Update for -6-09-2013

(to watch on youtube: http://www.youtube.com/watch?v=SCl-TEPTuIk)

Red

______________________________________________________

... an update from Ali

Dear RDL readers,

I know it has been long time since I last posted on the blog since nothing much And serious had happened. I recommended everyone not go short until late May Or early June. Red and I both agreed on a possible top on May 22nd-23rd. Now I am now going to explain whether it will be a major reversal or not.

In my previous posts I talked about the “law of vibration” and cycles and if you believe we humans are not exempt from the “natural law” you will absolutely believe that there is no randomness and imbalance in the behavior and emotions of the mass. Every living thing in the universe vibrates, thus moving in a cyclic motion. As a matter of fact cycles are progressional series where everything in nature combines in certain ratios (not only fibonacci numbers and golden ratios) to form a progressional series.

Actually, the ancients were truly aware of that as well. You see, the Mayans conceived of time and human history as moving in cycles small and large (It actually reflects the wheels within wheels). In the modern world there is only a single calendar to keep track of our annual solar circuit, while in ancient times the Mayans used variety of calendars. One of the most significant calendars is called the “Long Count”... and was so peculiar as it had no start date! The Mayan based their Long Count on what they referred to as “Birth of Venus”. It was based on 104 -year “Venus-Round Cycle” ( two calendars of 52 years), which was really an important ceremonial event for them. It was referred to as the point in time when all of their sacred calendars were realigned with the Cycle of Venus.

Now before I go on to explain more about the Mayan sacred calendars and such I would Like to touch on the brilliant work of Nikola Tesla who is the greatest genius of 20th century... not Einstein but Tesla! He studied Electromagnetic's and Electrophysics. Using Egyptian secrets and numerology he created free energy ( it was suppressed by the Illuminati), and also invented a flying saucer which could fly around based on its own energy. Actually many of his ground-breaking inventions were never released to the public and later he was called a “mad scientist”.

Anyway, historically he is known to have repeatedly said: If only the world knew the magnificence 3,6 and 9. He was truly obsessed with the groups of 3s, 6s being second and 9s being third. Only a few people can understand that he was actually referring to the “secrets of Egyptians” and I have somehow learned and found out that Tesla’s 3s, 6s and 9s nearly include everything in the nature. He also said that... and I quote: “Electricity came to me in a vision whilst I was looking at the sun. I saw four winding's wrapped around spaced at 90 degrees to each other”.

Now applying Tesla’s approach we have four quadrants in a circle which is representative of a cycle, unity or completeness, all spaced at 90 degrees to each other. And at each 90 degree, we have the number 13 or 4*13=52 (the number thirteen was a root number for the Mayans). If I link it all to the cycles of Stock market we will find out that it has been responsible for many of the biggest panics and bottoms since 1915... such as 1962, 1974, 1987, 2000 and 2013.

If you examine the cycles in charts you will discover that the length of the cycle varies a little, which is due to some natural phenomenon. The one in 2013 peaked in late May and we are about to see the consequences of it soon. But you should not expect a very large decline at first. First, the current uptrend is going to become weaker and weaker... then in late July or early August we must crash! Therefore in August and September you should totally be short.

Now if you we use 13 as the root of the Mayan calendar system we find the following number sequence: 13, 26, 39, 52, 65, 78, 91, 104 . If you notice, this number sequence is an octave consisting of eight tones and seven intervals. The truth of the matter is that we have seven “overtones” which have arisen from the “fundamental tone”. With that said, each number in the sequence can also be an octave. I have already explained that if you consider a circle as a unity of 52-year round cycle each of it's 90 degree-quadrants now belongs to the 13-year cycle. The 2/3rd's of the cycle which is perfectly “the major sixth” (in diatonic scale) is located at 60 degrees... 13*2/3 (0.667)=8.6 years.

Every cycle has their own building blocks and the 8.6-year cycle is one of the building blocks of the 13-year cycle in the stock market, (as rediscovered by Martin H. Armstrong). He is someone who could read the cycles better than Illuminati He made money when they lost money in the market, and soon they were mad at him and had him put in prison for seven years for manipulating the financial markets. He uses the pi (3.14) cycles.

To his amazement he discovered that there are 3141 days within the 8.6-year cycle. Google his economic confidence model, but you will find out that the amount of information on his work is really limited. If you break the 8.6-year cycle into smaller cycles you will then have four 2.15-year cycles. You might want to examine these cycles back in time... particularly from the year 2000 on. Again, the length of the cycles varies a little.

To sum up... due to Venus 13-year cycle the market is going to be weaker and weaker until the energy of the current uptrend is completely drained. Then we will see a series of panic declines. So the period between now and early August should raise caution.

Please feel free to get in touch with me with your comments.

May you profit handsomely, Ali

afiroozi (at) rocketmail (dot) com

P.S. Finanial markets grow both in time and price, and I have only talked about the timing aspect of the market in the article.

______________________________________________________

... back to Red

Great update from Ali, and now back to the short term for the market...

