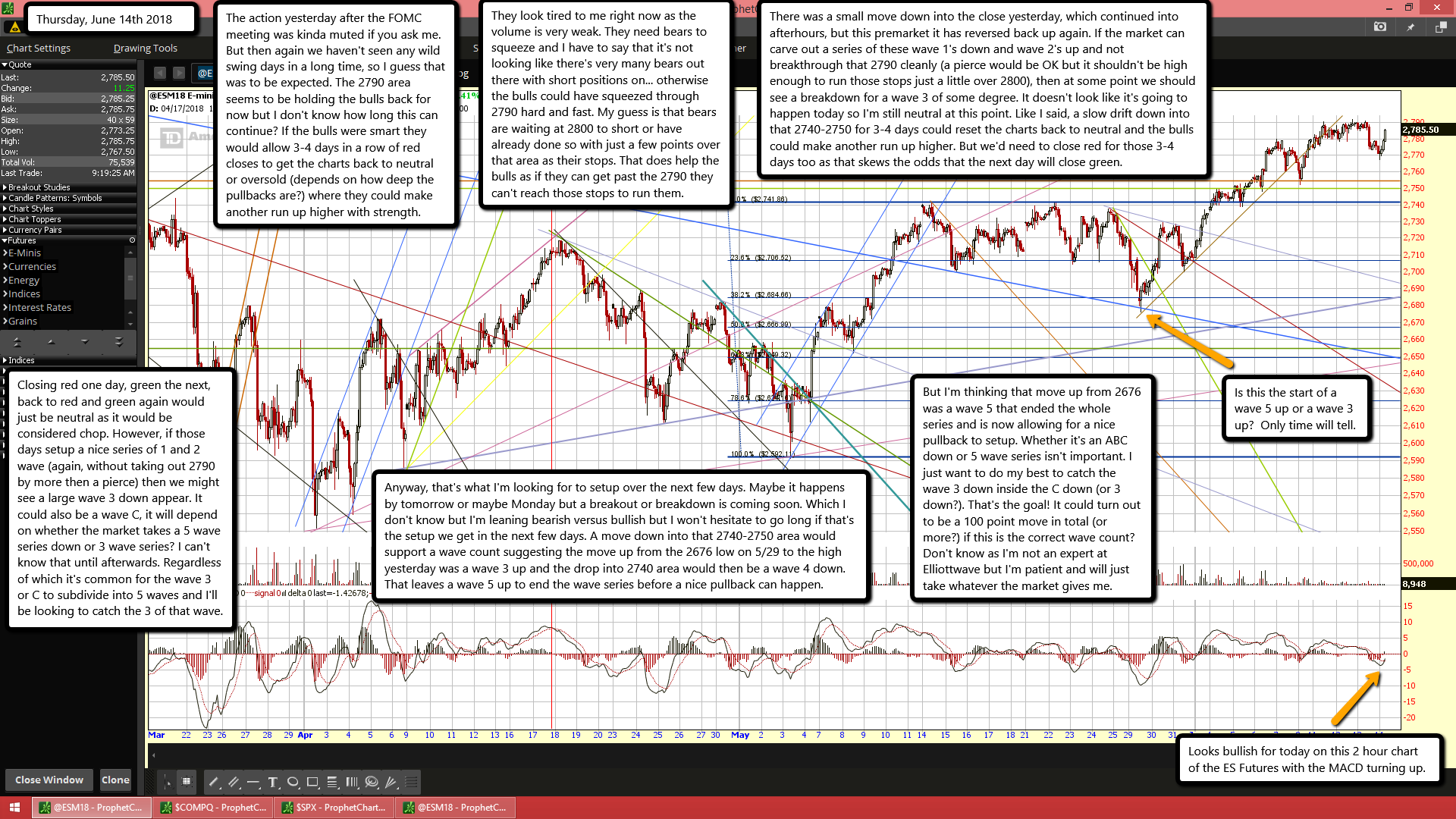

The action yesterday after the FOMC meeting was kinda muted if you ask me. But then again we haven't seen any wild swing days in a long time, so I guess that was to be expected. The 2790 area seems to be holding the bulls back for now but I don't know how long this can continue? If the bulls were smart they would allow 3-4 days in a row of red closes to get the charts back to neutral or oversold (depends on how deep the pullbacks are?) where they could make another run up higher with strength.

They look tired to me right now as the volume is very weak. They need bears to squeeze and I have to say that it's not looking like there's very many bears out there with short positions on... otherwise the bulls could have squeezed through 2790 hard and fast. My guess is that bears are waiting at 2800 to short or have already done so with just a few points over that area as their stops. That does help the bulls as if they can get past the 2790 they can't reach those stops to run them.

There was a small move down into the close yesterday, which continued into afterhours, but this premarket it has reversed back up again. If the market can carve out a series of these wave 1's down and wave 2's up and not breakthrough that 2790 cleanly (a pierce would be OK but it shouldn't be high enough to run those stops just a little over 2800), then at some point we should see a breakdown for a wave 3 of some degree. It doesn't look like it's going to happen today so I'm still neutral at this point. Like I said, a slow drift down into that 2740-2750 for 3-4 days could reset the charts back to neutral and the bulls could make another run up higher. But we'd need to close red for those 3-4 days too as that skews the odds that the next day will close green.

Closing red one day, green the next, back to red and green again would just be neutral as it would be considered chop. However, if those days setup a nice series of 1 and 2 wave (again, without taking out 2790 by more then a pierce) then we might see a large wave 3 down appear. It could also be a wave C, it will depend on whether the market takes a 5 wave series down or 3 wave series? I can't know that until afterwards. Regardless of which it's common for the wave 3 or C to subdivide into 5 waves and I'll be looking to catch the 3 of that wave.

Anyway, that's what I'm looking for to setup over the next few days. Maybe it happens by tomorrow or maybe Monday but a breakout or breakdown is coming soon. Which I don't know but I'm leaning bearish versus bullish but I won't hesitate to go long if that's the setup we get in the next few days. A move down into that 2740-2750 area would support a wave count suggesting the move up from the 2676 low on 5/29 to the high yesterday was a wave 3 up and the drop into 2740 area would then be a wave 4 down. That leaves a wave 5 up to end the wave series before a nice pullback can happen.

But I'm thinking that move up from 2676 was a wave 5 that ended the whole series and is now allowing for a nice pullback to setup. Whether it's an ABC down or 5 wave series isn't important. I just want to do my best to catch the wave 3 down inside the C down (or 3 down?). That's the goal! It could turn out to be a 100 point move in total (or more?) if this is the correct wave count? Don't know as I'm not an expert at Elliottwave but I'm patient and will just take whatever the market gives me.