Monday Update... another Flash Crash?

(or watch video on Youtube here: http://www.youtube.com/watch?v=NE6urtuguUg)

Yes folks we had another flash crash at 4:15pm EST that put the SPY at 106.46... a 12 point drop (about 120 on the SPX)! All orders were canceled and I'm sure it will be blamed on another "fat finger" (how many fat fingers does this guy have anyway?). LOL.

Regardless of the print, Apple sold off about 20 points in afterhours from have a disappointing future outlook, and not beating the "whisper number". So, unless the banks really blow out earnings tomorrow, I'd expect the market to sell off some. How low is unknown of course, but as long as the companies reporting do a better job then Apple did, then maybe a correction down to support at 1160-1165 area would be my best guess at the first downside target.

If that breaks, then the 1140 level should give some good support. Of course all of these support levels will be blown through hard if the banks really disappoint. Let's assume they borrowed Ben's eraser, and fudge their numbers properly, which as long as they did the market isn't likely to revisit that flash crash level tomorrow (crossing fingers here, hoping it does).

Red

_____________________________________________________________________________________

Will Next Weeks' Earnings Cause The Market To Sell Off?

I think so, as I believe the market has been "buying the rumor" and will now "sell the news". With big names like Apple, IBM, Goldman Sachs, Wells Fargo, Bank of America, JPM, and several more, then odds of all of them beating estimates huge is very slim. The market has run up hard and fast over the last several weeks, and is now at nose bleed territory.

So have many of the stocks coming out with earnings next week. If any of them disappoint, or even just "meet" estimates, that's not going to push the market any higher. They all need to just completely blow out estimates, and give a stellar outlook for future earnings. I just don't think that's going to happen.

It would be different if the market had been selling off for the last 3 weeks, as then they would just need an excuse to rally, and just meeting estimates would be a good enough reason to do so. But since the market has already rallied, it now going to need a whole lot more... if it wants to continue higher.

I think the top is already in on this market, and next week we'll see some selling. I think that the trendline that has been supporting this rally since it started will break on Monday after the bell or Tuesday morning. From there, it's down hill for a few days (at least).

There are other reasons to expect a sell off too... the dollar! It seems to have bottomed or will bottom in one more day... probably Monday. It's almost at a serious level of support, that will be a double bottom from months ago. The same thing is happening in reverse on the Euro, as it's also at a major resistance level.

Since the market trades the opposite of the dollar, any rally in the dollar and the market will sell off. This will cause gold to sell off too. The earnings coming out this week will just be an excuse to sell, as the dollar will be the real reason the market will be going down.

Of course any of the companies that disappoint will help increase the selling. Apple and IBM are already at extremely high levels, and even if they come out with great earnings, their upside is very limited. The banks could save the market if they all beat estimates, as they did sell off some already... meaning that they could bounce if their earnings are great.

But, if they also disappoint... look out below! Now I don't think they will, as we all know how good they lie, but they are under a lot of pressure right now as this foreclosure issue isn't going away soon. More and more people will default, and these banks are going to take the heat for it. Whether or not they actually lose money from it is unknown? Remember, they pushed off most of that toxic debt to the America people. But not all... they will still suffer as they have plenty of freshly defaulting loans on their books, and we ain't buying that crap from them!

The banks led this rally up, and they will lead it back down. While we will likely have a choppy week coming up, as wild swings occur from the various companies beating and not beating estimates, I still see the week closing lower. Google might have beat estimates on Friday, but look at how it affected the market... I didn't see much upside, did you?

That tells me that even if every company beat estimates next week, the overall upside in the market is very limited. But, what are the odds of every company beating estimates, and the dollar breaking down lower through major support? Slim is the answer...

While the gangsters in Washington can continue to print money at light speed, they can't manipulate the larger time frame charts that easily. While they can strecth out the charts to extended levels, at some point the charts will react as they should... meaning that "They will work again"!

