Technical Update 05/27/2013

(to watch on youtube: http://www.youtube.com/watch?v=OV3wOgTIfWI)

Red

______________________________________________________

Technical Update 05/19/2013

(to watch on youtube: http://www.youtube.com/watch?v=bK7pPVAXWQ4)

Red

______________________________________________________

Before my update here's an important update from Lindsey Williams...

We Will See The Collapse Of All Paper Money In A Period Of Two Years Maximum

(to watch on youtube: http://www.youtube.com/watch?v=HFDL-diXB_Q)

To me this update tells me that a stock market crash is coming this year and next year just like the 1929 crash happened first and then in 1932 (when it bottomed) President Roosevelt devalued the dollar overnight by telling everyone to turn in their $20 dollar gold coins, followed by a revaluation of $35 dollars for the same gold coin after the bank holiday ended. This means they are going to crash the stock market first and probably bottom in the 400-600 SPX area within the next 2 years and then they will close the banks for a week or so to revalue the dollar with a 40% haircut. Then once they reopen the banks every dollar will worth that much less, which also means that gold will soar by just as much on a percentage basis.

This means that YOU and I have only the next 24 months or so to make as much money as possible from this coming stock market crash. Then we are going to see massive inflation from this dollar devaluation and we'll also see a HUGE Bull market start that will take the Dow up to crazy highs like 30,000 or more! On the short term I see gold continuing down to "possibly" hit the FP of 939 (or the 935 FP) for a bottom followed by a rally to over $3,000 per ounce by the end of 2014.

(Side Note: Lindsey Williams stated the the cure for colon cancer is carnivora, and it's can be bought here 866-836-8735. I found this site on the internet selling it... http://www.carnivora.com)

Going back to a much shorting term I still see a very important high coming this May 22nd as the preferred date with possibly May 29th being the high. After that I'm expecting a 200 point drop in the SPX to start the first shock in the stock market. This will only be a small crack compared to what I see for 2014 as after a final high in February I see about a 1,000 point drop in the SPX by the end of that year! You will have the opportunity of a lifetime to make a huge chunk of money on this coming drop late this May and early June and then turn that into a million dollars or more in 2014 when the real crash happens!

There are many, many pieces to the puzzle coming together now and I'm more certain then ever that we are going drop hard starting this late May and into early June.

A new article out about the latest Bilderberg meeting shows us some interesting timing and dates. While those meetings are being exposed heavily now by people like Alex Jones and the now deceased insider reporter Jim Tucker the Legatus meetings aren't yet known to most of the "red pill taker" crowd. Only Reinhardt and myself are really talking about the connection they have to the stock market and with the next meeting set for this May 23rd-25th, 2013... followed by a Bilderberg meeting June 6th-9th (re-updating a prior date of June 9-11), one has to wonder what these Satanist Reptilian's have planned for us sheep? Here is that report...

American Free Press received e-mail from Grove Hotel staffer, apparently confirming that Bilderberg 2013 will be going down near Watford in the United Kingdom from June 6-9.

(to watch on youtube: http://www.youtube.com/watch?v=qAZtVdv4sZQ)

AFP’s Mark Anderson reports that he received an e-mail from a Grove Hotel employee, apparently confirming a UK-based Bilderberg meeting this coming June. Anderson writes:

“An email reply to AFP from a Grove staffer and a check of the hotel website’s calendar confirmed the hotel is booked solid June 5-9. The Bilderberg meeting itself, by all the latest indications, is to take place June 6-9. This updates a recent AFP report that stated England was likely the general meeting location but that the meeting would be held June 9-11. At the time, the hotel where the meeting was to be held was not yet known.”

Indeed. In recent weeks there have been several indications pointing to a probable UK Bilderberg meeting. As I recently reported, a call handler at the Hertfordshire constabulary confirmed that the Grove Hotel, both the surroundings and the Hotel itself will be cordoned off by the local Hertfordshire constabulary in a “security exercise”. The exercise, by the way, is planned exactly at the time that the Hotel, according to its employees, will accommodate a “high profile” international group- booking all 220 rooms. As Anderson notes in his article:

“The hotel’s location, some 18 miles outside of London, provides easy access to and from Heathrow Airport. Its rural setting is well suited for Bilderberg’s usual ring of armed security to keep pesky reporters and activists at bay.”

Thanks to many citizen-journalists probing the Hotel and local Hertfordshire constabulary it is also becoming obvious that an elite club will indeed descend on the area at the beginning of June. According to a recent vigilant posting on the Planet X website, an employee of the Grove Hotel has revealed that the hotel’s golf course is booked out by an “American Group” from June 6-9. The commenter, pretending to be interested to reserve the golf court, no booking is possible on those dates:

“No that is not possible during those dates because the private American Group Organizers have requested that they have full exclusive use themselves”.