(to watch on youtube: http://www.youtube.com/watch?v=j39z2hRW4vo)

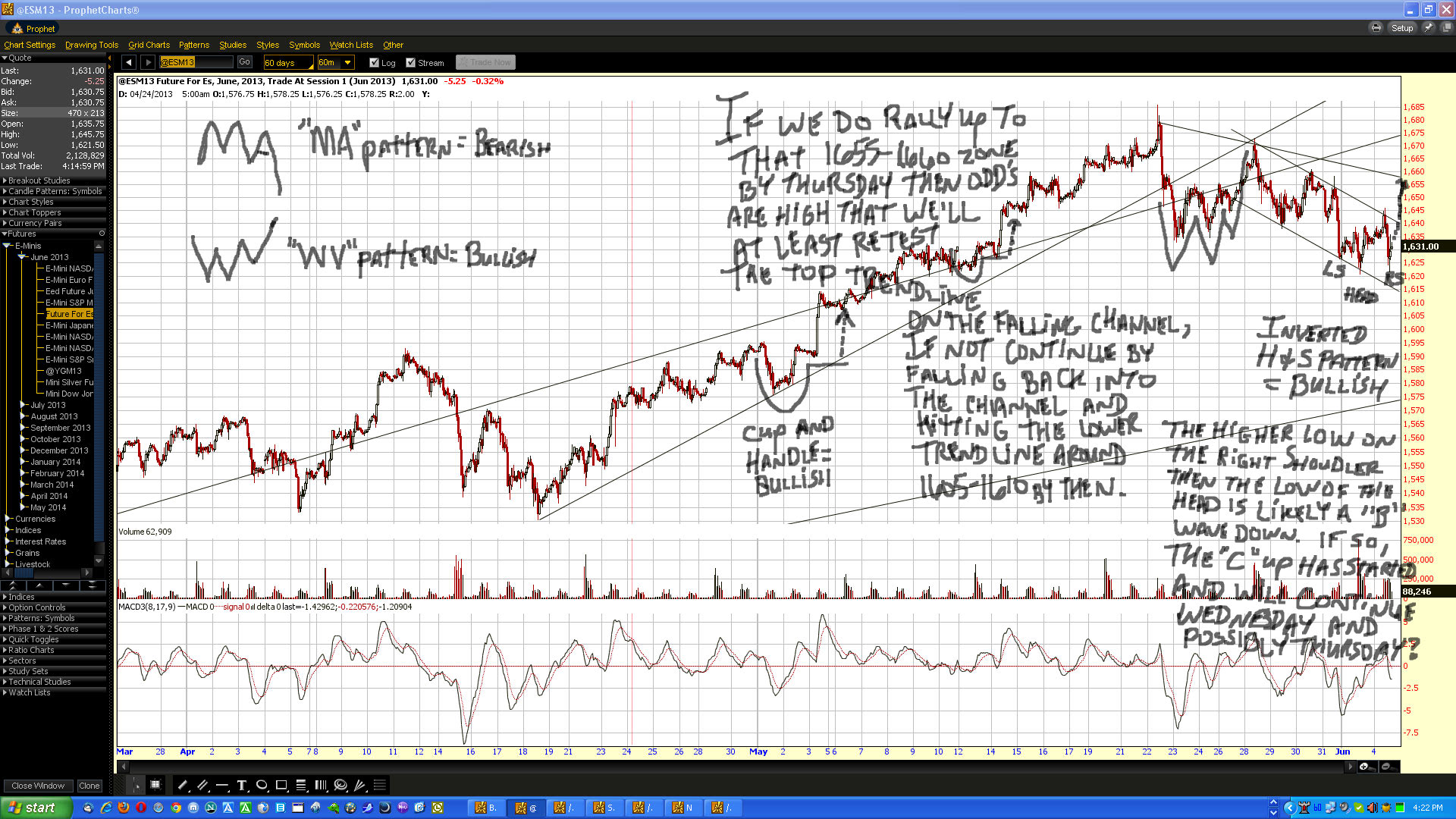

Last week I was expecting some type of wave up (a wave 5) to break the triangle but the market was too weak and it never happen. Hopefully most of you were already short and held through the rally's up and down. I would have loved to have seen that wave up to get short again at but missed it. Such is life I guess? So now we have a falling channel going on and from the looks of things I'm going to speculate that the next big move down day will be this coming Thursday, June 6th. Looking at the charts I see prior support in the current 1630 spx area from back on the 8th, 9th, 10th, and 13th of May. And since we are quite oversold on the short term I'm thinking that we'll dip down lower Monday morning and then chop back up a little throughout the rest of the day... basically going nowhere.

In fact, Monday should close down slightly or up slightly but nothing big either way. Then Tuesday and Wednesday I'm expecting more of the same to happen, but by the close on Wednesday I think we'll hit the top trendline on the falling channel. It should be around 1640 spx area by then I believe and by the time it hits it I think the short term charts will become overbought again and allow for another big down day to happen on Thursday with the target being the break of 1600 to fill the gap at 1597 spx. So an intraday low as deep as 1580 is possible (don't expect it though) but they should recapture the 1600 level by the end of the day I suspect.