Yes, the government can only do so much plugging of the dam... but eventually the pressure is too great and the dam will burst. We are at that level now. The dollar is not likely to breakdown through the double bottom support, and nor is the Euro likely to breakout over the resistances above. The charts say a breakdown in the market is coming next week, and I believe the gangsters can't succeed in manipulating them to a point that they don't work at this point.

Too many events are lining up together, that it's just to hard too control everything. The dollar, euro, gold, and all the major players coming out with earnings next week too... it's going to breakdown, I can't find any way to stop it at this point.

Ok, let's throw the charts away for a moment and look at the political agenda that's out there. The election is just a couple weeks away now, and the Republicans are expected to take back enough seats to remove the Democrats from having full control in congress and senate. What does that mean?

Well normally the market likes to have a stalemate in both houses as no big changes ever happen because both parties are always arguing over the details of each bill. But if one party has control then they can push through new bills that they approve fairly easily, and that worries the market as some of those bills can effect their ability to steal money from the taxpayers (errr... I mean "make an honest profit").

Right now they gangsters have been loving the free money the Democrats have giving too them, but they are worried that the Republicans might change all that. So it's a tough call for the market, as they would like to see the Republicans win enough seats to produce an equal number of both parties in both houses, which should make the market feel more at easy... and therefore allow a continued move higher.

But, it would also likely cut off their free money supply that the Democrats have been giving them. So do that mean that the market wants the Democrats to remain in control? Probably not, as the continued printing of money will also push the dollar down to a level that the market will view as "Bad" for the health of the economy. They know that the Democrats will continue to pump more money into the market, with some new Quantitative Easing program... but it's not being working so far, and the market knows that.

It really put the market in a very confused state of mind. Which party do they want to win? I can't answer that of course, but at this point I don't think it's going to really matter. I think the market will sell off regardless of which party wins, and the media will spin the news to reflect it that way.

Also, there is more "meetings" taking place too. And when they involve a list of people that their combined wealth is 30 Trillion Dollars... you better listen! I'm talking about the G20 meeting on November 11th-12th, and the 112 members that will be there. I can assure you that they will be making changes that will affect the market. So what will they be? Will we sell off into the meeting, or after the meeting?

Well, base on the charts, we should be selling off into the meeting. After the meeting they will likely pull another rabbit out of a hat, and rally the market. What will it be? Another QE program? I don't know, but that meeting is just as important as the Bilderberg meeting and Legatus Pilgrimages were.

After all, it's probably made up of the same members. Here's an interesting link to it on Seeker401's site (Follow the Money). I like his comments at the end, and agree... we are overdue for another false flag event. It's sad but true that these gangsters will have staged probably every major disaster/event in the last hundred years. Who knows which ones were staged and which one's weren't?

However, even though the charts alone say that the market should crash over the next few weeks, that not enough for the gangsters. They will likely use this large move down to create fear with another disaster. Of course they will profit from it too, but they thrive on fear and evil too, so using this to their advantage will be their plan.

Just look for Obama to be sitting in another classroom of kids while a staff member comes and whispers into his ear that the plan was successful and the disaster has started... just like it happened with Bush and 911. Obama will smile and continue chatting with the kids... just like Bush did. Wax on... Wax off... Wax on... Wax off!

Ben Fulford reported that Japan recently located 5 of 6 atomic bombs that North Korea smuggled into their country last week. Will the remaining bomb be used to start WW3? Or just to cause a stock market crash? Will it be set off in Japan or America? Who really smuggled the bombs into Japan... North Korea of the Federal Reverse Nazi Gangster Gang? You know who I suspect is really behind this...

By the way, please bookmark and forward this post around to everyone you can. We need the people to wake up and realize what might happen in the next few weeks. These false flag events that the gangsters create are a horrible thing, and really make my blood boil just knowing that I don't have the power to stop them! I would if I could, but the only power I have is this blog and these constant posts I make about them. So please spread the word if you care as much about the human race as I do.

Moving on...