The “American group”- comment is interesting in more than one respect. Not only does this slip-up by a Grove employee confirm the grounds (Hotel, all its facilities and the surrounding lands) are off-limit to the general public (meaning anyone not holding key power positions), it also suggests that the organizers are predominantly American. When we take a look at Bilderberg’s current steering committee we find no less than 11 Americans among the 34 members (including David Rockefeller). Because the event itself is “international” in nature, concerning “high profile” individuals – we now have further indications the UK will host this year’s Bilderberg conference. Adding this little information-droplet to the others, spilled by employees of the Grove Hotel and the local constabulary, the Hertfordshire venue is increasingly likely to be the spot where the annual Bilderberg conference is set to take place.

What I find interesting is this old clock from the Simpson's episode showing various combinations that could be pointing to a date of some nuclear explosion. We could have 11-6 (November 6th) or 6-11 (June 11th). Other interpretation have been done of course and no one has yet to figure out what (or if?) this really is a signal from the gangsters of what's coming in the future. I just find it interesting that the original date for the Bilderberg meeting was June 9-11... which looks like 911 to me. Now it's set for June 6-9, which is just before a possible reading of June 11th from the Simpson clock. That, along with a Legatus meeting just prior between May 23rd to 25th, has got to mean something.

What I find interesting is this old clock from the Simpson's episode showing various combinations that could be pointing to a date of some nuclear explosion. We could have 11-6 (November 6th) or 6-11 (June 11th). Other interpretation have been done of course and no one has yet to figure out what (or if?) this really is a signal from the gangsters of what's coming in the future. I just find it interesting that the original date for the Bilderberg meeting was June 9-11... which looks like 911 to me. Now it's set for June 6-9, which is just before a possible reading of June 11th from the Simpson clock. That, along with a Legatus meeting just prior between May 23rd to 25th, has got to mean something.

I'm not saying that anything will happen (like a false flag nuke going off in some part of the world) but it's certainly worth noting and keeping in the back of your mind. All move the stock market are planned by these Satanist months and years in advance so trying to forecast it isn't that easy to do. But they give us sheep signals to help us (not really, more like "because it's some sick code of ethics they must obey"), and it's up to us to figure them out.

Moving back to the short term...

(to watch on youtube: http://www.youtube.com/watch?v=gey-RP27_j0)

