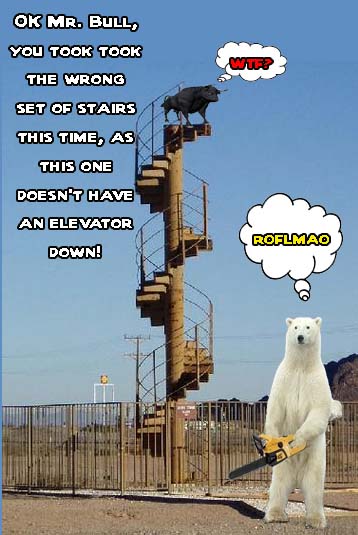

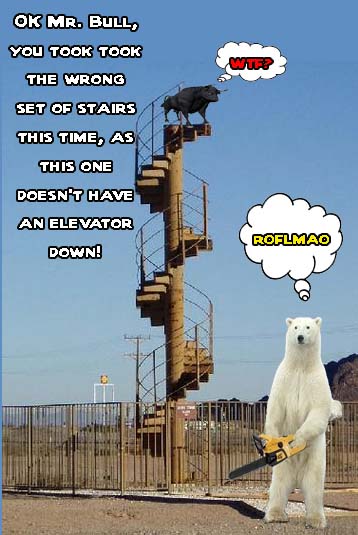

I don't know yet, but there's an angry bear wait for him below....

This movement reminds me of the countless grind higher, from the February low. Day by day, the market grind-ed higher, without hardly even a blip of a correction down. We live in a world that has clearly changed tremendously since the March 2009 low.

Computer bots (Skynet) now control the market, and they follow strict rules. Upward and downward sloping trendlines are the key to understanding how they move. Overhead horizontal trendlines are easily broken now, as the light volume allows the bot's to continue pushing up through them, day after day, with NO selling sticking.

These upward and downward sloping trendlines form rising and falling wedges. In a normal market, these rising wedges would break out to the downside, and the falling wedges would breakout to the upside. They would do this at fairly predictable times.

However, with Skynet running the show, the rising wedges don't break to the downside when they come to the apex of the wedge... they gap up, to make the wedge even steeper! The rising wedge that is currently in play now, since the 1040 low, should have broken down several times by now.

But each time the market falls back and touches the trendline, the bot's kick in and push it up more. All at the same time, the "insider's" (aka... Goldman Sachs, JP Morgan, etc...) are all sitting on their hands, and not selling anything, until a certain level is reached.

Sure, they are selling small amounts into each move higher, but they haven't started to dump their core holdings yet, as that won't happen until they get the OK from "The Powers That Be" (TPTB). When is that? I have no clue. We should dump 40 points tomorrow, if there wasn't any Skynet... but we might be lucky to get 10 points.

Unless of course... it's time to press the panic button? But the longer they wait, more angry the bears will be...

Red

P.S. Don't forget to take the time and cast your vote on the Polls I have listed on the blog. Thanks...

This statement from a site from which I gather market data (http://unicorn.us.com/advdec/):

“On 21 June 2002, data sources began reporting volumes 1000 times higher than past history, and have continued to do so. No explanation is available.”

I'm sure that some reasons are more people in the market, an explosion in options trading, easier trades via PC, smaller broker commissions, etc., but I would bet dollars to donuts that a lot of it is the bots playing Pong with prices all day.

As I have mentioned before, I had been out of the market for over 30 years until recently, and the changes are astonishing. A day in the market is exceedingly artificial, as I would imagine a visit to Disney World or a bored prostitute (I have avoided both in my life). Always the same false excitement at the opening and a cliffhanger close.

“Hope you had a real nice time today. Come back again soon!”

Hysterical Rip!

That pic is awesome!

Which one? The bear cartoon running, or the one I created with the bull up the stairs?

The bull pic, is top top comedy.

I can imagine, Something coming toward the bull, to knock him off!@

Red, I should have commented on your picture last night, had no idea it was your creation.