Then we should bounce back up nicely on Friday I think and probably into Monday the 10th, with Tuesday the 11th likely ending the bounce. Remember, I think we are going down to retest that 1536 prior low and I think we'll hit it by Friday the 14th at the latest. The old rule of thumb is that "they" (the market makers... aka gangsters) usually put in the low the Thursday or Friday the week prior to the monthly option expiration, which is June 21st... meaning either Thursday the 13th or Friday the 14th should be the low for this whole move down from the May 22nd high. I can count the wave better now and I think this is what we have coming...

The Largest Wave ONE down should be from 1687 spx to around 1536 spx. Inside that wave are 5 medium waves with the wave 1 down being from 1687 to 1636, and then back up to 1674 for the ABC medium wave 2 up. When that ended we started the smaller wave 1 down inside the medium wave 3 down. I suspect this medium wave 3 down is going from 1674 to just under 1600 to fill the gap. It has 5 smaller waves inside it and the first wave 1 down was from 1674 to 1640, and then a smaller wave 2 up to 1661 spx. So what we seen Friday was a smaller wave 3 down inside the medium wave 3 down. There is still more room to go down yet on that smaller wave 3, and looking at the chart it could go as low as 1620 on Monday.

Then we should have a smaller wave 4 up (inside the medium wave 3 down) on Tuesday and Wednesday which I think will hit the top trendline of the channel in the 1640-1650 area. Hard to say right now as the trendline will go lower every day, but 1640-1650 is the estimated zone that the smaller wave 4 up should hit that trendline and stop. This leaves the smaller wave 5 down inside the medium wave 3 down still left to go, and that's the wave I think will hit the 1600 area and end at. Then we should start the medium wave 4 up into Friday the 7th and Monday the 10th. It's likely going to be an ABC wave up so it could rally on Friday for the A wave up and down on Monday for the B wave down, with a final C wave up to happen on Tuesday the 11th... which would end the medium wave 4 up.

Next would be the medium wave 5 down that should last the rest of the week and take us to the 1536 area by Friday the 14th to put in the low for the larger wave 1 down from the May 22nd high at 1687 spx. After that we'll probably have a lot of chop the rest of June and into July for the larger wave 2 up. This means that late July and early August we could be seeing a larger wave 3 down start like Ali is talking about in his update post above. Catching the smaller wave 3 down, inside the medium wave 3 down, inside the larger wave 3 down will be a bears dream! I'll do my best to try to figure it out but do keep in mind that I get the counts wrong sometimes (like last week with that wave 5 up not happening), so always use your own judgement.

Ok, that's about all I can think of now so I'll see you all on the blog in the comment section...

Red

P.S. Here's a nice read from another blog that covers some of Martin Armstrong's predictions...

Martin Armstrong is undoubtedly one of the greatest cycle theorists of our day. His predictions include the 1989 peak in the Nikkei market to the day, as well as the 1987 crash and 2007 top in the U.S. markets. Armstrong's most famous cycle is 8.6 years, or pi*1000 days (3141 days). In Armstrong's article The Business Cycle and the Future (1999), he states:

I began with the very basic naive approach of simply adding up all the financial panics between 1683 and 1907 and dividing 224 years by the number of panics being 26 yielding 8.6 years. Well, this didn’t seem to be very valid at first, but it did allow for a greater amount of data to be tested compared to merely 3 waves described by Kondratieff.

...The issue of intensity seemed to revolve around periods of 51.6 years, which was in reality a group of 6 individual business cycles of 8.6 years in length.

...The total number of days within an 8.6-year business cycle was 3141. In reality, the 8.6-year cycle was equal to p (Pi) * 1000

In Armstrong's article, he further subdivides the 8.6 year cycle into four 2.15 year intervals, and lists several dates going into the future. Let's find out what is going on with the planets on these dates.

The Economic Confidence Model in 2.15-year intervals

1998.55... 07/20/98 2000.7.... 09/13/00 2002.85... 11/08/02 2005.... 01/02/05 2007.15... 02/27/07 2009.3... 04/23/09 2011.45... 06/18/11 2013.6... 08/12/13 2015.75... 10/07/15 2017.9... 12/01/17 2020.05... 01/26/20 2022.2... 03/22/22 2024.35... 05/16/24 2026.5... 07/11/26 2028.65... 09/04/28

Read the full article here...

http://planetforecaster.blogspot.com/2011/11/marty-its-planets-armstrong-215-year.html

ES Chart analysis: http://niftychartsandpatterns.blogspot.in/2013/06/es-chart-analysis.html

The low of the SPX today (so far) is 1622.72 or 1+6+(22)+7+2=38 and 3+8=11… so maybe the low is in now?

EURUSD Resistance levels: http://niftychartsandpatterns.blogspot.in/2013/06/eurusd-resistance-levels.html

The Turkish market had a mini-crash today. Down 10%. Wonder what Atilla has to say about that. His twitter account hasn’t had a comment since April 22.