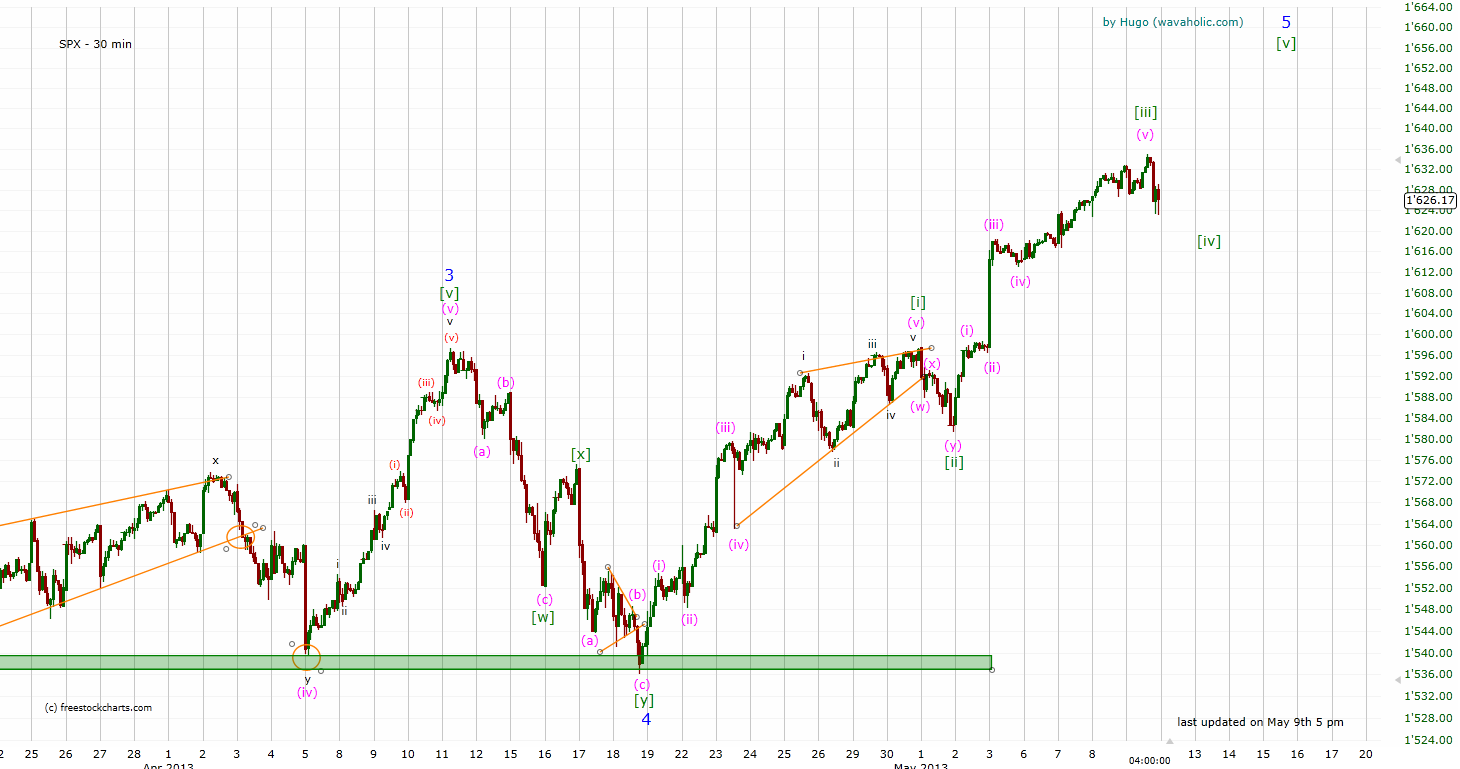

I'm kinda jumping around here as I'm writing this post on Sunday with multiple breaks throughout the day... meaning when I come back to write more I my decide to talk about a different subject. Right now I want to talk about next week and what I'm expecting to happen. I'm thinking that we had some kind of wave 3 up happen last Friday and into the close we started a wave 4 down. I'm not sure if it ended by the close Friday or if it will take all day Monday to complete, but once it ends I'm expecting one more move up to the 1630-1650 SPX area to end this very long rally and allow the first wave 1 down to start. So if we hit this zone by Tuesday then I'll be looking to go short. If it drags out a little longer then I'll just wait as I know it's very nearly done.

Then the first move down should find support around 1600 as that was prior resistance. It should end the first wave 1 down if it stops there and allow for a choppy move back up into May 22nd for the wave 2 up to complete. Then the wave 3 down should start and drop 150-200 SPX point in a period of about 18-20 calendar days (based on prior history of similar moves). If the wave 1 down breaks 1600 and goes to the next level of support around 1550-1570 SPX then the move back up for the wave 2 should be pushed out to the secondary date of May 29th before it ends and allows the wave 3 down to start. This is really a tough call here as I don't know when we are going to hit the top zone of 1630-1650, or how low the first wave 1 down will go.

Each move should take a certain amount of time based on similar moves in the past but telling you the exact date right now is hard too do. I'm estimating that we'll hit the top zone sometime this week and then start the first wave 1 down. That wave could last as little as 3-4 days if it's only 40-50 points down or 5-7 (trading) days if it's 80-100 points. From there we can calculate the move up to last 4-7 days as well, which should tell us if the high is going to be early on May 22nd or later on May 29th. We know from past history that many of the turns are centered around Legatus meetings and this coming meeting is dead set in the middle of those two "double ritual eleven" days happening on May 23rd to 25th.

Looking back at last year we see that they had a Legatus meeting on April 30th to May 2nd and the "eleven" date back then was May the 1st (05/01/2012 equals 0+5+0+1+2+0+1+2=11). This year we have an "eleven" date just before and after the meeting and both dates this time are "double elevens". You see, when you add up all the digits you get what I call a "yearly" eleven date. But there's also what I call a "daily" eleven date where just the day of the month equals eleven. So every month has 3 of those dates as you obviously have the 11th, but you also have the 22nd as it's a master number (just like 11) because it's a multiple of 11... meaning that all 11's, 22's, 33's, 44's, 55's, etc... are all master numbers and not to be added together like all other numbers are. That means that 11 isn't 1+1 to equal 2, but simply remains as "eleven". The same thing for 22, as it's not 2+2 to equal 4 but remains as twenty-two.

The only other day of every month that equals "eleven" is the 29th as 2+9=11. So every month has the 11th, 22nd, and 29th as "daily" elevens, and then there are the "yearly" eleven days where all the digits add up to eleven. So this coming May the 11th is of course a "daily" eleven but it's also a "yearly" eleven, whereas all the digits add up to 22, which is a master number and equal to 11 (0+5+[11]+2+0+1+3=22). The same thing is true for the 22nd as it adds up to 33 and then the 29th adds up to 22. All 3 dates are both "yearly" and "daily" elevens... or double elevens.