I couldn't stop laughing for about 10 minutes when I saw it. You have captured the situation perfectly somehow. About all you missed is the bull's ability to radio a helicopter or to sprout wings, lol.

It's like a twisted Road Runner cartoon, except the bull is even less likable than the bland RR.

I mean, I'd really like to see him in freezer wrap.

Forgive me for stating the obvious. No bears to be found; either converted to short term bulls or switched to the other side for good. After all who wants to compete with formidable machines?

http://www.theatlantic.com/magazine/archive/201…

Great article, with outstanding reader comments.

I'm still here and am still short. I took the day off from the pain since it was my b-day. CME is reporting the low on S&P futures as down 24.20 to 1076.70 at 4:11:58 CST time and hasn't updated since. Bloomberg is reporting the low as 1105. I guess CME just had a computer glitch or typo?

Hey, Monica, I missed you for yesterday's grim festivities, and hope that today will be a better day.

Stupid UK is rallying under its death cross, and will probably try once again this morning before a big tankerino. We may see 1125 in the meantime, I think.

Happy Birthday!

Happy Birthday Monica… for your present, we are going to send you a nice steak dinner, sliced up by a large chainsaw.

Happy birthday monica 🙂 … lets hope the mkt gives you a nice birthday present … u holding june or july puts ?

Hey Gang Keep an eye on Gold, it's telling us a story!! A very important one 🙂

Spain collapse? Yes, something big is hitting the fan.

Unemployment numbers reeked, too.

Close close close 🙂

Um, vital industrial centers in Cleveland, Detroit, Milwaukee, and Pine Bluffs, AR, devastated by dirty bombs, clearing large tracts of downtown real estate?

Whoa!!! very interesting 🙂

Happy Birthday to Monica!!

Not even a small gap down. It's like fighting the terminator… you can blow him up, crush him, and melt him in a pit of liquid steal, but he keeps coming back to life, time and time again.

I do say we roll over and said so in the lounge before the open 🙂

But yes, your right unreal ;(

We'll probably make a little double bottom at 1111 and rally again, lol.

I shouldn't joke like that.

SP 500 Hourly trend line break trade with MACD negative divergence

http://niftychartsandpatterns.blogspot.com/2010…

These bullets that you do are great, San.

There was some recent discussion on Humble Student's site about using some kind of Twitter widget to flash charts and comments. If you got into something like that, I'd definitely follow you.

Out of all longs early.

But holding off short adds as of yet. negative divergence is more pronounced IMO but rising wedges can go on and on. So now Mostly cash and some tza and drv . About to add a bit of spxu and typ.

Well done, Jim!

Got a target?

I think S$P goes back to 1050.

Just do not know how far this wedge takes us. Could be over today if it breaks the wedge.

can't take a whole lot more bad news can we.???

Remember, Monica seen 1076 yesterday… which is likely a fake print, not a mistake. That could be the target for Friday's close?

I'm surprised that you're looking for a quite low low rather than just a little rest for Ferdinand to catch his breath on the way to 1140.

I'm pretty open-minded about where it will go. I sure won't touch any position today.

You guys are probably right iam seeing a 1180 level before the drop to 1150

If we have really huge down days today and tomorrow, then I would expect a small 1-2 day rally then resume to find the 'real' bottom, wherever it is, to be confirmed by put/call ratios, etc. I think that would be followed by a pretty big rally, at least 50%-100% of losses.

If this bear rally is dinky, then I'm looking for 1130 or so followed by a bear market.

Important thing I have to do this time is cover somewhere.

Who told ya a rollover 🙂

Red Rover, Red Rover, Roll Over, Roll Over!

SP 500 Trendline break trade updated

http://niftychartsandpatterns.blogspot.com/2010…

I like it! Let's all get out our pencil erasers and make that line disappear… aka government style.

Sorry I am not getting the replies to my mail box properly. I am not able to reply to your comments. will update later

Sorry I am not getting the replies to my mail box properly. I am not able to reply to your comments. will update later.

TZA June $7 calls, $0.08, get 'em while they're hot!