3141 days?, interesting.

http://planetforecaster.blogspot.com/2011/11/marty-its-planets-armstrong-215-year.html

EDIT: so the top should be around 3rd week of June. sounds good to me.

From date:Friday, March 6, 2009

Added 1570 days (2 * 2.15 Yrs)

Resulting date: Sunday, June 23, 2013

Nice find DG! That’s worth reading and reposting for sure…

thanks, (I) always try to add value.

I try not to be a drive by troll.

DG you should never think of yourself as a troll. You’ve been stopping by for years now so I know you’re a regular reader. That article just confirms a lot of what Ali stated, which is very cool. 🙂

I like the 1570 . From March 6 2009 + 1570 days = 6/23/13

1570/1.6666= 942 = 10/4/2011 low ,

942* 1.3333= 1256 = 8/14/12 high

( 3;4;5 triangle ) .

John, are you implying a new “higher high” on June 23rd? Or just an important turning point? I personally think the high for this year was put in on May 22nd but I have no way of knowing for sure.

Not implying any direction or higher high – just a turning point is possible .

Ok… thanks. I kinda thought that’s what you were saying but I was just unclear on it. What’s interesting is that June 21st is Friday option expiration and that’s about when I think the wave 2 up will end. As I posted with a longer explanation comment above a bit I think we’re going to bottom tomorrow.

Then we should start an ABC rally up for the wave 2 into Friday the 21st… which will likely take out 1674 spx but stay under 1687, and then we should turn back down for the wave 3 somewhere around that time period. It should be the wave that goes to the 1536 prior low before bouncing again.

Bullish Engulfing of Coca Cola: http://niftychartsandpatterns.blogspot.in/2013/06/coca-cola-bullish-engulfing-pattern.html

ES Chart analysis: http://niftychartsandpatterns.blogspot.in/2013/06/es-chart-analysis_4.html

Here’s a possible move for today and Wednesday…

SPY Support and Resistance levels: http://niftychartsandpatterns.blogspot.in/2013/06/spy-support-and-resistance-levels.html

Ok, I think we have just completed the B wave down inside this 4th up. As long as they don’t go lower then yesterday’s low the count is good… meaning we had the A wave up yesterday, B down today and should have the C up tomorrow. That should end the wave 4 up and allow for a 5th wave down to happen late Wednesday and all day Thursday.

Bear in mind that “if” this is a wave 4 up (and I believe it is) then the C wave part of it should happen tomorrow with some type of gap up. Clearly they are trying to close this positive but probably won’t. Regardless, a gap up would confirm a C wave and it can’t go higher then 1674.21 SPX, or else it’s not a C wave inside a wave 4 up.

Personally I think it won’t get past that 1660 zone of horizontal resistance but never under estimate the bulls. Considering how close we are to the downward sloping trendline that’s coming in around 1645 right now, I’d have to think we’d gap over that and head toward 1660, and at most the 1674.21 high.

We’ll just have to play it by ear tomorrow and look for the market to peak early and rollover into the close. Failure to do so would mean that Thursday we should see the top of that final C wave up (inside the wave 4).

Here’s a possible plan for tomorrow…

Roger Federer eliminated from the French Open!!!!!! Crash on!!!!!????

He made it to the French Open Final in LeCarre’s 2009 mini-epic Our Kind of Traitor before the anti-hero Dima’s world came unglued. At the rate a certain little indicator is moving, I don’t see how the market can hold up until the French Open Final.

S&P 500 Analysis after closing bell: http://niftychartsandpatterns.blogspot.in/2013/06/s-500-analysis-after-closing-bell_5.html

ES update: http://niftychartsandpatterns.blogspot.in/2013/06/es-chart-analysis_5.html

APPLE Chart analysis: http://niftychartsandpatterns.blogspot.in/2013/06/apple-chart-update.html

The lack of a gap up out of the falling channel tells me one thing… the market is very likely going to tank on Thursday! It’s probably going to take the rest of today to get the 60min, 2h, and 4h charts overbought enough to allow the move down tomorrow but so far it’s looking really good for a very bearish Thursday.

So I’ll be looking for a lower high today to get short into Thursday. I’d guess that somewhere close to the top trendline in the falling channel would be good… probably 1640 area. The last few hours of the day will likely be the period we’ll see the peak. Remember though that the move down on Thursday is just a final 5th wave inside a larger wave 1 down. So I’d be exiting the short Thursday too… especially if we fill the gap at 1597 spx.

Sheesh… this market is really weak! I thought we’d bounce up one more time but yesterday’s high was about the best we’re going to get I guess. I still don’t want to go short here as we need a bounce. It’s just too oversold on the short term charts to go short at these levels.

I think that once again I’m too early on my rally call as it appears that we are going to end either today or tomorrow for this entire move down from the May 22nd high and start a larger wave 2 up soon. It should go up around that prior high at 1674 spx in the coming week/weeks.

But, Thursday’s have a habit of being bearish so if we rally one more time today into the close I’d say we’ll drop in the morning on Thursday to flush out the last long and trap the last bear. I’d like to see that gap filled at 1597 spx but maybe we don’t get it? We have gotten gap window it looks like but not gap fill.