Since many (not all... maybe 30%?) of the important tops occur on ritual eleven dates it's very important to monitor them and look for a high on them. This means that either the 22nd or the 29th should be the high for the wave 2 back up as the wave 3 down is a very important date and will likely be on a ritual eleven day. Nothing is written in stone of course but I'd pay close attention to those 2 dates. Between now and then it could be choppy as they make a wave 1 down and wave 2 up. My plan is to take a small short when we hit the 1630-1650 area to ride down that wave 1 to where ever they take it to. Maybe 50 points or maybe 80 points? I don't know which but both are worth shorting I believe.

That's about it I guess as we are all just waiting patiently for the right time to attack...

Red

APPLE Chart update: http://niftychartsandpatterns.blogspot.in/2013/05/apple-chart-update_7.html

Red, off topic but what’s the charting software you are running?

That’s “ProphetCharts” from inside my Ameritrade account. They offer both “ThinkOrSwim” and “ProphetCharts” and although I showed you the PC in the video I also use the TOS charts too.

GOLD Chart analysis: http://niftychartsandpatterns.blogspot.in/2013/05/gold-long-shadow-of-weekly-candle.html

Looks like a boring day gang. But I think we’ve met some type of short term top. I’d think we could see a move down to fill the gap around 1597 SPX here soon. It could start later today and carry over into Wednesday. Once hit it should provide support and allow for one more move back up to 1630-1650 to complete the high for this year.

I thought we might have done it today but it looks like it’s not going to happen. So it’s going to push out the time table a little I guess but all is still lining up nicely for the coming Legatus meeting to be the start of the really big move down.

FACEBOOK Chart update: http://niftychartsandpatterns.blogspot.in/2013/05/facebook-chart-update_7.html

I see a move down coming tomorrow gang… I’d guess a minimum of 20 points and maximum of 40 points.

Funny how many bulls are out there now and how many bear blogs are dead. Rest assured that this is NOT the start of a new bull market. After this coming 20-40 point drop and then the following last rally back up (target still 1630-1650 spx) we will see the bear return.

How do I know this? My “bear blog” is dead and so is every other bear blog. They always die as the market tops and this is no exception. The market is rigged to make you go long at the top and short at the bottom. There will likely be one more move up but this bull is almost dead… mark my words on that.

ES Chart analysis: http://niftychartsandpatterns.blogspot.in/2013/05/es-chart-analysis_8.html

GOOGLE Resistance line and Divergence: http://niftychartsandpatterns.blogspot.in/2013/05/google-resistance-line-and-divergence.html

Looks like the bulls are dragging this out and will likely wait until tomorrow before moving down 20-40 points. After it happens there should be one more rally back up which should take out this current high and get close to 1650 SPX.

Remember the old saying that the gang at “Mr TopStep” likes to quote… “the low is usually put in the Thursday or Friday prior to option expiration”. Tomorrow and Friday therefore should put in the low and then the week of option expiration (next week) they rally it back up to make those put holders expire worthless.

This is common manipulation by the gangsters as they don’t want to pay out any money to call holders or put holders. So they have to shake out the call holders with a move down quickly and then shake out the put holders the next week with a slow grind back up.

The likely downside target is the 1600 area where the market broke out from. There is the gap fill area at 1597 which really should be filled, but of course there’s no guarantee on that. Maybe we only dip to 1610 or so? I don’t know the downside target but tomorrow now seems like the best date for it to happen.