Looking over a Reinhardt's site I see that he posted a nice picture with the words "Crash of 2008" in it. The link above takes you to another page with a picture of what appears too be dear running. More likely he meant "bulls running", but maybe he didn't want too be to obvious? What should stand out to you is the date listed below that picture... "October 24th, 2010".

Now I'm not going to say that's the "crash date" or anything like that. I'll only say that the daily and weekly chart should roll over this week... and since that date is this coming Sunday, it might simply imply a "starting point" for coming crash. I will say that if the market can't breakout to new highs this week, (and I don't believe it will), the following week could be very ugly.

Just put all the pieces together folks... a dollar almost at a double bottom level of major support, the euro at a heavy resistance level, major earnings reports out this week with the news already priced in, the November elections just weeks away with the Republicans favored, a G20 meeting just shortly after the election, one missing atomic bomb in Japan, and let's not forget the ritual side of the market (from the video I posted on last weekend) that November 14th is 777 days from the September 29th, 2008 one day Dow loss of 777 points.

What more I can I say?

Red

STOP SAYING SELL OFF!!!! IT NEVER HAPPENS ANYWAY!!! For once maybe when you stop saying then it might happen. Just a thought.

He’s getting paid to say it………….lol

S&P 500 Before opening bell

We have POMO in 15 minutes (10:15 am to 11:00 am). The 60 minute chart is getting ready to go into positive territory on the histogram bars, and it looks like we are making a bull flag right now. We will probably move higher soon.

S&P 500 Near resistance level

BAIDU Triangle breakout

The spy looks like it’s forming a triangle on the shorter time frame charts. A breakout to the upside or downside should come before the end of the day.

http://www.scribd.com/doc/39575538/Trillion-Dollar-Deficits-Doesnt-Matter

I do not know if The bears will ever get out of the woods:

http://www.zerohedge.com/article/massive-63-billion-pomo-closes?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+zerohedge%2Ffeed+%28zero+hedge+-+on+a+long+enough+timeline%2C+the+survival+rate+for+everyone+drops+to+zero%29

Thanks Jim…

That tells me that the market will likely fall tomorrow, breaking the support line from the rising channel it’s in. Then on Wednesday, it will reverse and go back up as the POMO money will help the market backtest the broken trendline.

After that… who knows? I knew was going to be choppy this week.

Trading started with asia and london side looking like they might be in for early short entries however due to the news which was released just now everything shifted into buy gear as the companies earnings came in didnt really expect to see such a bounce.However with the buying time over and no more news coming out from now till closing things might stabilize around the region of 11050 i am however hoping for it to drop and close below the 11000 mark before end of trading.Todays POMO amount was relative big but overall i dont think the effect was really strong.This might just mean that overall traders are getting either wise to whats happening or that they are getting more cautious now.Once again they are stuck between 11100 and 10900 cant go up or down but once a clear move is made alot of traders waiting on the sidelines will be jumping in.

Yes, I agree… No one wants to go long at these nose bleed levels, but they are afraid to go short. The POMO money (which was very large, as ZH pointed out) only keep the market from rolling over today, as it clearly didn’t produce much of a rally up.

I also think we will sell off into the close, and be down again tomorrow. Since Wednesday will be another POMO day, we can expect a bounce on that day. How high is unknown, but the effect they are having on the market is certainly getting weaker each time.

The earnings are going to have to rally this market higher I believe. But, good earnings are already priced into most stocks, so they really have too beat by a lot to produce any really big move to the upside. I still think the overall week will end down, but be very choppy on a daily basis.

Leo,

The triangle of SPY in hour chart. I hope this is what you have mentioned earlier.

SPY TRIANGLE PATTERN

Yes, that’s what I was looking at. I do believe a breakout will happen by the end of the day.

Breakout looks very much possible.

One of the few tech methods that stands strong is one of the oldest, Fibonacci.

The trick is where do you start and stop the 0% and 100% lines. The answer is not always obvious, and often running form top to bottom of a 5 wave or 3 wave pattern works well. On my ES chart 1040 is roughly the bottom. See attached.