Anyway, the selling is almost done I think with “possibly” one more move lower Thursday morning. Then a rally to that 1670 area should start and take a few weeks I’d guess.

ES Chart update: http://niftychartsandpatterns.blogspot.in/2013/06/es-breaking-support-levels.html

Well, today was a great day for the bears but I have a feeling the party will be over tomorrow (at least until the next party starts several weeks later). Thursday have a history of being down days a lot lately and since we are already very oversold on the short term charts I tend to think we’ll bottom in the first half of the day tomorrow and rally into Friday and next week.

I stated several times in past posts, video’s and/or comments that the average move down is 18-20 days (about 3 weeks) and 80-100 spx points… and so far that appears to be very accurate as we topped on May 22nd and are 80 points lower now in just about 3 weeks. The moves up and down daily have been much tougher to call correctly but hopefully many of you just played the larger move and did well with it.

At this point I’m going to stick to my original thoughts that we’ll fill that gap around 1597 spx and then rally for awhile to put in the wave 2 up (with the wave 1 down being the May 22nd high until tomorrow’s expected low). So anyone still short should think about taking profits tomorrow at some point.

The rally back up can last from 1-2 weeks and considering that next Thursday/Friday is the week before options expiration (where lows are commonly put in) I’d have to think that we’ll start the first wave up (wave A) inside this wave 2 this Friday, then peak on Monday/Tuesday of next week, followed by the wave B down into June13th/14th.

That leaves the week of option expiration for the wave C up to complete the entire wave 2 from tomorrow’s low. The week after June 21st Friday opx would then be the period I’d be looking to get short again for a move down to the next target of 1536 spx to retest that prior bottom.

From there we should expect a rally most all of July I’d think and then we’ll look toward late July and early August for the next really big move down that Ali says should be a panic crash.

Here’s the newest sporting sensation, Yusiel Puig at work:

http://www.youtube.com/watch?v=tfsZzJ4z98w

His game ending throw on Monday night in his first major league game. #88 of the Padres hits a flyball to Puig who throws out #13 at first base. (Teammate is #23 so Puig to #23 to get out #13)

http://www.youtube.com/watch?v=YmhxyL4wTkQ

Highlights of his 2 home run game in his 2nd major league game last night. A little amateurish of a video but I like how it shows the crowds reaction….shows how Puig walks up to the plate the first time and immediately hits the home run and right at the camera operator as if he knew it was coming his way.

Puig caused quite a sensation in spring training after the Dodgers signed him last summer to a 7 year contract last year as a Cuban defector but the Dodgers sent him to the minors to start the year but he was called up on Monday (a coincidence considering his number?) due to a convenient injury to one of the Dodgers overpaid outfielders.

I don’t think I have ever seen an athlete wear Puig’s number before so it has me very intrigued.

And to top it off Puig’s second homer occurred in the 6th inning last night. One could see it coming although developments did deviate from the expected outcome somewhat. With the score tied at 6-6 in the 6th inning….(The scoreboard on TV did read 6 6–1(out)6(inning), I expected the batters ahead of Puig to get on base for a possible grand salami (slang for slam)(with camera constantly showing Puig awaiting his turn on the on deck circle) but alas the 2nd batter ahead of him struck out to make it 2 outs and then the batter ahead of him #47 doubled to drive in a run to make it 7-6 Dodgers. Puig then came up and delivered the 2 run home run to make it 9-6.

I only briefly caught his first home run which was 3 run shot. But in both cases the broadcast showed him following #47 into homeplate and then the dugout which was such an eerie coincidence since I had just seen that a sidewalk and parking nearby would be closed tomorrow from 7-4pm. (due to construction work)

The first home run was at 2-5 (Padres with the lead) in the fifth inning. Puig’s 3 run shot made it 5-5 (5th inning or 5-5 5 off of #38). He drove in numbers 18 (9) and 47(11) or 911.

In the first video as he runs into the infield after his throw, I can see a quick 666 flash with fellow outfielder Ethier #16.(7)

In his two home runs, I notice the combo with Padres’ 3Bman #7.

It looks like Fidel has been incubating him and prepping him for the grand ritual. (roiding and everything)

But he does have amazing bat speed and pop. (The ball just jumps off his bat)

Hi Red Dragon Leo, this is Platy from Planet Forecaster. I see you guys are looking at my site. 🙂

I really like your work. It looks like we are interested in a lot of the same things. 🙂 Your post made me think about this stuff a little more. In my post I showed that one 2.15 year cycle is 7/2 an orbit of Venus, 8/7 an orbit of Mars, and 2/11 an orbit of Jupiter. Finding a common denominator then, if we multiply all of those by 154 years, we find a repeating cycle at 154 years.

You can see that the upcoming Jupiter-Mars conjunction on Aug 17, 2013 will occur close to the same location just inside Cancer that it did 154 years ago, on May 24, 1859. The difference between these dates is 56,333 days, or 154.23 years. Divide that by 13 twice and you get 333.33 days.