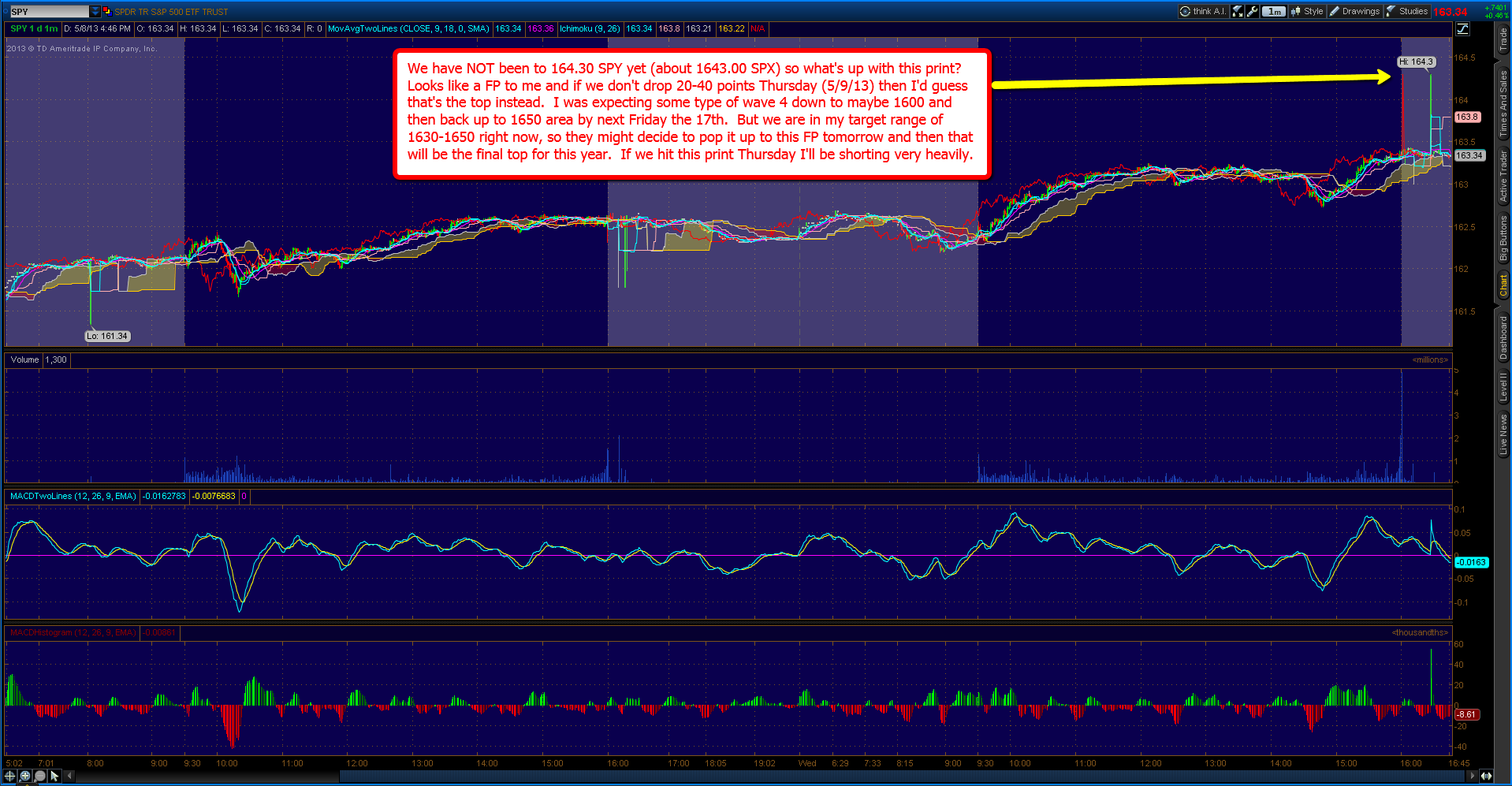

New FP on the SPY… possible final upside target for Thursday, May 9th.

http://screencast.com/t/HZjCzwDJa

i agree with this print. that might very well be the top for may.

1620 eps top, 1635-1645 stock buyback top.

SINKO de MAYA time NOW!!!!!!!!??????

Tomorrow is the infamous 59 and today was 117 trading days off the November low making it 275tds from last year’s 4-2 high which itself was 775 tds from the 3-6-9 low which all adds up to 1050 tds from 3-6-9. It is also a Fib 55 tds from the late Feb high.

Solar eclipse tomorrow and there was an extremely high tick reading today.

And WB’s old buddy Frank Holmes is imploring investors to ignore the sell in May and go away mantra. I wonder if the CNBC gang is parroting that philosophy. They did the opposite back in November 2000 before all the markets tanked.

It’s a nice job by the operators to start off the May seasonal period so strongly so that investors might ignore/ forget about the sell in May mantra.

Most indices have now put in two new bars in the new high (breakout) range, in particular the DAX.

APPLE Chart update: http://niftychartsandpatterns.blogspot.in/2013/05/apple-chart-update_9.html

You are such an awake and aware person to how this world runs. You see numbers and cycles most don’t. God has truly blessed you with an amazing third eye. Been following you for months. Wish you could give me a one hour tutor to get me started on my journey. Because I too also am familiar with sacred numbers/geomtery and can see certain paterns that history always repeats. I just need to turn this skill into making some money but don’t know anyone like you in real life. . after all its in investment to my future and not a cost. I need help getting started on the right foot.. Care to help? I can pay for your time. Namaste

It’s taken me the last 4 years to learn what I’ve learned John, and I’m just scratching the surface right now. I share all I know on the blog freely presently so I don’t know what more I could offer you? You probably know more about it then I do. But I’ll let you (and everyone) know when I go short for my “wildcard” option play around Legatus.

the plan

Nice Zstock… your 152 DIA (about 15200 DOW) lines up with the FP from yesterday of 164.3 SPY (about 1643 SPX). Looks like we know the target just not the date yet. It might drop back 20-40 points first and then go back up next week? Hard to say at this point but I’ll be waiting patiently.