OTM options that expire tomorrow are not a good r-r, imo.

They are $0.04 now.

For $0.04, I'd watch a monkey relieve himself. 🙂

Just because something seems cheap doesn't necessarily mean it is. Buying options this far out of the money a day before OPEX is like betting on black when 33 of the roulette tiles are red, imo.

Everybody here seems to hold the market makers in such contempt, I don't know why they'd be so eager to give them their money.

If you wanted to trade June options, IMO you should be trading ITM. I don't like that play, either, but at least you'd be holding something of value.

It is all gambling, with varying risks and rewards. This option goes in the money at 1090. I think we'll see that today.

I wouldn't bet the farm, of course.

I'm glad to hear it, and risk/reward is the name of the game. I don't like either on this trade.

You need a 10 percent move in TZA to hit the money, more or less, which means you need IWM to trade around 64 by tomorrow. There's gap support at 65.35 and at 64.94, with the 20dema and 20dsma above and below as additional possible support.

The Russell might fail. Price action today looks fairly supportive to me (the take out of yesterday's lows spurred buying, not selling), but if today's lows are taken out, the bears might yet run.

There are much better risk/reward plays for downside than OTM June options, IMO.

I have large amounts of TZA equity, just happened to notice the option price.

$RUT has been hit hard by this market so far, so TZA seems like a pretty good play.

I have noticed that none of the bearish ETFs are anywhere the levels they were when the indexes were in similar straits in February and last fall. To me, this is a sign that we're not done correcting yet.

The reason the levered ETFs are trading below their previous highs has nothing to do with them being undervalued and everything to do with the way their pricing works. Their leverage is recalculated daily, so in anything except a strong trend they will decay as a mathematical result of their compounding characteristics.

For that reason, they are terrible long-term holds, except in strongly trending markets (e.g., DRN from mid-Feb. to the end of April). If a strong trend take place against a levered ETF, the losses will be magnified beyond their nominal leverage.

Yeah, I'm not planning to leave -3X ETFs to my children. However, contrary to popular opinion I think they are a good place to be overnight should the SHTF like I think it might the next few weeks.

Overnight holds are no biggie (obviously the market can still move against you, but the compounding effect is less). I only wanted to point out why they were trading below their February highs, and why expecting them to trade like low-wattage futures is a mistake, a mistake a lot of people made last year.

Vixes are not supporting the increase selling pressure at this time.

Be careful on adds.

I think VIX has broken out to the upside, but STO has a negative divergence so it looks like a bullish time for the next 4 hours.

Hoping for a sharp sell-off late in the day and to hit 1075-1080 tomorrow morning. I will then liquidate puts, at least.

Going to keep an eye on VIX and this chart to time selling the ETFs, I think:

http://1.bp.blogspot.com/_Qe2EUehGkjM/TBl1chzTD…

When you say vix has broken, it looks like its bounced off short term trend line but i see no break??

I play particular attention to the vix % changes during the day to get a feel for intensity one way or another.

Today seems very complacent to me so i add just small positions on shorts.

To me, it looks like it had been in a falling wedge since last Tuesday, that it just broke out of yesterday. From that, it ought to work up to its old high, but the path will probably meander.

Dow jones next main support for the bulls

http://niftychartsandpatterns.blogspot.com/2010…

I think if we don't blow through 1090, this is b of 2. At 1090, c upward equalling .618 of a gets you to 1136 about where the 50d sma will be.

http://4.bp.blogspot.com/_TwUS3GyHKsQ/TBk-DuniD…

I am in your Camp on this one Diablos 🙂

H & S ON 15 MINS SPX?

You mean the one pointing at 1075?

the neckline is around 1102, so probably 1080

1075 close enough I guess

There's another formed over the past week, with the neckline 1090-ish.

Sounds good!

be careful with H & S because these days the success percentage is less than 50%

1080 looks like a pretty good target, being a 50% correction and having a lot of support on the 15min chart

Get ready.

They are going to run this up hard at EOD.