Then if you go the other way, 154.23 years 13 times is 2005, almost exactly.

Anyway, thanks a lot for your work, I’m going to start reading you regularly. 🙂

Hey Platy! Nice of you to stop by. Do post your blog link for others to visit if you don’t mind. And from what Ali pointed to about August 12th and others I’d say this August will be a very bearish period. Let’s hope we can all figure out the puzzle before hand so we can make good trades.

This is my blog: http://planetforecaster.blogspot.com/

I am currently thinking that we should find a low within the next few weeks and then head up to higher highs in August. There should be strong support at1593 SPX (previous resistance).

The Jupiter-Mars conjunction should be a major turn, one way or the other. Please see:

http://planetforecaster.blogspot.com/2011/08/jupiter-mars-affect-on-current-stock.html

http://planetforecaster.blogspot.com/2012/09/armstrongs-warning-about-august-2013.html

I agree – let’s combine resources and figure this thing out! 🙂

S&P 500 Analysis after closing bell: http://niftychartsandpatterns.blogspot.in/2013/06/s-500-analysis-after-closing-bell_6.html

I thought the Mars Jupiter conjunction occurred around my birthday which is my next high probability date for crash following the next 2 days……

The next two days might be more flash crashish but we’ll see

6-6 is 161 weeks from the flash crash on 5-6-10 or 3 years 1 month later. 1127 days later. Flash crash was 61 weeks from the 3-6-9 bottom or 60weeks6days later actually. 6-6 would be 4years3months from the 3-6-9 bottom.

Also this week is 4362 weeks from the lesser grand ritual 83years7months8days earlier.

9362 days from the lesser grand ritual 25years7months18 days earlier. The 62 number again 62=66.

Also 7711 days from the Bradley ode to the ’29’92 ritual date (426…wow 66)

It is a little quick off the top for a crash but the enlightened ones probably want to catch everyone off guard. A certain little indicator topped at the high of the year on May 22, not putting in a divergence and now it has plummeted through its April lows for the year (actually it will definitely do that tomorrow). Also notice $nya50r and $nya200r are also at their lows for the year….sitting on the precipice…..(stocks above the 50 and 200 day averages)

I was thinking that tomorrow could see a minor down day that penetrates the 50 day average (already penetrated on the $nya) but after reviewing some of these numbers and the info gleaned from the Puig videos maybe something more major might materialize.

Also reviewed Rammstein Meine Land beach video and noticed the Lifeguard stand with 2 6s on it although they are never seen together. The two years in the video are 1964 and 2012 but don’t see how one gets a 2013 out of it.

Then the Thrice are back playing in the NBA finals tomorrow and we have to remember the Thrice Number.

Also forgot the FB Facebook symbol also shown in The Silent Partner to represent the First Bank of Toronto…..FB===62.

6-6 is also 4months 2 days from Facebook day.

Looks like just a few more points to fill the 1597 spx gap, which I that point I’d expect a bounce to happen. I’m still unsure on how much of a bounce as although I said yesterday that we could go up to just above 1574 spx to make this wave 2 up the daily chart just has so much more room to go on the down side that I’m rethink that forecast now.

We’ll just have to wait to see how high the bounce is tomorrow but it’s possible that we only bounce for one day to the top trendline in this falling channel and then continue down all next week to retest that prior low of 1536 spx. I’m really having doubts on any big bounce from the gap fill area. That upper trendline around 1630 might be all we get?

The gap has been filled! Now I’m expecting a bounce into Friday. If we don’t take out the top trendline channel then I’m going to remain bearish and expect the move down to continue next week.

agreed. this drop is too fast. regardless,

my thinking is more of the one week out variety,

can a move back up, go higher, than the May 22nd high?

I’m still thinking that we’ll stick with the same pattern of putting in the low the Thursday or Friday prior to option expiration week. That means June 13th or 14th we should see the low, but what will the low be is the question?

When I see how high the MACD lines are on the daily chart I can easily see more downside coming before a really decent rally happens. Right now both lines are still in positive territory around 12 and 4.5 on the two different periods! They should be -10 before this move down ends I think.

So I’m only seeing a rally into tomorrow now to hit the upper trendline in the downward sloping channel. I’m guessing it will be around 1630 spx Friday. At that area I’d look to get short again into next Thursday/Friday with a retest of the 1536 spx low being the downside target.

APPLE Chart update: http://niftychartsandpatterns.blogspot.in/2013/06/apple-chart-analysis.html

Today’s action pushes things back into next week when there are some other better dates and anniversaries and past the French Open Final. Not to say that tomorrow can’t be a big down day but I guess the big meaning of 67 will have to reveal itself later (as in June July ???).

Today was about the Dow and Sp testing its 50 day average and then retaking its lower BB (most of the other indices as well). It is also matching up pattern wise with the recent action of the $xu100 (Turkish market) although its equivalent day to today featured a smaller upbar.