Z, what are the possibility of 15600dow, some numbers are coming like that. possible bubble top

Don’t talk like that… I’ve already made up my mind that 15,200 is the topping area.

chartwise

http://www.stocktiming.com/Wednesday-DailyMarketUpdate.htm

Silver triangle pattern: http://niftychartsandpatterns.blogspot.in/2013/05/silver-triangle-pattern.html

I get the feeling that they will not go up to hit the FP ) until next week. If we close down today by 10 points or more (on the SPX) then we could continue into Friday morning to put in the low. Then back up next week to hit the FP and end this bull market for this year, leaving only one more final high around 1700 SPX set for February 2014 around the Legatus meeting set for then. After that we should start the 1,000 point drop into the end of the year.

) until next week. If we close down today by 10 points or more (on the SPX) then we could continue into Friday morning to put in the low. Then back up next week to hit the FP and end this bull market for this year, leaving only one more final high around 1700 SPX set for February 2014 around the Legatus meeting set for then. After that we should start the 1,000 point drop into the end of the year.

not much movement, we could still hit it today

Yes, we could still hit it today… or tomorrow morning at the open I’d assume? It would be nice to do it today and then gap down tomorrow but the bears never usually get that lucky. If we do get today though I’ll be taking another put spread on it as this bull is on his last breath.

pop and drop tomorrow?

Hmmm… it certainly could pop and drop tomorrow. It’s not acting like it wants to hit the FP today, so hopefully it will do so tomorrow. However, if it keeps dropping into the close today and breaks down below 10 points or more then I’d have to think that it would continue down into Friday and put off the FP high until next week.

All aboard the bull train…

FACEBOOK Support and Resistance levels: http://niftychartsandpatterns.blogspot.in/2013/05/facebook-support-and-resistance-levels.html

Dow cannot have a negative close today

And what if it does? I think they’ll hold 15,000 but still close red.

Australian dollar is crashing now…..dropped below its daily and weekly bbs and is already on a week 4 TD downcount (and clearing all support in a new downrange) so it looks like it should keep its downside momentum going. Comparable to gold’s silent crash.

I am just hoping gold can bounce back up to its 50 day average. It will do a bull flip next week unless it makes a massive drop by the end of next week. And usually bull flip weeks are massive white bar weeks.

I did a study last weekend and gold and commodities were already in advanced MONTHLY TD downcounts and their TD prior 4 month comparisons were going to get easier the next few months. I believe gold was alread in month 5 now and the meat of downmoves come in the 5-6 periods. 8 and 9 are usually bunched close to 6 and 7 closes making a bull flip easier. Euro has an easy monthly TD setup and crude oil is getting there as well having made three consecutive lower highs over the last few months. Stocks could get there too via a hard downmove pronto.

On the otherside, the US dollar has been establishing an easy monthly TD upcount where the comparisons will be getting easier over the next few months.

Ok, we have a couple of things that could happen tomorrow and both are bearish. First off we know that the FP will eventually be hit and wasn’t hit today, so that means we shouldn’t get married to any decent move down. Secondly we know that Bernanke is going to speak tomorrow morning before the open, which could be positive or negative.

If he says something positive and the market rallies up to hit the FP then I’d go short my last 1/3 position (in put spread for now as we aren’t starting a wave 3 here, where I’ll go with straight puts). If he says something negative then the market should sell off the rest of the day and drop 20-40 points from the current high.

My thoughts are that he will say something negative and make the market drop all day. I’m not saying some big huge drop but over 10 points at least. Remember, we have a gap at 1597 spx that needs to be filled so that could be the low on Monday morning. Historically the market makers will generally put in a low the Thursday or Friday prior to options expiration week to shake out the call holders.

Then they will rally the week of option expiration week to make the new put holders expire worthless too. Remember that the market makers goal is to steal money from both the bulls and bears, which is why you sometimes have a 2 day drop right prior to that last week.

I give this scenario the highest odds for that reason and 2 other reasons. One is the fact that I’ve seen the game played many times in the past where they will put out a FP and come shy of hitting it making me think that it was “close enough” and then I get short later after chasing the move down.

