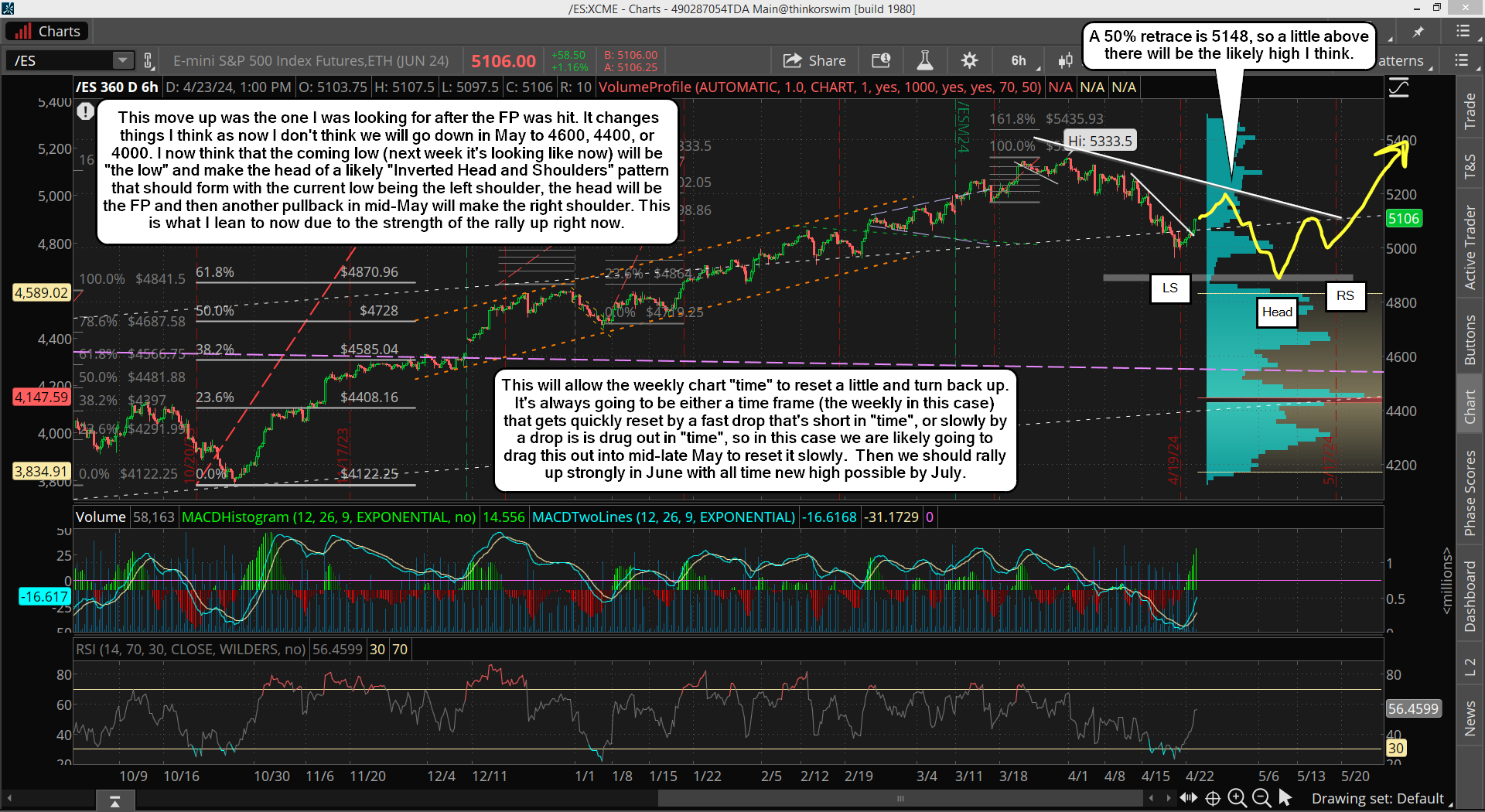

Yesterday rally has likely killed my wave count. The resistance was busted through, and now we appear to be getting the 50% rally up that I thought we wouldn't see until after we hit the FP on the SPY. This changes everything I think as now we will likely put in a low at the FP into early May and that will be "the low" for this correction.

I had previously thought that we would rally up 50% from the FP and then go back down to 4600, 4400, or even 4000, but those odds are super low now. We would have to rollover today and drop hard to the FP into this Friday, which then could bring those lower targets back in play, but that's the only way I see it possible. I posted the chart below yesterday in the chatroom, and it's what I think will play out now.

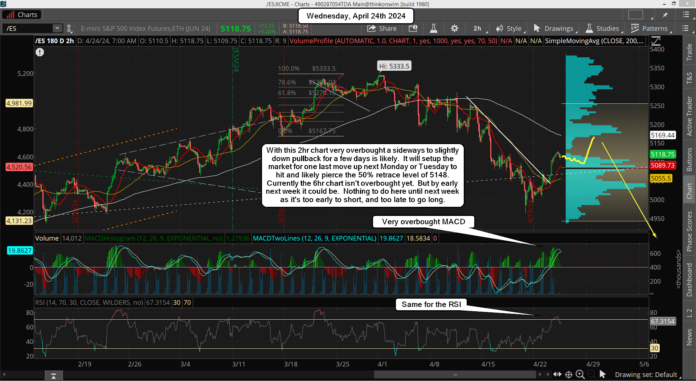

The top for this rally could end by next Monday or Tuesday, and then the drop to the FP should follow and bottom within 7-9 days (love to see it happen in 5-7 though). For the short term we are getting extended, so a pullback of 30-40 points could come at anytime. Here's a chart I posted yesterday showing it.

This is disappointing but we must remember that we are still in a bull market, so I really shouldn't be surprised. This will end up being about an 8% pullback from the top in an ABC pattern if my thoughts on the charts on this post are accurate. We shall see.

Have a blessed day.

The SP 500 got up to the 13day sma today and hit the other indicator I mentioned yesterday. (it often acts as a trend indicator-creating the resumption of the prevailing trend.) The 20 day ema crossed another indicator which preceded the final spike down late last August.

I expect a drop into the end of the month now for a full month downtrend. There is a Fed meeting on May 1st.

We should either top into that period or bottom, but I don’t know which? I lean toward a top, but either could happen. I think we are going up in an ABC and the 5128 high ended the A wave. We are in the B wave pullback now, and next should be the C wave up, which I have a FET of 5230 for it. I could be wrong but I think we top into the meeting.