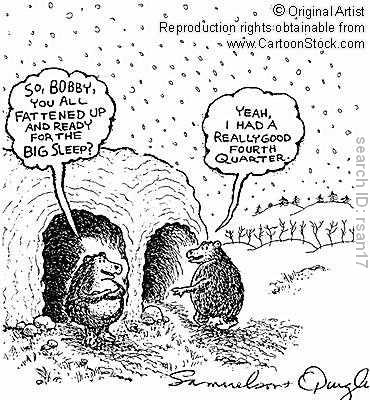

Is it time for the Bears to go back into hibernation?

Yesterday I called for the 1070.50 spx print to be hit, and it did exactly that today. But, will my call for a sell off tomorrow be right? I doubt it, as my luck isn't that good. I may get a few calls right from time to time, but tomorrow looks quite bullish right now, so calling for a big sell off is probably just wishful dreaming on my part.

The daily chart is pushing the market up hard, from oversold territory. It's about to cross over the zero level on the histogram bars... quite bullish. It could easily last until opx next Friday... or longer? And, it could just as easily roll back down tomorrow too.

There is no way of knowing how high it will go, with regard to putting in higher histogram bars... which should make a higher price on the overall market too.

The 60 minute chart is overbought, as the daily keeps pushing it back up every time it tries to roll over. The 15 minute chart has already dipped below into oversold territory and is now coming back up now. That's what caused the run up into the close, as the 15 finally curled up and crossed back above the zero level into positive territory again.

Overall, tomorrow looks very bullish with the daily and 15 minute chart ready to push the market up to the next level. The 60 is overbought though, which could limit the upside, and in fact it could make the day just trade sideways as the charts aren't all lined up together pointing in the same direction.

Honestly, I don't see much hope for the bears right now. The light volume will keep the market from selling off hard. I think a big news event is needed to bring the market down now. What could that be? I don't know? Maybe nothing, as they may want to take it up to 112.41 next week first, before they sell it off.

To sum it up, a slight down or flat day is bullish as that would just be a pullback in a move up higher next week. A gap up and crap could be very bearish though, as that might indicate that the sell off has started. The last hope for the bears tomorrow is a hard sell off... one that would make the bulls bail out, that just went long. But, I just don't see it in the charts. Sorry about that (I really am, as I'm short the market... so I'm a bear right now).

So the bulls have the ball for now, with 4 downs to go... at the bears' goal line. The only hope for the bears is a fumble. (Let it rain, snow, and hail down tomorrow on the field... go bears)

Red

thanks dont post much just appreciate your site

Thanks… I appreciate that.

Thanks… I appreciate that.

Today's was very similar to Tuesday if you remember. We gapped up and faded entire gap and beyond. Closed on what I call a “PPT-style” rally. IMO, history cannot repeat twice in the space of 4 days so I expect strength early and bearish reversal in the afternoon.

I hope you're right Troy, as I'm short now and this rally is very painfully. I'd love to see a big huge sell off tomorrow.

Red, the bears will prevail, but probably after you and I are killed!

LOL… that's the way it always is.

Monica, you are obviously a perma bear. Mid to long term iam also. But hanging on to short positions when the ticker is doing something else does not make money.

i made a killing on my bear funds before this 500 point push back and again on the rise.

I hope you are playing both sides.

Looks like any possible sell off is most likely delayed now, as this FP will probably be fulfilled first…

http://reddragonleo.com/wp-content/uploads/2010…

It should take the market up next week, as I'd estimate that this target could be reached in 3-5 days. Thanks for the print 🙂

Red,

i think the 24 area on vix takes us up to the 50day around 1100.

Its making sense since earnings are starting soon.

Yes, it very well could take us up that high Jim. The 61.8% fib area is next though, and that's around 1085 or so.

mini tank on the Euro happening overnight…..nothing huge but taunting some PRS133 channels

http://oahutrading.blogspot.com/2010/07/3-strik…

None of the blogs have mentioned the hammer on the NAZ. Interesting.

