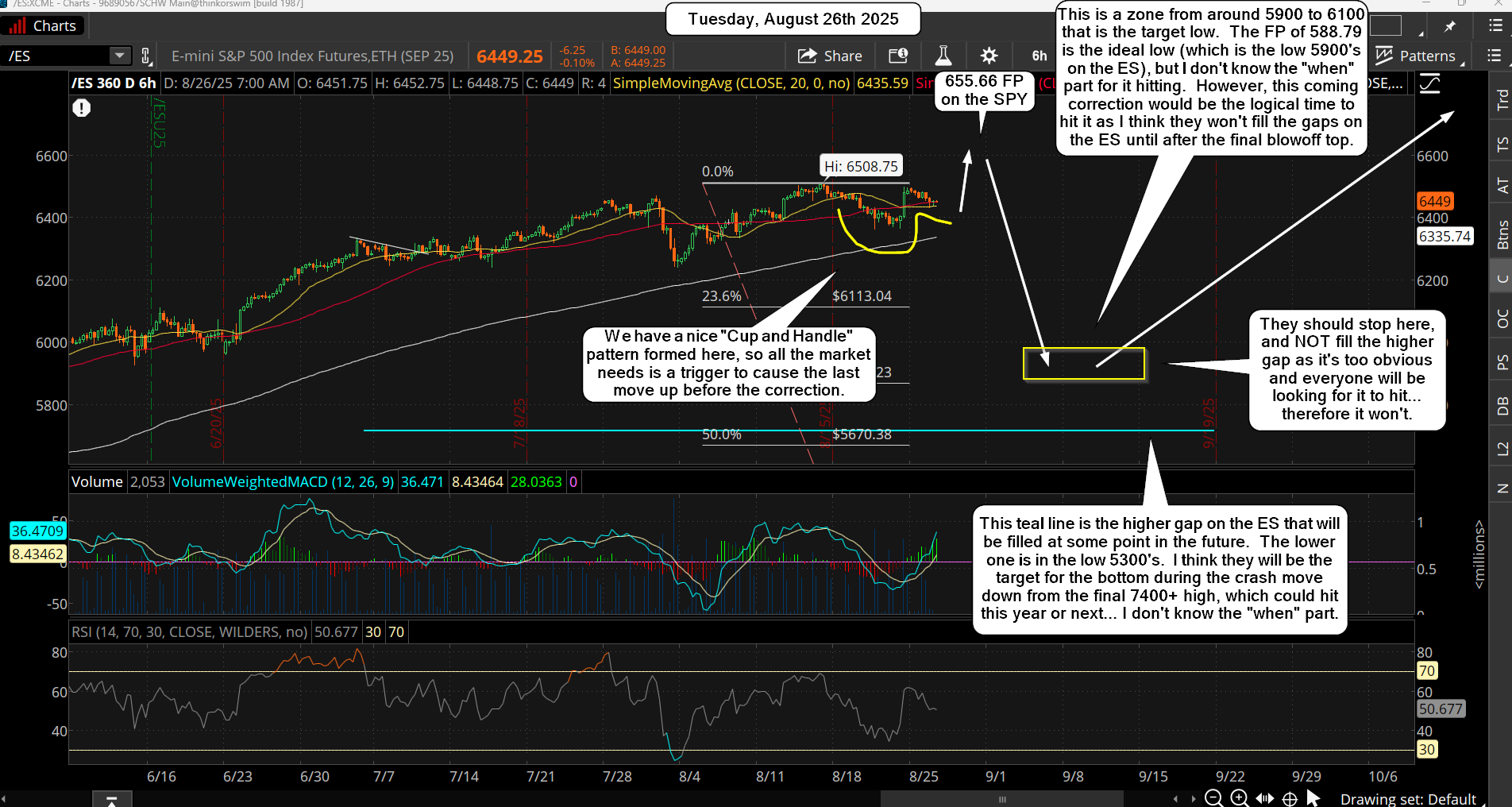

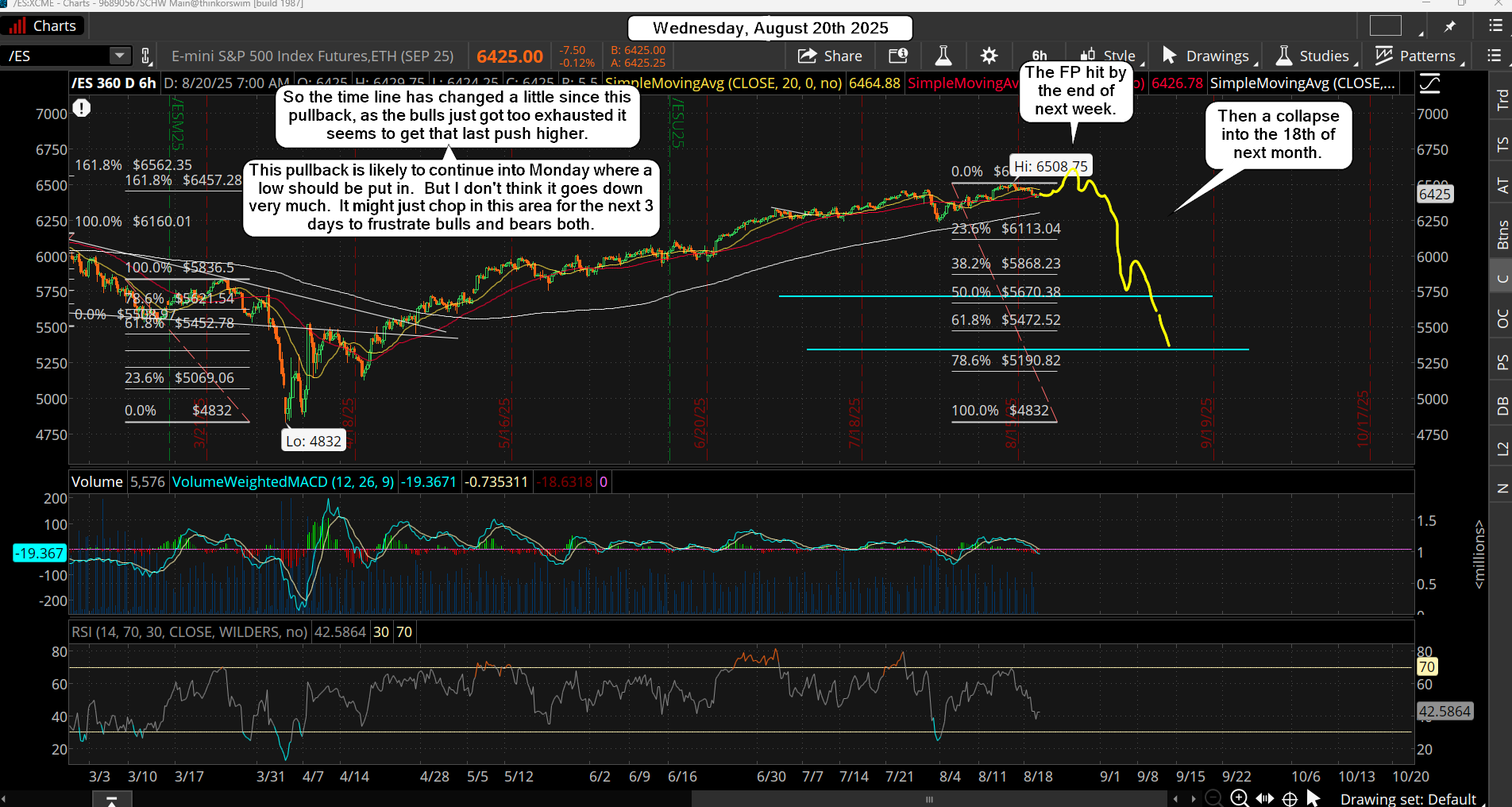

Well, we may or may not have topped? I say that because another new FP was found and it's at 640.44 on the SPY. That's only about 200 SPX/ES points lower now, so it's possible that we might see some crazy move happen where we drop to that level right after the FOMC meeting and then reverse back up on Thursday into Friday where we could (I know this is crazy) reach 6800 on the ES to take out the stops above the current all time high of 6696... and then we fall off a cliff next week. Below is that new FP on the SPY...