Anyone that thinks this is normal movement in the market is clueless… IMHO! This is 100% controlled right now, and by tomorrow the 60 minute chart will have worked off the overbought conditions and ready to rally on Monday. WTF?

Red,

I have intraday signals, says the DOW intraday… tops at 2:20 EDT. We'll see.

Looks that way now!

Hey Recnadnu5,

I had great signals, forecasting the mid-day top..they worked today. Yay+1

Like i said Yesterday its predeternined to go to 1140.

Its just a question if they have the momentum to pull it off. This AM I thought not when I got out of my longs.

the vixes are showing us nothing so it can go either way on light trading.

10 year T bill yields have fallen out of bed. If the usual relationship held, we would be at 1050 right now.

Dow jones triangle in 10 minutes chart

http://niftychartsandpatterns.blogspot.com/2010…

I am chart silly now.

have no clue how its going to end?

Hi Jim

I know REd doesnt mind if I tell you about my daily EKG.

It started on March 9th, and now has a 67% positive record

of picturing the day's flow of the spx. dowjones,

IT is published EVERy day at 8:30am for the day at hand.

SOME of the Missed graphs were PARTIALY OK, but I dont want to count them unless the EKG was within 75% of being correct

It does NOT give you EVERY Nuance, but does catch the important

turns and flow of the day

If you can use it to benefit your trading- OK, thats great!

IF not, then I wish you the best either way

Jay

http://jaywiz.bogspot.com

link isn't right

Something wrong w/ link.

Link is found under my Astrology sites category…

http://jaywiz.blogspot.com/

Dow jones Head and shoulders pattern. The pattern will become invalid if dow goes above 10410

http://niftychartsandpatterns.blogspot.com/2010…

Red,

QQQQ 50 day trap..with this signal, it Takes a lot of buying momentum to get above the 50 day, today's high 47.14. QQQQ probably down on Friday. headed toward 20 day, approx 45.2 -45-8

LOW, no more gov't housing loan assistance. I should have known a little earlier, like 2 weeks ago, this stock would re-test it's last lows 21-22…..21.5 is the long signal. ( double bottom) imo.

Hey Red,

I am an FX trader(scalper) who spends very little time looking at charts greater than 5M. (other than a quick glance at Daily or Hourly at the beginning of my day) What I want to know is where do the preponderance of fake prints show up? Which sites, charts, etc are regular fakers, if any? thx

I wish I could answer that question, but I find them many different places. The Nasdaq.com site, money.cnn.com, cnbc.com, and most are found looking at charts in my own account (Ameritrade, which now owns Think or Swim).

So there really isn't any one location, you just have to keep your eyes open on all the major sites, and look for mistakes.

Thanks Red

Bear case IS NOT going to play out. We had every reason to drop signficantly yesterday and today but did not. All it's done is given longs the opportunity to accumulate positions over the last 3 days for the move higher.

Everyone was expecting tons of volitility today and tomorrow, but this is exactly what market makers want. They will probably keep us at this same level tomorow so that both long and short option holders get hosed tomorrow. Then it is up, up and away.

The volatility is flat.

These movements are manipulated on very low volatility , volume.

Etc. Vixes .19% rut vix 1.44%. that's nothing

It definitely looks like 1136 will play out.

j

BP is going to add more float…$10Bil more..watch GS push BP up, going into this new offering, is my best guess.

Wow sure glad I missed watching my puts getting creamed today in real time. I was out with lunch with 10 guys from my company and they are bullish as hell. Just buy and it will go higher was the comment.

Well, I hope they don't need access to the internet to trade, as Obama is going to shut it down when he feels like it. Crooked bunch of gangsters they all are…

The crocks are fishing the retail in this way. When it does finally turn it's going to be sudden and hard. But it will be seen as a buying opportunity from the masses then they will be taken to the cleaners.

The only thing taken to the cleaners is me!

Something is just not right. I wish I knew. Look, tech is going to blow thru their earnings, I see that. But conspiracy theories aside, one has to believe that they are running this higher. I just cant believe that the H&S will play out as it is all over the web. Look what just happened. Cramer announced that the run was over on Street.com and the market reversed that day! Yet his minions remain! What up?