I am on record as guessing that we will fill the gap plus x, where x is a headfake.

Worst case is that x takes us a tad below the previous peek.

We are then headed down. IMO

However, I do not see the daily as

We will not know this day until the last hour.

i am going to yoga to get in touch w/ my feminine side

LOL… Good luck with that Jim. Be sure to loosen up before trying to stretch those old muscles of yours… he he he.

Who are you calling old????

S&P 500 Support and resistance lines

http://niftychartsandpatterns.blogspot.com/2010…

Looks like it could run a few more days before coming to the apex.

If it gets it will take some time. If the support breaks we may see some action today itself

Yes, “if” the support line breaks, then we could see a nice fall.

if you are looking for allot of move today don't a whole lotta chopfest

http://hotoptionbabe.com/blog/35-bullish-short-…

I agree totally Anna… probably a lot of nothing today.

Anna – I like the real picture of you! Anyway, I may not be around much in the future guys but I will be reading. Thanks always.

Hey Monica thanks so much 🙂

for today or longer?

I need to try to stay away. Not good for my soul. But I really do admire you guys and thank you so much for all the support you have given me. You are a great trader Anna. Kudos to you.

oh no we will miss you so much, but please you have my email stay in touch ok ?? 🙂

most definitely! You and red are seriously the best. And Red, I love you for opening my eyes up to things around me.

We'll miss you Monica. Stay safe.

:'-( tear

U no gives loves to me, 2? =snif= =grin=

I also understand. Too much stressing about whether things go up or down. We probably all need a vacation. 😉 Take care of yourself, and enjoy the real world a bit!

I know what you mean, I've actually took time off from 2006-2007 and it gave me a fresh new perspective. It's amazing what you'll see once you step away from the daily tape.

Nice call on the CSNT Woody.

Would have been better if ST had actually let me short it. =cries=

Yes, I'm not surprised you couldn't!

ST won't let you short stocks under $5. Time for a new broker? 🙁

When and if we get down to the spu 1045 or so today or monday, I'm buying the 1080 calls for the opx, hopefully we hit the trend line, now around 1090, by Wed ?1086 or so.

Then thurs or so buy puts (expire next day). On friday we have BAC (bank of america) earnings before the open, also citibank and GE.

For GE, don't they have a lot of overseas business? with the high dollar, this could have cut into their earnings.

also friday 10 am Umich sentiment. Last month was good reading. But confidence reading from the other goup (confrence board, I think) was down 10% from the previous month! Will this drop be reflected in U Mich reading on friday. ie Mich. reading has to get in line.??

Fundementally there is a (hopefully) decent possibility of a lot of bad fundementals a week from today (friday) to send this market way down??

I don't think this is nuts do you?

Then I'll have enough money for my 5 min Renko charts to tare ass!! I'll let you know how I make out.

Hopefully I'll be able to brag like hell.

Or, I will go down in a ball of flames

Rising Wedge

NEGATIVE DIVERGENCE

http://niftychartsandpatterns.blogspot.com/2010…

Coca Cola trading near the top of the range

http://niftychartsandpatterns.blogspot.com/2010…

Hi Anoopsan,

I tried leaving comments at your site, but I can't get through all the bells and whistles, you have your comment system set to.

Comment ended up lost, and now I can't get my gmail account to open. anyway,

I think KO double top 53 is a better short sell signal. Folks will be lifting those defensive stocks, this cycle.

Hi zstock7

There seems to be lots of resistance in the 53 area as well you may be right.

I will try to improve my comment system.

Snorrrrinng now….

Positively… BLAH! Did all the traders leave for another long weekend? 😉

S&P 500 Hour trend line is broken

http://niftychartsandpatterns.blogspot.com/2010…

Thanks San, but some how I think it will still close flat today.

Thought this interesting…

http://screencast.com/t/YzU2OTMzZ

Weiss this am came out w/ a 1090 target.

Here we go!

