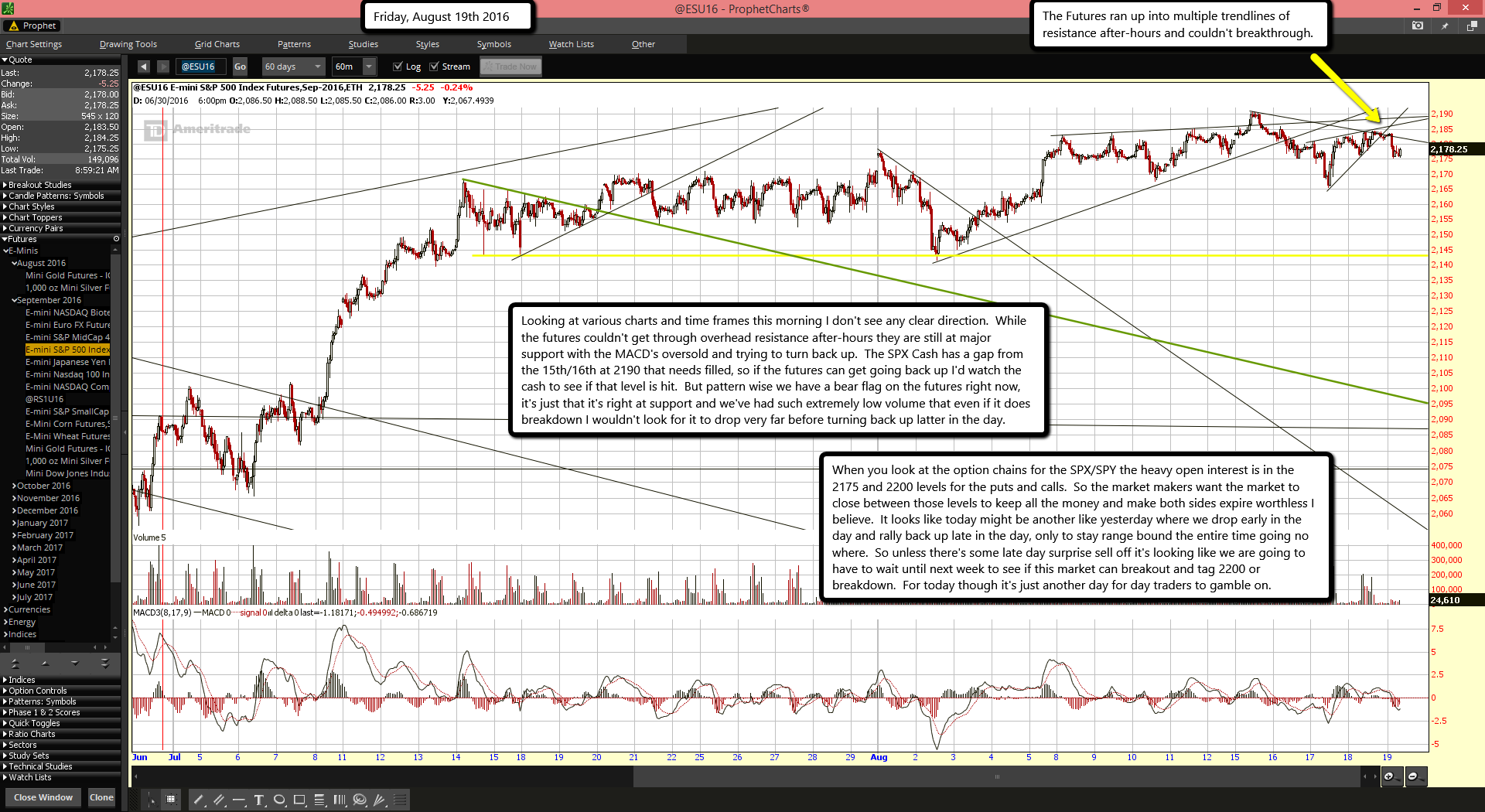

The Futures ran up into multiple trendlines of resistance after-hours and couldn't breakthrough.

Looking at various charts and time frames this morning I don't see any clear direction. While the futures couldn't get through overhead resistance after-hours they are still at major support with the MACD's oversold and trying to turn back up. The SPX Cash has a gap from the 15th/16th at 2190 that needs filled, so if the futures can get going back up I'd watch the cash to see if that level is hit. But pattern wise we have a bear flag on the futures right now, it's just that it's right at support and we've had such extremely low volume that even if it does breakdown I wouldn't look for it to drop very far before turning back up latter in the day.

When you look at the option chains for the SPX/SPY the heavy open interest is in the 2175 and 2200 levels for the puts and calls. So the market makers want the market to close between those levels to keep all the money and make both sides expire worthless I believe. It looks like today might be another like yesterday where we drop early in the day and rally back up late in the day, only to stay range bound the entire time going no where. So unless there's some late day surprise sell off it's looking like we are going to have to wait until next week to see if this market can breakout and tag 2200 or breakdown. For today though it's just another day for day traders to gamble on.