Check the “total market” DWC, we are also at an important Fibo. Investor complacency is high.

And Finally, right before the elections — “The Housing Boom is Back”, see newspaper headlines. I think I am going to buy some lemmings and hang out with them, at least they deserve some respect, 🙂

http://oahutrading.blogspot.com/

Seems like the last time we had the major media printing extremely optimistic stories, the market sold off shortly after that… but I can’t remember that far back.

well there is about another hour and a half to go before closing and somehow the market seems to be floating right now drifting upwards slightly.Dont really think that another bull run will happen but at the same time dont really think a huge sell off will happen before closing

The market is waiting on Apple and IBM’s earnings report after the bell. Not much is going to happen until then.

hmmm i see in that case give and take a little pullback today might end up at around the 11050 region before giving it another go tomorrow.Ive noticed that for the past few days asia side has started the day downwards but it always pulls back before the starting bell.States might be bullish but looking at asia and london they seem to be pulling the brakes alittle.

Dow Jones futures near resistance area: CLICK HERE

thanks anoopsan well they wont be able to break that 11100 for today at least. Im just hoping for the pullback to the 11050 mark before it closes its at 11062 right now with 4 mins to close come on bearssssssssssss

holy crap did that just come in ??????????

Does anyone else see this, or is this just an error on TOS?

Yes, and this on came in on Friday…

I don’t know what to believe, as they could just be real errors at TOS? This gold print is showing up again today too? Not normal, as in… that’s not how the normal FP show up. Strange?

Same here red:

http://stockcharts.com/h-sc/ui?s=SPY&p=D&yr=0&mn=6&dy=0&id=p06006452905

Thanks… I thought I was losing it for awhile.

This market makes anyone with a slightly real perception of reality loose it.

HMMMMMMMMMMMMM well there is always the tri factor to take into consideration by right if the market crashes to that degree then everyone will be throwing all their cash into gold or some other safe heaven to ride the storm out.For both gold and spy to show something of that nature and taking into mind that they are only a few days apart i believe something is either seriously wrong with TOS orrrrrrr something huge is coming.I know this is a prediction system but is the track record for TOS above 90% ??? if that is the case im closing all longs right now…..

Well, the whisper number on Apple was $4.75 and they just reported only $4.64 a share. IBM beat earnings, and we still got many banks coming out tomorrow and the rest of the week too. All in all… it makes for a wild week.

Red do you mind checking to see if anything of the same is showing up for the DJ30

Both the Dow and the DIA are normal. Only gold and the spy are showing “strange prints”…

i see thanks for checking but if SPY goes south its only a matter of time before everything else goes i can never tell which one is leading or lagging the DJ30 ,Russ or SPY but from a chart they all react the same way

http://cs1.it-finance.com/CapitalSpreads/itcharts_lightplus.phtml?key=ef7de8f48bb40b9a50f9062a8fdbca1b&uid=F39F6F5427D3CC68D91EB724393A64AD&id=51156

Leo,

Fresh out of the oven.

This is getting ridiculous.

Thanks Jason,

I see that too… it’s posted below. I thought it was just an error at TOS, but it’s showing up on Stockcharts too.

hold on boys a storms brewing if one is wrong then maybe a system error but showing up all over the place ?????????? Somethings coming and its gonna be huge

It was halted, but I guess it’s trading again as it’s down 20 points in afterhours, trading below 300. Ouch! Poor Steve Jobs…

Yes, i just noticed that after i posted mine. 🙂

This is just getting way out of whack now. I haven’t even shared most of what i saw earlier. Here are some latest snaps of the same.

Strange print with SPXU.(inverse sp etf) It was up 2% while the SP was up 8 points. I noticed a lot of strangeness looking at Ron Walker’s stock charts page. Had me wondering what was real and what wasn’t. QQQQ went from up to negative and this was after 1pm west coast closing time. I read on another site that Apple’s trading has been halted but I haven’t investigated any furthur.