EOD of ramp job again. I mean cmon, how blatant is the pump manipulation on pathetic volume

As long as the bears come back to work next week…. 😉 They DID work hard last week and most of this week. Everybody needs a vacation. =grin=

Rally time11

Dow jones approaching the resistane zone.

http://niftychartsandpatterns.blogspot.com/2010…

We are likely going up next week gang…

I am a bit nervous holding over weekend but I think they rally through Google next week

Hi Jim,I closed out GOOG today. ( 434 entry) Now I wished I had raised my stop loss, instead of closing it out. GOOG going higher on earnings.

AA, should go higher on earnings too. I imagined AA was up $3.20 or 28% in AH, after they reported. silly imagination.

You could be right, who knows. BUT at some point before OpEx, they're gonna have to harvest some of the calls bought – I believe there have been MANY bought by the retail crowd all through the decline these few weeks as I believe this last ramp job has been anticipated by many.

There will be a pullback next week, the question is how deep. Enjoy the winnings bulls, and relax bears. Fight again next week – have a good weekend all.

I'd say the pullback should be Monday after a ramp up in the morning to squeeze out those that went short today. How deep is a question I can't answer.

I think we will hit the 112.41 FP that I got a week back or so.

http://reddragonleo.com/wp-content/uploads/2010…

That would be over a 4% gain to hit that FP. That's enormous!

Dip on Monday, and maybe Tuesday, then a ramp up to opx to hit the FP… which would destroy every last bear.

Lots of fear in the bear camp this weekend. IMO, we're between 50-61.8% on the fibs in SPX and DJI for this bounce. On the traditional “leaders” like NASDAQ and Russell, they're both around 50% or below. Transports likewise around 50% retrace.

So far, this looks like normal retrace action except for financials which seems like they've taken a life of their own for whatever reason.

As I have said, we will ramp to fill the gap then headfake to x. Where x is at, thats anyones guess. We may take er up to the previous peak.

CNBC is bearish hence the rally. This run was actually predictable which is usually not the case. I mean we have had so many low volume run ups. I have removed volume from my intra-day indicators. I find them somewhat useful on the dailies.

I knew we would rally when the MA's crossed as CNBC hyped the cross and as many have pointed out history dictates otherwise.

What gap are you referring too? We filled the one today around 1075, is there another one I'm missing?

On the Naz

Like you said, this rally was predictable… Too predictable.

It's the perfect way too fool the most people. Just keep everything predictable for a certain period of time, and then once everyone gets used too it… change the game plan.

As long as the mass media stays bearish, the market could rally higher. I have a FP of DIA 118.16 (about 11,800 Dow), and it could be hit within a few months… if this large H&S Pattern is a huge bear trap?

Of course there will be pull backs along the way, as I expect Monday and Tuesday to sell off some. But, this “could” turn and rally for several months? That would surprise the most people… in my opinion.

AND would lead to an October crash scenario.

Hi Walrus,

Can I call you Walrus, instead of the eggman? kidding…

I like Red's 11,800, and I like your OCT crash. Good stuff.

Dow Jones analysis after closing bell

http://niftychartsandpatterns.blogspot.com/2010…

5 day forecast, up Mon, Down Tues. doji WED, up Thursday, FRI doji.

Hi Red!

FDO, looks like a long, at its current price. Most retail isn't moving gynourmous, so I'm Taking small profits on FDO, and then repeat the buy at a lower low.

BP PLC daily chart analysis

http://niftychartsandpatterns.blogspot.com/2010…

Here's an interesting sentiment chart, I found at molecools…

I think it says, the market bottomed this week.

http://www.bloomberg.com/apps/quote?ticker=AAII…

Most people I know that don't play the markets are now bearish, some of them even expecting a crash. That has got to be the ultimate contrarian indicator. The mistake a lot of people are making is seeing that the fundamentals are deteriorating, by know traders should know it means rally.

Hi newbear,

It's summer rally time…YAY! Buy the dips.

new post http://hotoptionbabe.com/blog/36-july-opx-week….

FDO, short at 36-37