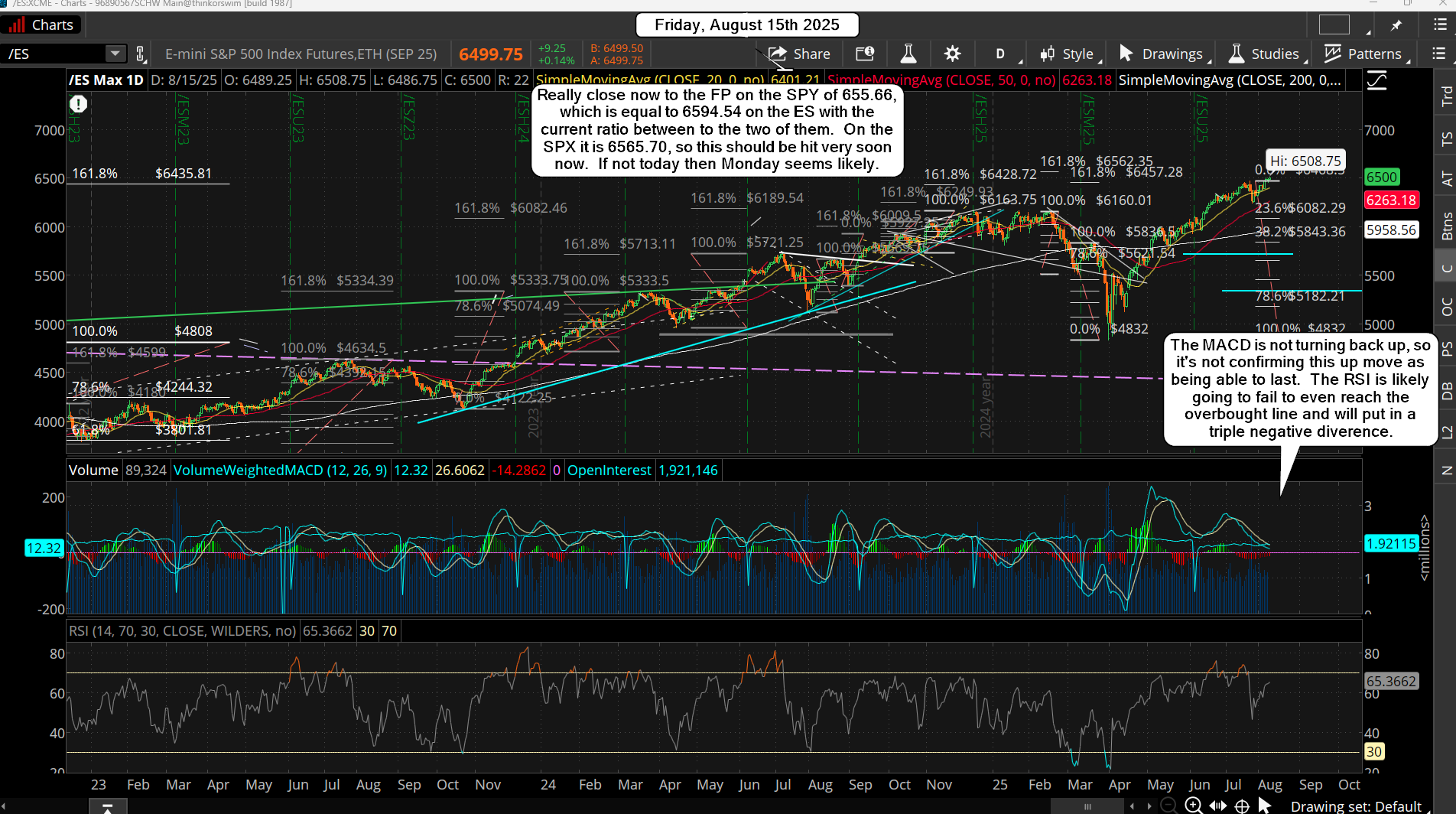

Now I said yesterday that I could go over all the prior FP's (at least the last year or so of them), and that's what I've done in the chart below. You'll see that most all of the FP's produce a nice "turn" up or down after they are hit, but a couple of them the market just "paused" and after some time it continued in the same direction. One of them was definitely a failed FP as it never hit and "paused" or "turned", which is the one in the March-April drop. There wasn't any reaction at it, so it failed for sure.

Currently we have went past the 655.66 FP and appear to have topped at 662.65, which isn't that much when you look at it on the chart above but point-wise it's a lot... especially when you short at the FP and have to ride out those points against you. I'm not sure whether or not to label it a failed FP as we have started to go down some now. I'll need to give it more time to see if it turns out to produce a nice turn or not.