Then it reverses back up a week later (or more) to rally back up and not only hit the FP put pierce through it a little bit… then they sell off for real. This is common move to trick the bears the see the FP and realize what it is… or at least they think they do.

I firmly believe that FP was real and will be hit before we rollover for good so any move down we have I’ll be ready to exit my current shorts when I see a bounce coming… which I have a feeling it will be around that gap fill area.

The 2nd reason I think whatever Bernanke says will cause the market to continue down all day and not rally up to the FP first and then sell off is the fact that we haven’t made any negative divergence yet on the daily chart. In fact today is the first lower bar on the histogram chart.

It’s very common for the market to start making lower histogram bars while the market drops some and then go back up and make a lower “hump” of histogram bars to create the divergence while the actual price of the market goes higher. This would mean we should drop for a few days and then rally back up for 3-5 more days hitting that FP but making lower histogram bars on the daily chart.

This could be dragged out all next week and even into May 22nd just before the Legatus meeting starts. It’s hard to know if they plan on starting early on the 22nd or waiting until the meeting is over and topping on either the 27th or 29th. (I just remembered that the 27th is an “eleven” day too as it all adds up to 20 and that equals 2, which is 1+1 or eleven).

Picking the date will be tough of course but those 3 dates are my preferred targets. So if we don’t hit the FP tomorrow then I’m expecting it to be hit on one of those days. If so, then the first drop should go down to test the 1536 prior bottom.

Then a bounce for a wave 2 up and then a wave 3 down that should be in the 1420-1440 area before stopping. Of course these targets are subject to change but that’s what I see currently. For tomorrow and Monday I’m expecting a gap fill around 1597 at the very most and at the least at gap window around 1610 spx.

It’s rare that Bernanke speaks prior to the market opening which should tell you that whatever he says they want the market to react to it all day long… but what reaction do they want? The best trick would be to tank it 20 points or more and then calm things down over the weekend… and then open up on Monday with all those bears trapped once again. But I’m just guessing here, as only the gangsters know what’s really planned for tomorrow.

EURUSD Death cross an update: http://niftychartsandpatterns.blogspot.in/2013/05/eurusd-death-cross-update.html

Tomorrow is another Friday following a new moon Thursday. With the Dark Knight Rising????

It will be 42 weeks from July 20 and 21 weeks from December 14 or 21weeks + 21 weeks. 147 days+147 days or 777+777……

Pain and Gain and Iron Man 3 once again representing a flurry of movies set in MIAMI.

ES Chart analysis: http://niftychartsandpatterns.blogspot.in/2013/05/es-chart-analysis_10.html

waiting for dow 15200-15600 zone

That 15200 DOW is about equal to the FP of 164.30 SPY (or 1643.00 SPX)

GOLD Range breakdown: http://niftychartsandpatterns.blogspot.in/2013/05/gold-range-breakdown.html

Selling is pretty weak today. I’ll wait for the FP you found to short

Wise idea Peter as it doesn’t look like it’s ready to go down any right now. They are just making a bullish triangle right now that should breakout to the upside Monday morning. Of course they still could breakdown just as easily as triangles can go either way. But since the bearish view of things rarely work and bullish view always works we have to lean toward a bullish breakout on Monday.

The only thing that bugs me is that they really won’t go down enough to create a 4th wave and to create the negative divergence on the daily chart I’m looking for. They need about 3 day of down movement which tells me Monday should be down… at least during the morning session.

However, the rising lower trendline on the channel has moved up to about 1615 today will continue rising on Monday as well. So the move down to gap window around 1610 doesn’t seem likely at this point. They are really stretching this out until the last day I guess, which is frustrating both bulls and bears.

Just holding some ES so I think I

SPY Chart analysis: http://niftychartsandpatterns.blogspot.in/2013/05/spy-chart-analysis_10.html

Got a little short, just in case that was close enough

with the new fed news, think you missed the initial drop Red?

I think that news could be used to drop us to the 1615 spx area to complete a smaller wave 4 down on Monday. Then back up later in the week to complete the 5th wave and end the whole rally from last November. This chart (isn’t mind) looks fairly accurate to what I’m expecting…

guess we’ll hav to see. I’m ES futures, and vix options. It was trange, to me, how the vix was moving up with the market. I guess that would negate the FP that you found then? wave 5s are usually pretty strong

PFIZER Bearish Monthly candle: http://niftychartsandpatterns.blogspot.in/2013/05/pfizer-bearish-monthly-candle.html

I think target is 1666

cos’ ’09 low was 666 ))

Parker you could be right on that call for 1666 for all I know? I’ve thought about it myself many times but it seems too obvious even for them to do. So I’m sticking with the 164.30 SPY FP and just a little above it. I’ve found that it’s common to pierce through FP’s a few points before rolling over. So maybe 1646 SPX instead of 1643 as the FP indicates.

