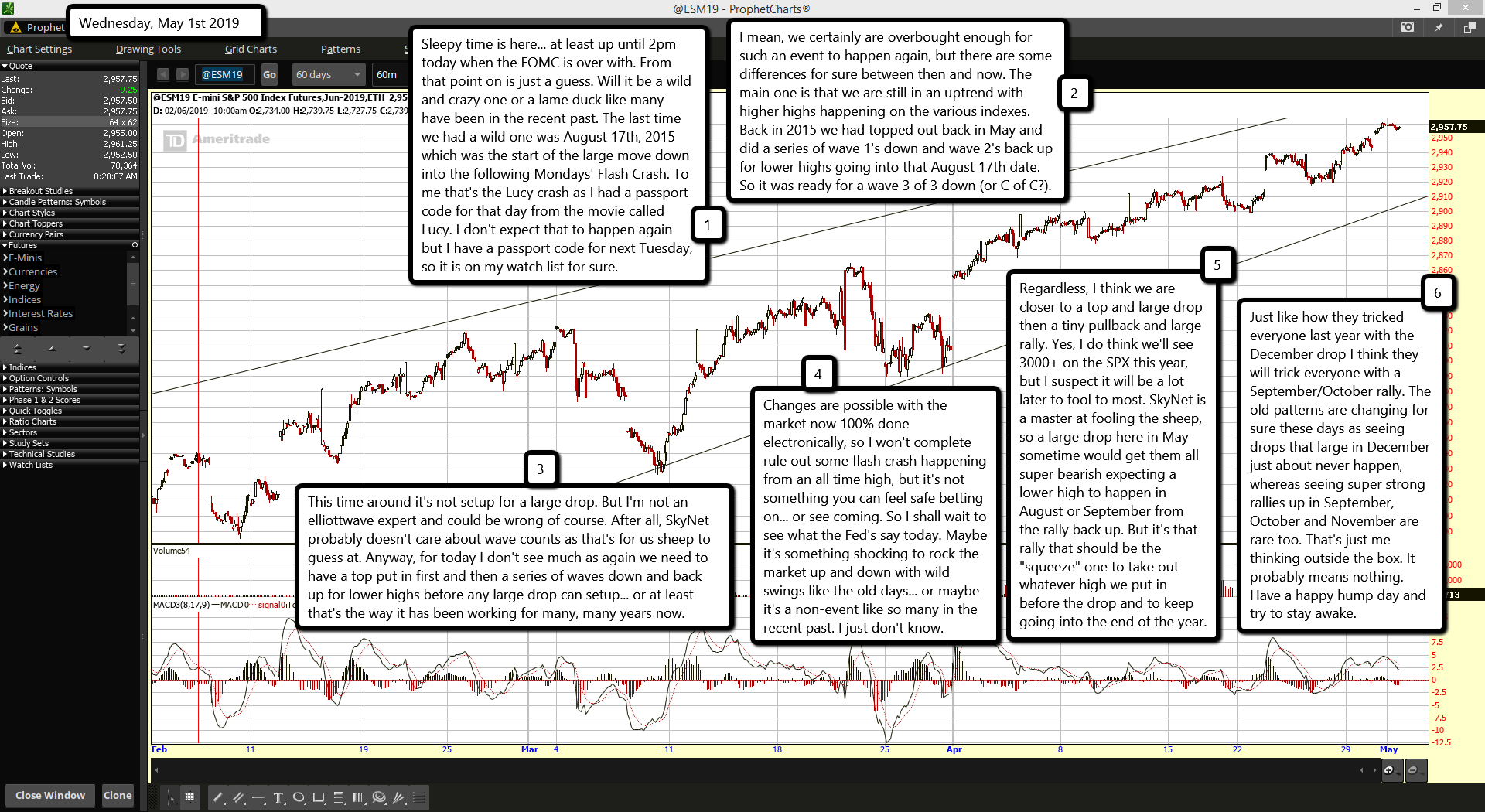

Sleepy time is here... at least up until 2pm today when the FOMC is over with. From that point on is just a guess. Will it be a wild and crazy one or a lame duck like many have been in the recent past. The last time we had a wild one was August 17th, 2015 which was the start of the large move down into the following Mondays' Flash Crash. To me that's the Lucy crash as I had a passport code for that day from the movie called Lucy. I don't expect that to happen again but I have a passport code for next Tuesday, so it is on my watch list for sure.

I mean, we certainly are overbought enough for such an event to happen again, but there are some differences for sure between then and now. The main one is that we are still in an uptrend with higher highs happening on the various indexes. Back in 2015 we had topped out back in May and did a series of wave 1's down and wave 2's back up for lower highs going into that August 17th date. So it was ready for a wave 3 of 3 down (or C of C?).

This time around it's not setup for a large drop. But I'm not an elliottwave expert and could be wrong of course. After all, SkyNet probably doesn't care about wave counts as that's for us sheep to guess at. Anyway, for today I don't see much as again we need to have a top put in first and then a series of waves down and back up for lower highs before any large drop can setup... or at least that's the way it has been working for many, many years now.

Changes are possible with the market now 100% done electronically, so I won't complete rule out some flash crash happening from an all time high, but it's not something you can feel safe betting on... or see coming. So I shall wait to see what the Fed's say today. Maybe it's something shocking to rock the market up and down with wild swings like the old days... or maybe it's a non-event like so many in the recent past. I just don't know.

Regardless, I think we are closer to a top and large drop then a tiny pullback and large rally. Yes, I do think we'll see 3000+ on the SPX this year, but I suspect it will be a lot later to fool to most. SkyNet is a master at fooling the sheep, so a large drop here in May sometime would get them all super bearish expecting a lower high to happen in August or September from the rally back up. But it's that rally that should be the "squeeze" one to take out whatever high we put in before the drop and to keep going into the end of the year.

Just like how they tricked everyone last year with the December drop I think they will trick everyone with a September/October rally. The old patterns are changing for sure these days as seeing drops that large in December just about never happen, whereas seeing super strong rallies up in September, October and November are rare too. That's just me thinking outside the box. It probably means nothing. Have a happy hump day and try to stay awake.