The big positive breadth reversal is a little worrisome. When it reverses like this off such an oversold level, it usually leads to a strong rally. But so far every reversal has been immediately met by a counter-reversal although recent moves did not feature today’s strong breadth. I don’t really sense a strong bearish participation in this market.

A certain little indicator plowed through its April lows today (at a steep rate of descent) and rarely features double bottoms.

It was also interesting to see copper and industrial metals sell off today despite the rally after putting in recent recovery highs. Euro had a big bounce going into currency opex tomorrow. (following the ECB meeting)

do not be surprised if the market continue to grind higher non stop. If tomorrow earases todays gain then yes I will turn bearish … we shall see.

Time to get short again I believe. Rally time is over I guess…

Next week I expect this… http://screencast.com/t/2W5FSFq2

Here’s the SPX forecast… http://screencast.com/t/1c5R1Zjr

SPY Chart analysis: http://niftychartsandpatterns.blogspot.in/2013/06/spy-chart-update_7.html

This bull flag in the making should play out Monday morning or into the close, but a failure to play out would be very bearish. Most bull flags do play out (I’d guess that 90% play out) but how high they go can be only 1 point or 20 points… there’s no set upside for a bull flag.

Meaning that we could fulfill the bull flag at any point today with a simple 1-2 point pop before the close. Then Monday will be anyone’s guess. Now the other pattern we see here is a “cup and handle” with the possible future pattern of an “inverted head and shoulders”.

The C&H could produce a rally to that 1660 zone, or we could drop back into the channel to form the right shoulder of the In-H&S pattern. My thoughts are that “if” they fall back into the channel today they won’t stop in the 1615-1625 zone to make the bottom of that right shoulder but will instead continue down to take out 1600 support level.

My thoughts are that we’ll fall back into the channel to make everyone guess about Monday over the weekend. Then simply open down a little on Monday and slowly continue down so as to not panic the bulls out or get the bears excited. But by next Thursday/Friday I think we’ll see the real low from this whole move down at 1687.

Officially the bull flag has been fulfilled. However, this move up into the close doesn’t meet the typical move up from a cup and handle pattern. So, it seems likely that they will go higher on Monday just looking at the patterns… so why does my gut tell me this is about all the upside we are going to get? Anyway, at this point I’m expecting at least a small pop up on Monday, if not a rally to 1660 spx, but I’m not playing this long trade as I just don’t trust it.

hey red, I think you’re over-thinking it a bit.

Daily charts are only day’2 UP. There is plenty of upside viable next week

I do agree, significant downside is coming – certainly stronger than this moderate 1687/1598 wave, but it will probably be from much higher levels, perhaps the sp’1730/40 area by late July..and then down to 1550 Aug/Sept.

—

anyway, have a good weekend!

FACEBOOK Trend update: http://niftychartsandpatterns.blogspot.in/2013/06/facebook-trend-update.html

S&P 500 Weekend update: http://niftychartsandpatterns.blogspot.in/2013/06/s-500-weekend-update_8.html

APPLE Weekend update: http://niftychartsandpatterns.blogspot.in/2013/06/apple-weekend-update.html

Well, it looks like the markets just had a pop off the lower BBs /50 day average up to a now flattish 20 day average which is standard. As some have mentioned, internals weren’t really that strong to match the price move (and it looks like the Dow really outperformed all of the indices yesterday).

In fact, I wouldn’t be surprised to see the last two days of gains reversed on Monday. It would match similar activity going into early May 2010 which is still holding up as a similar albeit more protracted fractal… A certain little component of a certain little indicator has now reached an area where a reversal back down can now be seen. It would be setting up a once common pattern that has now disappeared, “the complex bottom” pattern. For the past few years, the big spikes down seem to finish off a down move in the indices and the spikes seem to follow some muddling around beneath the 0 line (in negative territory). This spike has come from a yearly high and has been one relentless move down. But so far the indices haven’t matched the ferocity of this downspike.

Monday is 6-10 or 61??? Possibly the 6-25, that has accompanied some of the most notorious fake prints of the past.

But there are some better dates beyond Monday. It looks like one less assuming date will feature the heavy action in contrast to the star date of the week.

congratulations on your May 22 top call,amazing !

Thanks for stopping by…

Here’s a clip from the Italian film L’Avventura in tribute for the upcoming week:

http://www.youtube.com/watch?v=7HsBUYjwNX4

A scene set on a passenger train, we initially see Monica Vitti sitting down at seat 6 with the F of her pillow exposed behind her for an F 6 or 66. (at 18 seconds). Then the dude Sandro shows up and eventually sits opposite of her at 38 seconds and in the process of sitting down a 12 can be seen behind indicating the seat number and this matched with Vitti’s 6 seat number in the preceding shot forms the 612 combo. The S can also be seen on the pillow behind him for an S-12 combo 1912??? In the next shot, the seat number is now an 11 behind Sandro and there are no longer any letters on the pillow. Combined with Vitti’s still #6, we get a 611 combo.

I didn’t really know how one could get 2013 or a year out of it, until I noticed in the dialogue when Vitti mentions it was just 3 days ago when they first met… Three days ago (again)…..