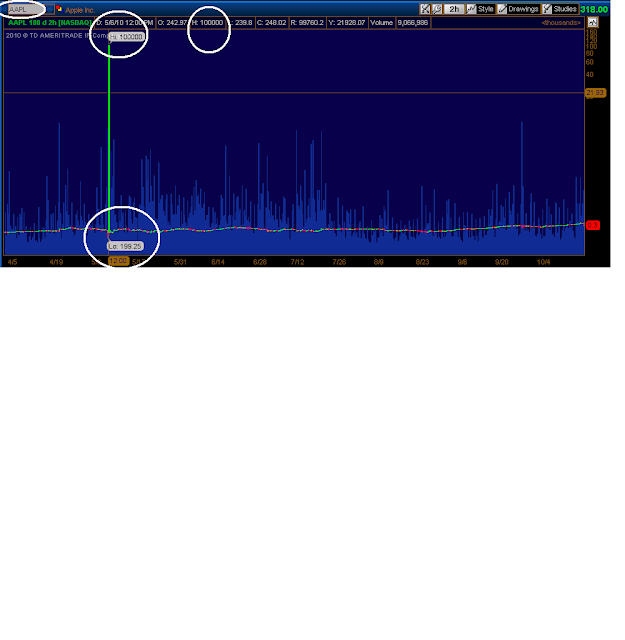

A low of 199 on aapl I can believe, but the high of 1 million! LOL!

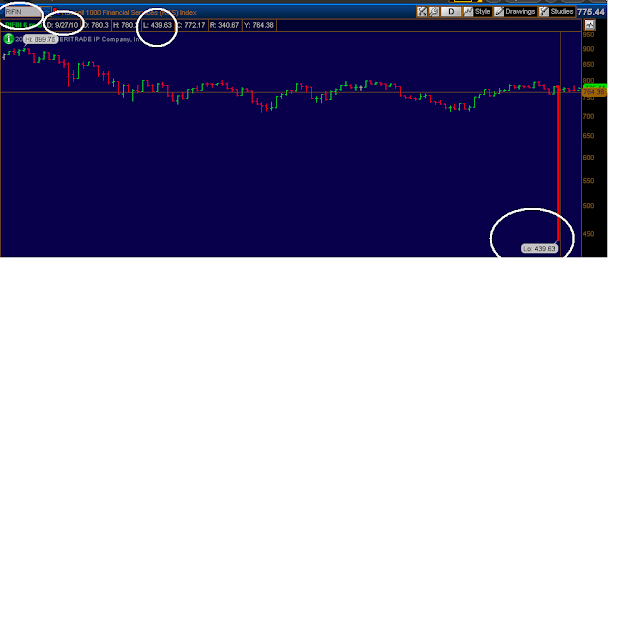

The RIFN print is believable too, as I can see 439.63 hit… but that’s assume the Dow drops to the 8300 print or lower too.

He still has more pennies then any of us, lol.

with the rise of android phones and tablets – plus unemployment – wonder if this is the top for them

http://www.zerohedge.com/article/itimber-0#comments

http://www.youtube.com/watch?v=yfl-K2WSebI&feature=player_embedded#!

The company also followed its typical approach of issuing a highly conservative forecast for the December quarter. Apple shares were halted for after-hours trades on Monday after closing up 1% at $318 in the regular session — setting a new high.

For the quarter, Apple reported net income of $4.31 billion, or $4.64 per share, compared to net income of $2.53 billion, or $2.77 per share, for the same period the previous year.

Revenue jumped 67% to $20.34 billion.

Analysts were expecting earnings of $4.10 per share on revenue of $18.9 billion, according to consensus estimates from FactSet Research.

IBM DOWN $5 IN AH, hope you shorted QQQQ

not too late to short QQQQ AH…it’s hanging in there, but overnight, overseas is going to tank, and QQQQ’s coming in gapped down.

AAPL didn’t beat the street by enough…only a 14% beat…That’s bad fo AAPL…It’s turning into a bad earnings season…

QQQQ Tues opening bell ..my best guess is 50.6