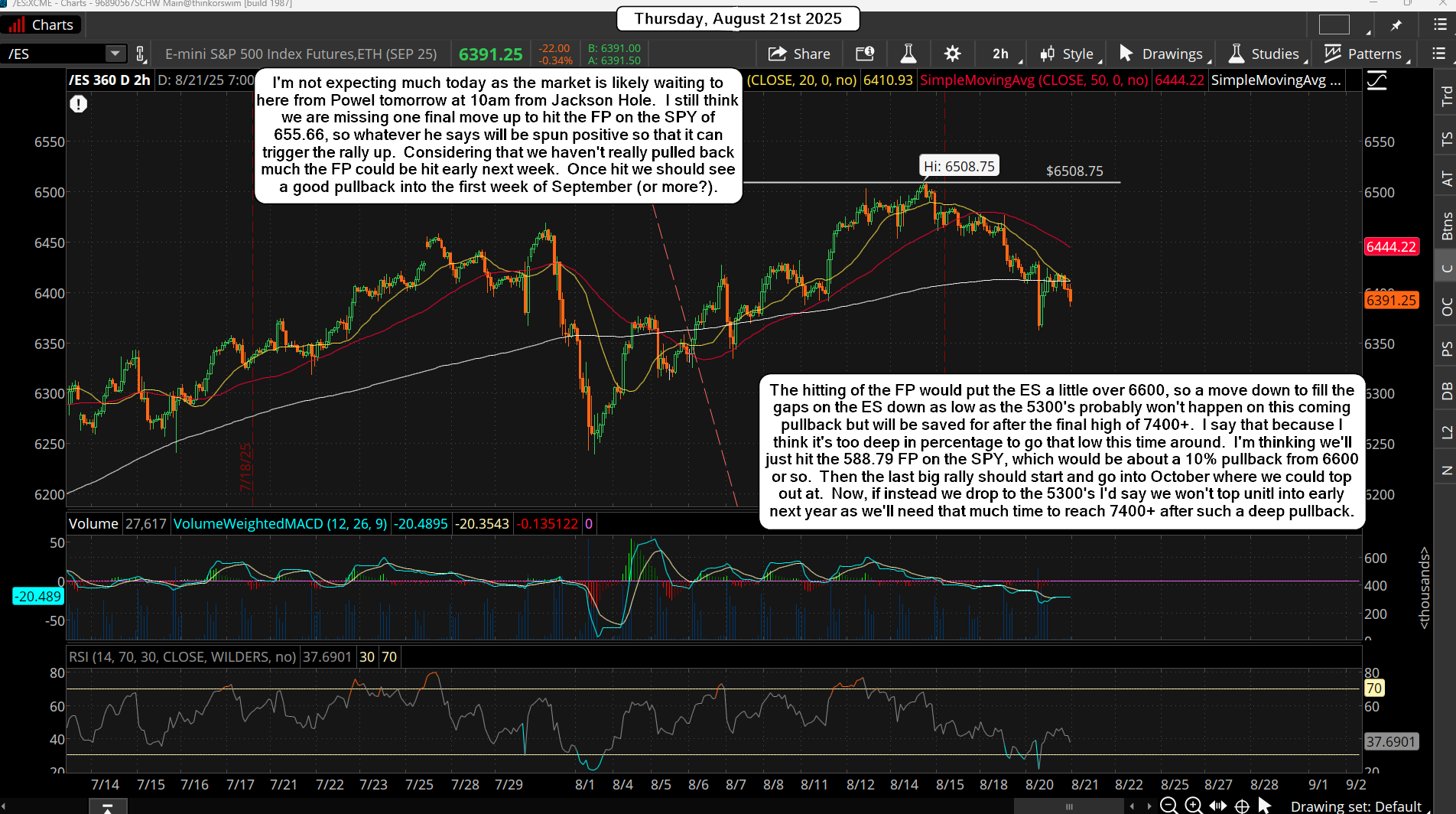

If we drop to the new FP of 640.44 then I'll label it a success, and then if we rally back up to 6800 or so into this Friday (I don't have any FP for that target) and rollover again I'll be looking for the 588.79 FP to be hit over the next two week. Or, we just by pass the 640.44 FP completely and continue lower all week... or maybe we bounce small from it for a B wave up with it being the A down? But I have to think that if we get a fast 200 point drop today we will see a very strong rally from it tomorrow and into Friday... that's "if" too many bears are short.

If this the drop catches the bears sleeping and traps the bulls then we should only go sideways to slightly up on Thursday/Friday after hitting the 640.44 FP. Lot's of possible moves here, so just be ready for something tricky. Oh... the other possible move is to go up to the 6800 target after the FOMC an into Thursday or Friday. But that 640.44 new FP means something, so it has to come into play some how I think. We'll see.

Have an blessed day.