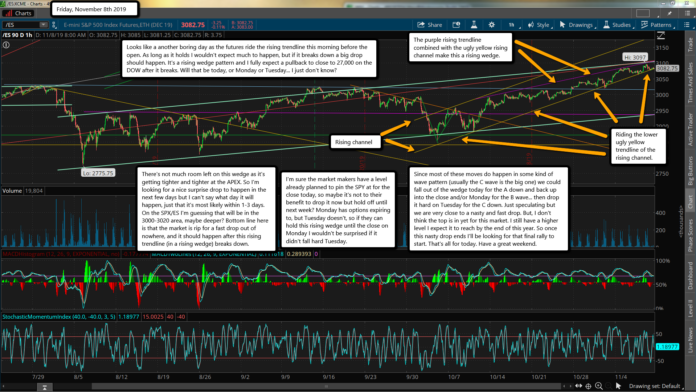

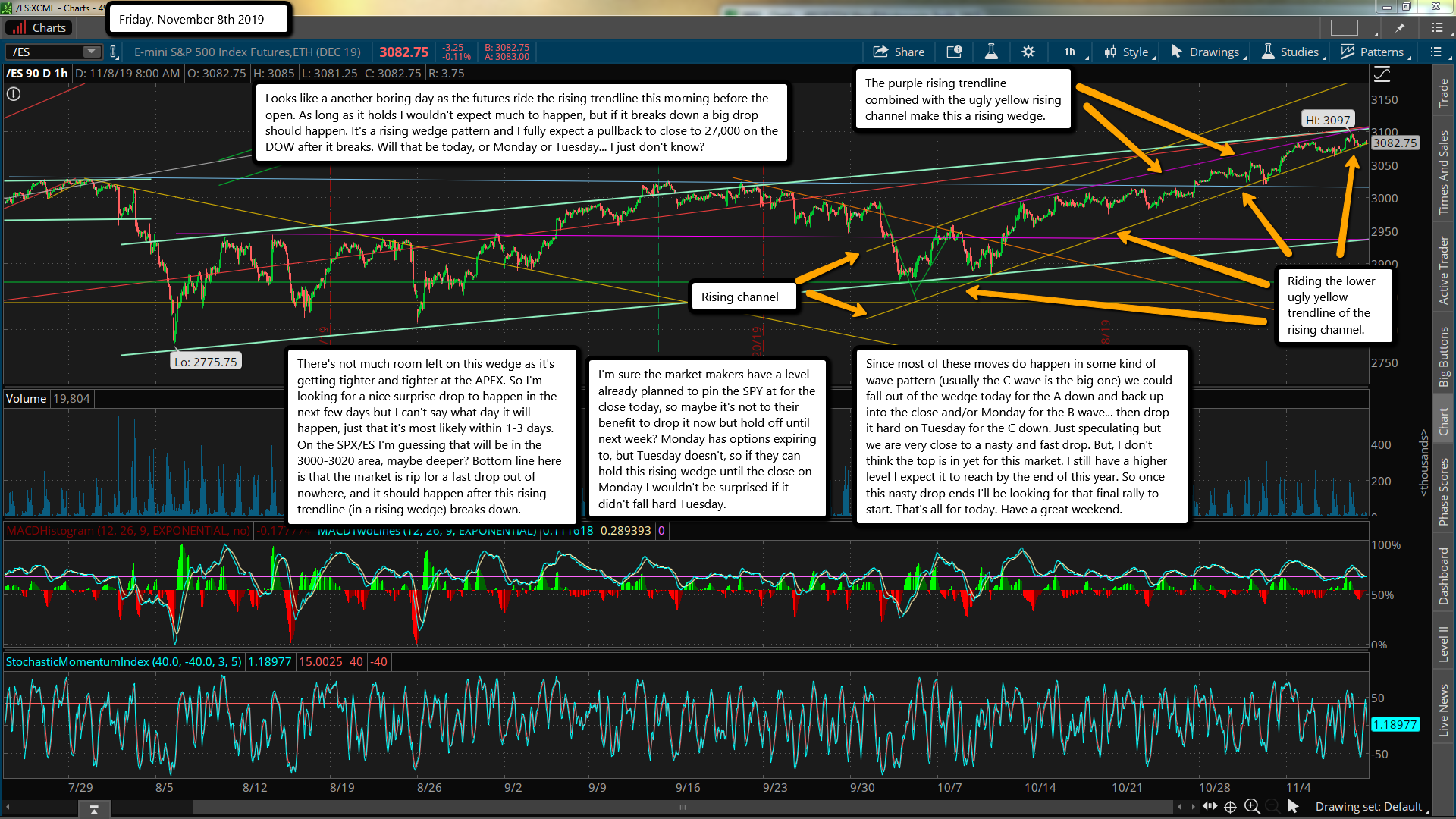

Looks like a another boring day as the futures ride the rising trendline this morning before the open. As long as it holds I wouldn't expect much to happen, but if it breaks down a big drop should happen. It's a rising wedge pattern and I fully expect a pullback to close to 27,000 on the DOW after it breaks. Will that be today, or Monday or Tuesday... I just don't know?

Looks like a another boring day as the futures ride the rising trendline this morning before the open. As long as it holds I wouldn't expect much to happen, but if it breaks down a big drop should happen. It's a rising wedge pattern and I fully expect a pullback to close to 27,000 on the DOW after it breaks. Will that be today, or Monday or Tuesday... I just don't know?

There's not much room left on this wedge as it's getting tighter and tighter at the APEX. So I'm looking for a nice surprise drop to happen in the next few days but I can't say what day it will happen, just that it's most likely within 1-3 days. On the SPX/ES I'm guessing that will be in the 3000-3020 area, maybe deeper? Bottom line here is that the market is rip for a fast drop out of nowhere, and it should happen after this rising trendline (in a rising wedge) breaks down.

I'm sure the market makers have a level already planned to pin the SPY at for the close today, so maybe it's not to their benefit to drop it now but hold off until next week? Monday has options expiring to, but Tuesday doesn't, so if they can hold this rising wedge until the close on Monday I wouldn't be surprised if it didn't fall hard Tuesday.

Since most of these moves do happen in some kind of wave pattern (usually the C wave is the big one) we could fall out of the wedge today for the A down and back up into the close and/or Monday for the B wave... then drop it hard on Tuesday for the C down. Just speculating but we are very close to a nasty and fast drop. But, I don't think the top is in yet for this market. I still have a higher level I expect it to reach by the end of this year. So once this nasty drop ends I'll be looking for that final rally to start. That's all for today. Have a great weekend.