Don't blame Goldman becuase they are the best at what they do. Blame the enablers. The TARPies are making money pushing this thing, pulling out their profits and handing it back to Uncle Sam.

Goldman is taking its lead from the CEO of the USA.

Dow jones end of day analysis

http://niftychartsandpatterns.blogspot.com/2010…

Nice charts. Read Colby's book and you will see that the 200D does not correlate at all to future market action. Although the gansta's use it all the time. Lets hope the clowns on CNBC pronounce the correction over tonight. Then it will be hamma time!

Two dojis to complete the B wave top in 1987 (and 1929). Now let's see if the SP can get below 1087 tomorrow.

B-wave? How about an ABC you later in the poorhouse wave, cause thats where I am at!

Solving the Cramer riddle, he's predicting some nasty stuff for tomorrow. ………………And Cano's the man this year not Zobrist.

Sorry for being out of the loop. What did Cramer say? And who is Cano? what is he saying? Please elaborate.

I'm just having fun with my fellow troll. He seems to be a fantasy baseball enthusiast…….As for Cramer, it's not what he said but what appeared on his show awhile back. Can't get into it. Maybe it'll show up on a youtube video one day.

Cobra has a chart that uses CPCE trends to identify market tops, including temporary ones. The technique is quite accurate, though sometimes events must unfold a little more in order for the user to fully understand what happened.

For example, it flashed a top signal for Tuesday, but it is possible that today's doji was the low relative to that high (if the market were to take off from here).

I don't think the market is going anywhere. I think that NYMO has to unwind first (being pumped full of low-volume sunshine and rainbows). This should give us two things: (1) a lower low than we have seen so far, and (2) a divergence in NYMO that will confirm that the final low has been achieved, which has been lacking so far.

Here's the chart I referred to: http://stockcharts.com/def/servlet/Favorites.CS…

Best to wait until after 7pm est to make sure that the final data is in.

Edit: Bottom line, I think 1087 is doable tomorrow.

Leo:

You may get your wish, courtesy of Daneric's EW:

http://2.bp.blogspot.com/_TwUS3GyHKsQ/TBqAHtx3w…

My wish would be a little deeper correction then that… starting with the first 1000 points down by 10 am… LOL

LOL. But as a smart man you know that a 1000 point drop will halt the exchanges. Better to take it a bit at a time.

He He He… we need “Fat Finger Freddy” to show up for work tomorrow drunk. Maybe he'll unplug the “kill switch” for the 1000 point drop too?

I have a better idea. Maybe we should give the BP guy one day to short his stock and the whole market in an effort of quickly capitalizing the 20 Billion fund. It would be for a good cause too.

Hi.

I am not a troll nor do I know what one is! Unless you are talking about Shrek.

Also, I am not a fantasy baseball fan.

Its amazing to me how quickly people pass judgement.

I picked up the handle as I was watching CNBC and Joe Kernan was talking to Becky about the Beatles and he asked her if she knew who the eggman was.

Thats it. Simple. Not troll nor bird nor even frog, just little old me

Underdog.

http://www.youtube.com/watch?v=Nnpil_pRUiw

He He He… we need “Fat Finger Freddy” to show up for work tomorrow drunk. Maybe he'll unplug the “kill switch” for the 1000 point drop too?

SP 500 analysis after closing bell

http://niftychartsandpatterns.blogspot.com/2010…

I agree with Red. Although you do post crisp charts. 🙂

Too many people are waiting for the R Shoulder to form.

It cant be that easy my friend. But I dont buy into the bots monitoring patterns. Retirement accounts are not traded on patterns they are traded on emotion. The big money comes from the hedgies and their ilk. They have already sunk the retailers. Now they are flash trading there way to repay the Tarp.

Red is on to something. Try and think like a crook!

Very funny and true. great blog.

Red!

I don’t think SUN should be this high…34-35

SUN CHART

Testing…

SUN chart