Translated numerically 3 (days)–1 (first)–3 days for a 31 or 13 or if one ignores the first then just 33??? Another hint at 13 or 11×3.

Contininuity problems for the acclaimed director Antoninni or since he is one of the leading artistic acolytes for the enlightened ones this was done intentionally???

I generally watch these clips with the sound off. It is easier to notice the numbers. The sound can be distracting. I noticed the guy yells in the Puig video which is a little annoying.

I’ve never seen this film. I just came across this clip. I think I came to this after researching Antonioni’s L’Eclipse..(The Eclipse) which has an interesting storyline…

They also talk about sacrifice in the clip….

Antonioni in his 60s heyday…..The master of modern day alienation……And laborious slow moving films….

QQQ Weekend update: http://niftychartsandpatterns.blogspot.in/2013/06/qqq-weekend-update_10.html

Refresh page for new video update (note: the audio is a little loud, sorry about that)

ES Testing resistance levels: http://niftychartsandpatterns.blogspot.in/2013/06/s-500-futures-resistance-levels.html

FACEBOOK Chart analysis: http://niftychartsandpatterns.blogspot.in/2013/06/facebook-chart-analysis.html

Typical consolation day today. We chopped sideways to make a bull flag on the 60 minutes chart as well as a “cup and handle” pattern. Based on those patterns we should pop higher tomorrow, but I’m just not feeling bullish here… are you?

Maybe we get one quick move up to scare out anyone that wen’t short today but I just don’t see it lasting very long. Most Tuesdays have been bullish this year and if we are to expect the same tomorrow then they need to attack the 1660 spx prior high range before you can convince me that the selling is over with. Even then I doubt if I’ll believe it!

Whatever happens on Tuesday I get the feeling it will be the end of this rally up. I’m still bearish until we retest that 1536 spx prior low and then I’ll look for a multi-week rally to start.

A certain little indicator and its component reversed today and headed southward again albeit a minor change. Which is to be expected if a complex bottom pattern is to play out. A launch to new highs would have seen this indicators continue rocketing higher today.

Interesting that the Dax followed the SP today and bounced up to its 20 day average before selling off a bit (bouncing off its lower BB).

Greece plunged 4.69% today to its lower BB today while most bond funds continued to sell off. EEM at new mutli-month lows.

And for tomorrow, the star date of the week, 6-11 or 11years 9months from you know when. What will transpire? For the stock market, the worst I can see is a drop to the 50 day average but maybe something else??? Another date has better numerology…

But 6-11 is 62 or 66.

Chicago and Boston, 2 of the original 6 NHL teams, will face each other in the NHL finals…26 or 62…

The Django ending numerology soliloquoy (which I can’t remember in its entirety) starts:

SJ: I count 6 shots N*&%^@##&

Dj: (pulls out a gun) 2 guns……

Tomorrow is also………………613 weeks from you know when…or 4291 days later……The Thrice number scrambled!!!!!!

9367 days from the lesser grand ritual….

The newest sporting sensation, Y. Puig, hit a grand salami on Thursday but I didn’t see it so I couldn’t really analyze it….On the face of it, I didn’t see anything but I need to review the video.

But it was mentioned that he has now hit for a home run cycle in his first 5 games as a potentially budding occultist/guest announced on the 4 letter morning show today. He has hit a 1 run, 2 run,3run, and now 4 run homerun or 4 home runs in his first 5 games. (actually 4 HRs in 4 games but I needed to keep the guest’s numerological presentation intact.)

In the Puig videos I linked below, I also missed a few things initially.

His first home run was hit off of #33(6) for a 666—Puig=#66. The second came off of #38.

In the first video, after his game-ending throw he runs into the infield (after passing #16) and jumps into #33 (for another 666) with #16 next to both of them.

In the L’Aventurra video, the S(19) +12 combines to form 31 or (111 or 13) another reference to 13???

In fact, Sorcerer displays the S L 3 or 19 12 9 in the American sequence…

GOLD Month and Weekly chart analysis: http://niftychartsandpatterns.blogspot.in/2013/06/gold-chart-analysis.html

I know that both the bulls and the bears see this inverted head and shoulders pattern but I would not trust it. I really don’t think it’s going to play out. In fact I think we are on our way down to retest the 1536 spx prior low (with some bounces along the way of course).

Looks very bearish to me on all short term charts. I could see a move lower into the close today or another gap down tomorrow. They are making another annoying triangle it seems, as well as a head and shoulders pattern with yesterday’s high being the head and today’s rally from the open being the right shoulder.

This new head and shoulders pattern is on the right shoulder of a bigger inverted head and shoulders pattern that I don’t think will play out. If they chop this up enough and make another triangle then we might not see the move down until Thursday, but right now it’s certainly not looking good for the bulls.

Ford chart analysis: http://niftychartsandpatterns.blogspot.in/2013/06/ford-chart-analysis.html

EURUSD Trend analysis: http://niftychartsandpatterns.blogspot.in/2013/06/eurusd-trend-update.html