APPLE Weekend update: http://niftychartsandpatterns.blogspot.com/2013/05/apple-weekend-update_11.html

USO Weekend update: http://niftychartsandpatterns.blogspot.in/2013/05/united-states-oil-weekend-update.html

This is crazy. canteven get one day on bad news

Totally nuts Peter… won’t go up to the 164.30 SPY FP or down to support at 1614 SPX. Drives me nuts too!

APPLE Chart analysis: http://niftychartsandpatterns.blogspot.in/2013/05/apple-hour-chart-analysis.html

This is very frustrating… which is of course what the gangsters love to do to us bears (and the bulls). No real direction here as they haven’t hit the FP yet to go short at or retested the 1615 spx area where the lower trendline in this rising channel is located at… so you can’t go long either. Very hard to do anything right now but just wait to see what they give us.

yeah, still holding some ES. will pickup some options if FP is hit. But market really needs a breather. Even if it’s just a minor move down

1636 (ie16-36 or 16-666) is 969.21 pts from 666.79 and today, 5-13-13 or 5-26 is 4 years 2months 7 days from 3-6-9 or 1528 days later.

ES Charts: http://niftychartsandpatterns.blogspot.in/2013/05/es-chart-analysis_14.html

The FP of 164.30 SPY has now been hit! I think we should rollover later today now.

vix is creeping up. keep your eyes open

Lots of accumulation on the VXX over the last couple of months. Insiders know whats coming next.

bought some ^vix calls for next week as a lotto ticket. Any downturn and it’s going to spike a few points

Precisely

I’m now short the 162/158 SPY put spread expiring May 31st for .55 cents… Good Luck Bears!

WOW! The bullishness must be to the most extreme levels ever right now! May I remind you of where the bull is right now…

And here’s the bear right now…

Yeah. This endless euphoria has already breached extremes. Up a few days, flat, then repeat

When this rally ends (and I personally think it has today) the bulls are going be trapped with no way to get out. They are going to go down with very little bounces for sleeping bears to get short at, or trapped bulls to get out at.

it’s going to be a thing of beauty Red

Yes it will Rod. While catching the exact top is about as hard as catching the exact bottom I’m just happy that I’ll be within the last 5% percentage of the move up so I’ll be catching the meat of the move down.

APPLE Chart analysis: http://niftychartsandpatterns.blogspot.in/2013/05/apple-chart-analysis.html

$vix up, crude oil, commodities,gold, euro, lumber all down in today’s upmarket. $ndx was up slightly as Apple was mini-hammered and looks to be starting a new leg down. Australian dollar continues to crash.

Breadth wasn’t even that strong for the day’s action.

Today 5-14 is 240 degrees/days from the 9-14 high. Today would be the last point for a high for the EXASperating flash crash scenario. But commodities seem to be in a holding pattern the last several weeks awaiting the big plunge. Gold is acting very feeble in its bull flip week.

Lumber has declined hard since its March peak and hasn’t shown any sign of a decent counter-trend pop/ reversal and has knifed right through its 200 day average. Not a good sign for the market.

I did hear on a real estate/mortgage loan infomercial a few months back that low FHA loan rates were set to expire on April 1 as well as low the current low mortgage insurance rate. So don’t be surprised that this front loaded housing demand into the early part of the year and that we start suddenly seeing disappointing housing numbers/ news going forward.

The infomercial sponsors were definitely trying to drive up business going into that April 1st date.

May 22nd?

I learned to never say ‘never’.

patience is key.

I think the upper bounds have certainly been hit like in 2012, but it can hug the high line and run even higher. only time will tell.

http://stockcharts.com/h-sc/ui?s=SSO&p=D&yr=1&mn=7&dy=0&id=p30382939504

The only thing that puzzles me is the fact that we’ve yet to top out and have our first wave 1 down, as usually that is complete before the Legatus meeting as most of the turns from them have been wave 3’s. So I’ve been expecting a turn down anytime now but they just don’t want to give up yet it seems.

If this keeps going then the 22nd will put in the high. But today isn’t over with yet so maybe we top today and roll over to fill the gap at 1597 in the next few days before bouncing into either the 22nd or the 29th to top for the wave 2 up.

ES at channel resistance: http://niftychartsandpatterns.blogspot.in/2013/05/es-at-channel-resistance.html